Physicists Got a Quantum Computer to Work by Blasting It With the Fibonacci Sequence

An experiment involving a Fibonacci pattern of laser pulses apparently yielded a new state of matter.

By

Isaac Schultz

Yesterday 8:05AM

A team of physicists say they managed to create a new phase of matter by shooting laser pulses reading out the Fibonacci sequence to a quantum computer in Colorado. The matter phase relies on a quirk of the Fibonacci sequence to remain in a quantum state for longer.

Just as ordinary matter can be in a solid, liquid, gas, or superheated plasmic phase (or state), quantum materials also have phases. The phase refers to how the matter is structured on an atomic level—the arrangement of its atoms or its electrons, for example. Several years ago, physicists discovered a quantum supersolid, and last year, a team confirmed the existence of quantum spin liquids, a long-suspected phase of quantum matter, in a simulator. The recent team thinks they’ve discovered another new phase.

Quantum bits, or qubits, are like ordinary computer bits in that their values can be 0 or 1, but they can also be 0 or 1 simultaneously, a state of ambiguity that allows the computers to consider many possible solutions to a problem much faster than an ordinary computer. Quantum computers should eventually be able to solve problems that classical computers can’t.

Qubits are often atoms; in the recent case, the researchers used 10 ytterbium ions, which were controlled by electric fields and manipulated using laser pulses. When multiple qubits’ states can be described in relation to one another, the qubits are considered entangled. Quantum entanglement is a delicate agreement between multiple qubits in a system, and the agreement is dissolved the moment any one of those bits’ values is certain. At that moment, the system decoheres, and the quantum operation falls apart.

A big challenge of quantum computing is maintaining the quantum state of qubits. The slightest fluctuations in temperature, vibrations, or electromagnetic fields can cause the supersensitive qubits to decohere and their calculations to fall apart. Since the longer the qubits stay quantum, the more you can get done, making computers’ quantum states persist for as long as possible is a crucial step for the field.

In the recent research, pulsing a laser periodically at the 10 ytterbium qubits kept them in a quantum state—meaning entangled—for 1.5 seconds. But when the researchers pulsed the lasers in the pattern of the Fibonacci sequence, they found that the qubits on the edge of the system remained in a quantum state for about 5.5 seconds, the entire length of the experiment (the qubits could have remained in a quantum state for longer, but the team ended the experiment at the 5.5-second mark). Their research was published this summer in Nature.

You can think of the Fibonacci sequence laser pulses as two frequencies that never overlap. That makes the pulses a quasicrystal: a pattern that has order, but no periodicity.

“The key result in my mind was showing the difference between these two different ways to engineer these quantum states and how one was better at protecting it from errors than the other,” said study co-author Justin Bohnet, a quantum engineer at Quantinuum, the company whose computer was used in the recent experiment.

The Fibonacci sequence is a numeric pattern in which each number is the sum of the two previous numbers (so 1, 1, 2, 3, 5, 8, 13, and so on). Its history goes back over 2,000 years and is connected to the so-called golden ratio. Now, the unique series may have quantum implications.

“It turns out that if you engineer laser pulses in the correct way, your quantum system can have symmetries that come from time translation,” said Philipp Dumitrescu, the paper’s lead author and a quantum physicist who conducted the work while at the Flatiron Institute. A time-translation symmetry means that an experiment will yield the same result, regardless of whether it takes place today, tomorrow, or 100 years from now.

“What we realized is that by using quasi-periodic sequences based on the Fibonacci pattern, you can have the system behave as if there are two distinct directions of time,” Dumitrescu added.

Shooting the qubits with laser pulses with a periodic (a simple A-B-A-B) pattern didn’t prolong the system’s quantum state. But by pulsing the laser in a Fibonacci sequence (A-AB-ABA-ABAAB, and so on), the researchers gave the qubits a non-repeating, or quasi-periodic, pattern.

It’s similar to the quasicrystals from the Trinity nuclear test site, but instead of being a three-dimensional quasicrystal, the physicists made a quasicrystal in time. In both cases, symmetries that exist at higher dimensions can be projected in a lower dimension, like the tessellated patterns in a two-dimensional Penrose tiling.

“With this quasi-periodic sequence, there’s a complicated evolution that cancels out all the errors that live on the edge,” Dumitrescu said in a Simons Foundation release. By on the edge, he’s referring to the qubits farthest from the center of their configuration at any one time. “Because of that, the edge stays quantum-mechanically coherent much, much longer than you’d expect.” The Fibonacci-pattern laser pulses made the edge qubits more robust.

More robust, longer-lived quantum systems are a vital need for the future of quantum computing. If it takes shooting qubits with a very specific mathematical rhythm of laser pulses to keep a quantum computer in an entangled state, then physicists had better start blasting.

More: What the Hell Is a Quantum Computer and How Excited Should I Be?

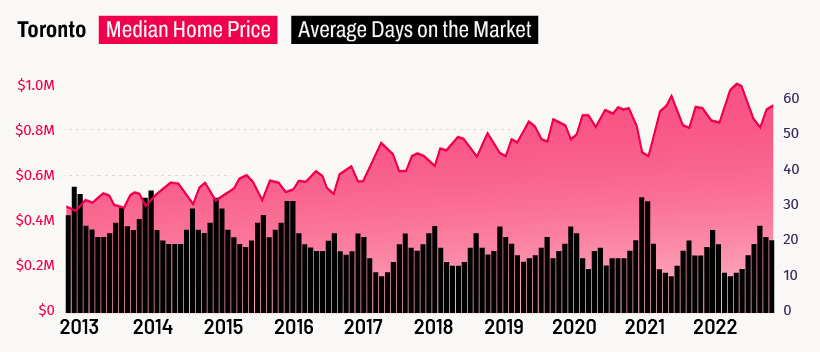

#1 TORONTO, CANADA

These Global Cities Show the Highest Real Estate Bubble Risk

Published October 19, 2022By Nick Routley These Global Cities Show the Highest Real Estate Bubble Risk (visualcapitalist.com)

These Global Cities Show the Highest Real Estate Bubble Risk (visualcapitalist.com)

▼ Use This Visualization

These Global Cities Show the Highest Real Estate Bubble Risk

Housing bubbles are a tricky phenomenon. As a market gathers steam and prices increase, it remains a matter of debate whether that market is overvalued and flooded with speculation, or it’s simply experiencing robust demand.

Of course, once a bubble bursts, it’s all obvious in hindsight.

One common red flag is when prices decouple from local incomes and rents. As well, imbalances in the real economy, such as excessive construction activity and lending can signal a bubble in the making.

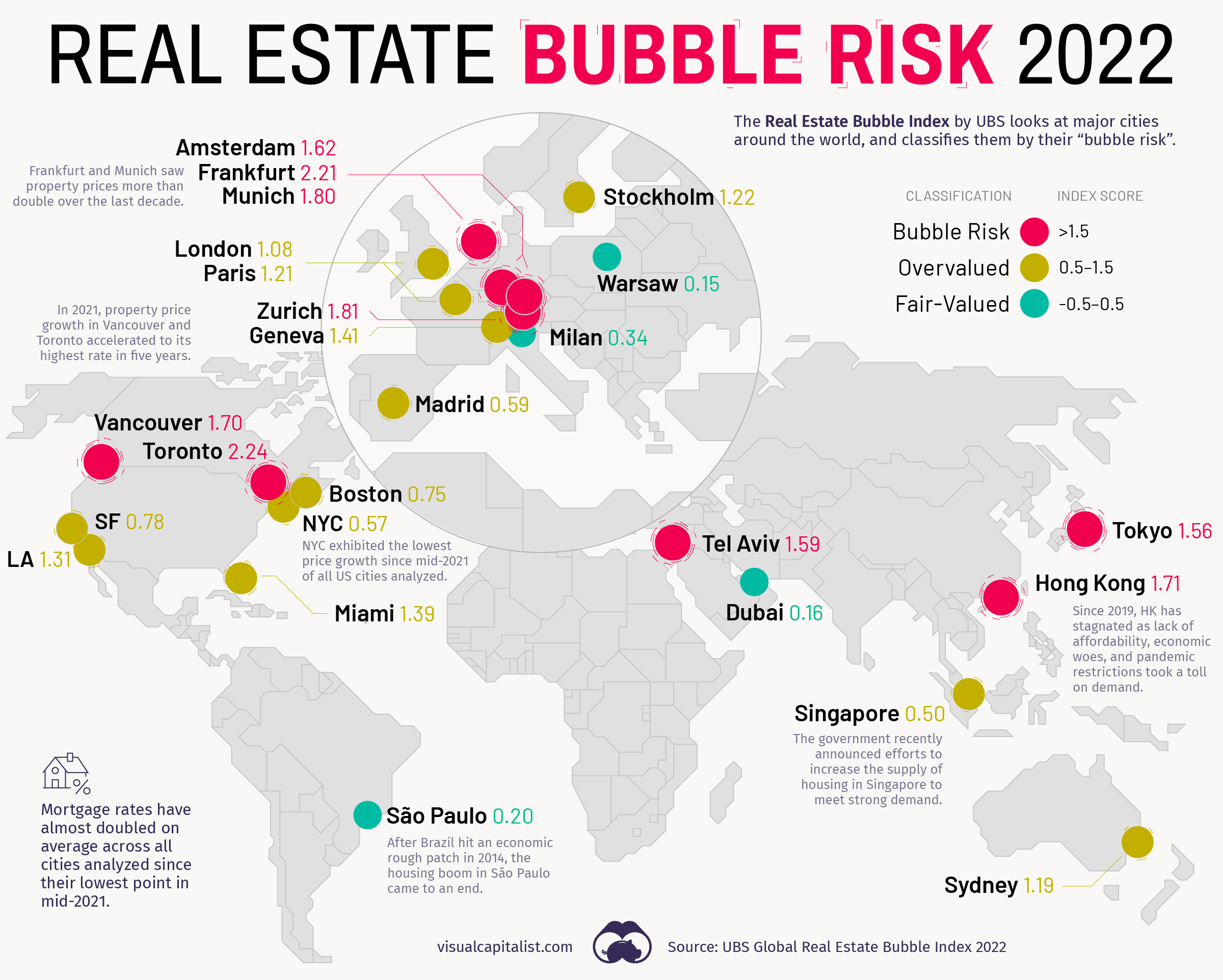

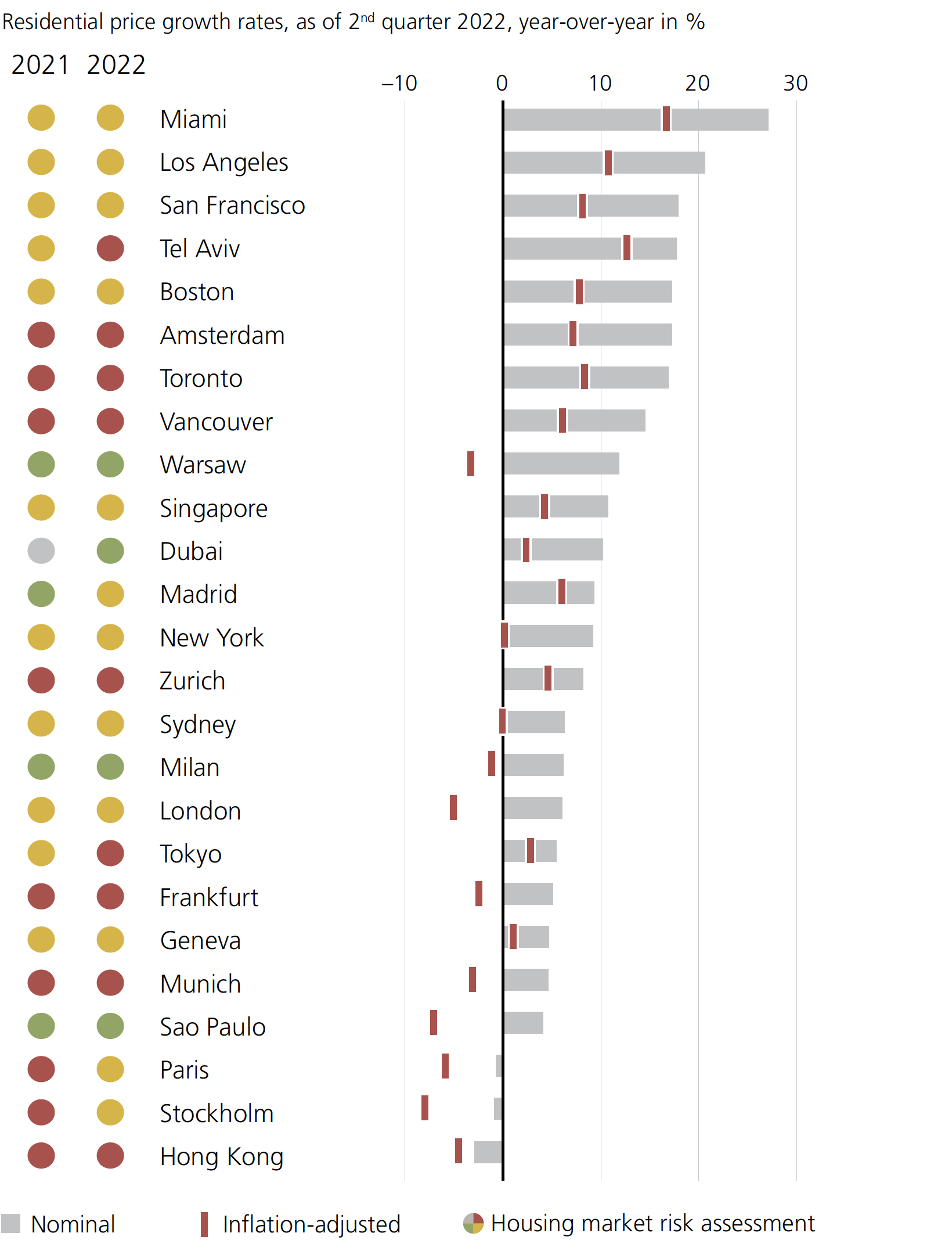

The map above, based on data from the Real Estate Bubble Index by UBS, examines 25 global cities, scoring them based on their bubble risk.

Overinflated Markets

In the 2022 edition of the Real Estate Bubble Index, nine of the cities covered were classified as having extreme bubble risk (1.5 or higher score).

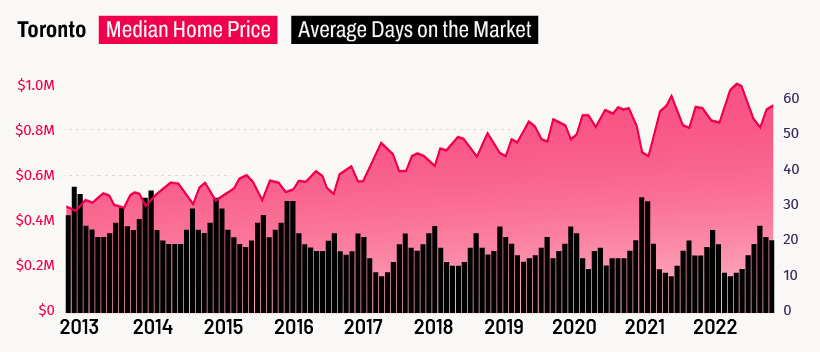

Canada’s largest city finds itself at the top of a ranking no city wants to end up on. Toronto’s home prices have been rising steadily for years now, and many, including UBS, believe that the city is now firmly in bubble territory.

Vancouver also finds itself in a similar position. Both Canadian cities have a high quality of life and have thriving tech industries.

Notably, none of the U.S. cities analyzed find themselves in the most extreme bubble risk category. The closest scoring U.S. city was Miami, which sits firmly in overvalued territory (0.5-1.5 range) with a score of 1.39.

Examining the Trends

In recent years, low interest rates helped push home prices and incomes further apart.

For cities in the bubble risk zone, prices have climbed by an average of 60% in inflation-adjusted terms over the past decade, while rents and real incomes increased by just 12%. And, while COVID-19 briefly put a dent in urban demand, rents in the cities analyzed rose at around the same pace as pre-pandemic times.

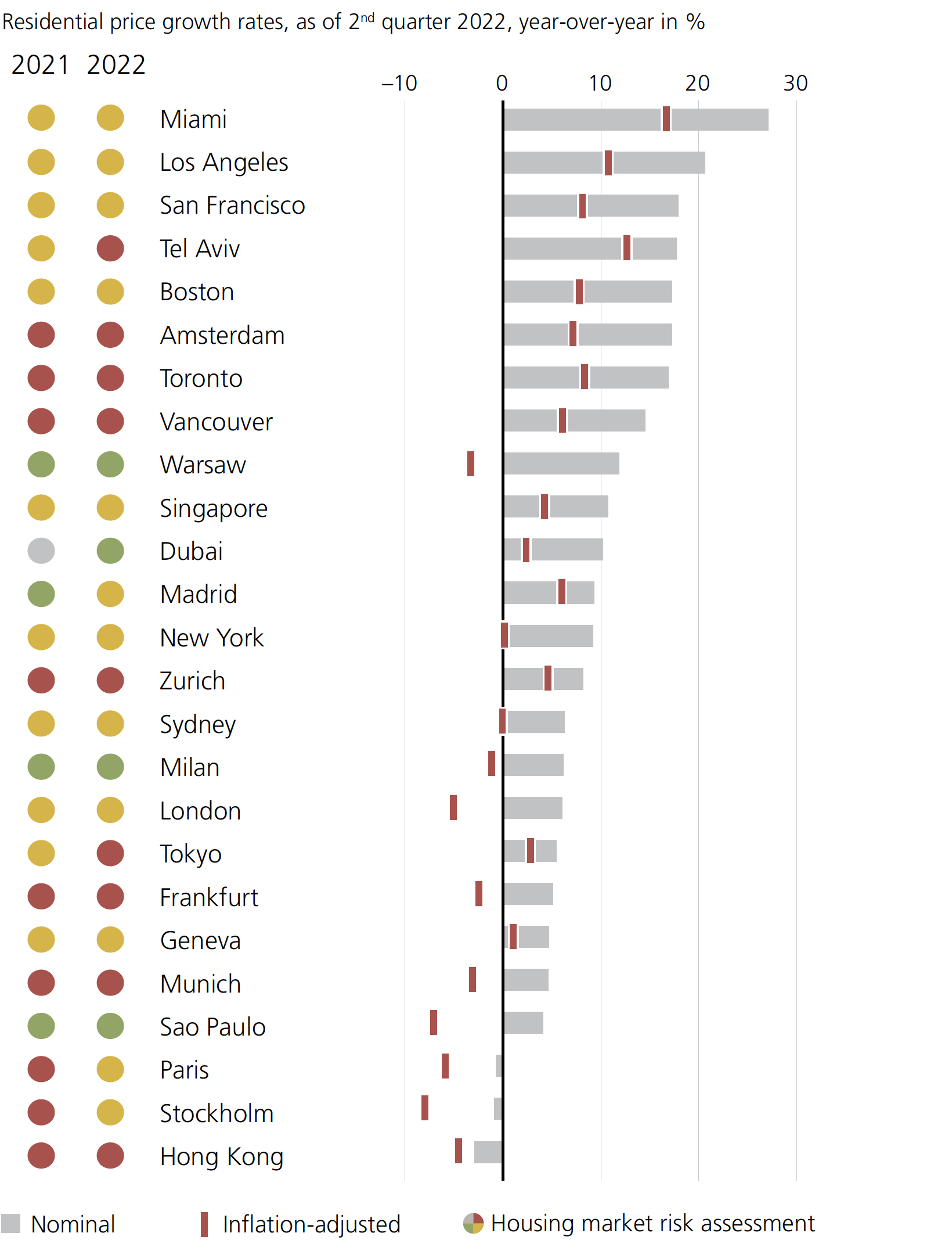

As a result, all but three of the cities saw positive price growth over the past year from a nominal price perspective:

U.S. cities occupy a number of spots at the top of this chart. Miami, in particular, is seeing strong internal migration patterns, as well as renewed interest from foreign investors.

Hong Kong experienced the biggest one-year nominal drop of all the cities analyzed. The report notes that since around 2019 Hong Kong “has broadly stagnated as the lack of affordability, economic woes, and pandemic restrictions all took a major toll on demand.”

Prices can’t rise forever. According to UBS, most cities with high valuations, price corrections have already begun, or could be right around the corner.

Housing bubble in Amsterdam on the verge of bursting as prices remain high

20 October 2022, By Victoria Séveno

The most recent edition of the Global Real Estate Bubble Index has once again highlighted the excessively high prices on the housing market in the Dutch capital, warning that the current housing bubble in Amsterdam shows a real risk of bursting.

UBS Global Real Estate Bubble Index 2022

Published annually by UBS, a Swiss bank and financial services company, the Global Real Estate Bubble Index determines which cities around the world have the greatest housing bubble risk by investigating international real estate trends and prices. The study analyses house prices in 25 cities using five key sub-indices: Price-to-income ratio

Price-to-rent ratio

Change in mortgage to GDP ratio

Change in construction to GDP ratio

Relative price city-to-country indicator

These factors are then used to determine the city’s risk of a real estate bubble - when property prices rise at rapid rates to the point where they reach unsustainable levels and drop sharply.

This year once again sees nine cities ranked in the “bubble risk” category, with Toronto overtaking Frankfurt to occupy the top spot. Other European cities found to have some of the most overpriced housing markets in the world included Zurich and Munich.

While Amsterdam didn’t rank quite as highly as some of its European neighbours, it once again managed to secure a spot in the top 10, rising from ninth place in 2021 to seventh place this year. The study notes that the city shows “an elevated risk” of a housing bubble.

Amsterdam housing market one of the most overpriced in the world

“Overall, bubble risk has increased only marginally as well, with the city’s price growth roughly in line with the national average,” the UBS report reads, noting that while Amsterdam displayed some of the most significant increases in housing prices out of all the European cities included in the study, Dutch salaries and rent prices have also increased - although not at the same rate.

According to the report, a skilled service worker based in the Dutch capital needs to work an average of eight years in order to be able to buy a 60-square-metre flat near the city centre. The same flat would have to be rented out for 31 years in order for the owner to turn a profit.

While house prices in the Netherlands have been steadily rising for years, recent changes to the interest rates on mortgages, the inflation rate, and the cost of energy mean the Dutch housing market is finally slowing down, with prices in some parts of the country actually falling. These latest trends could suggest that the national housing bubble is about to burst - although the market in Amsterdam remains extremely competitive.

International housing markets with the highest bubble risk

According to the latest edition of the UBS study, the following nine cities have all been categorised as at risk of a housing bubble:Toronto

Frankfurt

Zurich

Munich

Hong Kong

Vancouver

Amsterdam

Tel Aviv

Tokyo

For more information about the report, visit the UBS website.

Toronto

Toronto Frankfurt

Frankfurt Zurich

Zurich Hong Kong

Hong Kong Amsterdam

Amsterdam Tel Aviv

Tel Aviv Tokyo

Tokyo

Miami

Miami Stockholm

Stockholm Paris

Paris Sydney

Sydney London

London Madrid

Madrid Singapore

Singapore

Milan

Milan Sao Paulo

Sao Paulo Dubai

Dubai Warsaw

Warsaw