Nature's 3D printer: bristle worms form bristles piece by piece

Better understanding of this natural formation process offers potential for technical developments

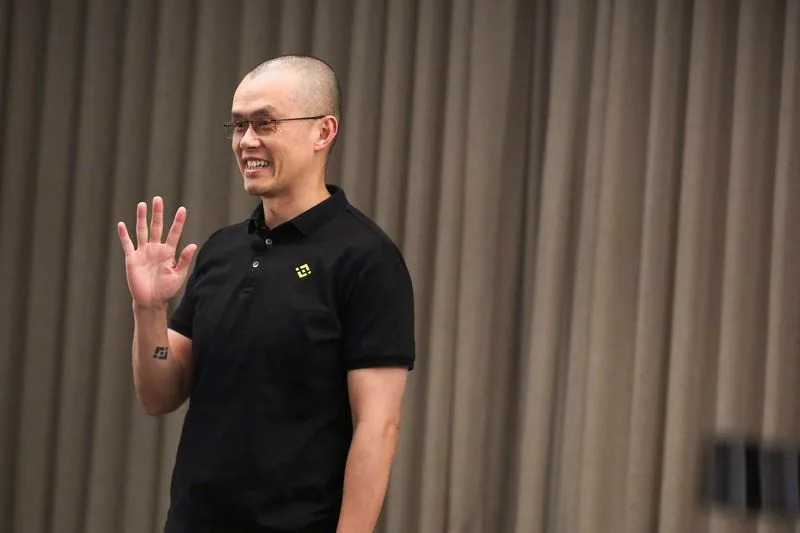

IMAGE:

LARVA OF THE MARINE ANNELID PLATYNEREIS DUMERILII, SCANNING ELECTRON MICROGRAPH (SIZE SCALE: 100ΜM)

view moreCREDIT: LUIS ZELAYA-LAINEZ, VIENNA UNIVERSITY OF TECHNOLOGY

A new interdisciplinary study led by molecular biologist Florian Raible from the Max Perutz Labs at the University of Vienna provides exciting insights into the bristles of the marine annelid worm Platynereis dumerilii. Specialized cells, so-called chaetoblasts, control the formation of the bristles. Their mode of operation is astonishingly similar to that of a technical 3D printer. The project is a collaboration with researchers from the University of Helsinki, Vienna University of Technology and Masaryk University in Brno. The study was recently published in the renowned journal Nature Communications.

Chitin is the primary building material both for the exoskeleton of insects and for the bristles of bristle worms such as the marine annelid worm Platynereis dumerilii. However, the bristle worms have a somewhat softer chitin – the so-called beta chitin – which is particularly interesting for biomedical applications. The bristles allow the worms to move around in the water. How exactly the chitin is formed into distinct bristles has so far remained enigmatic. The new study now provides exciting insight into this special biogenesis. Florian Raible explains: "The process begins with the tip of the bristle, followed by the middle section and finally the base of the bristles. The finished parts are pushed further and further out of the body. In this development process, the important functional units are created one after the other, piece by piece, which is similar to 3D printing."

A better understanding of processes such as these also holds potential for the development of future medical products or for the production of naturally degradable materials. Beta-chitin from the dorsal shell of squid, for example, is currently used as a raw material for the production of particularly well-tolerated wound dressings. "Perhaps in the future it will also be possible to use annelid cells to produce this material," says Raible.

The exact biological background to this: so-called chaetoblasts play a central role in this process. Chaetoblasts are specialized cells with long surface structures, so-called microvilli. These microvilli harbor a specific enzyme that the researches could show to be responsible for the formation of chitin, the material from which the bristles are ultimately made. The researchers' results show a dynamic cell surface characterized by geometrically arranged microvilli.

The individual microvilli have a similar function to the nozzles of a 3D printer. Florian Raible explains: "Our analysis suggests that the chitin is produced by the individual microvilli of the chaetoblast cell. The precise change in the number and shape of these microvilli over time is therefore the key to shaping the geometric structures of the individual bristles, such as individual teeth on the bristle tip, which are precise down to the sub-micrometer range." The bristles usually develop within just two days and can have different shapes; depending on the worm's stage of development, they are shorter or longer, more pointed or flatter.

In addition to the local collaboration with the Vienna University of Technology and imaging specialists from the University of Brno, the cooperation with the Jokitalo laboratory at the University of Helsinki proved to be a great benefit for the researchers at the University of Vienna. Using their expertise in serial block-face scanning electron microscopy (SBF-SEM), the researchers investigated the arrangement of microvilli in the bristle formation process and proposed a 3D model for the synthesis of bristle formation. First author Kyojiro Ikeda from the University of Vienna explains: "Standard electron tomography is very labor-intensive, as the cutting of the samples and their examination in the electron microscope must be done manually. With this approach, however, we can reliably automate the analysis of thousands of layers."

The Raible group is currently working on improving the resolution of the observation in order to reveal even more details about bristle biogenesis.

JOURNAL

Nature Communications

Comparison between "biological" (left) and "technological" 3D printing (right).

CREDIT

Claudia Amort, Studio Amort

Different segments of the bristles of the marine annelid Platynereis dumerilii. 3D reconstruction from more than 1000 electron micrographs. Blade (left), blade with joint (center), shaft (right).

CREDIT

Ilya Belevich, University of Helsinki

ARTICLE TITLE

Dynamic microvilli sculpt bristles at nanometric scale

ARTICLE PUBLICATION DATE

13-May-2024