CORPORATIONS AIN'T DEMOCRACIES

‘They pretend we don’t exist’: Wet’suwet’en hereditary chiefs insulted after RBC cancels in-person meeting last-minuteNATIONAL OBSERVER

Wet’suwet’en nation hereditary Chief Namoks (right) walks with Chief Gisdaya (centre) and Chief Madeek while in Toronto for the Royal Bank of Canada annual general meeting, on Thursday, April 7, 2022. (Christopher Katsarov / Canada's National Observer)

On the second floor of a hotel in the shadow of the CN Tower, Wet’suwet’en hereditary leadership and their allies crowded around laptops and cellphones for one purpose: confront RBC executives over the bank’s financing of the Coastal GasLink pipeline.

Chiefs Namoks, Gisdaya and Madeek, and others from the nation, travelled from their unceded territory in northern British Columbia — where the pipeline is currently under construction and land defenders have been arrested at gunpoint — to attend the bank’s annual general meeting (AGM) in downtown Toronto Thursday morning. But late Wednesday, RBC cancelled the in-person portion of the AGM, citing concerns about COVID, and shifted the entire meeting online

Not all shareholders were informed of the move ahead of time, and so, anticipating RBC representatives might be at the original in-person location to tell people, Wet’suwet’en chiefs began the day by marching from their hotel to the convention centre where the meeting was meant to take place. When they arrived, they found no representatives from the bank and left.

Wet'suwet'en nation hereditary Chief Namoks (far right), Chief Gisdaya (centre) and Chief Madeek are informed by Metro Convention Centre management the in-person RBC AGM has been cancelled.

(Christopher Katsarov / Canada's National Observer)

Chief Namoks called it an insult he won’t ever forget.

“Today is one of the highest insults I've ever received as a chief,” he said. “You’ve seen the violence (on Wet’suwet’en territory); I think today's insult was bigger.”

“They wouldn't even send anybody out to apologize for cancelling the RBC meeting on such short notice. We travelled across from our lands in British Columbia to here, and they don't even apologize to high chiefs? … They pretend we don't exist, and every aspect, they treat us as if we're not human.”

With the original plan to challenge RBC executives in person squashed, Plan B involved getting on the phones and hoping for the opportunity to ask a question at the virtual meeting. It worked. The three chiefs asked back-to-back-to-back questions, challenging RBC CEO Dave McKay over the bank’s financing of Coastal GasLink, a pipeline expected to carry 2.1 billion cubic feet of natural gas per day, if built, to the LNG Canada Kitimat facility for export. McKay responded to — but didn’t exactly answer — the questions, as several in the room commented.

Delegates and supporters of Wet'suwet'en hereditary leadership react while listening to the virtual Royal Bank of Canada annual general meeting, in Toronto on Thursday, April 7, 2022. (Christopher Katsarov / Canada's National Observer)

As McKay cycled through familiar talking points about the economic benefits of the pipeline, characterizing the nation as divided on the issue, jaws dropped and eyes rolled among Wet’suwet’en allies.

“Today is one of the highest insults I've ever received as a chief,” Wet'suwet'en hereditary Chief Namoks said Thursday after RBC abruptly cancelled its in-person shareholder meeting. #RBC #CoastalGasLink #FinancingDisaster

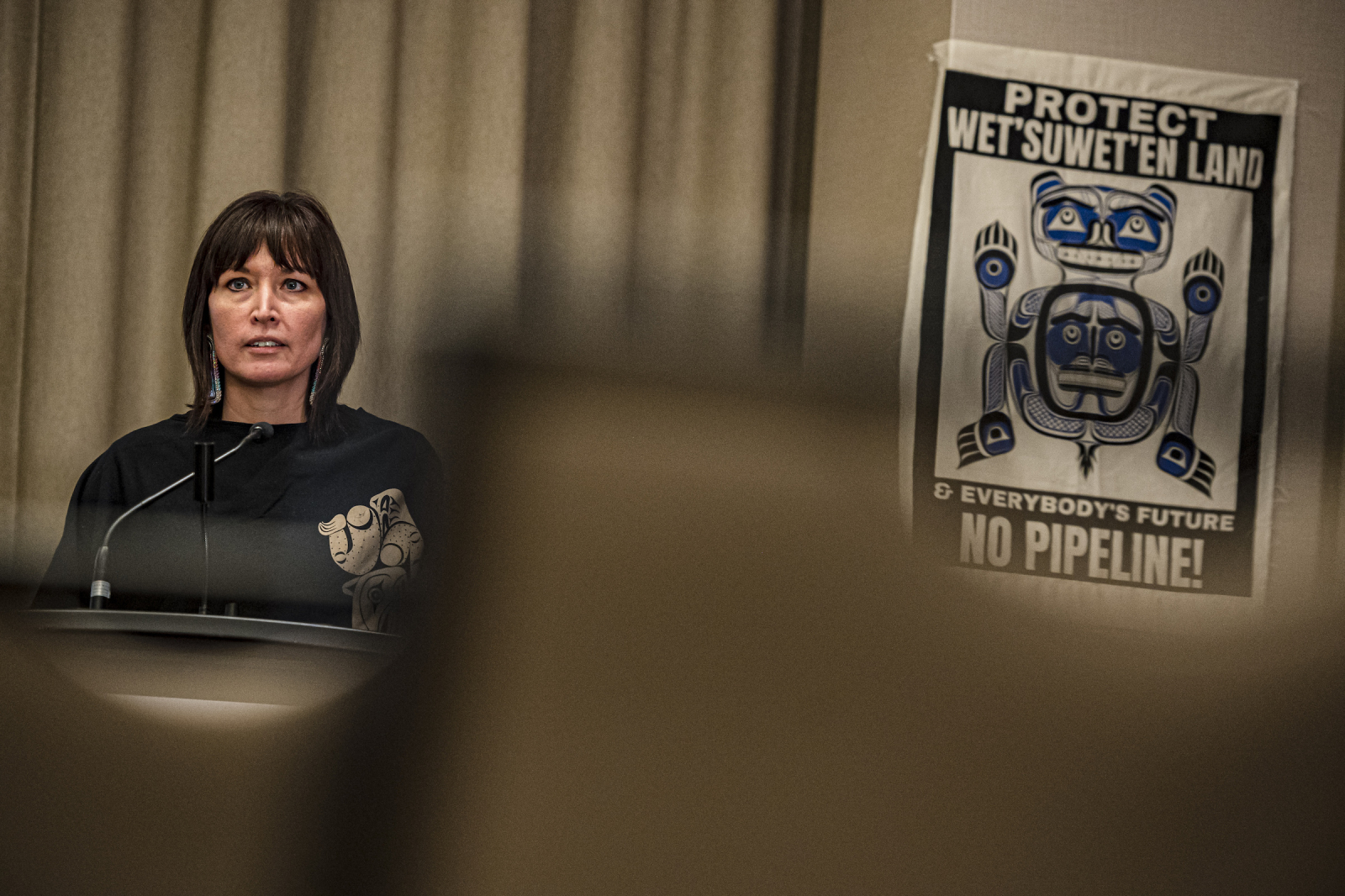

Chief Gisdaya asked how RBC was accountable to its human rights statement, which says the bank will avoid contributing to “adverse human rights impacts.”

“The pipeline defies the human rights of our young people by threatening their ability to feed themselves and practice their culture,” he said. “How is RBC being accountable to this policy, their shareholders, our human rights and the rights of our young people by continuing to fund the Coastal GasLink pipeline?”

Wet'suwet'en hereditary Chief Gisdaya speaks during the virtual Royal Bank of Canada annual general meeting, in Toronto on Thursday, April 7, 2022.

(Christopher Katsarov / Canada's National Observer)

McKay said he wanted to assure the chief that first and foremost, “RBC only supports projects that are environmentally and socially responsible.”

McKay then said with respect to Coastal GasLink, the pipeline has been approved and enjoys the support of 20 elected band councils — an irrelevant point, considering the Wet’suwet’en hereditary leadership have not consented and actively oppose construction through their territory. Coastal GasLink reached agreements with First Nation band councils along the project’s route, including Wet’suwet’en bands, and there is both support and opposition among members of the nation. However, hereditary Wet’suwet’en chiefs oppose the project, and it is the hereditary chiefs who hold authority over the land in question.

"I know there are divisions within parts of the community, and I know it's important that we respect that the First Nations need to resolve specific disagreements within their own communities,” McKay said.

“We're certainly willing to play any role if asked to help mediate those discussions,” he added.

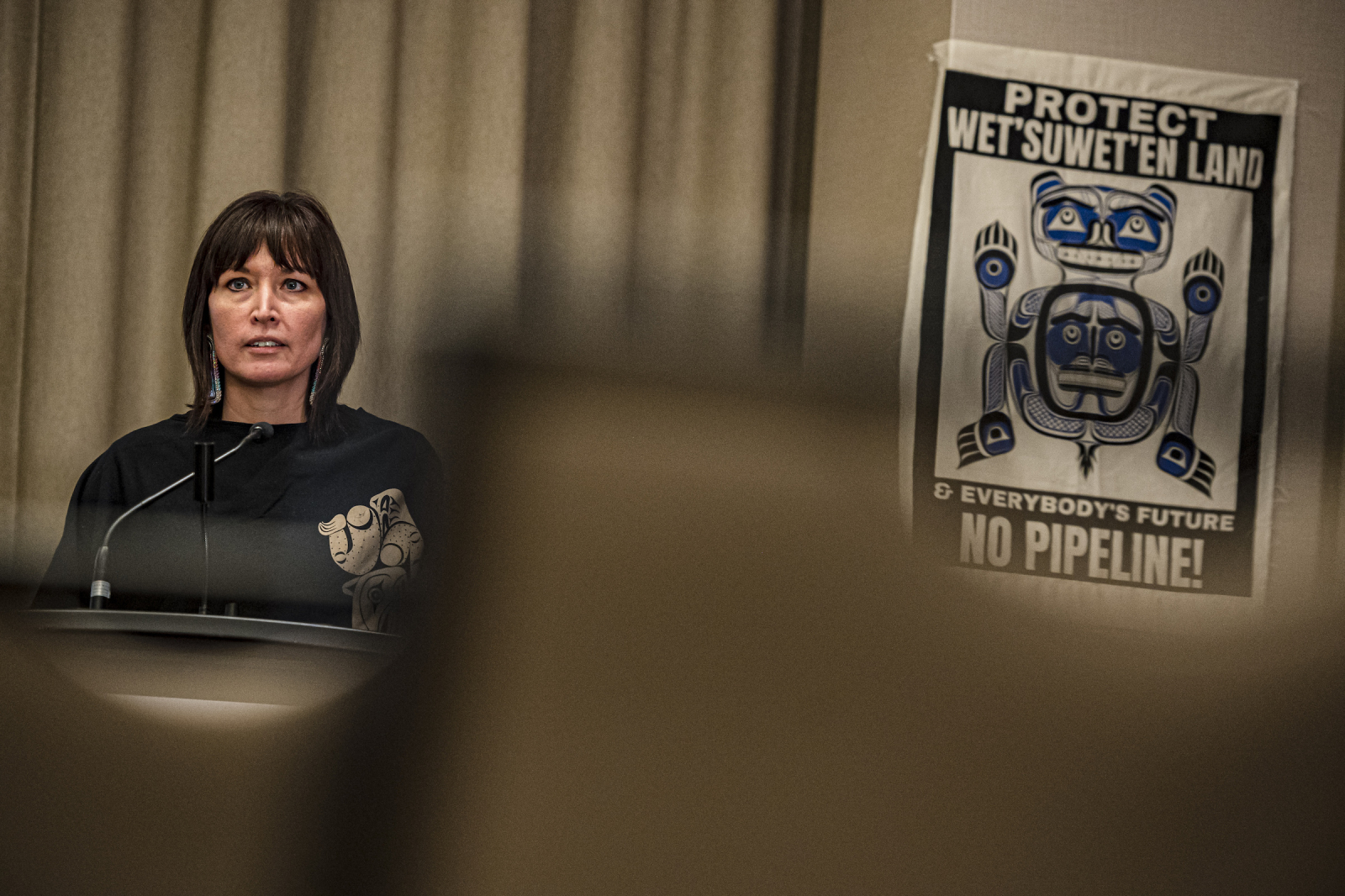

In an interview with Canada’s National Observer, Gidimt’en Checkpoint spokesperson Sleydo’ rejected the characterization of a divided nation in need of mediation and said it was a divide-and-conquer tactic .

Gidimt’en Checkpoint spokesperson Sleydo’ delivers remarks to media after a virtual Royal Bank of Canada annual general meeting, in Toronto, on Thursday, April 7, 2022. (Christopher Katsarov / Canada's National Observer)

“He tried to direct the conversation and focus on so-called divisions within our community, and I think that's what a lot of people do,” she said. “Even if there was division within our community and within our hereditary system, it does not negate the fact that Wet'suwet'en hereditary chiefs are the full jurisdiction on the land.”

The question of who has jurisdiction over the Wet’suwet’en traditional territory is long settled. In 1997, the Supreme Court of Canada recognized in its landmark case Delgamuukw v. British Columbia that Canada did not extinguish Wet’suwet’en title to the land. That case acknowledged the nation’s hereditary governance structure, meaning Wet’suwet’en law is recognized by Canada’s highest court and authority over the nation’s land lies with the hereditary chiefs.

Following the virtual AGM, Wet’suwet’en leaders spoke to a crowd of supporters gathered in a nearby park. Chief Namoks said the nation was asking RBC and its shareholders to “be human.”

“When we work together to put pressure on financial institutions such as RBC, that's where you make a difference,” he said. “We need to stand together. Pull your money out of such banking institutions like RBC.”

Wet'suwet'en nation Hereditary Chief Namoks speaks to a gathering of demonstrators outside the Metro Convention Centre in Toronto, on Thursday, April 7, 2022. (Christopher Katsarov / Canada's National Observer)

Speaking to the same crowd, Chief Gisdaya warned of the climate risks of continued fossil fuel investment.

“I used to look forward to the summer,” he said. “Now I'm scared because of all the fires, and it's coming closer up north.

“It's just the beginning and it's going to get worse yet if they don't change now. Not 2030; it has to be now.”

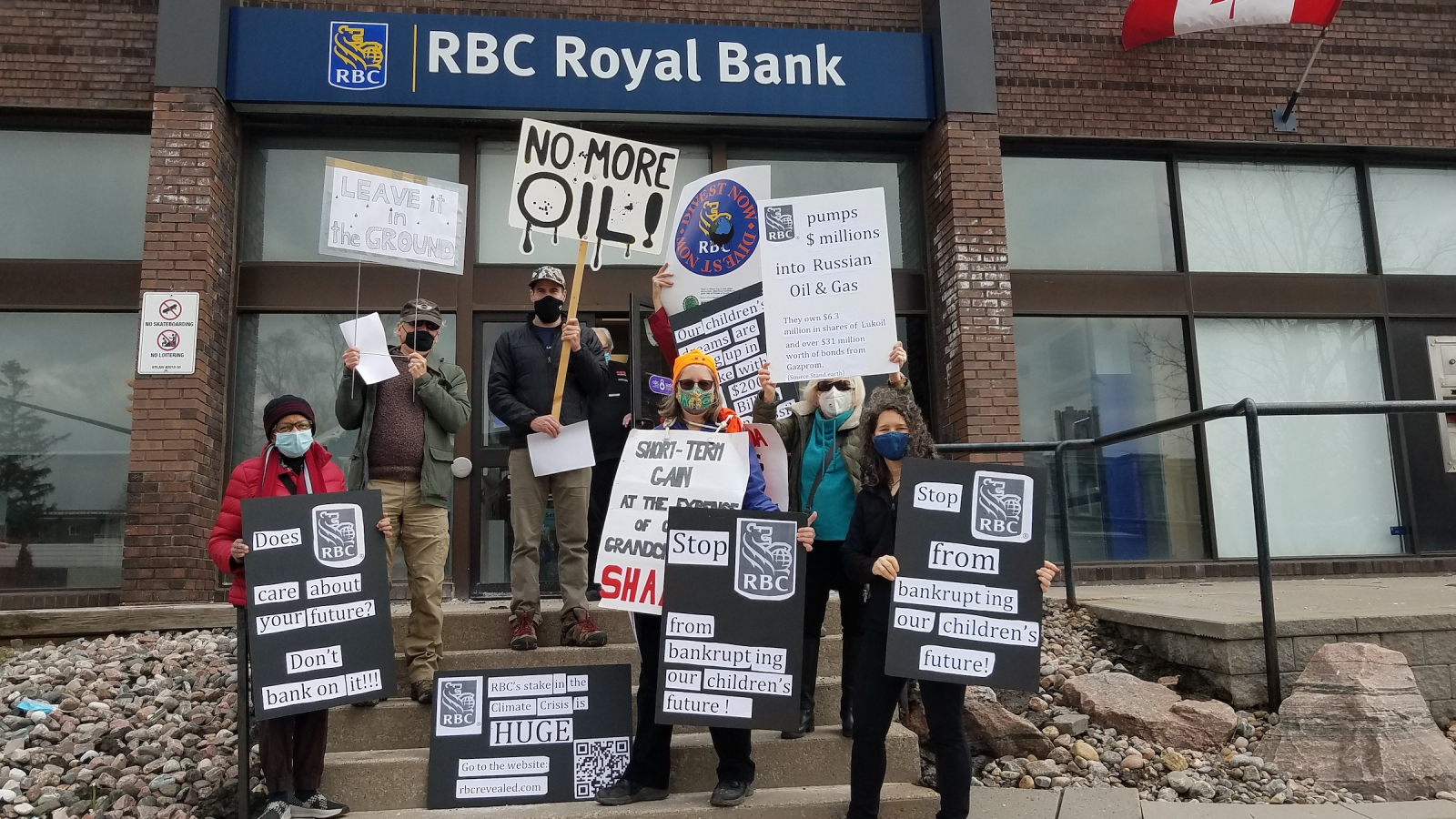

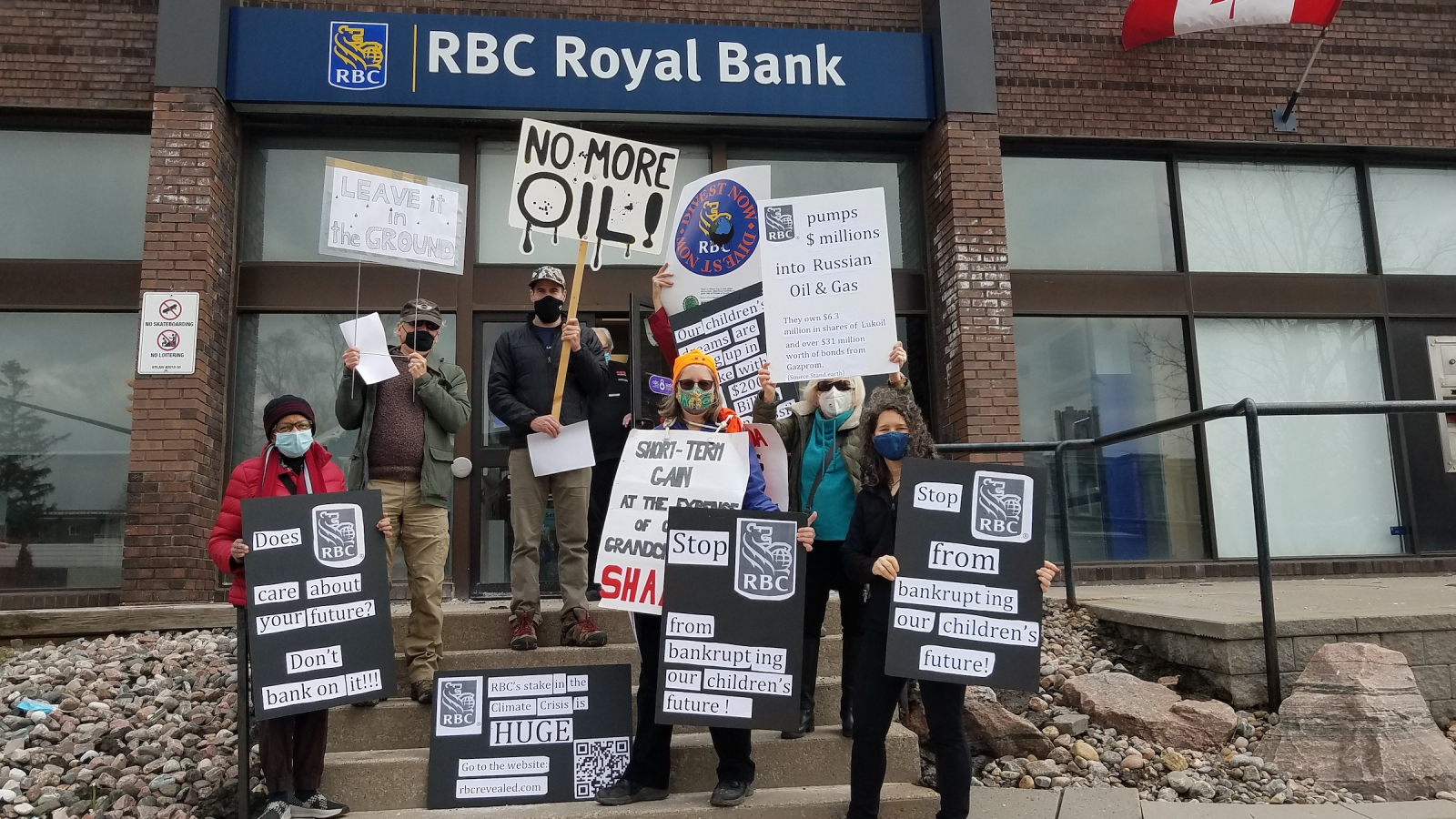

Across the country, solidarity protests outside of RBC branches were held.

Supporters of Wet'suwet'en hereditary leadership protest in solidarity outside an RBC branch in Markham, Ont., on Thursday, April 7, 2022. Photo courtesy of Leadnow

“For RBC customers concerned about the climate crisis and climate chaos, RBC management demonstrates extreme commitments to ‘horse and buggy’ industries,” said Mike Benedict from Extinction Rebellion Ottawa. “RBC must change or perish.”

Banking on a Better Future youth organizer Aishwarya Puttur said in a statement RBC is “killing our chances at a livable future.”

“Youth are key for RBC’s business, but how can RBC expect young people to bank with them when they are actively financing the leading cause of the climate crisis, destroying our futures and the current livelihoods of millions of people?” she asked.

TC Energy is building the Coastal GasLink pipeline to feed LNG Canada’s Kitimat facility with fracked methane from the Dawson Creek area of B.C. Last year, the Calgary-headquartered fossil fuel giant sold its majority stake in Coastal GasLink to Alberta and South Korea’s public pension plans, managed by investment companies AIMCo and KKR, respectively.

The sale not only generated $600 million for the company, it triggered a financing scheme with dozens of banks that allowed the company to immediately tap about $2.1 billion to pay for the project’s construction. BankTrack identifies 27 financiers of Coastal GasLink that, together, have given the project a $6.4-billion loan.

Among the 27 financiers are Canada’s big five banks — RBC, BMO, Scotiabank, CIBC and TD — along with the National Bank of Canada, JP Morgan Chase, Bank of China, Bank of America, South Korea-headquartered KB Financial Group, Japan-based Mizuho, Mitsubishi UFJ Financial Group and many others. Export Development Canada is also listed as a financier.

One reason why Wet’suwet’en leadership are targeting RBC over its role in Coastal GasLink is sheer size. Among the world’s banks, RBC is the fifth-largest financier of fossil fuels, having loaned or invested over $260 billion to coal, oil and gas companies since the Paris Agreement was signed.

Delegates and supporters of Wet'suwet'en hereditary leadership protest outside the Royal Bank of Canada annual general meeting, in Toronto on Thursday, April 7, 2022. (Christopher Katsarov / Canada's National Observer)

RBC rejects shareholder resolutions

During the AGM, RBC shareholders voted on a series of climate resolutions aimed at improving the company’s performance in bringing down planet-warming greenhouse gas emissions.

Among the proposals were requests for RBC to stop participating in pollution-intensive asset privatization deals, to adopt an annual advisory voting policy to guide climate action and, in a resolution filed by Investors for Paris Compliance, to halt financing for fossil fuel companies under the banner of “sustainability.”

All three proposals were shot down.

The resolution from Investors for Paris Compliance flows from a series of questionable deals RBC inked last year. Among them was a $1.1-billion sustainability-linked bond RBC and several other Canadian banks bought, providing fossil fuel giant Enbridge with cash it could use to build pipelines and pay police to clear Indigenous opposition.

“We’re disappointed that more big institutional investors — including the banks — didn’t vote to tackle the greenwashing of sustainable finance, but we’re pleased we could draw some attention to this critical issue,” said Investors for Paris Compliance director of corporate engagement Matt Price.

“Ultimately, the regulator needs to step in to ensure the integrity of these products if banks and investors won’t do it themselves.”

April 8th 2022

from the Special Report: Financing disaster

John Woodside

Reporter

@Woodsideful