Akshay Chinchalkar, Bloomberg News

A security cage protects the automated teller machine (ATM) of a cryptocurrency kiosk in Antwerp, Belgium, on Monday, June 6, 2022. Bitcoin has been trading around the $30,000 level for weeks now, defying predictions of a potential further decline but also struggling to gain upward momentum as the broader US market has also taken a beating. Photographer: Valeria Mongelli/Bloomberg , Bloomberg

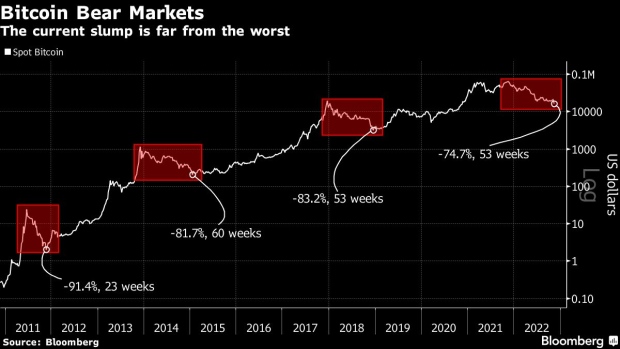

(Bloomberg) -- Bitcoin has further to fall before it finds a base to stage any recovery, if the depth of previous routs is any guide. While the crypto currency’s near 75% plunge from its 2021 high has already sent shock waves through markets, it would need to fall below $13,000 to begin matching the magnitude of previous drawbacks. How long it could take to get there is an open question: the current slump is longer than the average of past cases but still seven weeks shy of the tumble that ended in 2015.

©2022 Bloomberg L.P.

Crypto market rout deepens as Binance seen balking at takeover

, Bloomberg News

Nov. 9,2022

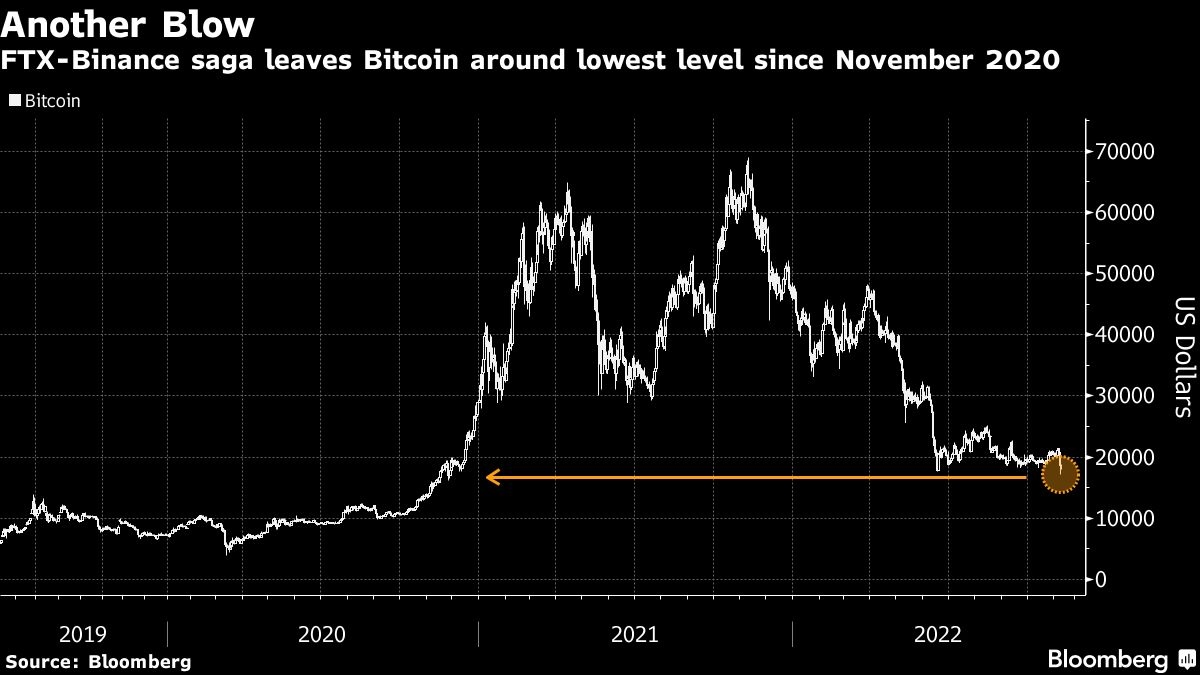

The week’s rout in cryptocurrencies deepened, with Bitcoin tumbling to the lowest levels in two years, as Binance is seen increasingly unlikely to follow through on its takeover of FTX.com.

Bitcoin, the largest token by market value, fell as much as 11 per cent to US$16,705 on Wednesday, the least since November 2020. That brings this week decline to about 20 per cent. It reached a record high of almost US$69,000 a year ago. Just about every digital coin was struggling: Ether, Solana, Polkadot and Avalanche all dropped.

FTT, the utility token of the FTX exchange, collapsed by more than 40 per cent, following a more-than-70 per cent tumble on Tuesday.

“The market is now in full fear mode,” said Ilan Solot, co‑head of digital assets at Marex Solutions. “Because Pandora’s box has been opened with this Binance-FTX deal and now everyone’s looking to see if there’s more dominoes and what else needs to be liquidated.”

At issue is Binance executives finding through due diligence that the gap between liabilities and assets at FTX is likely in the billions, and possibly more than US$6 billion, said a person familiar with the matter, who wasn’t authorized to publicly discuss the matter. Binance Chief Executive Officer Changpeng “CZ” Zhao had stunned the crypto world on Tuesday with an announcement that his firm was moving to take over FTX.com, which suffered a liquidity crunch after Zhao announced that he was selling a US$530 million holding of FTX’s native token.

Investors are on edge about spreading contagion given the pivotal role FTX and its co-founder Sam Bankman-Fried played in the industry.

“Since I entered the crypto industry in 2016, very few periods tested its market infrastructure and participants like the last 24 hours did,” said crypto hedge-fund manager Dan Liebau of Modular Asset Management.

Noelle Acheson, author of the “Crypto is Macro Now” newsletter, pointed out that Bitcoin, which typically holds up better than other tokens during times of stress, was seeing greater declines than some other altcoins. That potentially points to institutional investors bailing “as a result of the drama.”

“It’s a sign that this is a blow to confidence in the industry as a whole, from the investor’s point of view,” she said in an interview. “From the industry’s point of view, it’s also a pretty steep blow, much more so than what we saw with Three Arrows Capital and with the Terra implosion. This is sitting harder.”

The sense of dread that swept across clients of fallen crypto exchange FTX.com was so intense that they pulled out US$430 million worth of Bitcoin in the space of just four days. FTX had more than 20,000 Bitcoins going into Sunday, according to data from CryptoQuant. That fell to almost zero by Wednesday after fears about FTX.com’s financial health led customers to flee.

FTT, the utility token of the FTX exchange, has collapsed by more than 75 per cent in the past 24 hours and was trading around US$4.20, according to CoinGecko data.

“The letter of intent is non-binding, which means that further issues could still arise if CZ/Binance decide to back out of the deal,” said David Moreno Darocas, research associate at CryptoCompare.

The letter of acquisition intent by Zhao’s Binance Holdings came after a bitter feud between with Bankman-Fried spilled into the open. Zhao actively undermined confidence in FTX’s finances, helping spark an exodus of users from the three-year-old FTX.com exchange.

A day before reaching a deal, Bankman-Fried said on Twitter that assets on FTX were “fine.”

Terms of the emergency buyout were scant, with Binance saying the agreement came after “a significant liquidity crunch” befell FTX and the firm asked for its help.

The price of Sol, the native token of the Solana blockchain -- which is associated with both FTX and Bankman-Fried’s crypto trading house Alameda Research -- posted dramatic declines alongside other tokens of Solana-based projects. Sol was down as much as 36 per cent on Wednesday, taking losses this year to 90 per cent.

“SBF and FTX were the biggest patrons of Solana,” Teng Yan, a researcher at digital-asset research firm Delphi Digital, said on Twitter. “This era is over. Binance has taken over, and they will heavily favor BNB chain over Solana. Alameda had ~US$1B in locked and unlocked US$SOL, which they’ll have to sell if insolvent. This puts a huge sell pressure on US$SOL.”

The FTX-Binance ordeal gave some traders flashbacks to the issues suffered by Celsius -- the crypto lender that collapsed earlier this year -- as well as those seen by other firms that were engulfed in this year’s crash in digital assets.

Teong Hng, CEO at crypto investment firm Satori Research, said the “situation is still very fluid” while adding “I am confident these two crypto giants will do the right thing to protect investors and the industry.”

CANADIAN BITCOIN OWNERSHIP SIGNIFICANTLY INCREASED DURING THE PANDEMIC: BOC SURVEY

Hilary Punchard, BNN Bloomberg

Oct 12, 2022

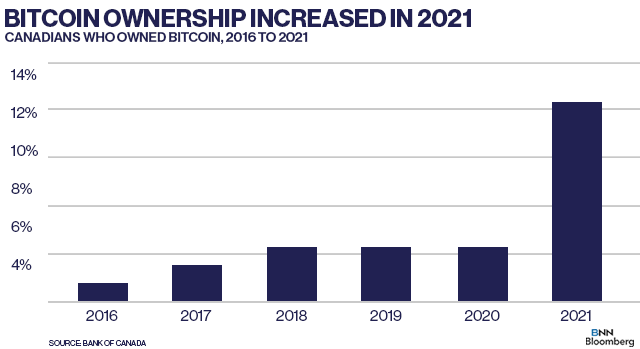

Bitcoin ownership significantly increased among Canadians last year, according to a survey released by the Bank of Canada.

In the central bank’s 2021 Bitcoin Omnibus Survey, it found ownership levels increased to 13 per cent in 2021.

The number of Canadians who owned Bitcoin sat at five per cent between 2018 and 2020.

“This increase occurred following widespread increases in the savings and wealth of Canadians during the pandemic,” the BoC report states.

“At the same time, some fintech companies began to offer cryptocurrencies alongside traditional investment products, providing consumers with a wider range of accessible and user-friendly platforms to buy Bitcoin.”

Bitcoin ownership increased the most among men (19 per cent) compared with women (seven per cent.)

The survey also found younger Canadians are more likely to be Bitcoin owners, with 26 per cent of Canadians 18 to 34 investing in the digital asset in 2021.

SMALLER STAKES

The majority of Bitcoin owners have a smaller stake in the digital asset.

“In 2021, the median amount of Bitcoin held was $500 worth, and 70 per cent of Bitcoin owners held the equivalent of $5,000 or less,” the report said.

“The value of Bitcoin holdings is higher for long-term owners than recent owners because long-term owners benefited from the significant run-up in prices that occurred during 2020.”

ONE-OUT-OF-FOUR REPORTED SIGNIFICANT LOSS

Many Canadian Bitcoin owners have suffered a significant investment loss at some point.

The report found 25 per cent of Bitcoin owners had lost a large amount in a price crash, which is up from 18 per cent in 2019.

Over the past three years, Bitcoin hit a high of US$67,734.04 on November 9, 2021.

Since then, the cryptocurrency has fallen more than 28 per cent to trade at $19,096.57 as of mid-day Wednesday.

Canadians also said that they’ve reported other issues with their crypto assets such as losing access to their wallet (11 per cent), transaction problems (nine per cent) or stolen funds (seven per cent.)

The Canadian Press

Oct 3, 2022

The Ontario Securities Commission says it has filed allegations against Troy Richard James Hogg related to a crypto token offering that raised US$51 million.

The statement of allegations says that between May 2017 and June 2019, Hogg, an Ontario resident, promoted and sold a crypto asset named Dignity token, previously called Unity Ingot, to investors around the world.

The regulator alleges that Hogg and his companies — Cryptobontix Inc., Arbitrade Exchange Inc. and Arbitrade Ltd. — defrauded investors with false and misleading statements in promotional materials, including that gold bullion supported the value of the tokens.

The OSC alleges that Hogg and his companies further defrauded investors by spending a significant amount of invested funds on things unrelated to crypto security tokens, including buying real estate and making payments to companies controlled by Hogg.

The regulator also alleges that Hogg did not file a prospectus for the token or obtain the necessary registration with the OSC to engage in trading activities.

The OSC says it was assisted in its investigation by the U.S. Securities and Exchange Commission, which ran a parallel investigation and has levelled charges against Hogg and several U.S. residents.

No comments:

Post a Comment