THE RECESSION IS A MYTH

2022 was strongest year for gold demand in over a decade — reportStaff Writer | January 31, 2023 |

File image.

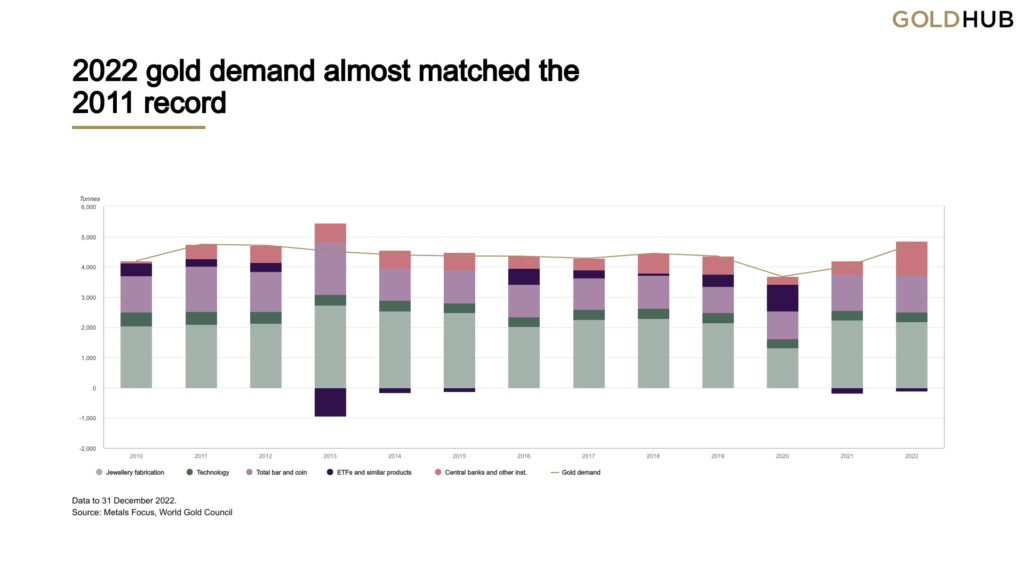

Demand for gold has reached its highest in over a decade on the back of colossal purchases made by central banks, as well as vigorous retail investor buying and slower ETF outflows, the World Gold Council (WGC) said on Tuesday.

Annual gold demand jumped 18% to 4,741 tonnes, almost on a par with 2011 – a time of exceptional investment demand, the WGC said in its 2022 Gold Demand Trends report. The strong full-year total was aided by record Q4 demand of 1,337 tonnes.

The investment portion of demand reached 1,107 tonnes in 2022, representing a 10% increase over 2021. Demand for gold bars and coins grew 2% to 1,217 tonnes, while holdings of gold ETFs fell by a smaller amount than in 2021, which further contributed to total investment growth. Quarterly fluctuations in OTC demand largely netted out over the year.

Jewellery consumption, on the other hand, softened a fraction in 2022, down by 3% at 2,086 tonnes. Much of the weakness came through in the fourth quarter as the gold price surged.

Demand for gold in technology saw a sharp Q4 drop, resulting in a full-year decline of 7%. This was a consequence of deteriorating global economic conditions, which hampered demand for consumer electronics.

Central bank buying

In 2022, central banks added 1,136 tonnes of gold worth some $70 billion to their stockpiles, which was by far the biggest purchase of any year since 1967. Purchases in Q4 alone (417 tonnes) almost matched that of 2021 (450 tonnes).

The trend underlines a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year. Since the financial crisis of 2008-09, European banks stopped selling and a growing number of emerging economies such as Russia, Turkey and India have bought.

Central banks like gold because it is expected to hold its value through turbulent times and, unlike currencies and bonds, it does not rely on any issuer or government. It also enables central banks to diversify away from assets like US Treasuries and the dollar.

“This is a continuation of a trend,” WGC analyst Krishan Gopaul said in a Reuters note.

“You can see those drivers feeding into what happened last year. You had on the geopolitical front and the macroeconomic front a lot of uncertainty and volatility,” he added.

Outlook for 2023

Looking ahead, the WGC said it has not altered its view of a good year for gold, with more upside potential than downside risk given a growing risk of recession in the US and Europe.

“A lacklustre 2022 for ETF and OTC demand is likely to set the stage for a year of growth in investment,” said the WGC, noting that “gold’s stable performance in 2022, despite strong headwinds from rising rates and a strong dollar for most of the year, has reignited investor interest.”

“Jewellery demand is also likely to capitalize on a resilient 2022, driven primarily by the reopening of China,” the WGC added.

Central bank buying – despite the latest trend – is unlikely to match 2022 levels, according to the Council, as demand remains difficult to forecast partly because it can be policy driven and does not always respond to the most common economic drivers.

“Lower total reserves may constrain the capacity to add to existing allocations. But lagged reporting by some central banks means that we need to apply a high degree of uncertainty to our expectations, predominantly to the upside,” the WGC said.

(With files from Reuters)

No comments:

Post a Comment