Staff Writer | October 3, 2024

The mining industry will require $2.1 trillion in new investments by 2050 to meet the raw material demands of a net-zero emissions world, according to BloombergNEF’s (BNEF) annual Transition Metals Outlook.

Despite a decade of growth in metals supply, BNEF reports that current raw material availability remains insufficient to meet the rising demand.

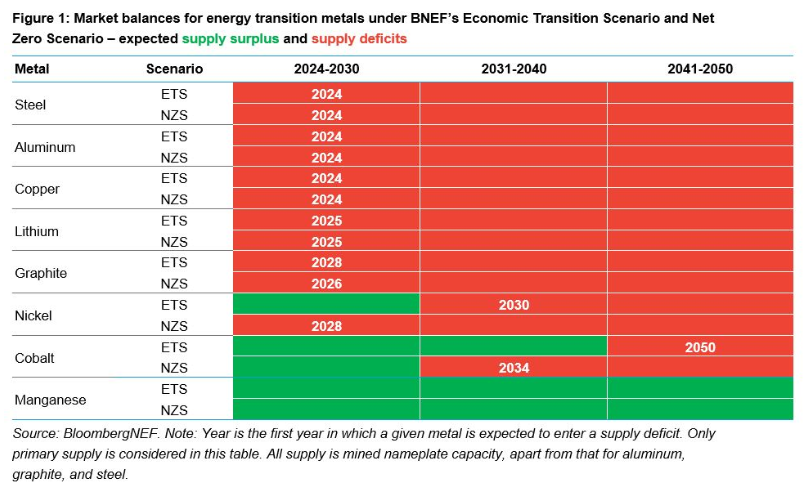

The report highlights that critical energy transition metals, including aluminum, copper and lithium, could face supply deficits this decade — some as early as this year.

According to BNEF’s Economic Transition Scenario (ETS), which assumes no new policy support and is driven by the cost competitiveness of technologies, the world may need 3 billion tonnes of metals between 2024 and 2050 to support low-carbon solutions such as electric vehicles, wind turbines, and electrolyzers. That figure could rise to 6 billion tonnes to achieve net-zero emissions by 2050.

Recycling could help alleviate some of the pressure, with BNEF predicting that output from secondary sources will become an integral part of the energy transition metals supply chain.

“Good government policies are crucial to the industry’s success. For batteries and stationary storage, governments need to establish collection networks, set recovery rate requirements, develop frameworks to trace individual cells, and provide guidelines for second-life battery management,” BNEF metals and mining associate Allan Ray Restauro said.

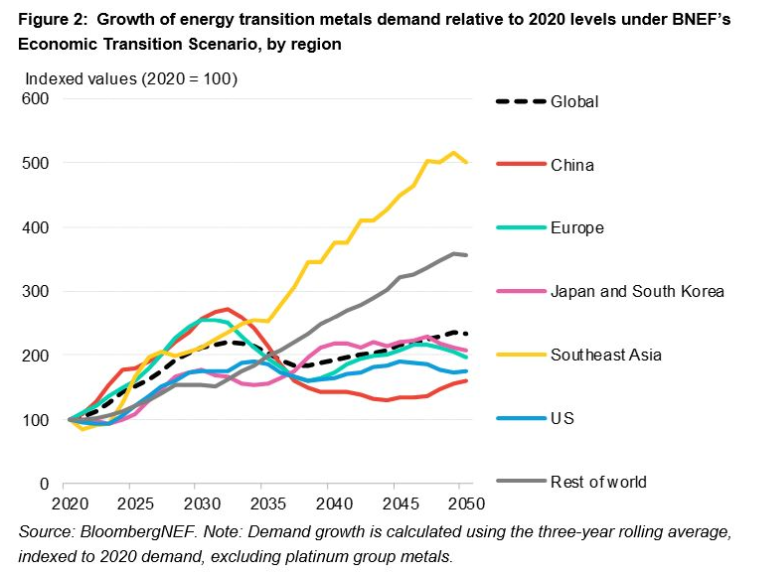

The pace of demand growth will vary across regions.

In China, for instance, consumption outpaced the global average between 2020 and 2023, but the country’s demand for energy transition metals is expected to peak in 2030. Southeast Asia is projected to become the fastest-growing market for these metals during the 2030s, according to BNEF’s ETS.

Read More: Lack of capital rises to top risk in EY mining survey

EY Survey Shows Capital As Top Mining Risk For 2025

By Sean Ashcroft

October 01, 2024

A reclaimer used to move stockpiles of crushed iron ore on a mine site.

Ernst & Young mining sector survey reveals the industry is experiencing capital allocation challenges against a backdrop of energy transition demands

Mining companies face mounting pressure to secure capital while meeting rising demand for minerals essential to the energy transition, according to a new survey by Ernst & Young (EY), the global professional services firm.

The survey, based on responses from 353 senior mining executives globally, identifies capital management as the primary business risk for the sector in 2025. This challenge emerges as companies navigate between growth requirements and investor expectations for capital discipline.

Lee Downham, Energy and Resources Lead at EY in the UK, says: "Capital has emerged as the number one risk for mining companies, signalling a need to shift gears."

Mining firms are encountering difficulties in raising funds despite increasing demand for critical minerals. The current economic climate has created a challenging environment for securing investment, the report says.

Investors now require mining companies to demonstrate stringent capital management practices while simultaneously developing strategies for future growth.

EY shows environmental stewardship the key issue

EY says environmental management has become a central focus for mining operations, reflecting heightened scrutiny from stakeholders and regulators.

The survey indicates that less than half of respondents express confidence in meeting environmental obligations, highlighting the scale of the challenge facing the industry.

Members of the International Council on Mining and Metals, an international organisation dedicated to improving mining industry standards, have committed to environmental targets. This commitment encompasses biodiversity protection and water resource management.

The report also shows that mining companies are implementing green initiatives to align with investor expectations. These programmes aim to reduce environmental impact while maintaining operational efficiency.

EY mining risk assessment focuses on resource depletion

The industry faces significant challenges related to resource depletion, which appears as a new risk in the EY survey -- reflecting growing concerns about meeting future mineral demand.

Exploration costs, meanwhile, continue to rise, while new mineral discoveries become increasingly rare. This combination creates obstacles for mining companies seeking to replace depleting resources, EY says.

The report urges mining firms to overcome the multiple barriers they face to bring new projects online. These challenges include regulatory requirements, community expectations and technical complexities.

Waste management practices are receiving increased attention from investors. Mining companies are developing closed-loop processes to minimise waste production and maximise resource utilisation.

Mining's capital discipline impacts future growth plans

The requirement to maintain capital discipline while pursuing growth opportunities may lead to increased merger and acquisition activity within the mining sector.

Downham adds: "Miners must move from focusing solely on short-term returns to prioritising long-term value creation."

The survey methodology included responses from board members, C-suite executives and departmental leaders. All participating organisations reported annual revenue exceeding US$bn.

Downham concludes: "While they have a strong track record of capital discipline, it's now crucial to balance this with strategic investments that drive sustainable growth."

By Sean Ashcroft

October 01, 2024

A reclaimer used to move stockpiles of crushed iron ore on a mine site.

Ernst & Young mining sector survey reveals the industry is experiencing capital allocation challenges against a backdrop of energy transition demands

Mining companies face mounting pressure to secure capital while meeting rising demand for minerals essential to the energy transition, according to a new survey by Ernst & Young (EY), the global professional services firm.

The survey, based on responses from 353 senior mining executives globally, identifies capital management as the primary business risk for the sector in 2025. This challenge emerges as companies navigate between growth requirements and investor expectations for capital discipline.

Lee Downham, Energy and Resources Lead at EY in the UK, says: "Capital has emerged as the number one risk for mining companies, signalling a need to shift gears."

Mining firms are encountering difficulties in raising funds despite increasing demand for critical minerals. The current economic climate has created a challenging environment for securing investment, the report says.

Investors now require mining companies to demonstrate stringent capital management practices while simultaneously developing strategies for future growth.

EY shows environmental stewardship the key issue

EY says environmental management has become a central focus for mining operations, reflecting heightened scrutiny from stakeholders and regulators.

The survey indicates that less than half of respondents express confidence in meeting environmental obligations, highlighting the scale of the challenge facing the industry.

Members of the International Council on Mining and Metals, an international organisation dedicated to improving mining industry standards, have committed to environmental targets. This commitment encompasses biodiversity protection and water resource management.

The report also shows that mining companies are implementing green initiatives to align with investor expectations. These programmes aim to reduce environmental impact while maintaining operational efficiency.

EY mining risk assessment focuses on resource depletion

The industry faces significant challenges related to resource depletion, which appears as a new risk in the EY survey -- reflecting growing concerns about meeting future mineral demand.

Exploration costs, meanwhile, continue to rise, while new mineral discoveries become increasingly rare. This combination creates obstacles for mining companies seeking to replace depleting resources, EY says.

The report urges mining firms to overcome the multiple barriers they face to bring new projects online. These challenges include regulatory requirements, community expectations and technical complexities.

Waste management practices are receiving increased attention from investors. Mining companies are developing closed-loop processes to minimise waste production and maximise resource utilisation.

Mining's capital discipline impacts future growth plans

The requirement to maintain capital discipline while pursuing growth opportunities may lead to increased merger and acquisition activity within the mining sector.

Downham adds: "Miners must move from focusing solely on short-term returns to prioritising long-term value creation."

The survey methodology included responses from board members, C-suite executives and departmental leaders. All participating organisations reported annual revenue exceeding US$bn.

Downham concludes: "While they have a strong track record of capital discipline, it's now crucial to balance this with strategic investments that drive sustainable growth."

No comments:

Post a Comment