It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Friday, February 03, 2023

Mia Rabson, The Canadian Press

Feb 2, 2023

The federal government will show Canadians its plan to protect jobs during the clean energy transition no later than early spring, Natural Resources Minister Jonathan Wilkinson said Wednesday.

Legislation to guide how that plan is implemented, however, won't come for some time after that.

The Liberals have promised a "just transition act" since at least 2019, and Wilkinson has been saying it will finally happen this year.

That prospect prompted outcry in Alberta, where the energy transition will have the biggest impact and provincial politicians are headed for a tightly contested election this spring.

Alberta Premier Danielle Smith has asked for a meeting with Prime Minister Justin Trudeau to help shape that legislation. Her chief opponent, NDP Leader Rachel Notley, asked the federal Liberals to delay the whole thing at least until after the election, which is scheduled for the end of May.

But Wilkinson said the bill, for which he didn't offer a timeline, will in some ways be secondary to the action plan listing what the government intends to do. He said that plan will hopefully be revealed by the end of March, though it may "slip into the next quarter."

"The legislation will guide future efforts and will create a governance structure, but it's the policy statement that I think is going to be the most impactful," he said. "And, as I say, we will be releasing that in the coming few months."

He said the plan is based on lengthy consultations with provinces, labour organizations, business and Indigenous communities. Ultimately, he said, it will contain no surprises.

The concept of a "just transition" has existed for several decades, but it took on new meaning after the 2015 Paris climate agreement committed most of the world to transitioning to cleaner energy sources in a bid to slow climate change.

The idea is that any efforts to adjust reliance on fossil fuels must ensure that people who work in energy industries can move to new sectors and will not be left out in the cold.

The "just transition" debate exploded last month when Smith lambasted the federal government for a briefing document that listed the number of jobs that could be affected by the ongoing global transition away from fossil fuels and towards renewable energy.

Smith misread the total number of jobs in the affected sectors to mean the number of jobs the federal government expected would be lost, and pledged to "fight this just transition idea" with everything she had.

A week later, the premier wrote to Trudeau warning him that the Ottawa-Alberta relationship was "at a crossroads," and demanding that Alberta be included in all discussions on a "just transition" going forward.

She also said the legislation shouldn't be labelled as a "just transition" bill, but one about "sustainable jobs."

That request hit the federal government with interest and even amusement, since several federal ministers had already signalled their intention to use the term.

"I think I've been pretty clear I don't like the term 'just transition,'" Wilkinson said Wednesday.

"I prefer 'sustainable jobs.' I think it speaks to a future where we're looking to build economic opportunity for all regions of this country, very much including Alberta and Saskatchewan."

Smith will be in Ottawa next week as part of a first ministers meeting on health care, but there is no sign she will get a one-on-one meeting with Trudeau on sustainable jobs.

This report by The Canadian Press was first published Feb. 1, 2023.

OTTP

Canada's US$181B pension fund pauses private China deals

Layan Odeh and Ben Bartenstein, Bloomberg Ne

Ontario Teachers’ Pension Plan, a Canadian fund that manages $242.5 billion (US$181 billion) of assets, has paused direct investing in private assets in China, according to people familiar with the matter.

Geopolitical risk is among the reasons behind the pension fund’s move, said one person, who asked not to be identified discussing a sensitive matter.

“Our current focus is on listed securities, building value in our existing portfolio, and investing in public and private assets via fund partners,” rather than direct private investments, according to a statement from Dan Madge, a spokesperson for Ontario Teachers’.

Canada has already started restricting Chinese investment in its critical minerals sector, ordering three Chinese firms to divest from a trio of junior lithium explorers in early November. The country has also proposed to change its foreign investment law, creating new powers for a cabinet minister to impose conditions on deals to protect national security.

Teachers’ has about $5 billion invested in China, equal to about 2 per cent of its portfolio, Madge said. Direct investments include online education startup Zuoyebang, community group buying company Xingsheng Youxuan, and micro lender CD Finance, according to its website.

China assets are rallying as a relaxation of pandemic restrictions and renewed support for the embattled property sector boost sentiment after two years of declines. China’s main stock index has soared almost 20 per cent from October lows, putting it on the verge of a bull market.

Even with the private asset pause in China, the Toronto-based fund is growing in Asia. Teachers’ plans to deploy about half of new investments outside North America, and recently opened an office in Mumbai while expanding in Singapore.

“We have strong momentum in Asia and will continue seizing diversified investment opportunities in the region,” Madge said.

Ontario Teachers’ manages funds for 333,000 retired and working teachers in Canada’s most-populous province. It has set a target to have $300 billion in net assets by 2030, according to its website.

Holly McKenzie-Sutter, BNN Bloomberg

Just days after stepping down as CEO of Clearco, founder Michele Romanow is still at the Toronto office every day and doesn’t have much time for extra hobbies. As she puts it, she remains “incredibly active” in the e-commerce company that went from being valued at $2 billion two years ago, to laying off more than half its workforce and exiting international markets in the last six months.

The Canadian entrepreneur recognizable for her role on on CBC television show Dragons’ Den is now an executive co-chair and board member at Clearco, which has shifted from “growth mode” to a focus on profitability amid a downturn in the technology sector that’s led to tens of thousands of layoffs in recent months.

For Romanow, it’s important “to show up and take responsibility” during tough times, even if “founders don't control macroeconomic conditions” like Russia’s attack on Ukraine or rising interest rates.

“The reality is when you sign up for this job, it's kind of all your fault,” she said in an interview with BNN Bloomberg.

That’s meant sleepless nights and difficult goodbyes to colleagues after making the “devastating” decision to pursue a further round of layoffs, slashing the workforce by another quarter this month. Last summer, Clearco cut 125 positions in July and another 60 jobs in August.

“It's the hardest move for a leader,” she said. “Every time you have to fire a single person or multiple people in a layoff, you don't sleep as a founder, and I think that's a good thing. I think that makes you human.”

Romanow said she and company co-founder Andrew D’Souza have opened their networks to help former employees land new jobs, while trying to be generous with severance.

Looking forward, Romanow said she is focused on what’s best for Clearco and its remaining employees as the “COVID boom” in tech wanes and companies across the sector adjust. Big names like Canada’s Shopify Inc., Google, Microsoft Corp., International Business Machines Corp. and Facebook parent company Meta Platforms, Inc. have also cut thousands of jobs in the past several months.

“It's fun to build when the sun is out…(but) real leaders are made when it starts raining,” Romanow said. “You have to figure out how to fix and pivot and adjust a business for the economic climate you're in.”

NEW ECONOMIC REALITY

Romanow got the idea for Clearco from Dragons’ Den, where she and other business leaders hear pitches from Canadian entrepreneurs. The company, founded in 2015, loans money to businesses based on revenue rather than assets. It does not require personal guarantees, so people do not have to put their mortgages on the line to start businesses.

E-commerce and technology companies generally benefited from a growing customer base and more demand for online services during the pandemic as people were forced to stay home. Romanow contends a recession that was held back due to government supports early in the pandemic “had to catch up with itself” eventually.

Clearco “hired too quickly” in the past few years, Romanow said, as the company built new projects and expanded into 13 countries, where credit markets eventually turned. The combination of events ultimately led to it scaling back over the last year, pulling the plug on some projects and cutting its workforce to 140 this month, down from 500 early in 2022. Romanow also stepped down as CEO, a year after taking on the role.

“The goal is what the market is demanding, which is that every tech company become profitable,” she said. “We’re very focused on our path to profitability, the capital, the structures and our funds that we need to do that, and being as efficient as possible.”

Romanow grew up in a family of entrepreneurs and started her first business as a post-secondary student – and she has faced the need to pivot in a changing economy before. She recalled starting an East Coast caviar fishery as one of her earliest ventures, only to realize, come 2008, that she had “started a business with the world's most unnecessary luxury product” during a recession.

At this chapter in Clearco’s story, she decided the time was right to move into a different kind of leadership role where she now focuses on fundraising, relationships with partners and directing strategy, while new CEO Andrew Curtis takes the helm.

“For me, this is really about not having an ego. I care about the success of the company and that's it,” Romanow said.

She sees opportunities for Clearco despite tightening economic conditions. Entrepreneurs have shown more interest in Clearco’s products in the last six months, Romanow said, as venture capital has become less available amid economic headwinds and businesses owners seek other funding options.

INNOVATION BOOM POTENTIAL

Romanow said she also sees potential for an innovation boom as highly skilled tech workers are laid off in droves, similar to the period of business creativity she saw after the 2008 recession, when she started a competitor to Groupon and other now-ubiquitous companies like Instagram, Airbnb, Inc. and Uber Technologies, Inc. came to be.

Some laid off Clearco employees have already started new businesses, Romanow said, hinting at the beginnings of a potential silver lining to the distressing period for the technology sector.

“I think what's going to happen is we're going to see a lot of new businesses being created, which is a really positive thing, although this is going to be a tough period of time,” she said.

As for herself, Romanow said she is staying focused on her company’s goals before jumping headfirst into another business idea.

“I think once an entrepreneur, always an entrepreneur, but right now my focus is Clearco,” she said. ”This is a tough environment and I need to remain focused on getting through this next chapter.”'

Clearco CEO Romanow steps down as firm slashes jobs

Amber Kanwar, BNN Bloomberg

Jan 16, 2023

Canadian fintech Clearco – once a high-flier in this country’s high-tech sector – is undertaking another major round of layoffs and will replace the company’s co-founder Michele Romanow as CEO.

Clearco plans to reduce its workforce by another 25%-- just six months after a similar layoff at the company saw 125 employees let go. Romanow, who started the company in 2015 with four other founders and became CEO less than a year ago, will become Executive co-Chair and remain on the board. She is expected to be replaced as CEO by Andrew Curtis, who has been working as an advisor with the company for the past 6 months.

Toronto-based Clearco, whose official name is CFT Clear Finance Technology, lends money to people and companies based on revenue rather than assets.

The company is coming off a tumultuous year. Two years ago, Clearco embarked on an ambitious international expansion. But by the end of last August, the company announced it was exiting all international markets. At the time, the company blamed a combination of rising interest rates, inflation, currency swings and an overall slowdown in e-commerce, as well as supply chain constraints the companies it lends to were dealing with.

Clearco is by no means the only tech company finding itself in deep cost-cutting mode. Last summer, Shopify cut its workforce by 10%. In the U.S., major tech companies like Meta, Amazon, Salesforce and Twitter have announced thousands of job cuts. A total of 237,874 tech jobs were lost last year according to TrueUp, which tracks tech layoffs. So far in 2023, more than 30,000 jobs have been cut.

Still, it marks a tremendous turn of fortunes for a company that was valued at $2 billion dollars less than two years ago when Softbank led the funding round. Clearco, which has yet to turn a profit, has raised almost $700 million in funding over the past several years, according to Crunchbase. Part of that is a debt investment from Silicon Valley Bank. Sources say that recently the debt has become increasingly difficult to service.

Incoming CEO Andrew Curtis has a finance and capital markets background. He was brought in as an advisor six months ago, in part to help with capital structure issues the company has been working through. Curtis denied any struggles with servicing the debt from Silicon Valley Bank in an interview with BNN Bloomberg saying, “We are able to service the Silicon Valley Bank debt and have been able to service the Silicon Valley Bank debt.”

Late last summer, Clearco hired U.S. fintech investment bank Financial Technology Partners to explore strategic options, including a possible sale. There was some inbound interest but the focus of the strategic review was injection of capital instead of an outright sale, according to a source familiar with the matter. Financial Technology Partners had no comment. In an interview with BNN Bloomberg, Romanow denied that the purpose of the engagement with Financial Technology Partners was to sell the company, "I wouldn’t call that a failed process at all because that wasn’t the purpose of that.”

In addition to layoffs and management changes, the company also intends to raise more capital. “We have a plan for profitability, so we may be taking on additional capital raises,” said Curtis in an interview, “but that doesn’t mean we don’t have very strong liquidity right now.” In October, Clearco raised US$30 million from existing investors and founders. “In our business there is always a need to raise capital,” added Romanow.

Michele Romanow's e-commerce investing company Clearco has laid off 60 employees as it hands off its international business, a month after cutting 25 per cent of its workforce.

Spokesperson Nick Rosen-Wachs says the staff impacted were located in the U.K., Ireland, Australia and Germany.

The layoffs at the "Dragon's Den" star's company come as Clearco announced a strategic partnership with Outfund, the U.K. and Australia's largest e-commecer investor.

The terms of the partnership between the companies that provide founders with non-dilutive capital were not publicized, but Clearco says the agreement does not include any of its staff, technology, intellectual property, infrastructure or operations.

Clearco says it will offer departing employees severance and a two-year window to exercise equity as it moves towards focusing entirely on its two core and largest markets, the U.S. and Canada.

On July 29, Clearco announced it was laying off 125 employees of its 500-person workforce, saying it had grown its head count too quickly in anticipation of continued economic growth.

At the time, the company said it was considering “strategic options” for its international operations.

"We are confident that this is the best decision for our customers who will continue to benefit from Outfund’s revenue-based financing model without ever having to give up equity in their businesses," Romanow said in a statement Tuesday.

"It is of course with great regret that we have had to let our international team go as part of this partnership. They are a hugely talented team and we are confident that we will be able to support them in their next steps.”

The reasoning behind the recent cuts at Clearco speak to a broader trend happening in the tech sector worldwide as exuberance around stocks has faded, inflation has soared and recession rumours have loomed.

CANADA

Senate passes Liberals' controversial online streaming act with a dozen amendments

Mickey Djuric, The Canadian Press

Big tech companies that offer online streaming services could soon be required to contribute to Canadian content as a controversial Liberal bill gets one step closer to becoming law.

The Senate has passed the online streaming act known as Bill C-11 with a dozen amendments following a lengthy study by senators.

The bill would update Canada's broadcasting rules to reflect online streaming giants such as YouTube, Netflix and Spotify, and require them to contribute to Canadian content and make it accessible to users in Canada — or face steep penalties.

Canadian Heritage Minister Pablo Rodriguez says he hopes the House of Commons will pass the bill next week after it reviews the Senate's changes.

Senators made amendments intended to protect user-generated content and highlight the promotion of Indigenous languages and Black content creators.

They also included a change that would prohibit CBC from producing sponsored content, and another that would require companies to verify users' ages before they access sexually-explicit material.

Rodriguez said Thursday that the Liberal government would not accept all of the Senate's recommendations, but he didn't say which ones he disagrees with.

"We'll see when the bill comes back. There are amendments that have zero impact on the bill. And others that do, and those, we will not accept them," the minister said Thursday during a Canadian Media Producers Association panel.

The Senate also removed a clause in the bill that Sen. Paula Simons described as giving "extraordinary new powers to the government to make political decisions about things."

Ian Scott, the former chair of Canadian Radio-television and Telecommunications Commission, had told a Senate committee that some provisions in the bill did move the balance point "slightly closer to lessening the independence" of the regulator — though he insisted that it would remain independent.

The CRTC, now under the leadership of Vicky Eatrides, will be tasked with enforcing the bill's provisions.

The Senate passed the bill on the anniversary of its introduction in the House of Commons.

Between the House of Commons and Senate, there have been approximately 218 witnesses, 43 meetings, 119 briefs and 73 proposed amendments, said Rodriguez.

"It's the longest bill," he said.

The proposed law has come under intense scrutiny amid accusations from companies and critics who said it left too much room for government control over user-generated content and social-media algorithms.

Rodriguez said tech giants can get creative with ways they promote Canadian content, such as with billboards, advertising or, if they so choose, tweaks to their algorithms.

The bill has also caught the attention of the United States. Its embassy in Ottawa recently said that it is holding consultations with U.S. companies that it is concerned could face discrimination if the bill passes.

Last week, two U.S. senators called for a trade crackdown on Canada over Bill C-11, saying that the prospective law flouts trade agreements.

"I'm not worried, because we think it complies with trade obligations," Rodriguez said.

This report by The Canadian Press was first published Feb. 2, 2023.

Airlines ask Supreme Court to hear case on passenger bill of rights

The Canadian Press

A group of airlines is asking the Supreme Court of Canada to hear their case after a lower court largely upheld the validity of Canada's air passenger bill of rights.

Air Canada and Porter Airlines Inc. are among the group seeking leave to appeal to the Supreme Court, along with a number of U.S. and international airlines including Delta Air Lines, Lufthansa and British Airways.

The International Air Transport Association, which represents about 290 member airlines, is also an applicant.

In December, the Federal Court of Appeal ruled against the airlines by largely upholding a slate of passenger protection regulations introduced by the Canadian Transportation Agency in 2019.

Among other things, the air passenger bill of rights bolsters compensation for air travellers subjected to delayed flights and damaged luggage.

Airlines have argued Canada's passenger rights charter violates global standards and should be rendered invalid for international flights.

This report by The Canadian Press was first published Feb. 3, 2023.

RENTIER CAPITALI$M CREATES INFLATION

Investors made up 20 to 30% of homeowners in some provinces: Statistics Canada

New Statistics Canada data shows investors made up almost one third of homeowners in some provinces in 2020.

The data agency says investors made up 31.5 per cent of Nova Scotia's homeowners that year and 29 per cent of New Brunswick's property holders.

Investors in British Columbia came in at 23.3 per cent followed by 20.4 per cent in Manitoba and 20.2 per cent in Ontario.

When grouped together, the data agency's calculations show under one in five homes in British Columbia, Manitoba, Ontario, New Brunswick and Nova Scotia was considered an investment property in 2020.

Houses used as an investment were mainly owned by individuals living in the same province as the property.

However, condo apartments were used as an investment more often than houses, with Ontario alone seeing the highest rate of condo apartments used as investments at 41.9 per cent.

This report by The Canadian Press was first published Feb. 3, 2023.

Bruno Venditti | January 31, 2023 |

(Image: Kazatomprom)

There will likely be a further recovery of uranium prices in 2023 as nuclear energy regains popularity, was the sentiment among uranium specialists who spoke on Monday at the Vancouver Resource Investment Conference (VRIC).

With several of the world’s most developed countries announcing plans to extend the life of their existing nuclear power plants and some expanding their fleets, there was an optimistic buzz at VRIC.

Amid the energy crisis accelerated by the Russian-Ukraine war, countries like Japan, France, South Korea, India, the UK, the US, and Germany recently announced new constructions and additional incentives and funding for nuclear power.

“I think the principal factor is the change of public opinion in Japan. With regards to the pace of Japanese restarts, the biggest source of new demand that you could have on the planet is from their 40 existing reactors,” said Rick Rule, CEO of Sprott US Holdings.

“They don’t have to be built, they just have to be restarted. That would raise the structural demand for uranium by between 10 and 12 million pounds a year.”

According to Goviex Uranium CEO Daniel Major, demand is set to increase while supply remains tight.

“At the end of the day, we consume about 190 million pounds a year. Currently, we dig out of the ground about 130 million pounds,” said Major.

Spot uranium started the year rising from $48.66 to over $50/lb in a two-week period.

For Rick Rule, some greenfield supply could come from Kazakhstan, but with a new incentive price close to $70 a pound.

According to the veteran investor, the outlook is also very bullish over the next ten years.

“There’s a billion people on Earth that have no access to electricity at all. There are 2 billion people on Earth who experience energy poverty, either intermittent energy or unaffordable energy,” said Rule.

“When we talk about energy in the West, we talk about stuff like Teslas,” he pointed out. “Increasing the living standards of the poorest of the poor means that we’re gonna need more energy from all sources. Solar, sure. Wind, yeah. Coal, of course. But nuclear is a wonderful source of post-construction, cheap, reliable, non-carbon generating baseload power.”

Related: Are metals headed for a golden age?

Staff Writer | January 31, 2023 |

File image.

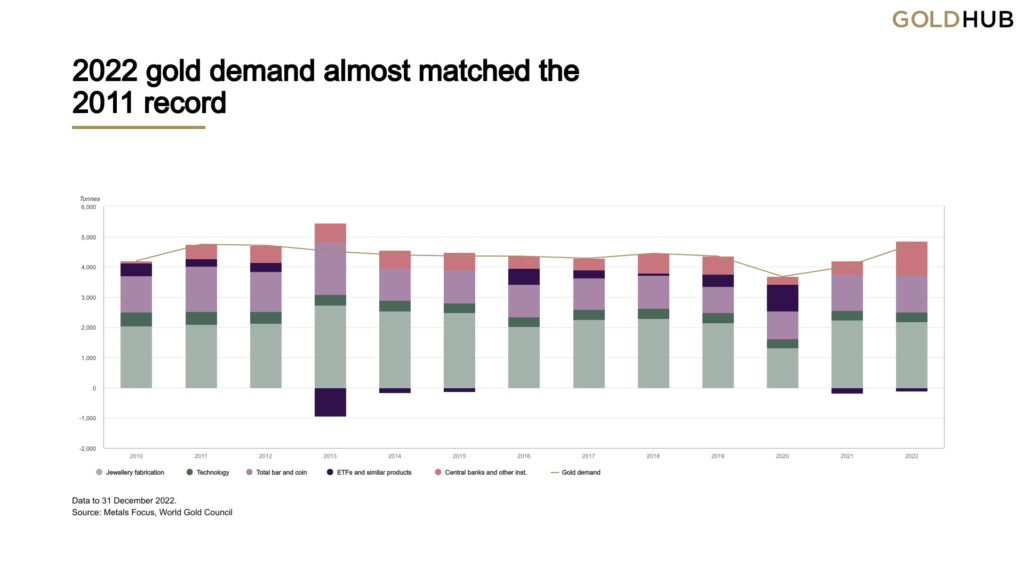

Demand for gold has reached its highest in over a decade on the back of colossal purchases made by central banks, as well as vigorous retail investor buying and slower ETF outflows, the World Gold Council (WGC) said on Tuesday.

Annual gold demand jumped 18% to 4,741 tonnes, almost on a par with 2011 – a time of exceptional investment demand, the WGC said in its 2022 Gold Demand Trends report. The strong full-year total was aided by record Q4 demand of 1,337 tonnes.

The investment portion of demand reached 1,107 tonnes in 2022, representing a 10% increase over 2021. Demand for gold bars and coins grew 2% to 1,217 tonnes, while holdings of gold ETFs fell by a smaller amount than in 2021, which further contributed to total investment growth. Quarterly fluctuations in OTC demand largely netted out over the year.

Jewellery consumption, on the other hand, softened a fraction in 2022, down by 3% at 2,086 tonnes. Much of the weakness came through in the fourth quarter as the gold price surged.

Demand for gold in technology saw a sharp Q4 drop, resulting in a full-year decline of 7%. This was a consequence of deteriorating global economic conditions, which hampered demand for consumer electronics.

Central bank buying

In 2022, central banks added 1,136 tonnes of gold worth some $70 billion to their stockpiles, which was by far the biggest purchase of any year since 1967. Purchases in Q4 alone (417 tonnes) almost matched that of 2021 (450 tonnes).

The trend underlines a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year. Since the financial crisis of 2008-09, European banks stopped selling and a growing number of emerging economies such as Russia, Turkey and India have bought.

Central banks like gold because it is expected to hold its value through turbulent times and, unlike currencies and bonds, it does not rely on any issuer or government. It also enables central banks to diversify away from assets like US Treasuries and the dollar.

“This is a continuation of a trend,” WGC analyst Krishan Gopaul said in a Reuters note.

“You can see those drivers feeding into what happened last year. You had on the geopolitical front and the macroeconomic front a lot of uncertainty and volatility,” he added.

Outlook for 2023

Looking ahead, the WGC said it has not altered its view of a good year for gold, with more upside potential than downside risk given a growing risk of recession in the US and Europe.

“A lacklustre 2022 for ETF and OTC demand is likely to set the stage for a year of growth in investment,” said the WGC, noting that “gold’s stable performance in 2022, despite strong headwinds from rising rates and a strong dollar for most of the year, has reignited investor interest.”

“Jewellery demand is also likely to capitalize on a resilient 2022, driven primarily by the reopening of China,” the WGC added.

Central bank buying – despite the latest trend – is unlikely to match 2022 levels, according to the Council, as demand remains difficult to forecast partly because it can be policy driven and does not always respond to the most common economic drivers.

“Lower total reserves may constrain the capacity to add to existing allocations. But lagged reporting by some central banks means that we need to apply a high degree of uncertainty to our expectations, predominantly to the upside,” the WGC said.

(With files from Reuters)

Reuters | January 31, 2023

South Africa is coming off its safest year on record in mining, with accident-related deaths falling to 49 from 74 the previous year, a government report showed on Tuesday.

A total of 1,946 serious injuries were reported in 2022, down from 2,123 a year earlier, the report showed, prompting Mines Minister Gwede Mantashe to say more needed to be done to improve safety.

“We are improving in fatalities, we are improving in injuries, but the numbers remain high. An incident is a pointer that there was a potential fatality,” Mantashe said during the report’s release in Pretoria.

Mine fatalities have declined since 309 lives were lost in 1999, though 2020 and 2021 saw deaths rise again, industry data shows.

“The industry will build on the momentum we achieved during 2022 when we halted and significantly reversed the regression in safety during the previous two years in which 74 and 60 of our colleagues died in 2021 and 2020, respectively,” said Lerato Tsele, acting head of safety and sustainable development at the Minerals Council of South Africa.

In a statement, the Minerals Council said industry-wide safety initiatives were helping, including a push to eliminate accidents involving falling rocks.

These, which once accounted for about half of all deaths in the sector, fell to six last year from 20 in 2021, the report showed.

(By Nelson Banya; Editing by Jason Neely)

Bloomberg News | January 31, 2023

Sterlite Copper Plant – Image courtesy of Vedanta

Vedanta Ltd. has shelved the plan to sell its copper smelter in the southern Indian state of Tamil Nadu, which accounted for almost 40% of the metal’s production in the country, and has doubled down on its efforts to restart the plant, according to people familiar with the matter.

After scrapping the seven-month-old process to offload the 400,000 tons-a-year Sterlite Copper plant, the company will now work with the local population to restart the factory that was shut on environmental concerns, the people said, asking not to be named as the information is not public. Vedanta’s petition to lift a local government order to close the plant will be heard by the Supreme Court on Feb. 21.

Restarting the smelter will lead to a surge in India’s copper output and cut imports. The refined metal is poised to play an important role in the nation’s shift toward electric vehicles and renewables and has lured interest from billionaire Gautam Adani’s group, which has the ambition to become one of the largest copper producers in the country.

India “can’t afford to close this plant permanently when the demand for copper is at its peak in the country,” a spokesman for Vedanta said in an emailed statement, replying to a query on it scrapping the sale process. “There has been a positive sway among the people of the region with more voices coming forward to support the reopening of the plant.”

The company, controlled by billionaire Anil Agarwal was working with Axis Capital Ltd. to sell the assets and had invited bids from prospective bidders in a newspaper advertisement in June. The smelter has been closed since 2018 on orders from the state government following the death of more than a dozen people when police opened fire on villagers protesting pollution from the facility.

India had turned a net importer of the metal for the first time in almost two decades following the plant’s closure, Vedanta’s spokesperson said.

(By Anto Antony, with assistance from Swansy Afonso and Shruti Mahajan)