August 22, 2021

Several years ago during a radio interview, the host told me that the Chinese were planning on deploying a commercial modular molten salt reactor (MSR) by 2020. For context, these nuclear reactors are based on existing technology demonstrated by previous operating prototypes, can use fuel that is hundreds of times more abundant than the only naturally occurring fissile isotope (uranium-235), are resistant to making bomb-grade material, and cannot suffer meltdowns. Modular design could allow them to be built in factories and shipped ready to install to any suitable location.

The host was confident about his prediction because it had come from one of the many books circulating at the time telling us how great the human future would be and that new technology would solve all the world’s major problems including hunger, climate change, environmental pollution and resource scarcity. This would happen in part due to abundant energy produced by MSRs even as human populations continued to grow.

Sticking to the narrow question of MSRs, I opined that development of complex technologies takes far longer than anticipated and that there are unique challenges in the utility industry. I guessed it would be 20 years before a viable commercial Chinese MSR would appear.

While the Chinese did recently begin construction of a demonstration modular nuclear reactor, this reactor is of the light-water variety—the kind that is already widely in use, that is subject to the catastrophic meltdowns that haunt the nuclear industry, that uses uranium as its fuel, and that can foster proliferation of nuclear weapons.

The pressurized water reactor mentioned in the news release linked above is a type of light-water reactor (LWR). The design is undoubtedly safer than previous LWRs. But it still suffers from the many drawbacks of LWRs and seems unlikely to be widely adopted.

Small, modular reactors have been touted by the nuclear industry as the solution for rapid deployment of nuclear electric generating capacity in order to address climate change by reducing fossil fuel dependency in electricity generation. But this latest entry by the Chinese seems unlikely to address that need both because of its limitations and drawbacks and the fact that the world seems to be moving away from nuclear power. For example, Germany and Sweden are leading the way in decommissioning and dismantling nuclear power plants.

So, what happened to the Chinese molten salt reactor that was supposed to revolutionize the nuclear industry and dramatically expand its reach? The World Nuclear Association reports that the Chinese are still working on it and expect to deploy it some time in the 2030s.

The radio interview mentioned above took place in 2015. We are, of course, already past 2020 when the Chinese MSR was predicted to appear by the show’s host. In the interview I explained that new energy technologies must go through the prototype stage for proof of concept. All the prototype stage answers is, “Does this particular configuration actually work?” Then, money permitting, a larger pilot plant is built to show that the design can be scaled and run for long periods with reliability.

With these two stages, we’re already many years down the road, probably 10 or more years. Finally, if all goes well and money is available, a full-scale demonstration plant that provides electricity to the grid is built. From start to finish—siting, design specifications, approvals, contracting, construction, fueling and finally start-up—this process can take years.

Once a demonstration plant is up and running, its performance comes under scrutiny. Can it remain running without excessive downtime? Is the all-in cost of producing electricity competitive with the alternatives over time, not just a week or a month, but years? How well does the plant work with the grid and the mix of other sources of electricity? And, can an outside party, an interested utility, for example, verify the information provided by the owner of the demonstration plant?

There is a key regulatory question, too: Will this particular design and configuration pass muster with regulatory officials in the country of the utility thinking about deploying it?

Assuming all the above steps go well, we have only just arrived at the stage where utilities are thinking about deploying such technology. Now those utilities have to decide to deploy it and then begin the processes already detailed above for the demonstration plant. Even if this new type of reactor in its modular form is destined to displace existing forms of electricity generation, it could take another 20 years for it to make significant inroads in the utility market. Electricity generating plants can last for 40 or 50 years. Not surprisingly, utilities are loathe to replace plants they have already paid for if those plants are still generating profits—unless the utilities are forced to do so by government regulations.

As I concluded in 2008, the nuclear-dominated energy future prophesied by governments and industry never arrived and probably never would. The advent of a Chinese modular nuclear reactor is unlikely to change that. And, the fact that modular MSRs—a far safer option with potentially far greater fuel resources—remain only a distant hope is more proof that nuclear power is not going to be able to address climate change in any relevant time frame.

The techno-uptopians keep promising us technological solutions to our myriad critical problems that either don’t appear, don’t solve the problem, create many new difficult problems, or keep getting delayed far into the future (fusion-based energy comes to mind). What they never seriously ask us to do is change the way we live. That must be a major reason their “solutions” find such a large audience of ready believers.

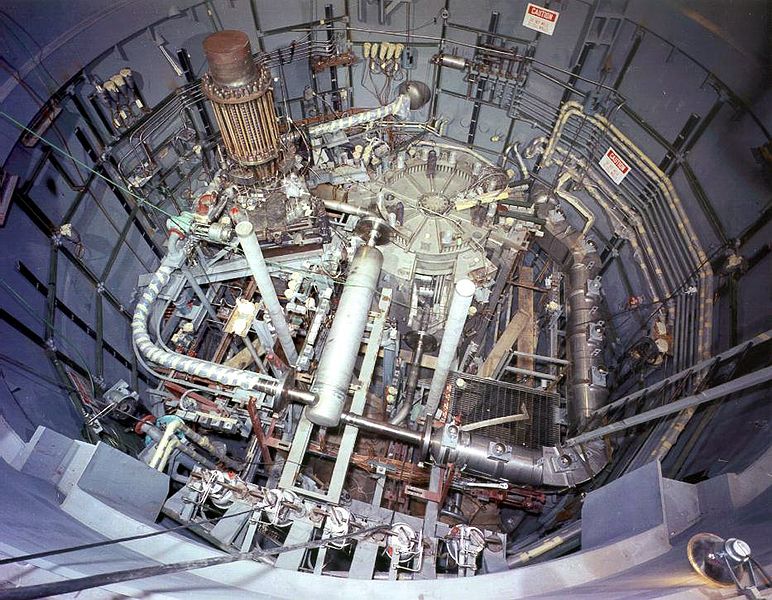

Photo: Top down view of the Moplten Salt Reactor Experiment (MSRE}. Oak Ridge National Laboratory (US Dept of Energyy) via Wikimedia Commons https://commons.wikimedia.org/wiki/File:MSRE_Reactor.JPG

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/K5UMBZIWCBB3JMMS6YXKKZC3HE.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/7MZSDFFQVVGMVAQTUOGSFIUQS4.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/66EMBS2WKJG3ZDH2QL6YTZWCDY.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/EO7QJQW7YZAQXKWFHI2SD23UZM.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/U6YKDQKHLZHFJAXOJOAMD5J2JM.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/adn/NIOMGVISHFCBPFNEZM4FT3HR7Y.jpg)