WORKERS KAPITAL

Netherlands’ $900 Billion Pension Funds Ready to Invest Big in Renewables

The Netherlands' five largest pension funds have said they are willing to invest billions in the country’s renewable energy sector and the electricity grid. The funds, with a combined 900 billion euros ($975 billion) in assets, have offered to help with finances and expertise in the nation’s electric grid expansion and sustainable heating projects.

"We want to make a bigger impact, we can and want to invest more in the Dutch energy transition," the funds said in a letter addressed to the country’s political parties looking to form the next government.

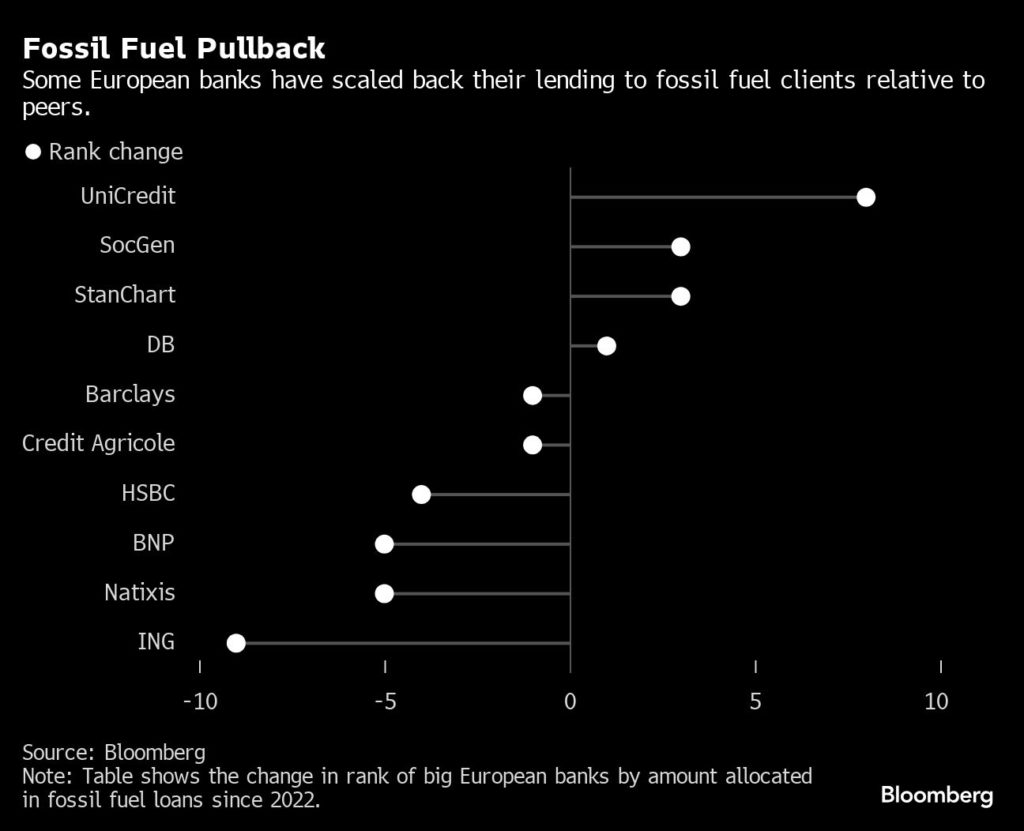

Pension funds across the globe are becoming increasingly engaged in the clean energy transition and frequently oppose the fossil fuel sector.

Four years ago, New York City’s Mayor Bill de Blasio and former Comptroller Scott M. Stringer announced that the city’s $226B pension fund would divest the majority of its fossil fuel investments and cut ties with other companies that have been contributing to global warming.

New York State officials are yet to make a final decision whether to sell their $1 billion in investments in major U.S. oil and gas companies, including Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. (NYSE:CVX) in what could be one of the biggest divestment drives by a pension fund. The fund has already sold off most assets in coal and Canada’s oil sands, although it still holds its $1.5 million investment in Arch Resources (NYSE:ARCH), the second largest U.S. coal producer.

Last year, Norway’s largest pensions manager, KLP, blacklisted Gulf companies listed in the United Arab Emirates, Saudi Arabia, Qatar and Kuwait due to human rights violations and also divested from Saudi Aramco due to climate risks

Meanwhile, last year, Norway’s giant sovereign wealth fund supported proposals by ExxonMobil and Chevron shareholders at their annual general meeting to introduce emissions targets.

With $1.4 trillion in assets, Norway's wealth fund is the largest in the world, and the sixth-largest investor in Exxon with a nearly 1.2% stake.

By Alex Kimani for Oilprice.com