New evidence links ancient eruptions to climate changes that let dinos start a climb to dominance

During a 2-million-year-long rainy period in the Late Triassic, known as the Carnian Pluvial Episode (illustrated here), dinosaurs began to grow, diversify and take over.

© DAVIDE BONADONNA

By Megan Sever

SEPTEMBER 30, 2021

The biggest beasts to walk the Earth had humble beginnings. The first dinosaurs were cat-sized, lurking in the shadows, just waiting for their moment. That moment came when four major pulses of volcanic activity changed the climate in a geologic blink of an eye, causing a 2-million-year-long rainy spell that coincided with dinos rising to dominance, a new study suggests.

Clues found in sediments buried deep beneath an ancient lake basin in China link the volcanic eruptions with climate swings and environmental changes that created a globe-spanning hot and humid oasis in the middle of the hot and dry Triassic Period, researchers report in the Oct. 5 Proceedings of the National Academy of Sciences. During this geologically brief rainy period 234 million to 232 million years ago, called the Carnian Pluvial Episode, dinosaurs started evolving into the hulking and diverse creatures that would dominate the landscape for the next 166 million years.

Previous research has noted the jump in global temperatures, humidity and rainfall during this time period, as well as a changeover in land and sea life. But these studies lacked detail on what caused these changes, says Jason Hilton, a paleobotanist at the University of Birmingham in England.

So Hilton and his colleagues turned to a several-hundred-meter-long core of lake-bottom sediments drawn from the Jiyuan Basin for answers. The core contained four distinct layers of sediments that included volcanic ash that the team dated to between 234 million and 232 million years ago, matching the timing of the Carnian Pluvial Episode. Within those layers, the team also found mercury, a proxy for volcanic eruptions. “Mercury entered the lake from a mix of atmospheric pollution, volcanic ash and also being washed in from surrounding land that had elevated levels of mercury from volcanism,” Hilton says.

The rock record from 234 million to 232 million years ago, captured in these cores from an ancient lakebed in northern China, shows signs of wet weather almost everywhere. The cores also show evidence of volcanic activity. JING LU

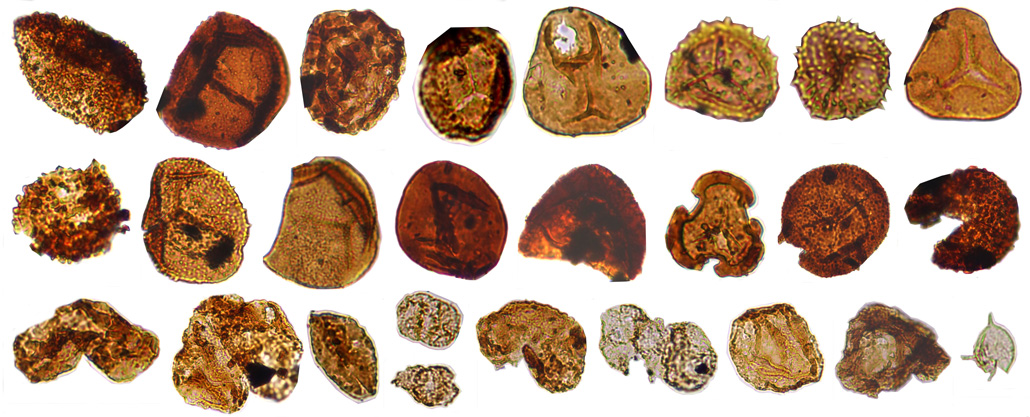

Further evidence for the link between volcanism and environmental change during the Carnian Pluvial Episode came from corresponding layers in the core that showed different types of carbon, indicating four massive releases of carbon dioxide into the atmosphere. Finally, microfossils and pollens changed within the same core section, from species that prefer drier climates to ones that tend to grow in warm and humid climates.

The reconstructed history suggests that the volcanic pulses injected huge amounts of CO₂ into the atmosphere, says coauthor Jacopo Dal Corso, a geologist at the University of Leeds in England. That boosted temperatures and intensified the hydrologic cycle, enhancing rainfall and increasing runoff into lakes, he says. At the same time, terrestrial plants evolved, with humidity-loving flora becoming predominant. As the rains created wet environments, turtles, large amphibians called metoposaurids — and dinosaurs — began to thrive.

Together, these diverse lines of evidence reveal that the Carnian Pluvial Episode was actually four distinct pulses of significant environmental change — each triggered by massive volcanic eruptions, Dal Corso says.

Pollens, spores and algae collected from the core sample from the Carnian Pluvial Episode reveal a change from more arid-loving plants and animals to more humid-loving plants and animals.PEIXIN ZHANG

Pollens, spores and algae collected from the core sample from the Carnian Pluvial Episode reveal a change from more arid-loving plants and animals to more humid-loving plants and animals.PEIXIN ZHANGThe mercury and carbon data together suggest the increase in mercury came from a “major source of volcanism that was capable of impacting the global carbon cycle,” rather than local eruptions, the team writes. That volcanism likely came from the Wrangellia Large Igneous Province eruption in what is now British Columbia and Alaska, which has previously, but tenuously, been linked to the Carnian Pluvial Episode. If true, it means the Wrangellia eruption occurred in pulses, rather than one sustained eruption.

This paper marks the “first time that mercury and carbon isotope data are so well correlated across the Carnian Pluvial Episode,” says Andrea Marzoli, an igneous petrologist at the University of Padua in Italy who has studied Wrangellia but was not involved in this research. “The authors make a strong argument in favor of volcanically induced global climate change pulses.” However, Marzoli notes, “the link to Wrangellia is still weak, simply because we don’t know the age of Wrangellia.”

Alastair Ruffell, a forensic geologist at Queen’s University Belfast in Ireland not involved in this study, agrees, saying he’d like to see more evidence of cause and effect between Wrangellia and the environmental changes. This study offers some of the best proxies and data from terrestrial sources to date, but more terrestrial records of the Carnian Pluvial Episode are needed, he says, to “understand what this actually looked like on the ground.”

The climate changes marked a tipping point for life that couldn’t adjust, and those groups went extinct. Animals like dinosaurs and plants like cycads, says Ruffell, were “waiting in the wings” to seize their opportunity. A similar cycle of volcanic activity and environmental change starting about 184 million years ago may have paved the way for the biggest of all dinos, long-necked sauropods, to lumber into dominance