Reuters | August 29, 2024 | 9:25 am News Africa Gold

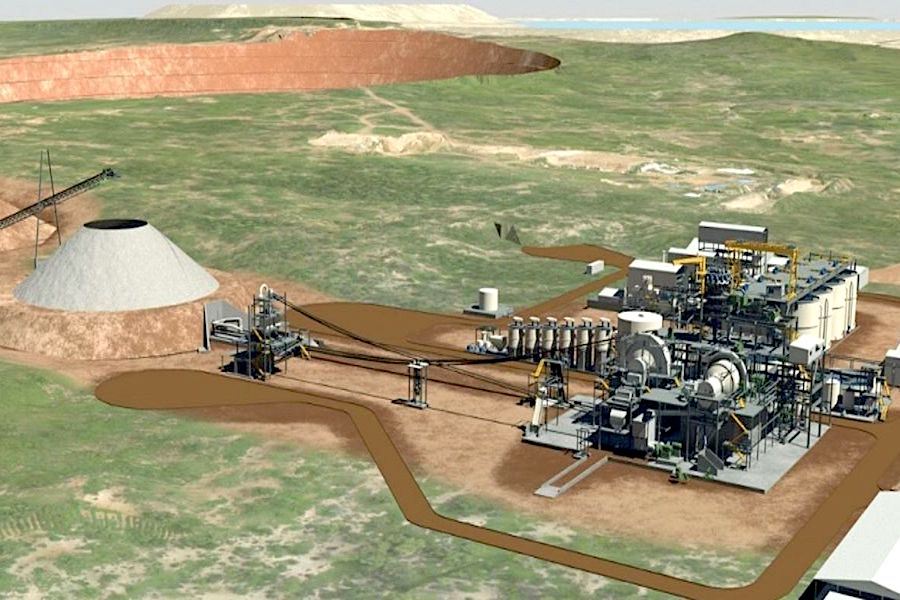

Proposed plant at the Namdini gold project in Ghana. (Image courtesy of Cardinal Resources.)

Africa’s top gold producer Ghana will commission its first large-scale greenfield mine in more than a decade in November, with expected annual production of more than 350,000 ounces, the head of its mining sector regulator told Reuters.

The Cardinal Namdini mine is owned by Cardinal Resources, a unit of Shandong Gold, which received a licence for the facility in 2020.

Ghana, the world’s number two cocoa producer, has seen gold exploration slump over the past decade, limiting new projects and lowering output from big miners.

Martin Ayisi, CEO of the Minerals Commission, said three other new mines, including a lithium project, will come onstream by 2026 to boost the West Africa nation’s minerals production and quicken a recovery from its worst economic crisis in a generation.

Ghana last commissioned a large-scale greenfield mine in 2013 when miner Newmont launched its Akyem site in southeastern Ghana.

Since then, “exploration took a nosedive”, Ayisi said in an interview on Monday, but “we will now have commissioning galore”.

“First is Cardinal Namdini, which is a monster mine and it will produce an average of 358,000 ounces per year. Mid-year 2025, Newmont will commission another monster mine – Ahafo North.”

He said the two mines would add at least 600,000 ounces of gold to Ghana’s annual output while bolstering economic growth and creating hundreds of jobs.

Ghana mined 4.03 million ounces of gold in 2023, driven largely by increased output from small-scale and artisanal miners.

Ayisi said another two new mines – a gold mine by Azumah Resources in northwestern Ghana along the border with Burkina Faso, and the country’s first lithium project, owned by Atlantic Lithium – will start production in 2026.

Miners welcome Ghana’s stable fiscal regime, but say excessive costs and bureaucracy are a deterrent for investment.

Ayisi said the Minerals Commission was working with the government to lower the exploration tax.

“Ivory Coast is number one when it comes to exploration spend because they have made it easier. We are number four, but we can be number one,” he said.

Gold production hit 2.5 million ounces by July this year, of which 42% came from small-scale and artisanal miners as surging global gold prices boosted the sector.

(By Maxwell Akalaare Adombila; Editing by Alessandra Prentice and Jan Harvey)