Anthony Vasquez-Peddie

Friday, November 5, 2021

Wind turbines turn behind a solar farm in Rapshagen, Germany, Oct. 28, 2021.

TORONTO -- Most of the electricity demand in advanced, industrialized nations can be met with a combination of wind and solar power, according to a recent study, but contingency measures may be necessary in order to fully satisfy requirements.

The study, published in the peer-reviewed journal Nature Communications, confronted the question of dependability of electricity systems that rely on intermittent resources. It found the most reliable renewable systems were heavily based on wind and could meet electricity requirements in the countries studied 72 to 91 per cent of the time. By mixing in 12 hours of stored energy, the figure increased to 83 to 94 per cent.

Despite the positive numbers, the researchers caution that even in a system that exceeds 90 per cent of a country's needs, hundreds of hours of unmet demand may occur annually.

"Wind and solar could meet more than 80 per cent of demand in many places without crazy amounts of storage or excess generating capacity, which is the critical point," Steve Davis, study co-author and University of California, Irvine, professor of Earth system science, said in a news release. "But depending on the country, there may be many multi-day periods throughout the year when some demand will need to be met by energy storage and other non-fossil energy sources in a zero-carbon future."

The team of researchers analyzed 39 years of data from 42 countries to determine if solar and wind energy sources could sustain their needs.

They found that large countries closer to the equator could more easily convert to sustainable power resources due to the amount of solar energy available throughout the year. Higher-latitude countries, however, must lean more heavily into wind power.

"Historic data show that countries that are farther from the equator can occasionally experience periods called 'dark doldrums' during which there is very limited solar and wind power availability," Dan Tong, lead author and assistant professor of Earth system science at Tsinghua University.

The researchers also found land mass to be a factor in terms of reliability. Countries with the largest land areas, such as Canada, had the most reliable solar and wind systems.

Smaller countries in regions like Europe, however, do not have the same luxury. The researchers say cooperation between nations in terms pooling and sharing energy may help relieve potential problems.

"Europe provides a good example,” Tong said. “A lot of consistency and reliability could be provided by a system that includes solar resources from Spain, Italy and Greece with bountiful wind available in the Netherlands, Denmark and the Baltic region.”

To meet more demand for electricity, countries could engage in increased capacity overbuilding, the addition of batteries and additional storage methods.

“Around the world, there are some definite geophysical constraints on our ability to produce net-zero carbon electricity,” Davis said. “It comes down to the difference between the difficult and the impossible. It will be hard to completely eliminate fossil fuels from our power generation mix, but we can achieve that goal when technologies, economics and sociopolitical will are aligned.”

Currently, two-thirds of Canada’s electricity comes from renewable resources, according to the federal government. About 59.6 per cent of the total is produced via hydroelectricity, while 5.1 per cent comes from wind and 0.6 per cent comes from solar energy.

Canada also exports about eight per cent of the electricity it generates to the U.S.

Wind and solar could power the world's major countries most of the time

With the eyes of the world on the United Nations COP26 climate summit in Glasgow, Scotland, strategies for decarbonizing energy infrastructure are a trending topic. Yet critics of renewables question the dependability of systems that rely on intermittent resources. A recent study led by researchers at the University of California, Irvine tackles the reliability question head-on.

In a paper published recently in Nature Communications, the authors, including experts from China's Tsinghua University, the Carnegie Institution for Science and Caltech, said that most of the current electricity demand in advanced, industrialized nations can be met by some combination of wind and solar power. But that positive finding comes with the caveat that extra efforts are going to be necessary to completely satisfy the countries' requirements.

Most reliable systems, which are dominated by wind power, are capable of meeting electricity requirements in the countries studied 72 to 91 percent of the time, even without energy storage, according to the study. With the addition of 12 hours of energy storage capacity, systems become dominated by solar power and can satisfy demand 83 to 94 percent of hours.

"Wind and solar could meet more than 80 percent of demand in many places without crazy amounts of storage or excess generating capacity, which is the critical point," said co-author Steve Davis, UCI professor of Earth system science. "But depending on the country, there may be many multi-day periods throughout the year when some demand will need to be met by energy storage and other non-fossil energy sources in a zero-carbon future."

The team analyzed 39 years' worth of hourly energy demand data from 42 major countries to evaluate the adequacy of wind and solar power resources to serve their needs. They found that a full conversion to sustainable power resources can be easier for larger, lower-latitude countries, which can rely on solar power availability throughout the year.

The researchers highlighted Germany as an example of a relatively smaller country, in terms of land mass, at higher latitude which will make it more challenging to meet its electricity needs with wind and solar resources.

"Historic data show that countries that are farther from the equator can occasionally experience periods called 'dark doldrums' during which there is very limited solar and wind power availability," said lead author Dan Tong, assistant professor of Earth system science at Tsinghua University. "One recent occurrence of this phenomenon in Germany lasted for two weeks, forcing Germans to resort to dispatchable generation, which in many cases is provided by fossil fuel-burning plants."

Among the approaches the researchers suggested to alleviate this problem are a building up generating capacity that exceeds annual demand, developing long-term storage capabilities and pooling resources of multiple nations on a continental land mass.

"Europe provides a good example," said Tong, who began her work on this study as a post-doctoral scholar in UCI's Department of Earth System Science. "A lot of consistency and reliability could be provided by a system that includes solar resources from Spain, Italy and Greece with bountiful wind available in the Netherlands, Denmark and the Baltic region."

The researchers found that a wind and solar power system could provide about 85 percent of the total electricity demand of the United States, and that amount could also be increased through capacity overbuilding, addition of batteries and other storage methods, and connecting with other national partners on the North American continent.

"Around the world, there are some definite geophysical constraints on our ability to produce net-zero carbon electricity," said Davis. "It comes down to the difference between the difficult and the impossible. It will be hard to completely eliminate fossil fuels from our power generation mix, but we can achieve that goal when technologies, economics and socio-political will are aligned."Green hydrogen production from curtailed wind and solar power

More information: Dan Tong et al, Geophysical constraints on the reliability of solar and wind power worldwide, Nature Communications (2021). DOI: 10.1038/s41467-021-26355-z

Journal information: Nature Communications

Provided by University of California, Irvine

As Africa’s renewables grow, fossil fuels inventories drop – report

MINING.COM Staff Writer | November 5, 2021

Wind turbines in South Africa. (Image by Lollie-Pop, Flickr).

In contrast to fossil fuels, Africa’s renewable energy sector shows uptake in generation, capacity, and forecasts, a new report by PwC states.

According to the consultancy, the continent’s fossil fuel inventories show a downturn in production, consumption, and exports between 2019 and 2020, which is largely a result of delays or cancellations of large projects due to the covid-19 pandemic, as well as global investment pressure resulting in the rapid exit of and disinvestment in portfolios.

Looking just at oil, PwC data show that production significantly decreased by 19% to 6.8 mmbbl/d from the prior year. This accounts for 7.8% of global production. Consumption saw a decrease of 14% to 3.5 mmbbl/d from the prior year, and exports saw a drop to 5.7 mmbbl/d.

“Despite companies commencing exploration and development projects, planned capital expenditure in 2020–2021 fell from $90 billion pre-covid-19 to $60 billion,” the report titled Africa Energy Review 2021 reads.

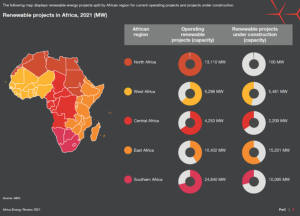

The other side of the coin is renewables, which are on the rise across the continent with an annual growth rate of 21% between 2010 and 2020 and a current total renewable capacity of more than 58 GW – of which hydropower contributes 63%.

The consultancy firm reports that wind energy generation increased by 14% and solar energy generation increased by 13%, while total renewable energy generation increased by 11% in 2020 compared to the previous year. Solar capacity increased by 13%, wind capacity increased by 11% and hydropower increased by more than 25% in 2020 compared to 2019.

“Most African countries are also increasing investment in solar and hydropower technologies with projects currently under construction estimated to add 33 GW of renewable energy capacity,” the review states.

“Total installed renewable energy capacity in Africa has grown by over 24 GW since 2013. The continent’s capacity is expected to increase again by the end of 2021 with growth led by solar and wind projects in Egypt, Algeria, Tunisia, Morocco, and Ethiopia.”

Despite these positive trends, mid-term forecasts can look daunting, as PwC says that 27.32 EJ of additional renewable generation is needed within Africa’s energy mix by 2050 to compensate for declining fossil fuels. This is a significant increase from the current renewable generation of just 1.79 EJ.

“Africa’s coal and oil energy production are expected to drop by around 96% and 71% respectively by 2050. This will be driven by declining demand for fossil fuels globally with leading international oil and gas companies already refocusing their portfolios to include higher renewables exposure,” the report reads. “Renewable energy is expected to see large gains in Africa over the next three decades. By 2050, energy production from solar and wind is expected to increase by as much as 110 times and 40 times respectively.”

In the view of the experts at PwC, employment levels in the energy sector will depend greatly on the way the energy transition takes place.

They believe that if Africa is pressured into rapidly transitioning to renewables and is assisted in this process through renewable energy funding, the transition of workers away from fossil fuel-related jobs will be much faster. This means that the potential loss of jobs can be mitigated.

Net-zero goals

Although Africa is home to 17% of the global population, it produces less than 5% of global annual emissions and accounts for only 3% of global cumulative emissions.

Yet, 35 out of 54 African countries have made commitments towards net-zero emissions, a goal that is unaffordable for most of them as an estimated $2.8 trillion are needed just to transition to a clean energy mix and reduce its current annual CO2 emissions of 1.62m kilotons of CO2e.

“Investment in low-carbon energy systems in Africa lags global pace, but despite global climate finance commitments from developed economies aimed at $100bn per annum, the allocation to Africa falls significantly short of what the continent requires to meet global targets. The fiscal constraints being experienced across Africa create a challenge for the continent to move with pace on its net-zero journey,” the report reads.

For the analysts at PwC, private partnerships, public-private partnerships and blended finance are key and will need to be deployed together with strong public sector governance and innovative financing instruments to overcome these challenges.