It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Friday, April 12, 2024

April 08, 2024 | Source: Graphjet Technology Sdn Bhd

Facility expected to transform 30,000 metric tons of agriculture waste annually into up to 10,000 metric tons of graphite per year, enough material to power more than 100,000 electric vehicles

Graphjet aims to commission and begin production at new U.S. facility in 2026

Graphjet expects to create more than 500 high-skilled labor positions

New facility to position Graphjet as the leading supplier of graphite in the U.S. market to support the growing electric vehicle battery ecosystem

KUALA LUMPUR, Malaysia, April 08, 2024 (GLOBE NEWSWIRE) -- Graphjet Technology (“Graphjet” or “the Company”) (Nasdaq:GTI), a leading developer of patented technologies to produce graphite and graphene directly from agricultural waste, today announced it plans to build a commercial artificial graphite production facility in Nevada. This plant is expected to be a first-of-its-kind in the United States.

The plant is expected to be capable of recycling up to 30,000 metric tons of palm kernel material equivalent – a widely abundant agricultural waste product in Malaysia – to produce up to 10,000 metric tons of battery-grade, artificial graphite per year. This level of production is expected to be able to support the production of enough batteries to power more 100,000 electric vehicles (EVs) per year.

In addition to producing graphite, Graphjet’s first commercial plant in Malaysia, which is on track to be commissioned in the second quarter of 2024, will process palm kernel shells into hard carbon, which will be shipped to Nevada. This eliminates a conversion step in Graphjet’s production process, which would enable its Nevada facility to produce graphite more quickly. Graphjet is aiming to commission and begin production at the new facility in 2026.

“As the only pure-play direct agriculture waste-to-graphite technology developer, Graphjet is well positioned to become the leading source of graphite for the U.S. and we are excited to have Nevada serve as our launching pad into this market,” said Aiden Lee, CEO and Co-Founder of Graphjet. “We are laser focused on getting our commercial production online as quickly as possible and are in discussions with several players to secure offtake agreements for our planned Nevada facility. We look forward to investing into the region and creating many local green energy jobs as we build a first-of-its-kind, next-generation graphite production facility in the U.S.”

Nevada is a strategic location for Graphjet as it is located in close proximity to a large quantity of battery manufacturers and automotive OEMs, which will require a significant amount of graphite for future EV battery production. Graphjet’s Nevada manufacturing facility is expected to create more than 500 high skilled labor positions. Furthermore, Graphjet expects to invest between $150 million and $200 million into the facility and is currently evaluating financing and strategic options to fund the plant.

Mr. Lee continued, “As leading automotive OEMs and battery manufacturers seek cost-effective and more environmentally friendly sourced production, Graphjet is able to provide a sustainable and cost effective solution that can support their graphite needs and address the accelerating demand for this strategic material. For perspective, Graphjet’s technology produces only 2.95 C02 emissions per KG of graphite, compared to 17 C02 emissions per KG with synthetic graphite in China and even 9.2. C02 emissions per KG with natural graphite in Canada.”

About Graphjet Technology Sdn. Bhd.

Graphjet Technology Sdn. Bhd. (Nasdaq: GTI) was founded in 2019 in Malaysia as an innovative graphene and graphite producer. Graphjet Technology has the world’s first patented technology to recycle palm kernel shells generated in the production of palm seed oil to produce single layer graphene and artificial graphite. Graphjet’s sustainable production methods utilizing palm kernel shells, a waste agricultural product that is common in Malaysia, will set a new shift in graphite and graphene supply chain of the world. For more information, please visit https://www.graphjettech.com/.

Reuters | April 9, 2024 |

Aluminum ingots. Stock image.

Vietnam’s top miner Vinacomin plans to invest 182 trillion dong ($7.3 billion) to ramp up its alumina-aluminum production to meet the country’s rising demand for the metal, the government said on Tuesday.

The investment by the state-run firm will go to two bauxite exploration projects and five refining projects in the Central Highlands province of Dak Nong, the government said in a statement. It did not give a time frame for completion.

The Southeast Asian country, a regional manufacturing hub, started its alumina production more than a decade ago, but there have been concerns about pollution and high electricity consumption.

According to the government, Vinacomin will raise the alumina capacity of its Nhan Co Alumina complex to 2 million tons a year from 650,000 tons.

It will also triple the capacity of the bauxite-alumina-aluminum Dak Nong complex nearby to 2 million tons of alumina and 0.5-1 million tons of aluminum a year, the government said.

Dak Nong province has a reserve of 5.4 billion tons of bauxite, the most common raw material used for alumina and aluminum production, according to state media.

(By Khanh Vu; Editing by Kanupriya Kapoor)

Reuters | April 9, 2024 |

Rasp mine, Australia. Credit: Toho Zinc

Benchmark zinc smelter treatment charges have fallen sharply this year, attesting to a tightening of the mine supply chain.

Canadian miner Teck Resources has agreed to pay Korea Zinc $165 per metric ton to convert its zinc concentrate into refined metal, down from the $274 covering last year’s shipments.

The annual terms negotiated by the two companies have in recent years been the benchmark for the rest of the industry.

Treatment charges rise during times of raw material surplus and slide during periods of shortfall.

Last year’s numbers were high because of a smelter bottleneck and resulting glut of mined concentrate in 2022. This year’s low outcome says much about how zinc’s supply dynamics have changed in the intervening 12 months.

A string of mine closures, many of them due to the weak price environment, has tightened concentrate availability with significant implications for the refined metal market.

Falling mine production

London Metal Exchange (LME) zinc went from boom to bust over the course of 2022 and early 2023, the three-month price collapsing from an all-time high of $4,896 per ton in March 2022 to a three-year low of $2,215 in May 2023.

The price implosion caused several higher-cost mines to close, most notably Boliden’s Tara mine in Ireland, Nyrstar’s Middle Tennessee operations and Toho Zinc’s Rasp mine in Australia.

The lengthening tally of casualties caused global mined output of zinc to contract by 1.4% year-on-year in 2023, according to the International Lead and Zinc Study Group (ILZSG). It was the second consecutive year of decline after a 2.6% drop in 2022.

This year may not turn out much better.

A November fire at the Ozernoy mine in Russia has delayed commissioning of what was expected to one of the biggest additions to global production this year.

Ozernoy, capable of producing 350,000 tons of contained zinc every year, now seems unlikely to restart processing ore into concentrates until the fourth quarter of this year.

When ILZSG last met in October for its biannual meeting, the Group forecast a robust 3.9% year-on-year increase in mined output this year. That’s starting to look optimistic and may be subject to revision when the Group holds its spring 2024 meeting.

Smelter recovery

While mine supply has continued sliding, global smelter production has bounced back strongly since 2022.

The main driver of higher smelter output has been China, where producers cranked up refined metal production to 6.6 million tons in 2023, a year-on-year increase of 10.9%, according to local data provider Shanghai Metal Market.

That collective performance helped global output recover by 3.8% last year after a similar-sized dip in 2022.

True, there are still Western smelters struggling with high energy prices, such as Nyrstar’s Budel plant in the Netherlands which closed in January.

But conversely, the Nordenham smelter in Germany has been ramping up after a year of being on care and maintenance.

It’s the gap between weak global mine performance and resurgent smelter demand for concentrates that explains the sharp drop in the annual benchmark treatment charge.

Spot terms have fallen further as smelters scramble for material. Price reporting agency Fastmarkets assesses those for concentrate delivered to Chinese ports at $50-80 per ton.

Metal glut

The developing tightness in the zinc raw materials part of the production chain isn’t yet having any discernible impact on the refined metal balance.

Zinc remains the laggard of the LME pack even as improving macroeconomic sentiment lifts the base metals complex. Currently trading around $2,700 per ton, LME three-month metal is up by just 3.0% on the start of the year, compared with copper’s 10% gains.

The metal’s usage in the form of galvanised steel means it is heavily exposed to the construction sector, a particularly weak part of the economy in both China and the rest of the world.

With smelting activity rising over the last 12 months, there is no shortage of refined zinc.

LME stocks recovered from a depleted 27,750 tons to 223,225 tons over the course of 2023. They have risen by another 37,000 tons so far this year thanks to sporadic bursts of warranting activity.

LME time-spreads suggest there may be more surplus metal hovering over the market.

The benchmark cash-to-three-months period has moved into super-contango territory, widening to over $50 per ton last month. The contango contracted to $38 at the Monday close but is still wider than anything seen since 2012-2013.

Twist in the zinc plot

The analyst consensus coming into this year was that zinc was on course to register a second year of significant supply surplus.

ILZSG forecast a massive 367,000-ton global glut when it met in October. The median expectation in the Reuters January poll of base metal analysts was for a 300,000-ton surplus. Not one of the 11 analysts offering a supply-demand balance forecast expected anything other than too much metal.

Such is the tightening in the zinc concentrates segment of the market, however, that expectations are being adjusted.

Analysts at Macquarie Bank, for example, are now projecting a small 61,000-ton supply deficit over the year.

“Given the very tight concentrates market, we have reduced our global refined production forecast to -0.4% this year,” the bank said in its March quarterly “Commodities Compendium”.

Western production is expected to remain challenged and Chinese production growth is likely to brake sharply to just 0.5% due to a lack of feed.

Several Chinese smelters have already brought forward maintenance or trimmed run-rates in reaction to the margin compression caused by low treatment fees, which account for around 40% of a typical smelter’s profits, according to Macquarie.

The bank expects a return to surplus next year but it could be a bumpy price ride since this year’s zinc narrative has already taken a very unexpected turn.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Kim Coghill)

Karelian says Kuhmo region could hold more coloured diamonds

Karelian Diamond Resources PLC - Finland-focused diamond exploration company - Says analysis of Kimberlitic garnets taken from near the location where the company discovered a green diamond indicate the presence of a diamond stability field and diamond-bearing Kimberlite. In 2022, Karelian found a green diamond in the Kuhmo region of Finland, and subsequently submitted sixty garnets sourced nearby to Renaud Geological Consulting Ltd for testing in Canada. Karelian says the discovery ‘could be particularly significant as coloured diamonds, including green diamonds, sell for prices which can be multiples of those for clear colourless diamonds’.

Chair Richard Conroy says: ‘These results are a further and very important step forward in bringing to a successful conclusion the search for the origin of the green diamond discovered by the company in the Kuhmo region of Finland.’

Reuters | April 9, 2024 |

Iron ore futures prices extended gains to a second straight session on Tuesday, underpinned by mounting hopes of improving demand for the key steelmaking ingredient in top consumer China in the coming weeks.

The most-traded September iron ore on China’s Dalian Commodity Exchange (DCE) ended daytime trade up 5.63% at 815.5 yuan ($112.73) per metric ton, its highest level since March 25, following a rise of more than 3% on Monday.

The benchmark May iron ore on the Singapore Exchange was 3.54% higher at $107.95 a ton, as of 0700 GMT, its highest level since March 26, after rising over 6% in the previous session.

Overall macro expectations have somewhat improved after China’sannouncement regarding policies including crude steel control, analysts at Huatai Futures said in a note.

China last Wednesday revealed plans to managecrude steel output this year.

“Steel margins have improved, which may encourage steelmakers to resume production later, thus generating more needs for ore,” Huatai Futures said, while citing high portside ore stocks and higher-than-usual shipments as potential headwinds.

There are also expectations that some steelmakers may ramp up production to generate more cash flow before being required to curb production later this year, analysts said.

The flurry of post-holiday restocking among Chinese steelmakers additionally aided sentiment on Tuesday.

Transaction volumes of iron ore at major ports swelled to 1.63 million tons on Monday from 305,000 tons on Sunday, a working day in China, data from consultancy Mysteel showed.

The obvious cost competitiveness of iron ore against steel scrap increased the appeal of the steelmaking feedstock as margins remained thin despite some improvement.

Other steelmaking ingredients on the DCE also posted gains, with coking coal and coke up 3.36% and 2.5%, respectively.

Steel benchmarks on the Shanghai Futures Exchange were mostly up.

Rebar strengthened 2.19%, hot-rolled coil rose 1.92%, wire rod increased 0.48%, and stainless steel gained 0.77%.

($1 = 7.2338 Chinese yuan)

(By Cassandra Yap and Amy Lv; Editing by Eileen Soreng and Sonia Cheema)

Bloomberg News | April 11, 2024

Peabody’s North Antelope Rochelle Mine (NARM). (Image courtesy of Peabody Energy)

Peabody Energy Corp. shares sunk to the lowest in seven months after the biggest US coal miner warned that first-quarter sales will be lower than expected due to production issues at mines in Australia and weak demand in the US.

Peabody expects to report revenue of $980 million for the quarter, according to a statement Thursday. Analysts had been expecting revenue of $1.03 billion for the period. Shares of the St. Louis-based company fell as much as 7.3% to its lowest since Sept. 11 before paring losses.

Shares traded at $22.68 as of 9:49 a.m. in New York, down 3.8%.

Warm winter weather and low natural gas prices ate into coal demand in the US as utilities continue to shift away from the dirtiest fossil fuel. Peabody also said its results were impacted by production issues at some mines in Australia that reduced output, and lower prices for some metallurgical coal.

“Our first quarter included some unforeseen production challenges that are now behind us,” Peabody chief executive officer Jim Grech said in the statement.

Coal may get a boost later this year. A government forecast released this week calls for hot summer temperatures that will boost residential electricity usage by almost 4%.

(By Will Wade)

Reuters | April 11, 2024 |

Mao Zedong statue.(Image courtesy of 猫猫的日记本 |Wikimedia Commons.)

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at stabilizing thermal coal prices and supplies to power plants.

The rule, which was first issued in draft form by the National Development and Reform Commission (NDRC) in December, called for 300 million metric tons of “dispatchable” annual coal production by 2030, equivalent to about 6% of last year’s output.

China set a goal in 2021 to have coal reserves equivalent to 15% of annual output stocked at mines, ports, power plants and other designated storage areas.

The new system will build on that measure by ensuring that a certain amount of production capacity is ready to be mined when needed.

It will focus on mines that produce coal for electricity and heat generation – prices of which are closely monitored by authorities because of their connection to power prices and local livelihoods – rather than coking coal, which is used to make steel.

Coal mines that are part of the capacity reserve system must be able to dispatch output when authorities deem prices to have exceeded a “reasonable” range or when supplies are tight. These mines would also no longer be subject to local government requirements to sign medium- and long-term contracts with buyers.

Large scale, modern mines with good safety conditions in China’s top coal-producing regions of Shanxi, Inner Mongolia, Shaanxi and Xinjiang would be prioritised for inclusion into the coal reserve plan, according to the NDRC notice.

China is the world’s top coal consumer and producer, mining a record 4.66 billion tons last year. But the country has been concerned about energy security since a crippling domestic coal and power shortage in 2021 that prompted a probe into soaring coal prices.

Coal output is expected to stabilize this year as China ramps up renewable power and is likely to notch just 1% production growth, according to an industry group forecast.

(By Colleen Howe; Editing by Christopher Cushing and Jamie Freed)

Reuters | April 10, 2024 |

Aerial view on the power station in Poland Opole. Stock image.

Polish government is abandoning plans to separate coal-fired power plants into a special company and is considering merging them with mines, said Industry Minister Marzena Czarnecka in a interview published on Wednesday in Rzeczpospolita daily.

The previous government’s plan assumed the creation of one large state-owned company NABE, that would pool the assets of power plants generating energy from coal. However, according to the Minister of Industry, this is not a good idea.

“The problem of coal assets would not be solved, but only transferred to the state treasury, i.e. onto the shoulders of taxpayers. The NABE project will not be implemented,” she said in an interview.

Czarnecka said that linking coal-fired power plants with mines is being considered instead and the ministry will talk to banks to develop an optimal and acceptable model for them, so that they can finance the green transformation of energy groups.

“However, I am convinced that there is no other way than to assign a given power plant to a given mine. Otherwise, this process will not take place,” she said.

“In July, we should present a plan to ‘assign’ specific mines to specific power plants. In September, we will present legal solutions on how to implement this idea. We would like to complete this process of arrangements this year.”

(By Pawel Florkiewicz; Editing by Jason Neely)

Bloomberg News | April 10, 2024 |

Credit: Vitol Group

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with an “exciting decade” ahead.

“It’s a relatively small addition to our business,” chief executive officer Russell Hardy said at the Financial Times Commodities Summit on Tuesday.

Hardy’s comments are the first public acknowledgment of a step the energy trading giant has been making over the past six months. Vitol brought in an iron ore trader last year, Bloomberg previously reported. It’s also in the process of hiring two base metals traders who recently left rival Mercuria Energy Group, Reuters reported last week.

The buildout comes as Vitol — the world’s biggest independent commodities trader — expands beyond oil, gas and power after banking net profits of more than $28 billion in the past two years.

The firm was burned by an earlier foray into metals trading when it bought Euromin — a company that focused on trading metals, especially in the former Soviet Union, in the 1990s.

“I wouldn’t describe it as our finest hour — we struggled a little bit with managing the risks,” Hardy said. “So we’re very much starting from scratch again and really we’re just scratching the surface.”

(By Archie Hunter and Jack Farchy)

Bloomberg News | April 9, 2024 |

BHP’s Spence Growth Option project. (Image courtesy of BHP).

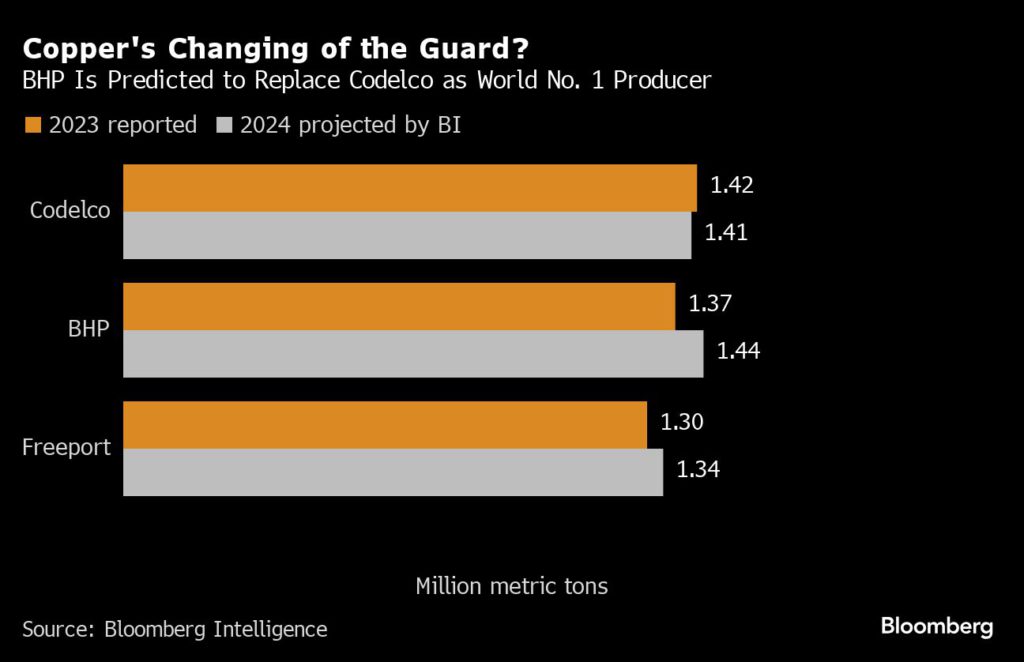

The copper industry is about to get a new leader as BHP Group overtakes Codelco in the global producer rankings, according to Bloomberg Intelligence estimates.

As long as BHP’s giant Escondida mine in Chile continues to step up production, the Australian company will nudge past Codelco this year, disrupting the Chilean state-owned behemoth’s reign as No. 1, said Bloomberg Intelligence analyst Grant Sporre.

Still, Codelco may recover the top spot in the years ahead as it battles to recover from delays and missteps at its projects.

(By James Attwood)

Read More: Copper price near 15-month high as supply fears spur bullish calls

April 09, 2024 17:01 ET| Source: BRAZIL POTASH CORP

GOVERNOR OF THE STATE OF AMAZONAS ANNOUNCES ISSUANCE OF MINE INSTALLATION LICENSE AFTER ALL REGULATORY FILINGS AND INDIGENOUS CONSULTATIONS COMPLETED

HISTORICAL STEP FOR BRAZIL TO MATERIALLY REDUCE DEPENDENCE ON IMPORTED POTASH AS ALL POTASH PLANNED TO BE SOLD DOMESTICALLY

PROJECT TO INITIALLY PRODUCE 2.4 MILLION TONS PER YEAR WITH ABILITY TO INCREASE PRODUCTION

STRATEGIC RELATIONSHIP WITH AMMAGI FOR OFFTAKE AND DISTRIBUTION SIGNED

PROJECT REDUCES GREENHOUSE GAS EMISSIONS BY ~1.4 MILLION TONS PER YEAR

MANAUS, Brazil, April 09, 2024 (GLOBE NEWSWIRE) -- Brazil Potash Corp. (“Brazil Potash” or the “Company”) is excited to announce the Amazon State Environmental Protection Institute (IPAAM), has granted the mine Installation License for the Autazes Potash Project (the “Project”) to the 100% owned Brazilian subsidiary Potassio do Brasil, allowing for construction to commence. This is a major milestone in the Company’s development and follows several years of environmental, social, and technical studies as well as the successful completion of local Indigenous People’s ‘free, prior, and informed consultations’.

Brazil Potash’s mine Installation License was granted at a ceremony organized by Amazon State Governor Wilson Lima, and attended by IPAAM President Juliano Valente, State Deputy Sinesio Campos, Potássio do Brasil President Adriano Espeschit, several other government officials, and major press outlets recognizing the importance of establishing a sustainable domestic source of potash in Brazil for global food security. The Company expects to start construction with the awarding of contracts for mine surface works and shaft construction.

Tadeu de Souza – Amazonas Vice Governor, Wilson Lima – Amazonas Governor, Anderson Cavalcante – Mayor Autazes, Silas Camara – Federal Deputy, Sinésio Campos – State Deputy, Ronney Peixoto – Mining Secretary of State, Kleber Mura – CIM Coordinator General

Extensive media attendance at license grant ceremony

BRAZIL AND THE NEED FOR FERTILIZERS

Global food security depends on the continued success of Brazilian agricultural exports. The country is a leading producer and exporter of orange juice, soybeans, corn, sugar and cotton as well as beef, poultry and pork. Abundant arable land, good year-round weather and efficient farming have made Brazilian farmers among the most productive globally, contributing roughly 30% to Brazil’s GDP. Critical to Brazil’s continuing productivity is access to affordable fertilizers. However, Brazil is highly exposed as it imports 85% of its fertilizer needs including 98% of its potash, half of which comes from countries currently at war or sanctioned, including Russia, Belarus, and Israel, when a massive potash basin exists in its own backyard. Now, with the License approval, Brazil can produce this essential mineral for its farmers in country, by-passing the risk and costs of imports. Potash is extremely important to efficiently grow food as it strengthens the stem of plants to make them more resilient to stresses caused by drought, extreme temperatures, and insect infestation.

ABOUT BRAZIL POTASH. GAME CHANGER FOR BRAZIL AND THE WORLD FOR FOOD SECURITY

Brazil Potash’s Autazes deposit can be mined and processed, using proven off the shelf environmentally friendly technology, to extract the ore using room and pillar mining, separate out the potash using hot water and return the remaining material (sodium chloride tailings) back underground. From an environmental perspective, this project has positive greenhouse gas credentials considering it will operate with predominantly green produced electric energy (Brazil has 84%+ renewable energy in its grid). Production in country also eliminates 12,000 to 20,000 kilometers of shipping to reach Brazil’s large soybean farmers in Mato Grosso resulting in clear benefits to Brazil and for global food security.

“We are thrilled to receive the mine installation license from the Amazon State Environmental Protection Institute. For several years, Brazil Potash has been waiting for this moment to show that is possible to have a sustainable mining operation in the Amazon region. With the Autazes Potash Project's support from the Mura Indigenous people, we can show the world that it is possible to have more development for local communities with a better quality of life. This truly marks a win-win for Brazil’s economy, its people, and the world,” said Adriano Espeschit, President of Potássio do Brasil.

Brazil Potash’s CEO, Matt Simpson, commented, “I am very proud of the years of permitting, indigenous, government, and community relations work completed by our team in Brazil headed by our President Adriano Espeschit, which has resulting in securing the mine Installation License. This is a major milestone to advance and derisk the development of the Autazes Potash Project as we move closer to the start of project construction”.

EXTENSIVE USE OF GREEN ENERGY AND POSITIVE SOCIAL IMPACT

Brazil Potash will have a positive impact on the economy and environment of the Amazonas state by reducing green house gases by ~1.4 million tons per year. The Company will create an estimated 10,000 new jobs and will be largest contributor to the GDP for the state of Amazonas. In addition, the project will produce potash locally and sell it in local currency thus saving Brazil roughly US$1 billion in currency outflows. The Company is also committed to suppling potash in small quantities to domestic farmers as they need it and supporting the initiatives of the Brazilian Government to restore degraded land.

For more information, please contact:

Brazil Potash Investor Relations

info@brazilpotash.com

Cautionary Note Regarding Forward-Looking Statements

All statements, other than statements of historical fact, contained in this shareholder update constitute “forward-looking statements” and are based on the reasonable expectations, estimates and projections of the Company as of the date of this letter. The words “plans,” “expects,” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “does not anticipate,” or “believes,” or variations of such words and phrases or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will be taken,” “occur” or “be achieved” and similar expressions identify forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Mura’s Indigenous people consultation process; the potash market globally and in Brazil; geopolitical tensions and opportunities; the potential benefits to Brazil and the Mura Indigenous people and the world from the Project; government support of the Company and its project; population growth and Brazil’s natural resources, the importation of potash in Brazil, the growth of the potash market and price expectations, advancing construction financing, offtake agreements, raising capital, completing a strategic transaction with a third party, environmental or community benefits, expected industry demands, the Company’s business strategy, the Company’s forecast of annual production and sales of potash, appointment of directors, currency fluctuations, government regulation and environmental regulation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates and assumptions contained in this letter, which may prove to be incorrect, include, but are not limited to, the various assumptions of the Company set forth herein. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to fluctuations in the supply and demand for potash, changes in competitive pressures, including pricing pressures, timing and amount of capital expenditures, changes in capital markets and corresponding effects on the Company’s investments, changes in currency and exchange rates, unexpected geological or environmental conditions, changes in and the effects of, government legislation, taxation, environmental regulations, licensing, controls and regulations and political or economic developments in jurisdictions in which the Company carries on its business or expects to do business, success in retaining or recruiting officers and directors for the future success of the Company’s business, officers and directors allocating their time to other ventures; success in obtaining any required additional financing to make target acquisition or develop the Project; employee and community relations, and risks associated with obtaining any necessary licenses or permits. Many of these uncertainties and contingencies can affect the Company’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, the Company. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All of the forward-looking statements made in this letter are qualified by these cautionary statements. These factors are not intended to represent a complete list of the factors that could affect the Company. The Company disclaims any intention or obligation to update or revise any forward-looking statements, except to the extent required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4529432a-8480-4ad0-96c7-68a4c48dd28d

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b2a4f5c-747c-4d93-9bbb-7e2c9fc9c213

Cecilia Jamasmie | April 11, 2024 |

Early drilling at the Crawford project.(Image courtesy of Noble Mineral Exploration..)

Canada Nickel (TSX-V: CNC) has kicked off front end engineering design (FEED) at its flagship Crawford nickel project in northern Ontario, which it expects to bring into production in 2027.

Ausenco Engineering Canada, the engineering partner, will lead this development phase, which is planned to be finished by August. Data collected during the 2024 winter geotechnical program, which is nearing completion, will support FEED activities, Canada Nickel said.

“As we continue to successfully advance Crawford financing and permitting activities, we are confidently moving into this next phase of project development,” chief executive Mark Selby said.

Canada Nickel’s boss reiterated the company is aiming for a mine construction decision by mid-2025, with first production by the end of 2027.

The proposed operation will consist of two open pits complemented by an on-site mill, to be completed in two phases to allow for throughput ramp-up, the feasibility study showed. Total capital cost for the two phases is estimated at $3.5 billion.

Over a 41-year project life, total metal production is calculated at 3.54 billion lb. of nickel, 52.9 million lb. of cobalt, 490,000 oz. of palladium and platinum, 58 million tonnes of iron, and 6.2 million lb. of chromium.

Crawford’s feasibility study describes the use of conventional open-pit mining methods to extract 1,715 million tonnes of ore and 3,992 million tonnes of waste over a 33.5-year period. This time-frame includes 2.5 years of pre-stripping.

The company will use a mixed fleet of mining equipment for the open-pit, including 120-tonne-class backhoe excavators to load 40-tonne articulated trucks. Areas with sand and till footwall will be mined using 300-tonne electric face shovels to load 90-tonne trucks, Canada Nickel has said.

Peak production at Crawford nickel mine is expected in year 11, when autonomous trucks and remotely operated shovels are fully integrated into the operation. Canada Nickel counts the backing of top players in the mining and batteries markets. The Toronto-based miner attracted the interest of Agnico Eagle Mines (TSX, NYSE: AEM), Canada’s largest gold producer, which now owns 12% of Canada Nickel.

Also in January, the company secured an investment from South Korea’s Samsung SDI. Through this deal, the battery maker can earn a 8.7% in Canada Nickel as well as rights to 10% of the nickel-cobalt production from the Crawford project over its expected mine life.

Crawford hosts one of the world’s largest nickel resources, totalling 2.46 billion tonnes at 0.24% nickel for 13.3 billion pounds of contained nickel, according to its feasibility study. This pegged the project’s after-tax net present value (8% discount) at $2.6 billion and internal rate of return at 18.3%.