U$

GDP Grows 3.3 Percent in Fourth Quarter as

Productivity Surge Continues

The Commerce Department reported that GDP grew at a 3.3 percent rate in the fourth quarter driven by continued strength in consumption. This growth brought the growth for 2024 (4th quarter 2022 to 4th quarter 2023) to 3.1 percent. This is especially striking since this is a year for which many forecasters had projected a recession at the end of 2022.

The good news on growth was also accompanied by good news on inflation. The core PCE deflator rose at a 2.0 percent annual rate for the second consecutive quarter. The overall PCE rose at just a 1.7 percent rate, as sharply falling gas prices pulled down the overall figure. Given that the Fed’s target is having 2.0 percent as an average rate of inflation (i.e. not a ceiling) for the overall CPI, it certainly looks like recent data are consistent with its target.

More Evidence of a Productivity Uptick

Perhaps even more important than the rise in GDP in the quarter is the implication for productivity growth. The index of aggregate hours rose at just a 0.8 percent annual rate in the fourth quarter, while self-employment was virtually flat. This means that the rate of productivity growth for the quarter is likely to be somewhat above 2.0 percent. This follows two quarters of extraordinarily rapid growth and brings the rate for the year to roughly 2.5 percent.

Productivity data are notoriously erratic, so even three consecutive quarters of strong growth must be viewed with caution. Coming out of the pandemic, productivity growth was terrible, with reported growth being negative in 2022. If the fourth quarter data come in close to 2.0 percent, this will bring the average rate for the four years since the start of the pandemic to 1.5 percent. This is considerably more rapid than the 1.1 percent rate for the decade prior to the pandemic, but somewhat slower for the years immediately preceding the pandemic.

If a rate of 1.5 percent or higher can be sustained, it will allow for more rapid real wage growth. It should also help to alleviate concerns about inflation.

4.6 Percent Durable Goods Growth Leads Consumption, Overall Growth at 2.8 Percent

During the pandemic, there was a huge surge in durable goods consumption as people were unable to do things like go to restaurants and movies or travel. As the fears of the pandemic waned in 2021 and 2022, there was a shift back to service consumption. That was largely completed in 2022. While service consumption is still below its pre-recession share, largely due to a fall in the health care share, it is no longer gaining share at the expense of goods consumption and especially durable goods.

Durable goods consumption increased at a 4.6 percent annual rate, led by a 10.9 jump in purchases of recreational vehicles. These are items like all-terrain vehicles and private boats. This category of spending has been one of the leading growth areas of consumption since the pandemic (along with categories like jewelry and restaurant meals), not areas generally considered necessities.

Service Consumption Grew 2.4 Percent

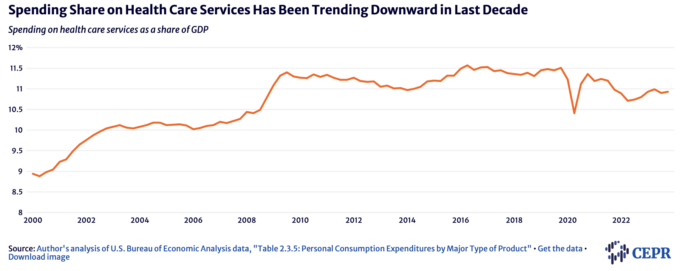

Real spending on housing (including utilities) and health care, the two largest components of service consumption, rose 0.4 percent and 3.4 percent, respectively. In the case of health care, nominal spending, as a share of income, is probably the more important factor than real spending. We care about our health, not the number of doctors visits or tests we receive. Nominal spending on health care services, by far the largest component of health care spending, is actually below its pre-pandemic level as a share of GDP at 10.9 percent compared to 11.5 percent in the fourth quarter of 2019.

Modest Uptick in Investment Growth

Non-residential investment spending grew at a 1.9 percent rate in the fourth quarter, up slightly from a 1.4 percent rate in the third quarter. The biggest factor in the uptick was a 1.0 percent rise in equipment investment after a 4.4 percent decline in the third quarter. Structure investment slowed to a 3.2 percent rise after three consecutive quarters of double-digit growth. The slowing of the huge surge in factory construction is the main factor here.

Investment in intellectual products grew at a 2.1 percent rate, slightly higher than the 1.8 percent rate in the third quarter. The Hollywood strikes have been a factor holding down investment in this category. Their end should be a positive in the next quarter.

High interest rates have been a factor depressing investment in recent quarters. If we see rates decline in 2024, there should be a pick-up from current growth rates.

Housing Is a Small Positive in the Fourth Quarter

Residential investment increased at a 1.1 percent rate in the quarter, down from 6.7 percent growth in the third quarter. The third quarter growth followed nine consecutive quarters of negative growth. It looks as though the housing downturn is over. With declining mortgage rates it should be at least a small positive in 2024.

Trade Added 0.43 Percentage Points to Growth

The trade deficit expanded rapidly in the pandemic due to the massive shift to goods consumption. It shifted back in 2022, as consumption of services rebounded back towards pre-pandemic levels. In the last year, trade has not been a major factor overall in GDP growth. The real deficit was $965.6 billion in the fourth quarter of 2022, and it was $908.2 billion last quarter.

The fourth quarter drop was due to a 6.3 percent rise in exports, and outweighed the impact of a 1.9 percent increase in imports. There is likely to be little net contribution of trade to GDP in 2024, unless the wars in Gaza or Ukraine explode into a larger conflict. If Europe does sink into a recession, it will be somewhat of a drag on U.S. exports, but the impact on U.S. exports of a modest decline in European GDP, compared with a scenario where it maintains a modest positive growth rate, is not large.

Saving Rate Edges Down to 4.0 Percent

The saving rate edged down from 4.2 percent in the third quarter. Much has been made of the low saving rate in recent quarters. While this is often taken as evidence of households hitting bottom, a deeper look shows a different picture.

There has been an extraordinarily large positive statistical discrepancy in the last year, hitting 2.4 percent of GDP in the third quarter. (We don’t have fourth quarter data yet.) The statistical discrepancy is the gap between GDP measured on the output side and GDP measured on the income side. In principle, they should be the same, but in a huge economy like ours, the two measures will never be exactly even.

Economists usually assume that the true figure is somewhere in the middle. If we make that assumption here, that means that income is somewhat higher than our data show. It also means that consumption is somewhat lower. Since saving is the gap between income and consumption, it is a safe bet that true savings, and therefore the saving rate, are considerably higher than the data now indicate.

Another Very Solid GDP Report

It is difficult to find much bad in this report. There can always be unexpected events that are a big hit to the economy, but the picture here is one of a very solid non-inflationary growth headed in 2024.

This first appeared on Dean Baker’s Beat the Press blog.

No comments:

Post a Comment