CRIMINAL CRYPTO CAPITALI$M

The fallen kings of cryptoAFP

Wed, 22 November 2023

Sam Bankman-Fried founded FTX, a crypto exchange that collapsed spectacularly in 2022 (Ed JONES)

Binance boss Changpeng Zhao has become the most powerful cryptocurrency figure to fall in a two-year period chaotic even by the standards of the notoriously volatile industry.

Zhao stepped down as CEO of Binance -- the largest crypto exchange in the world -- after he and the company pleaded guilty on Tuesday to sweeping US money laundering violations and agreed to fines of more than $4 billion.

Here are three of the highest-profile crypto executives who have fallen foul of the law since last year:

- Changpeng 'CZ' Zhao -

Born in China in 1977, Zhao moved with his family to Canada in the 1980s and later got a degree in computer science from McGill University, according to his profile in the Bloomberg Billionaires Index.

He founded Binance in 2017 in Shanghai, and led the company's explosive growth into the world's biggest cryptocurrency exchange.

An outspoken celebrity in the crypto world with 8.7 million followers on X, Zhao became the richest known figure in the nascent industry. His net worth peaked at around $65 billion in 2022, according to a Forbes index.

With the prestige and wealth came increased scrutiny of Binance's operations, as prominent crypto firms around the world began to buckle under a wave of criminal investigations.

The United States accused Zhao and Binance of multiple violations, including knowingly allowing transactions to militant groups such as the Islamic State and in barred jurisdictions such as North Korea and Iran.

On Tuesday, they pleaded guilty. The firm has agreed to total penalties of nearly $4.4 billion, while he will pay $50 million, according to court documents.

Zhao resigned as CEO of Binance and while he will reportedly retain his shares in the company, he has been banned from any involvement in its business. He is expected to face sentencing later.

Forbes listed his net worth as $10.2 billion as of Wednesday.

- Sam Bankman-Fried -

If Zhao was the richest and most powerful person in crypto, Sam Bankman-Fried was easily the most famous.

Born to Stanford University professors, Bankman-Fried graduated from MIT with a degree in physics.

In 2019, he founded FTX, which skyrocketed to become the world's second-largest crypto exchange.

Along the way, Bankman-Fried built up his image as the unofficial ambassador for the cryptocurrency industry, with high-profile appearances in the media and even the US Congress.

At one point in 2022, he had a net worth of $24 billion, according to Forbes.

But he had been walking a dangerous path -- his team used customers' money for everything from buying posh real estate to covering risky moves by affiliate Alameda Research.

It all came crashing down when these moves were revealed in the media in November 2022. Within hours, rival CZ Zhao said Binance would sell all the FTX tokens it held.

It sparked a stunning collapse of FTX and Bankman-Fried's empire, his fame turning to notoriety.

Arrested in the Bahamas in January, he was found guilty this month of what US prosecutors described as "one of the biggest financial frauds in American history". He faces up to 110 years in prison.

During his trial, the 31-year-old admitted to making "mistakes" but denied trying to defraud anyone.

- Do Kwon -

South Korean entrepreneur Do Kwon co-founded Terraform Labs in 2018, developing the cryptocurrencies TerraUSD and Luna.

The Stanford grad successfully marketed them as the next big thing in crypto, attracting billions in investments and global hype.

Media reports in South Korea described him as a "genius".

But in May last year, the value of these currencies -- marketed as "stablecoins" -- plummeted, wiping out around $40 billion in investments and sending a shock wave through the rest of the industry.

It led to more than $500 billion in further losses on global crypto markets, industry data suggested.

Experts said Do Kwon -- whose full name is Kwon Do-kyung -- had marketed a glorified Ponzi scheme.

Brash and outspoken on social media, Do Kwon left South Korea before the collapse and spent months on the run.

He was arrested in Montenegro this year after being caught trying to catch a flight using fake Costa Rican travel documents.

He faces multiple criminal charges in the United States and South Korea.

qan/leg

Binance was slapped with a $4.3 billion fine because it let groups like Hamas and ISIS receive funds: Treasury Department

Kai Xiang Teo,Matthew Loh

Wed, November 22, 2023

Binance cofounder and former CEO Changpeng "CZ" Zhao, and US treasury secretary Janet YellenBen McShane/Sportsfile and Anna Moneymaker via Getty Images

Binance has reached a settlement with US regulators to pay out over $4 billion in fines.

The treasury department says the company enabled transactions from Hamas, the Islamic State, and Al Qaeda.

A lawsuit from the CFTC said Binance employees joked about transactions with Hamas.

Binance on Tuesday reached a settlement with US regulators — including the justice and treasury departments — to pay $4.3 billion in fines for violating anti-money laundering and sanctions laws.

Changpeng "CZ" Zhao, the cofounder of Binance and a central figure in the crypto world, is also stepping down as CEO under the settlement.

The treasury department said Binance failed to report over 100,000 suspicious transactions involving terrorist groups, ransomware, child sexual exploitation material, and scams.

Chief among these is the accusation that Binance was used to send money to the al-Qassam Brigades, the militant wing of Hamas, the Palestinian Islamic Jihad, al-Qaeda, and the Islamic State of Iraq and Syria.

The Hamas transactions were acknowledged in February 2019 by Binance's chief compliance officer at the time, Samuel Lim, according to a Commodity Futures Trading Commission lawsuit filed in March against the crypto exchange.

Lim had been told about "HAMAS transactions," and responded by saying that terrorists often send "small sums" of money because "large sums constitute money laundering," the CFTC complaint said.

"Can barely buy an AK-47 with 600 bucks," the colleague replied, per the complaint.

The complaint outlined several other messages between Lim and his staff that regulators said were clear signs Binance knew illegal transactions could and were being made through its services.

"I HAZ NO CONFIDENCE IN OUR GEOFENCING," Lim was told by a Binance employee, who was tasked with reporting money laundering, the complaint said.

On top of Tuesday's settlement, which also resolves the March CFTC complaint, Zhao is pleading guilty to breaking anti money-laundering law, per the justice department. Zhao will personally pay $50 million in fines, and faces up to 18 months in prison, The New York Times reported.

The settlement represents the culmination of long-running scrutiny from regulators against the cryptocurrency exchange. The justice department opened an investigation into Binance's compliance with anti money laundering law in 2018.

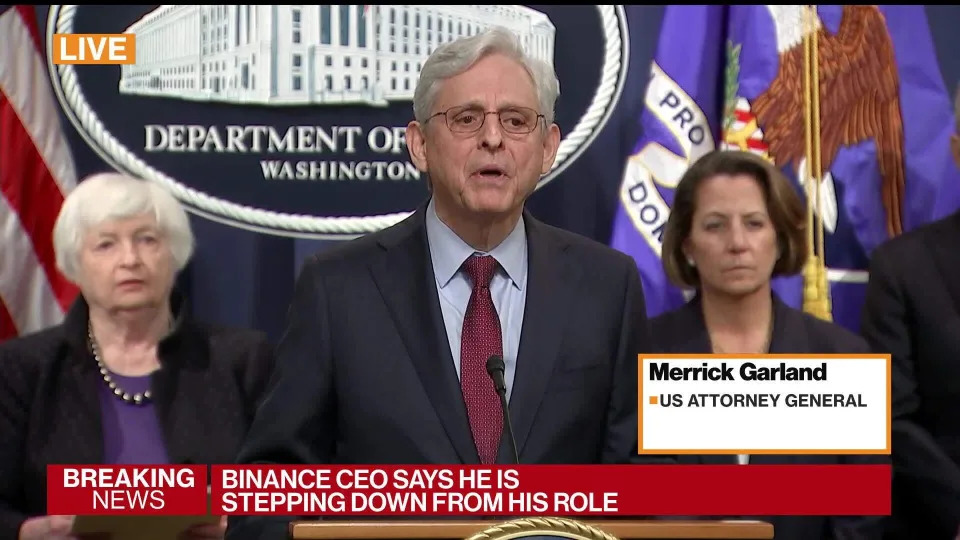

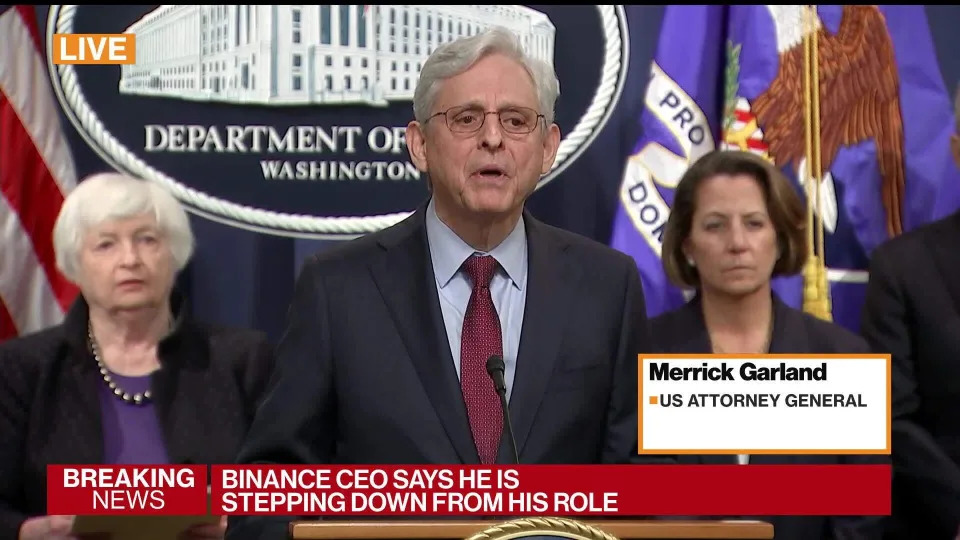

"Binance became the world's largest cryptocurrency exchange in part because of the crimes it committed — now it is paying one of the largest corporate penalties in U.S. history," Attorney General Merrick Garland said on Tuesday.

Binance and its former CEO struck an upbeat tone after the settlement was announced. Binance acknowledged the settlement and Zhao's resignation in a blog on Tuesday, saying Richard Teng — who was the global head of regional markets — would take over as CEO.

"Binance grew at an extremely fast pace globally, in a new and evolving industry that was in the early stages of regulation, and Binanace made misguided decisions along the way," the blog said. "Today, Binance takes responsibility for this past chapter."

Yesha Yadav, a law professor at Vanderbilt University, told Reuters that the deal "looks designed to give Binance the chance to live another day, while removing CZ, a figurehead who has been so intrinsically linked to the growth of a business model."

Although the deal means a settlement with the justice and treasury departments, as well as with the Commodity Futures Trading Commission, Binance is not out of deep water yet. The settlement does not cover an ongoing lawsuit from the Securities and Exchange Commission that accused Binance of operating as an illegal exchange.

In response to a request for comment, Binance directed Business Insider to the company's blog post on the settlement deal.

Changpeng Zhao, the crypto king and Binance chief, ousted for US crimes

Tom Wilson

Tue, November 21, 2023

LONDON (Reuters) -The most powerful man in crypto has lost his crown - and could see his freedom curtailed as well.

Binance chief Changpeng Zhao on Tuesday stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement resolving a years-long probe into the world's largest crypto exchange, prosecutors said.

The deal with the Justice Department, part of a large settlement between Binance and other U.S. agencies, resolves criminal charges for conducting an unlicensed money transmitter business, conspiracy and breaching sanctions regulations.

It also leaves Zhao's future uncertain.

"Today, I stepped down as CEO of Binance," Zhao tweeted. "Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility."

Zhao, known as CZ, will personally pay $50 million and is barred from all involvement with Binance.

U.S. sentencing guidelines call for prison time of 10 to 18 months for the charges he faces. Prosecutors are seeking an 18-month prison sentence, the New York Times reported.

Zhao and his lawyers did not return calls seeking comment.

LOFTY AMBITIONS

After launching Binance in Shanghai in 2017, Zhao dreamed big. "We want to take over the entire market!" he told staff in a company chat group that year.

The 46-year-old CEO did not waver in his belief as he built up his crypto exchange. Even this year, Zhao felt a major goal was within reach.

"The idea that a five-year-old start-up could mature and operate at the same level as a financial institution that has been around for 200 years was once impossible to fathom," Zhao wrote in January in a review of the previous year. "But we are nearly there today."

In that review, Binance hailed its progress in complying with regulations across the world. The exchange had strived through the year to strengthen client checks, it said, developing crypto's "best security and compliance team."

Zhao's public aim to be a part of all that has been dashed by Tuesday's guilty plea and settlement.

"By failing to comply with U.S. law, Binance made it easy for criminals to move their stolen funds and illicit proceeds on its exchanges," U.S. Attorney General Merrick Garland said on Tuesday. "Binance also did more than just fail to comply with federal law. It pretended to comply."

'ZHAO ANSWERS TO NO ONE'

Zhao was born in China before moving to Canada in 1989 at age 12, two months after China's Tiananmen Square crackdown on pro-democracy protesters, he wrote in a blog last year.

The tycoon crisscrossed the globe in his quest for success, working in Tokyo and New York before moving to Shanghai, where he embraced crypto and founded Binance.

Its expansion was dramatic. Binance became the world's biggest crypto exchange within six months.

While its market share has slipped this year, it still accounts for about half of global crypto trading volumes, according to research firm CCData.

From the company's earliest days, Zhao kept a tight grip on Binance, as a powerful leader committed to secrecy and focused on market domination, a Reuters report last year found. As CEO, he remained in control of minute operational detail, at the same time posting social media selfies with world leaders and city mayors.

Zhao installed a tight circle of associates, many of whom had worked or studied in China, into top jobs. Co-founder Yi He now runs Binance's venture capital arm, as well as other key departments.

As Binance hired more widely from traditional financial and regulatory worlds, Zhao's tight control over his company was undiminished. The company, which calls itself an "ecosystem," has set up more than 70 entities, most controlled by Zhao personally.

"Zhao answers to no one but himself," the Commodity Futures Trading Commission wrote in March after suing Binance for operating what it called a "sham" compliance program.

It is unclear whether Zhao will now relinquish control of the firms. In the meantime, one of his appointees will take over running Binance.

Richard Teng, a senior Binance executive who joined in 2021, is the new CEO, Zhao posted on social media on Tuesday. Teng "will ensure Binance delivers on our next phase of security, transparency, compliance, and growth," he said.

(Reporting by Tom Wilson in London; Editing by Lisa Shumaker and Bill Berkrot)

Kai Xiang Teo,Matthew Loh

Wed, November 22, 2023

Binance cofounder and former CEO Changpeng "CZ" Zhao, and US treasury secretary Janet YellenBen McShane/Sportsfile and Anna Moneymaker via Getty Images

Binance has reached a settlement with US regulators to pay out over $4 billion in fines.

The treasury department says the company enabled transactions from Hamas, the Islamic State, and Al Qaeda.

A lawsuit from the CFTC said Binance employees joked about transactions with Hamas.

Binance on Tuesday reached a settlement with US regulators — including the justice and treasury departments — to pay $4.3 billion in fines for violating anti-money laundering and sanctions laws.

Changpeng "CZ" Zhao, the cofounder of Binance and a central figure in the crypto world, is also stepping down as CEO under the settlement.

The treasury department said Binance failed to report over 100,000 suspicious transactions involving terrorist groups, ransomware, child sexual exploitation material, and scams.

Chief among these is the accusation that Binance was used to send money to the al-Qassam Brigades, the militant wing of Hamas, the Palestinian Islamic Jihad, al-Qaeda, and the Islamic State of Iraq and Syria.

The Hamas transactions were acknowledged in February 2019 by Binance's chief compliance officer at the time, Samuel Lim, according to a Commodity Futures Trading Commission lawsuit filed in March against the crypto exchange.

Lim had been told about "HAMAS transactions," and responded by saying that terrorists often send "small sums" of money because "large sums constitute money laundering," the CFTC complaint said.

"Can barely buy an AK-47 with 600 bucks," the colleague replied, per the complaint.

The complaint outlined several other messages between Lim and his staff that regulators said were clear signs Binance knew illegal transactions could and were being made through its services.

"I HAZ NO CONFIDENCE IN OUR GEOFENCING," Lim was told by a Binance employee, who was tasked with reporting money laundering, the complaint said.

On top of Tuesday's settlement, which also resolves the March CFTC complaint, Zhao is pleading guilty to breaking anti money-laundering law, per the justice department. Zhao will personally pay $50 million in fines, and faces up to 18 months in prison, The New York Times reported.

The settlement represents the culmination of long-running scrutiny from regulators against the cryptocurrency exchange. The justice department opened an investigation into Binance's compliance with anti money laundering law in 2018.

"Binance became the world's largest cryptocurrency exchange in part because of the crimes it committed — now it is paying one of the largest corporate penalties in U.S. history," Attorney General Merrick Garland said on Tuesday.

Binance and its former CEO struck an upbeat tone after the settlement was announced. Binance acknowledged the settlement and Zhao's resignation in a blog on Tuesday, saying Richard Teng — who was the global head of regional markets — would take over as CEO.

"Binance grew at an extremely fast pace globally, in a new and evolving industry that was in the early stages of regulation, and Binanace made misguided decisions along the way," the blog said. "Today, Binance takes responsibility for this past chapter."

Yesha Yadav, a law professor at Vanderbilt University, told Reuters that the deal "looks designed to give Binance the chance to live another day, while removing CZ, a figurehead who has been so intrinsically linked to the growth of a business model."

Although the deal means a settlement with the justice and treasury departments, as well as with the Commodity Futures Trading Commission, Binance is not out of deep water yet. The settlement does not cover an ongoing lawsuit from the Securities and Exchange Commission that accused Binance of operating as an illegal exchange.

In response to a request for comment, Binance directed Business Insider to the company's blog post on the settlement deal.

Changpeng Zhao, the crypto king and Binance chief, ousted for US crimes

Tom Wilson

Tue, November 21, 2023

LONDON (Reuters) -The most powerful man in crypto has lost his crown - and could see his freedom curtailed as well.

Binance chief Changpeng Zhao on Tuesday stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement resolving a years-long probe into the world's largest crypto exchange, prosecutors said.

The deal with the Justice Department, part of a large settlement between Binance and other U.S. agencies, resolves criminal charges for conducting an unlicensed money transmitter business, conspiracy and breaching sanctions regulations.

It also leaves Zhao's future uncertain.

"Today, I stepped down as CEO of Binance," Zhao tweeted. "Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility."

Zhao, known as CZ, will personally pay $50 million and is barred from all involvement with Binance.

U.S. sentencing guidelines call for prison time of 10 to 18 months for the charges he faces. Prosecutors are seeking an 18-month prison sentence, the New York Times reported.

Zhao and his lawyers did not return calls seeking comment.

LOFTY AMBITIONS

After launching Binance in Shanghai in 2017, Zhao dreamed big. "We want to take over the entire market!" he told staff in a company chat group that year.

The 46-year-old CEO did not waver in his belief as he built up his crypto exchange. Even this year, Zhao felt a major goal was within reach.

"The idea that a five-year-old start-up could mature and operate at the same level as a financial institution that has been around for 200 years was once impossible to fathom," Zhao wrote in January in a review of the previous year. "But we are nearly there today."

In that review, Binance hailed its progress in complying with regulations across the world. The exchange had strived through the year to strengthen client checks, it said, developing crypto's "best security and compliance team."

Zhao's public aim to be a part of all that has been dashed by Tuesday's guilty plea and settlement.

"By failing to comply with U.S. law, Binance made it easy for criminals to move their stolen funds and illicit proceeds on its exchanges," U.S. Attorney General Merrick Garland said on Tuesday. "Binance also did more than just fail to comply with federal law. It pretended to comply."

'ZHAO ANSWERS TO NO ONE'

Zhao was born in China before moving to Canada in 1989 at age 12, two months after China's Tiananmen Square crackdown on pro-democracy protesters, he wrote in a blog last year.

The tycoon crisscrossed the globe in his quest for success, working in Tokyo and New York before moving to Shanghai, where he embraced crypto and founded Binance.

Its expansion was dramatic. Binance became the world's biggest crypto exchange within six months.

While its market share has slipped this year, it still accounts for about half of global crypto trading volumes, according to research firm CCData.

From the company's earliest days, Zhao kept a tight grip on Binance, as a powerful leader committed to secrecy and focused on market domination, a Reuters report last year found. As CEO, he remained in control of minute operational detail, at the same time posting social media selfies with world leaders and city mayors.

Zhao installed a tight circle of associates, many of whom had worked or studied in China, into top jobs. Co-founder Yi He now runs Binance's venture capital arm, as well as other key departments.

As Binance hired more widely from traditional financial and regulatory worlds, Zhao's tight control over his company was undiminished. The company, which calls itself an "ecosystem," has set up more than 70 entities, most controlled by Zhao personally.

"Zhao answers to no one but himself," the Commodity Futures Trading Commission wrote in March after suing Binance for operating what it called a "sham" compliance program.

It is unclear whether Zhao will now relinquish control of the firms. In the meantime, one of his appointees will take over running Binance.

Richard Teng, a senior Binance executive who joined in 2021, is the new CEO, Zhao posted on social media on Tuesday. Teng "will ensure Binance delivers on our next phase of security, transparency, compliance, and growth," he said.

(Reporting by Tom Wilson in London; Editing by Lisa Shumaker and Bill Berkrot)

What’s behind Binance’s rumored $4 billion deal with the Justice Department

Jeff John Roberts

Tue, November 21, 2023

Antonio Masiello—Getty Images

The chess match between Binance and the Justice Department may be heading to an endgame. On Tuesday, Bloomberg reported that the parties are discussing a resolution that would see the company pay $4 billion to put an end to its long-running legal troubles with Uncle Sam.

The Bloomberg report is notable because it’s the first news of the Binance investigation in months, and comes half a year after industry insiders were certain the Justice Department was going to drop a legal bomb on the company to follow earlier lawsuits by the SEC and the CFTC. The story is also remarkable because, contrary to earlier reports, it suggests Binance might just come through this alive.

The Justice Department has been leaking like a sieve throughout the investigation, and earlier leaks suggested the consequences would be more dire. While $4 billion would amount to a staggering penalty—one of the biggest corporate fines in history—the Bloomberg report did not repeat earlier rumors that Changpeng Zhao would have to step down as CEO or even serve prison time as part of a settlement.

If the Justice Department is indeed easing up, the question is why. There are a few theories. One is that the agency has mishandled the investigation. One person familiar with the proceedings recently told me that the Binance file was initially handled by “main Justice,” which they described as a bureaucratic blob compared with the agency’s more specialized divisions. Now, even though those divisions—including prosecutors versed in sanctions law—have joined the party, the investigation may now amount to a sprawling mess that the agency just wants to be done with.

Another possibility is that the Justice Department has decided it would be a bad idea to blow Binance up altogether since doing so could cause a financial cataclysm in the crypto markets that spreads to other parts of finance. I’m skeptical of this. The Biden administration has made clear it would be delighted to see crypto wiped out altogether, while there is a loose consensus among economist types that a crypto meltdown would be unlikely to cause wider contagion.

A final explanation for why the Justice Department may be backing off slightly in its Binance investigation is that Zhao, the company’s CEO, has a few cards to play of his own. Even as the investigation has forced him to retreat from key markets—and to pull Binance staff out of the U.S. altogether—the company is still doing brisk business in Asia and offshore. Meanwhile, Zhao also has some leverage in the form of Binance’s ability to help track down bad guys using the platform. Even though the company has racked up a phone book’s worth of money laundering violations over the years, it has also helped law enforcement crack down on terrorists in places like Central Asia. All of this means that, if the Justice Department goes all out trying to nail the company to the wall, Zhao could simply walk away and let law enforcement try to figure who owns millions of Binance wallets.

Meanwhile, the recent thaw in Crypto Winter—which has seen the price of Bitcoin soar and trading volumes rise—has likely translated to more revenue for Binance (even as its overall market share has slipped) and more runway for Zhao to ride out the investigation. Hence the Justice Department may have finally concluded it makes sense to punish Binance severely rather than to try and kill it off altogether. All of this is mostly speculation, of course, but if you had to bet, it wouldn’t be crazy to predict that Binance and its CEO will survive the investigation—that’s what the markets appear to be doing right now in any case.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

This story was originally featured on Fortune.com

Jeff John Roberts

Tue, November 21, 2023

Antonio Masiello—Getty Images

The chess match between Binance and the Justice Department may be heading to an endgame. On Tuesday, Bloomberg reported that the parties are discussing a resolution that would see the company pay $4 billion to put an end to its long-running legal troubles with Uncle Sam.

The Bloomberg report is notable because it’s the first news of the Binance investigation in months, and comes half a year after industry insiders were certain the Justice Department was going to drop a legal bomb on the company to follow earlier lawsuits by the SEC and the CFTC. The story is also remarkable because, contrary to earlier reports, it suggests Binance might just come through this alive.

The Justice Department has been leaking like a sieve throughout the investigation, and earlier leaks suggested the consequences would be more dire. While $4 billion would amount to a staggering penalty—one of the biggest corporate fines in history—the Bloomberg report did not repeat earlier rumors that Changpeng Zhao would have to step down as CEO or even serve prison time as part of a settlement.

If the Justice Department is indeed easing up, the question is why. There are a few theories. One is that the agency has mishandled the investigation. One person familiar with the proceedings recently told me that the Binance file was initially handled by “main Justice,” which they described as a bureaucratic blob compared with the agency’s more specialized divisions. Now, even though those divisions—including prosecutors versed in sanctions law—have joined the party, the investigation may now amount to a sprawling mess that the agency just wants to be done with.

Another possibility is that the Justice Department has decided it would be a bad idea to blow Binance up altogether since doing so could cause a financial cataclysm in the crypto markets that spreads to other parts of finance. I’m skeptical of this. The Biden administration has made clear it would be delighted to see crypto wiped out altogether, while there is a loose consensus among economist types that a crypto meltdown would be unlikely to cause wider contagion.

A final explanation for why the Justice Department may be backing off slightly in its Binance investigation is that Zhao, the company’s CEO, has a few cards to play of his own. Even as the investigation has forced him to retreat from key markets—and to pull Binance staff out of the U.S. altogether—the company is still doing brisk business in Asia and offshore. Meanwhile, Zhao also has some leverage in the form of Binance’s ability to help track down bad guys using the platform. Even though the company has racked up a phone book’s worth of money laundering violations over the years, it has also helped law enforcement crack down on terrorists in places like Central Asia. All of this means that, if the Justice Department goes all out trying to nail the company to the wall, Zhao could simply walk away and let law enforcement try to figure who owns millions of Binance wallets.

Meanwhile, the recent thaw in Crypto Winter—which has seen the price of Bitcoin soar and trading volumes rise—has likely translated to more revenue for Binance (even as its overall market share has slipped) and more runway for Zhao to ride out the investigation. Hence the Justice Department may have finally concluded it makes sense to punish Binance severely rather than to try and kill it off altogether. All of this is mostly speculation, of course, but if you had to bet, it wouldn’t be crazy to predict that Binance and its CEO will survive the investigation—that’s what the markets appear to be doing right now in any case.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

This story was originally featured on Fortune.com

What does the Binance and Zhao scandal mean for the crypto world?

Binance saw $800 million in outflows after news broke of Changpeng Zhao’s plea deal. Experts say it could have been much worse

Marco Quiroz-Gutierrez

Wed, November 22, 2023

David Ryder—Getty Images

Hundreds of millions of dollars worth of cryptocurrencies have poured out of Binance over the past day, but experts told Fortune that the outflows are actually lower than many expected after the company and founder Changpeng “CZ” Zhao reached a deal with U.S. prosecutors and regulators.

About $800 million worth of Bitcoin, Ether, and the USDT and USDC stablecoins were withdrawn from the crypto exchange after news of the agreement initially broke on Tuesday, according to digital asset data and index provider CCData. The outflows can be explained in part by investors concerned about impending regulatory requirements Binance will be subject to per its agreement with prosecutors, or from institutional investors moving money elsewhere to save face, said CCData research lead Josh de Vos.

While the massive outflows were notable compared with a typical trading day, Binance’s resilience was surprising, de Vos told Fortune. “The level of outflows are probably lower than expected given the news,” he added.

On Tuesday, Binance agreed to pay $4.3 billion in penalties while Zhao stepped down as CEO and pleaded guilty to a criminal charge. The news rocked the crypto world and sent Binance’s native cryptocurrency, BNB, plummeting before a resurgence. Much the same appears to have happened with the exchange's outflows.

Despite the initial spike, the rate of outflows had mostly tempered by Wednesday, according to figures from CCData. But the exchange was still seeing average outflows of between $25 million and $50 million per hour, which could prove an issue if that pace doesn't taper, de Vos explained.

“If those flows are consistent," he said, "it could lead to a liquidity problem—or the perception of one, which can still have the same result."

Breaking down the outflows by coin, CoinMetrics noted that investors withdrew $300 million in Bitcoin alone from the crypto exchange over the past 24 hours. Solutions engineer Parker Merritt said the outflows highlighted some investors’ skittishness, especially in light of what's happened to FTX.

“We've all seen the downside of what can happen when you put full trust into a centralized exchange with FTX,” Merritt added.

Still, Merritt noted, the Bitcoin outflows aren't even the most ever for Binance: Earlier this month, the exchange recorded Bitcoin outflows of about $1.6 billion that weren't directly tied to a single news event. And back in May, when the company claimed to be shuffling around its Bitcoin reserves, some $5 billion was withdrawn. Working in the company’s favor is its mostly transparent system for proving reserves and the fact that its agreement with prosecutors was not as draconian as it could have been.

While the multibillion-dollar penalty was a blow for the world’s largest crypto exchange, it will continue to operate, and its former CEO is facing minimal prison time. All things considered, Merritt added, Binance appears to be on track to overcome its latest setback.

“If the U.S. is willing to settle with Binance for any sum of money,” he said, “you know they're in relatively good regulatory standing following that."

Meet Changpeng 'CZ' Zhao, the billionaire Binance CEO stepping down and pleading guilty to anti-money laundering charges

Marielle Descalsota,Pete Syme,Aaron Mok

Tue, November 21, 2023

Binance founder Changpeng Zhao is stepping down from his CEO role as a result of the DOJ's probe.REUTERS/Darrin Zammit Lupi

Changpeng Zhao, also known as CZ, has been one of the wealthiest people in crypto.

His rivalry with Sam Bankman-Fried nearly saw Binance save FTX from bankruptcy.

However, Binance later ran into its own issues, and Zhao is now pleading guilty to the DOJ's anti-money laundering probe and stepping down as CEO.

Changpeng Zhao is the founder of Binance, the world's largest cryptocurrency exchange.

Changpeng Zhao, who founded and served as CEO of Binance.Antonio Masiello/Getty Images

Zhao — who's often known as CZ — is one of the most prominent people in cryptocurrency, and has been the wealthiest person in the industry.

With a net worth of $23.5 billion as of November 20, he was listed as the 68th-richest person in the world, according to the Bloomberg Billionaires Index.

But crypto winter has taken a toll across the industry, and Zhao is no exception. His real-time estimated net worth is a far cry from the peak of his personal wealth: His net worth peaked at $95.9 billion earlier this year, the Bloomberg Billionaires Index shows.

Zhao's interest in cryptocurrency began in 2013 when he first learned about Bitcoin, according to a 2018 Forbes report. His career in the up-and-coming digital currency industry started at Blockchain.info, where he served as the head of development.

Zhao founded Binance in 2017 and powered it to become the biggest cryptocurrency exchange by trading volume. The exchange handles some $76 billion in daily trading volume, according to Protocol. In 2021 alone, Binance generated over $20 billion in revenue, according to Bloomberg. Binance is bigger than its four largest competitors combined, per Bloomberg.

Editor's note: This story was first published in October 2022 and has been updated to reflect recent developments.

Zhao was born in a rural village in Jiangsu province in China in 1977 to a family of teachers.

Nanjing, Suzhou, China.Fang Daqing/VCG/Getty Images

Zhao, who is Chinese-Canadian, moved to Vancouver in the late 1980s with his family, according to Forbes.

Zhao's father, Shengkai, was a professor who was exiled to the countryside during the Cultural Revolution in China, according to the Maclean's report.

Zhao said in a September blog post that his family had to wait in line outside the Canadian embassy for three days to procure visas. He added that he was "lucky to have been able to leave at that time."

Shengkai immigrated to Canada to pursue a doctorate degree at the University of British Columbia, per Maclean's. After the Tiananmen Square protests in 1989, Zhao and his family followed his father and moved to Vancouver.

Zhao said he experienced food rationing growing up in rural China. "You get a ticket to buy meat," Zhao told Fortune in a March interview. Zhao told Maclean's that it wasn't until he moved to Canada that he ever drank fresh milk, because it was so rare to find it in China.

When Zhao moved to Canada, he held a number of part-time jobs, according to the Maclean's report

McGill University, where Zhao attended.JHVEPhoto/iStock/Getty Images

Zhao's interest in technology was fueled by a $14,000 286 DOS computer that his father — "a math whiz and programmer" — bought when was Zhao was in his teens, per Maclean's. Before attending McGill, Zhao enrolled in programming classes in high school and started coding when he was just 16 years old, per Bloomberg.

After graduating from university, Zhao worked first on the Tokyo Exchange, and from 2001 to 2005, on Bloomberg's Tradebook, Mustajab said.

In 2005, Zhao quit the corporate life and moved to Shanghai to become a partner at the trading system company Fusion Systems. According to Zhao's Linkedin page, he left the company in December 2013.

The vast majority of Zhao's multibillion-dollar wealth comes from his controlling stake in Binance Holdings, per Bloomberg.

Cryptocurrency exchange Binance founder and CEO Changpeng Zhao speaks at a Binance fifth anniversary event in Paris, France, July 8, 2022.Staff/Reuters

While Bloomberg estimates Zhao was worth around $23.5 billion from his majority stake in the cryptocurrency platform, it's not a complete picture of his wealth. Bloomberg said it did not include cryptocurrency directly held by Zhao in his net worth, as the amount is not publicly available.

Zhao has personal cryptocurrency holdings in Bitcoin and Binance Coin, per a September report by Bloomberg. In 2021, Binance had over 90 million users, Bloomberg reported, citing an estimate from Zhao.

Zhao is said to have a considerable amount of wealth from Bitcoin, having bought $1 million worth of the digital currency when it was just $600 a unit, per Maclean's.

Binance declined to confirm Zhao's net worth and the source of his wealth to Insider.

But Zhao's journey at Binance has been far from smooth sailing — the company has been embroiled in several controversies.

Changpeng Zhao, founder of Binance.REUTERS/Darrin Zammit Lupi

In October, some $570 million worth of cryptocurrency traded on Binance was stolen in a blockchain hack, according to the New York Times. Zhao told CNBC in an October interview that no users had lost money in the attack, and that "software code is never bug free." The Binance hack is one of the biggest cryptocurrency hacks of all time.

Binance said in a blog post that in the event of a hack in the future, its validators will decide if the hacked funds will be frozen. The decision would be made through a series of "on-chain governance votes" — the system that manages and implements changes to the blockchain. Binance added they would also consider implementing a "bug bounty reward system," so users are incentivized to report bugs.

"Nearly $570 million were minted and taken by the hacker, $100 million are unrecovered and moved off chain by the hacker. No users or users funds affected," Mustajab said.

Binance has also been criticized for its ties to China. Binance only delisted Chinese yuan-based trading pairs on the exchange in 2021, and served customers in China for several years, according to September article by Protos. Chinese authorities banned all crypto-related transactions in September 2021.

Zhao responded to these allegations in a blog post published in September, where he clarified that Binance was never incorporated in China and said it does not "operate like a Chinese company culturally." He added that he is "a Canadian citizen, period."

Binance also garnered controversy for enabling Iran-based users to trade cryptocurrencies on the exchange despite US-imposed sanctions, according to a July report by Reuters. Binance informed traders in Iran to liquidate their accounts in November 2018, but seven traders continued until September 2021 to use the account even after the ban. Binance did not respond to Reuters' requests for comment at the time.

Zhao was known for his rivalry with FTX cofounder Sam Bankman-Fried. Last year, Binance looked set to rescue SBF's firm from bankruptcy, before backing out of the deal.

Zhao Changpeng and Sam Bankman-Fried.Horacio Villalobos/CorbisAlex Wong/Getty Images

Binance signed a non-binding agreement to acquire FTX, Zhao said in a Twitter post on November 8, 2022. At the time, FTX was the third largest cryptocurrency exchange by trading volume after Binance and Coinbase, before filing for bankruptcy three days later.

It all started with a public spat on November 6 last year, when Zhao announced on Twitter that Binance would be liquidating its FTT tokens, the cryptocurrency of FTX.

Anthony Scaramucci, who sold 30% of his business to FTX, told Insider last January that Bankman-Fried had been saying "nasty things" about Zhao during a fundraising tour in the Middle East – which may have prompted Binance to sell off its FTT holdings.

In a Twitter post, Bankman-Fried said that Zhao was "trying to go after us with false rumors," and that FTX and its assets "are fine."

But then Binance pulled out of the deal, and FTX filed for bankruptcy. SBF was later found guilty on multiple fraud charges.

Binance then ran into legal troubles of its own, after the CFTC alleged it had violated trading rules.

Binance logo is displayed on a mobile phone screen.Beata Zawrzel/NurPhoto via Getty Images

On March 27, the Commodity Futures and Trading Commission sued Zhao, Binance, and its former chief compliance officer, Samuel Lim, for allegedly violating trading rules.

It alleged a "willful evasion of federal law" because Binance ignored requirements to register the exchange, and helped customers to evade its "ineffective compliance program."

The CFTC said Binance didn't require customers to provide ID, and "failed to implement basic compliance procedures designed to prevent and detect terrorist financing and money laundering."

The filing shows officers discussing transactions from Hamas, the Palestinian militant group that later conducted terrorist attacks against Israel in October. "Like come on. They are here for crime," Lim said in internal communications, per the filing.

Zhao has split his time between Dubai and France. He was previously based in Singapore.

Marina Bay Sands in Singapore.Marielle Descalsota/Insider

Zhao moved to Dubai in late 2021, where he leases an office to run what Bloomberg described as "a new phase" of Binance. Zhao also owns an apartment and a minivan in the city, the publication reported.

"I have always liked placed with diverse cultures," Zhao told the Gulf News in an August, 2022 interview. He described the city as "very pro-crypto," according to a 2021 interview with Bloomberg.

Previously, Zhao lived in Singapore from 2019 to 2021. The city-state spent hundreds of millions of dollars investing in the sector amidst a crackdown on the industry in the US, UK, and China.

Zhao is pleading guilty to anti-money laundering charges and will step down from his role as CEO of Binance.

Changpeng Zhao steps down from his role as CEO of Binance after he pleaded guilty to anti-money laundering charges.Andrey Rudakov/Bloomberg via Getty Images

Binance will pay a $4.3 billion fine in response to the verdict.

Part of the fine will go toward settling the lawsuit brought by the CFTC earlier this year, which accused Binance and Zhao of failing to stop illegal trading activity on the crypto exchange.

The crypto exchange is also pleading guilty to related charges, which could potentially put an end to a Department of Justice investigation spanning nearly five years.

Zhao will continue to have majority ownership of the crypto exchange.

Author Laura Sánchez

Cryptocurrency

Published Nov 23, 2023

Published Nov 23, 2023

© Reuter

Investing.com - The cryptocurrency sector rises on Thursday on the back of corporate news. Bitcoin moves above $37,000 and Ethereum rises above $2,000.

The sector is rebounding from recent declines after news that Changpeng Zhao, founder and CEO of Binance, the world's largest crypto exchange, resigned following revelations of wrongdoing in the United States. The firm has reached an agreement with the Department of Justice, the Treasury and the Commodity Futures Trading Commission (CFTC) to pay a record $4.368 billion fine for violating anti-money laundering laws and securities regulation.

Franco Macchiavelli, head of analysis at Admirals Spain, discusses the implications of the Binance case for the crypto world. "The Binance case has huge implications on several fronts. First, it sends a strong message about accountability and regulatory compliance in the cryptocurrency space. This event underscores the critical importance of following financial laws, especially in a field as dynamic and evolving as cryptocurrencies," he says.

"The record $4.3 billion fine and associated penalties highlight the global reach of US regulatory jurisdiction in the crypto space. This suggests a trend towards stricter regulation and more rigorous oversight of cryptocurrency exchange activities, especially in relation to compliance with money laundering and international sanctions laws," Macchiavelli adds.

"Moreover, the fact that the founder, Zhao, pleaded guilty and agreed to pay a significant personal fine signals that the leaders of crypto platforms can be held personally liable for the illegal actions of their companies. This could change the way industry leaders approach compliance and business decision-making," he adds.

"Finally, this event highlights the importance of regulatory compliance and constant monitoring in the crypto space. Companies operating in this sector should pay special attention to global financial regulations and establish robust compliance programmes to avoid similar sanctions in the future," he concludes.

Manuel Villegas, digital assets analyst at Julius Baer (SIX:BAER), notes that "regulatory hurdles are likely to increase as a result of these developments, but overall we do not believe they will hinder the long-term evolution of the asset class".

Investing.com - The cryptocurrency sector rises on Thursday on the back of corporate news. Bitcoin moves above $37,000 and Ethereum rises above $2,000.

The sector is rebounding from recent declines after news that Changpeng Zhao, founder and CEO of Binance, the world's largest crypto exchange, resigned following revelations of wrongdoing in the United States. The firm has reached an agreement with the Department of Justice, the Treasury and the Commodity Futures Trading Commission (CFTC) to pay a record $4.368 billion fine for violating anti-money laundering laws and securities regulation.

Franco Macchiavelli, head of analysis at Admirals Spain, discusses the implications of the Binance case for the crypto world. "The Binance case has huge implications on several fronts. First, it sends a strong message about accountability and regulatory compliance in the cryptocurrency space. This event underscores the critical importance of following financial laws, especially in a field as dynamic and evolving as cryptocurrencies," he says.

"The record $4.3 billion fine and associated penalties highlight the global reach of US regulatory jurisdiction in the crypto space. This suggests a trend towards stricter regulation and more rigorous oversight of cryptocurrency exchange activities, especially in relation to compliance with money laundering and international sanctions laws," Macchiavelli adds.

"Moreover, the fact that the founder, Zhao, pleaded guilty and agreed to pay a significant personal fine signals that the leaders of crypto platforms can be held personally liable for the illegal actions of their companies. This could change the way industry leaders approach compliance and business decision-making," he adds.

"Finally, this event highlights the importance of regulatory compliance and constant monitoring in the crypto space. Companies operating in this sector should pay special attention to global financial regulations and establish robust compliance programmes to avoid similar sanctions in the future," he concludes.

Manuel Villegas, digital assets analyst at Julius Baer (SIX:BAER), notes that "regulatory hurdles are likely to increase as a result of these developments, but overall we do not believe they will hinder the long-term evolution of the asset class".

Binance saw $800 million in outflows after news broke of Changpeng Zhao’s plea deal. Experts say it could have been much worse

Marco Quiroz-Gutierrez

Wed, November 22, 2023

David Ryder—Getty Images

Hundreds of millions of dollars worth of cryptocurrencies have poured out of Binance over the past day, but experts told Fortune that the outflows are actually lower than many expected after the company and founder Changpeng “CZ” Zhao reached a deal with U.S. prosecutors and regulators.

About $800 million worth of Bitcoin, Ether, and the USDT and USDC stablecoins were withdrawn from the crypto exchange after news of the agreement initially broke on Tuesday, according to digital asset data and index provider CCData. The outflows can be explained in part by investors concerned about impending regulatory requirements Binance will be subject to per its agreement with prosecutors, or from institutional investors moving money elsewhere to save face, said CCData research lead Josh de Vos.

While the massive outflows were notable compared with a typical trading day, Binance’s resilience was surprising, de Vos told Fortune. “The level of outflows are probably lower than expected given the news,” he added.

On Tuesday, Binance agreed to pay $4.3 billion in penalties while Zhao stepped down as CEO and pleaded guilty to a criminal charge. The news rocked the crypto world and sent Binance’s native cryptocurrency, BNB, plummeting before a resurgence. Much the same appears to have happened with the exchange's outflows.

Despite the initial spike, the rate of outflows had mostly tempered by Wednesday, according to figures from CCData. But the exchange was still seeing average outflows of between $25 million and $50 million per hour, which could prove an issue if that pace doesn't taper, de Vos explained.

“If those flows are consistent," he said, "it could lead to a liquidity problem—or the perception of one, which can still have the same result."

Breaking down the outflows by coin, CoinMetrics noted that investors withdrew $300 million in Bitcoin alone from the crypto exchange over the past 24 hours. Solutions engineer Parker Merritt said the outflows highlighted some investors’ skittishness, especially in light of what's happened to FTX.

“We've all seen the downside of what can happen when you put full trust into a centralized exchange with FTX,” Merritt added.

Still, Merritt noted, the Bitcoin outflows aren't even the most ever for Binance: Earlier this month, the exchange recorded Bitcoin outflows of about $1.6 billion that weren't directly tied to a single news event. And back in May, when the company claimed to be shuffling around its Bitcoin reserves, some $5 billion was withdrawn. Working in the company’s favor is its mostly transparent system for proving reserves and the fact that its agreement with prosecutors was not as draconian as it could have been.

While the multibillion-dollar penalty was a blow for the world’s largest crypto exchange, it will continue to operate, and its former CEO is facing minimal prison time. All things considered, Merritt added, Binance appears to be on track to overcome its latest setback.

“If the U.S. is willing to settle with Binance for any sum of money,” he said, “you know they're in relatively good regulatory standing following that."

Meet Changpeng 'CZ' Zhao, the billionaire Binance CEO stepping down and pleading guilty to anti-money laundering charges

Marielle Descalsota,Pete Syme,Aaron Mok

Tue, November 21, 2023

Binance founder Changpeng Zhao is stepping down from his CEO role as a result of the DOJ's probe.REUTERS/Darrin Zammit Lupi

Changpeng Zhao, also known as CZ, has been one of the wealthiest people in crypto.

His rivalry with Sam Bankman-Fried nearly saw Binance save FTX from bankruptcy.

However, Binance later ran into its own issues, and Zhao is now pleading guilty to the DOJ's anti-money laundering probe and stepping down as CEO.

Changpeng Zhao is the founder of Binance, the world's largest cryptocurrency exchange.

Changpeng Zhao, who founded and served as CEO of Binance.Antonio Masiello/Getty Images

Zhao — who's often known as CZ — is one of the most prominent people in cryptocurrency, and has been the wealthiest person in the industry.

With a net worth of $23.5 billion as of November 20, he was listed as the 68th-richest person in the world, according to the Bloomberg Billionaires Index.

But crypto winter has taken a toll across the industry, and Zhao is no exception. His real-time estimated net worth is a far cry from the peak of his personal wealth: His net worth peaked at $95.9 billion earlier this year, the Bloomberg Billionaires Index shows.

Zhao's interest in cryptocurrency began in 2013 when he first learned about Bitcoin, according to a 2018 Forbes report. His career in the up-and-coming digital currency industry started at Blockchain.info, where he served as the head of development.

Zhao founded Binance in 2017 and powered it to become the biggest cryptocurrency exchange by trading volume. The exchange handles some $76 billion in daily trading volume, according to Protocol. In 2021 alone, Binance generated over $20 billion in revenue, according to Bloomberg. Binance is bigger than its four largest competitors combined, per Bloomberg.

Editor's note: This story was first published in October 2022 and has been updated to reflect recent developments.

Zhao was born in a rural village in Jiangsu province in China in 1977 to a family of teachers.

Nanjing, Suzhou, China.Fang Daqing/VCG/Getty Images

Zhao, who is Chinese-Canadian, moved to Vancouver in the late 1980s with his family, according to Forbes.

Zhao's father, Shengkai, was a professor who was exiled to the countryside during the Cultural Revolution in China, according to the Maclean's report.

Zhao said in a September blog post that his family had to wait in line outside the Canadian embassy for three days to procure visas. He added that he was "lucky to have been able to leave at that time."

Shengkai immigrated to Canada to pursue a doctorate degree at the University of British Columbia, per Maclean's. After the Tiananmen Square protests in 1989, Zhao and his family followed his father and moved to Vancouver.

Zhao said he experienced food rationing growing up in rural China. "You get a ticket to buy meat," Zhao told Fortune in a March interview. Zhao told Maclean's that it wasn't until he moved to Canada that he ever drank fresh milk, because it was so rare to find it in China.

When Zhao moved to Canada, he held a number of part-time jobs, according to the Maclean's report

.

McDonald's in Richmond, BC, Canada.Cheng Feng Chiang/iStock/Getty Images

He started working at McDonald's when he was 14 and worked there for two years, Dewi Mustajab, a spokesperson for Binance, told Insider.

Zhao also worked at a Chevron gas station and as a referee for volleyball games in his teens to earn money, per Maclean's.

Zhao said in the blog post that moving to Canada "changed my life forever." He added that he spent his "best years as a teenager" growing up in Vancouver.

Zhao is known to be frugal: He doesn't own cars, yachts, or luxury watches. Instead, he has digital watches like the Apple Watch, and he recently bought a Toyota Velfire van, Mustajab said.

Zhao studied computer science at McGill University in Montreal, the same school where his father worked as a visiting scholar.

McDonald's in Richmond, BC, Canada.Cheng Feng Chiang/iStock/Getty Images

He started working at McDonald's when he was 14 and worked there for two years, Dewi Mustajab, a spokesperson for Binance, told Insider.

Zhao also worked at a Chevron gas station and as a referee for volleyball games in his teens to earn money, per Maclean's.

Zhao said in the blog post that moving to Canada "changed my life forever." He added that he spent his "best years as a teenager" growing up in Vancouver.

Zhao is known to be frugal: He doesn't own cars, yachts, or luxury watches. Instead, he has digital watches like the Apple Watch, and he recently bought a Toyota Velfire van, Mustajab said.

Zhao studied computer science at McGill University in Montreal, the same school where his father worked as a visiting scholar.

McGill University, where Zhao attended.JHVEPhoto/iStock/Getty Images

Zhao's interest in technology was fueled by a $14,000 286 DOS computer that his father — "a math whiz and programmer" — bought when was Zhao was in his teens, per Maclean's. Before attending McGill, Zhao enrolled in programming classes in high school and started coding when he was just 16 years old, per Bloomberg.

After graduating from university, Zhao worked first on the Tokyo Exchange, and from 2001 to 2005, on Bloomberg's Tradebook, Mustajab said.

In 2005, Zhao quit the corporate life and moved to Shanghai to become a partner at the trading system company Fusion Systems. According to Zhao's Linkedin page, he left the company in December 2013.

The vast majority of Zhao's multibillion-dollar wealth comes from his controlling stake in Binance Holdings, per Bloomberg.

Cryptocurrency exchange Binance founder and CEO Changpeng Zhao speaks at a Binance fifth anniversary event in Paris, France, July 8, 2022.Staff/Reuters

While Bloomberg estimates Zhao was worth around $23.5 billion from his majority stake in the cryptocurrency platform, it's not a complete picture of his wealth. Bloomberg said it did not include cryptocurrency directly held by Zhao in his net worth, as the amount is not publicly available.

Zhao has personal cryptocurrency holdings in Bitcoin and Binance Coin, per a September report by Bloomberg. In 2021, Binance had over 90 million users, Bloomberg reported, citing an estimate from Zhao.

Zhao is said to have a considerable amount of wealth from Bitcoin, having bought $1 million worth of the digital currency when it was just $600 a unit, per Maclean's.

Binance declined to confirm Zhao's net worth and the source of his wealth to Insider.

But Zhao's journey at Binance has been far from smooth sailing — the company has been embroiled in several controversies.

Changpeng Zhao, founder of Binance.REUTERS/Darrin Zammit Lupi

In October, some $570 million worth of cryptocurrency traded on Binance was stolen in a blockchain hack, according to the New York Times. Zhao told CNBC in an October interview that no users had lost money in the attack, and that "software code is never bug free." The Binance hack is one of the biggest cryptocurrency hacks of all time.

Binance said in a blog post that in the event of a hack in the future, its validators will decide if the hacked funds will be frozen. The decision would be made through a series of "on-chain governance votes" — the system that manages and implements changes to the blockchain. Binance added they would also consider implementing a "bug bounty reward system," so users are incentivized to report bugs.

"Nearly $570 million were minted and taken by the hacker, $100 million are unrecovered and moved off chain by the hacker. No users or users funds affected," Mustajab said.

Binance has also been criticized for its ties to China. Binance only delisted Chinese yuan-based trading pairs on the exchange in 2021, and served customers in China for several years, according to September article by Protos. Chinese authorities banned all crypto-related transactions in September 2021.

Zhao responded to these allegations in a blog post published in September, where he clarified that Binance was never incorporated in China and said it does not "operate like a Chinese company culturally." He added that he is "a Canadian citizen, period."

Binance also garnered controversy for enabling Iran-based users to trade cryptocurrencies on the exchange despite US-imposed sanctions, according to a July report by Reuters. Binance informed traders in Iran to liquidate their accounts in November 2018, but seven traders continued until September 2021 to use the account even after the ban. Binance did not respond to Reuters' requests for comment at the time.

Zhao was known for his rivalry with FTX cofounder Sam Bankman-Fried. Last year, Binance looked set to rescue SBF's firm from bankruptcy, before backing out of the deal.

Zhao Changpeng and Sam Bankman-Fried.Horacio Villalobos/CorbisAlex Wong/Getty Images

Binance signed a non-binding agreement to acquire FTX, Zhao said in a Twitter post on November 8, 2022. At the time, FTX was the third largest cryptocurrency exchange by trading volume after Binance and Coinbase, before filing for bankruptcy three days later.

It all started with a public spat on November 6 last year, when Zhao announced on Twitter that Binance would be liquidating its FTT tokens, the cryptocurrency of FTX.

Anthony Scaramucci, who sold 30% of his business to FTX, told Insider last January that Bankman-Fried had been saying "nasty things" about Zhao during a fundraising tour in the Middle East – which may have prompted Binance to sell off its FTT holdings.

In a Twitter post, Bankman-Fried said that Zhao was "trying to go after us with false rumors," and that FTX and its assets "are fine."

But then Binance pulled out of the deal, and FTX filed for bankruptcy. SBF was later found guilty on multiple fraud charges.

Binance then ran into legal troubles of its own, after the CFTC alleged it had violated trading rules.

Binance logo is displayed on a mobile phone screen.Beata Zawrzel/NurPhoto via Getty Images

On March 27, the Commodity Futures and Trading Commission sued Zhao, Binance, and its former chief compliance officer, Samuel Lim, for allegedly violating trading rules.

It alleged a "willful evasion of federal law" because Binance ignored requirements to register the exchange, and helped customers to evade its "ineffective compliance program."

The CFTC said Binance didn't require customers to provide ID, and "failed to implement basic compliance procedures designed to prevent and detect terrorist financing and money laundering."

The filing shows officers discussing transactions from Hamas, the Palestinian militant group that later conducted terrorist attacks against Israel in October. "Like come on. They are here for crime," Lim said in internal communications, per the filing.

Zhao has split his time between Dubai and France. He was previously based in Singapore.

Marina Bay Sands in Singapore.Marielle Descalsota/Insider

Zhao moved to Dubai in late 2021, where he leases an office to run what Bloomberg described as "a new phase" of Binance. Zhao also owns an apartment and a minivan in the city, the publication reported.

"I have always liked placed with diverse cultures," Zhao told the Gulf News in an August, 2022 interview. He described the city as "very pro-crypto," according to a 2021 interview with Bloomberg.

Previously, Zhao lived in Singapore from 2019 to 2021. The city-state spent hundreds of millions of dollars investing in the sector amidst a crackdown on the industry in the US, UK, and China.

Zhao is pleading guilty to anti-money laundering charges and will step down from his role as CEO of Binance.

Changpeng Zhao steps down from his role as CEO of Binance after he pleaded guilty to anti-money laundering charges.Andrey Rudakov/Bloomberg via Getty Images

Binance will pay a $4.3 billion fine in response to the verdict.

Part of the fine will go toward settling the lawsuit brought by the CFTC earlier this year, which accused Binance and Zhao of failing to stop illegal trading activity on the crypto exchange.

The crypto exchange is also pleading guilty to related charges, which could potentially put an end to a Department of Justice investigation spanning nearly five years.

Zhao will continue to have majority ownership of the crypto exchange.

The Sudden Downfall of Changpeng Zhao, the Crypto Titan Behind Binance

Olga Kharif

Wed, November 22, 2023

The Sudden Downfall of Changpeng Zhao, the Crypto Titan Behind Binance

(Bloomberg) -- Changpeng Zhao had long cultivated the image of the rugged pugilist of the cryptocurrencies world.

When his rival Sam Bankman-Fried’s crypto empire collapsed a year ago, Zhao, or “CZ” as his fans call him, was in the middle of it all, yanking his money in a very public way and helping trigger the ultimately fatal run on the firms. Years earlier he claimed the company’s headquarters was wherever he happened to be, a thinly veiled salvo against regulators trying to nail down jurisdiction. And this March, when US regulators charged Zhao and his firm, Binance Holdings, with violating US securities laws, his on-line response was “4,” which is Zhao code for dismissing something as unworthy of his attention.

On Tuesday, though, Zhao cut a very different image in a Seattle courtroom. Dressed in dark suit and pale blue tie before a federal judge, he pleaded guilty to criminal charges for anti-money laundering and US sanctions violations, including allowing transactions with Hamas and other terrorist groups, under a sweeping deal with the Justice department designed to keep the biggest crypto exchange operating. Binance itself agreed to plead guilty to criminal charges and pay over $4 billion in penalties. Zhao stepped down as CEO and will pay a $50 million fine.

Zhao’s capitulation in many ways is the culmination of a multi-year dragnet by international regulators who sought to rein in and impose regulations on Binance — and, by extension, the broader industry.

Moreover, it marks the second time in less than a year that the crypto universe, still reeling from a crash that shaved some $2 trillion off the value of the market, loses one of its biggest stars. Bankman-Fried may have been the best known name in crypto but Zhao, worth almost $100 billion at his zenith in early 2022, was the wealthiest and most powerful.

“This is a big deal,” said Michael Rosen, chief investment officer at Angeles Investments. Zhao’s “prominence helped him until it hurt him,” converting him eventually into a big target for authorities.

Richard Teng, a civil servant-turned-crypto executive, succeeded Zhao.

Binance Coin, a cryptocurrency also known as BNB that is the main transactional token on the exchange, dropped more than 8% on Tuesday.

Zhao played a key role in bringing cryptocurrencies into the mainstream. He built Binance into a juggernaut that at one point controlled almost two-thirds of spot trading over centralized exchanges — attracting scrutiny from regulators and law enforcement agencies around the world along the way.

The departure of crypto’s perhaps most iconic remaining executive comes as the industry tries to put its reputation for scandals, scams and other illicit activities behind it. Several entrepreneurs associated with that era, from Bankman-Fried to Do Kwon and Alex Mashinsky, are either in jail or have been charged with alleged crimes that led to multibillion-dollar losses.

Zhao faces as many as 10 years in prison but is expected to get no more than 18 months under a plea deal that appears to have saved him from the harsh penalties that other prominent crypto criminals have faced. The Justice Department hasn’t decided yet what length of a prison term they will seek for him.

“I will have to deal with some pain, but will survive,” Zhao said in an internal announcement. “I needed a break anyway.” He also provided a glimpse of what’s in store for Binance: “We will get through, although with some changes in structure.”

Born in China, Zhao moved to Vancouver when he was 12 and became a Canadian citizen. With a computer science degree from McGill University, he began a career building trading systems, including a stint at Bloomberg LP, the parent company of Bloomberg News.

In 2013, Zhao was running his own software company in Shanghai when he discovered Bitcoin over a poker game. After working at crypto firms Blockchain.info and OKCoin, he started Binance in 2017 together with Chief Marketing Officer Yi He, with whom he has children.

Binance quickly embarked on an acquisition spree that saw it morph into a brokerage, digital wallet, venture fund, custody service, data provider, digital-art marketplace and token issuer — all under Zhao’s direct control.

Within just a few years, Zhao was the richest person in crypto. Favoring a buzz cut and black polo shirts featuring Binance’s logo, he became a fixture on the crypto conference circuit, spending 580 hours on airplanes in 2022 by his own estimate.

The lack of separation between business actives such as custodial and trading services common among crypto exchanges, unlike in traditional finance — has stirred concerns that giant crypto exchanges like Binance could pose systemic risks.

When Bankman-Fried’s FTX imploded in November 2022, billions of dollars of client funds were trapped because FTX had lent assets to the hedge fund he also controlled, Alameda Research, which had made huge losing bets. Zhao himself helped hasten FTX’s demise with a post on Twitter about selling Binance’s holding of its native token FTT, which touched off a stampede to withdraw money from FTX.

Bankman-Fried was convicted of a massive fraud in early November and is awaiting sentencing. He faces the possibility of decades in prison.

Binance and other exchanges have argued that they present no similar risks because all of their client assets are kept separated and thus available for withdrawal at any time. Zhao himself regularly uses the term “SAFU” in tweets to assure customers that their funds are safe.

In the third quarter, the exchange has accounted for about 38% of all trading volumes across the spot market, down from nearly 55% in the first quarter of the year, according to researcher CCData. By comparison, Coinbase Global Inc., the biggest US crypto exchange, had a 5.7% market share in the quarter.

While Zhao publicly displayed defiance amid the charges, Binance authorities were working with regulators behind the scenes. Even Zhao’s official statement back in March was a bit more conciliatory than his “4” tweet, saying the firm was looking for “amicable solutions.”

The 4 tweet quickly became a favorite of his on-line detractors Tuesday. It actually represented, they snickered, the $4 billion fine Binance would pay.

--With assistance from Justina Lee, Emily Nicolle and Isabelle Lee.

Olga Kharif

Wed, November 22, 2023

The Sudden Downfall of Changpeng Zhao, the Crypto Titan Behind Binance

(Bloomberg) -- Changpeng Zhao had long cultivated the image of the rugged pugilist of the cryptocurrencies world.

When his rival Sam Bankman-Fried’s crypto empire collapsed a year ago, Zhao, or “CZ” as his fans call him, was in the middle of it all, yanking his money in a very public way and helping trigger the ultimately fatal run on the firms. Years earlier he claimed the company’s headquarters was wherever he happened to be, a thinly veiled salvo against regulators trying to nail down jurisdiction. And this March, when US regulators charged Zhao and his firm, Binance Holdings, with violating US securities laws, his on-line response was “4,” which is Zhao code for dismissing something as unworthy of his attention.

On Tuesday, though, Zhao cut a very different image in a Seattle courtroom. Dressed in dark suit and pale blue tie before a federal judge, he pleaded guilty to criminal charges for anti-money laundering and US sanctions violations, including allowing transactions with Hamas and other terrorist groups, under a sweeping deal with the Justice department designed to keep the biggest crypto exchange operating. Binance itself agreed to plead guilty to criminal charges and pay over $4 billion in penalties. Zhao stepped down as CEO and will pay a $50 million fine.

Zhao’s capitulation in many ways is the culmination of a multi-year dragnet by international regulators who sought to rein in and impose regulations on Binance — and, by extension, the broader industry.

Moreover, it marks the second time in less than a year that the crypto universe, still reeling from a crash that shaved some $2 trillion off the value of the market, loses one of its biggest stars. Bankman-Fried may have been the best known name in crypto but Zhao, worth almost $100 billion at his zenith in early 2022, was the wealthiest and most powerful.

“This is a big deal,” said Michael Rosen, chief investment officer at Angeles Investments. Zhao’s “prominence helped him until it hurt him,” converting him eventually into a big target for authorities.

Richard Teng, a civil servant-turned-crypto executive, succeeded Zhao.

Binance Coin, a cryptocurrency also known as BNB that is the main transactional token on the exchange, dropped more than 8% on Tuesday.

Zhao played a key role in bringing cryptocurrencies into the mainstream. He built Binance into a juggernaut that at one point controlled almost two-thirds of spot trading over centralized exchanges — attracting scrutiny from regulators and law enforcement agencies around the world along the way.

The departure of crypto’s perhaps most iconic remaining executive comes as the industry tries to put its reputation for scandals, scams and other illicit activities behind it. Several entrepreneurs associated with that era, from Bankman-Fried to Do Kwon and Alex Mashinsky, are either in jail or have been charged with alleged crimes that led to multibillion-dollar losses.

Zhao faces as many as 10 years in prison but is expected to get no more than 18 months under a plea deal that appears to have saved him from the harsh penalties that other prominent crypto criminals have faced. The Justice Department hasn’t decided yet what length of a prison term they will seek for him.

“I will have to deal with some pain, but will survive,” Zhao said in an internal announcement. “I needed a break anyway.” He also provided a glimpse of what’s in store for Binance: “We will get through, although with some changes in structure.”

Born in China, Zhao moved to Vancouver when he was 12 and became a Canadian citizen. With a computer science degree from McGill University, he began a career building trading systems, including a stint at Bloomberg LP, the parent company of Bloomberg News.

In 2013, Zhao was running his own software company in Shanghai when he discovered Bitcoin over a poker game. After working at crypto firms Blockchain.info and OKCoin, he started Binance in 2017 together with Chief Marketing Officer Yi He, with whom he has children.

Binance quickly embarked on an acquisition spree that saw it morph into a brokerage, digital wallet, venture fund, custody service, data provider, digital-art marketplace and token issuer — all under Zhao’s direct control.

Within just a few years, Zhao was the richest person in crypto. Favoring a buzz cut and black polo shirts featuring Binance’s logo, he became a fixture on the crypto conference circuit, spending 580 hours on airplanes in 2022 by his own estimate.

The lack of separation between business actives such as custodial and trading services common among crypto exchanges, unlike in traditional finance — has stirred concerns that giant crypto exchanges like Binance could pose systemic risks.

When Bankman-Fried’s FTX imploded in November 2022, billions of dollars of client funds were trapped because FTX had lent assets to the hedge fund he also controlled, Alameda Research, which had made huge losing bets. Zhao himself helped hasten FTX’s demise with a post on Twitter about selling Binance’s holding of its native token FTT, which touched off a stampede to withdraw money from FTX.

Bankman-Fried was convicted of a massive fraud in early November and is awaiting sentencing. He faces the possibility of decades in prison.

Binance and other exchanges have argued that they present no similar risks because all of their client assets are kept separated and thus available for withdrawal at any time. Zhao himself regularly uses the term “SAFU” in tweets to assure customers that their funds are safe.

In the third quarter, the exchange has accounted for about 38% of all trading volumes across the spot market, down from nearly 55% in the first quarter of the year, according to researcher CCData. By comparison, Coinbase Global Inc., the biggest US crypto exchange, had a 5.7% market share in the quarter.

While Zhao publicly displayed defiance amid the charges, Binance authorities were working with regulators behind the scenes. Even Zhao’s official statement back in March was a bit more conciliatory than his “4” tweet, saying the firm was looking for “amicable solutions.”

The 4 tweet quickly became a favorite of his on-line detractors Tuesday. It actually represented, they snickered, the $4 billion fine Binance would pay.

--With assistance from Justina Lee, Emily Nicolle and Isabelle Lee.

Bloomberg Businessweek

Binance sees $956 million in outflows after Zhao steps down to settle US probe

Lisa Pauline Mattackal, Chris Prentice and Jonathan Stempel

Wed, November 22, 2023

(Reuters) -Investors pulled about $956 million from crypto exchange Binance over the past 24 hours, market data showed, after its chief, Changpeng Zhao, stepped down and faced prison time after pleading guilty on Tuesday to settle a years-long U.S. illicit finance probe.

The deal, in which Binance will pay $4.3 billion to U.S. authorities, raises questions over the future of the world's largest crypto exchange and marks another blow for an industry beset by scandals. Zhao has been replaced by Richard Teng, a senior Binance executive who joined in 2021, the company said.