As many commentators have noted, Israel’s exploding pager/walkie-talkie attacks, followed by air strikes on a Hezbollah command post and then broadly across Lebanon are a gambit to try to get Lebanon to respond in a manner that would get the US to come in more formally on Israel’s side as the Axis of Resistance is inflicting costs on Israel over its Gaza genocide.

However, the reporting on the large scale terrorist act of the communication-devices-turned-bombs illustrates how corrupted this information environment is. Israel and its cheerleaders have attempted to justify this act as part of an intended military operation, to disrupt Hezbollah’s operations. The only “bad” thing was they executed prematurely.

In fact, as we’ll unpack further below, this tech-bombing was even worse than you imagined. The military wing of Hezbollah does not use pager or walkie talkies. They’ve used their own fiber optic network since 2006, and otherwise rely on couriers. These devices were in the hands of civilian Hezbollah workers, such as members of its large social services effort. Yes, military members may have been hurt too, but that was dumb luck, like being in proximity to blown-up pager-user or picking up a ringing device on behalf of someone else.

Needless to say, this also means that the device attacks were pure terrorism, with no remotely colorable military purpose whatsoever. Remember, the press has brayed that Israel has been working on this caper for 15 years. But Hezbollah moved its military comms to fiber optic before that. And Israel surely knew that. So that means this entire enterprise was from its outset a terrorist scheme and never a military operation.

But why should that be a surprise? This is how Israel has rolled since its Stern Gang days.

Because we are in what Lambert would call an overly-dynamic situation, rather than attempt a state-of-play account, it seemed more productive to alert readers to how the deeply polluted state of Anglosphere reporting. It should be no surprise that it is coming to resemble Western reporting on the Ukraine conflict, as overstating Israeli successes and underplaying or ignoring Hezbollah/Axis of Resistance wins.

This matters because if Israel’s efforts to subdue the Axis of Resistance fall short, which seems likely, the campaign to get the US committed to the conflict will only intensify. Mind you, in reality, it’s not as if we could do all that much even if we wanted to, ex possibly commit more air power. As Associated Press pointed out yesterday, the US has only 40,000 men in the entire theater. They presumably already have things to do. It takes 6+ months to move more men and the needed logistical support in were we to deploy more than say some Special Forces types. And the US is low on materiel world-wide, thanks to having drained our stockpiles to back Ukraine. For instance, one thing the US is short on globally is Patriot air defense missiles, and at least as of now, we are prioritizing Ukraine.

The general tendency for Western reporting to favor our allies dovetails with Israeli press censorship. The Israeli government finds it important to restore if at all possible the image of the IDF as formidable, both to restore its citizens’ once central belief that Israel was safe place for Jews, and to project power in the region.

Yours truly in now finding it necessary to listen to Alastair Crooke’s Monday morning talks on Judge Napolitano to sanity check Israeli claims. Readers may recall that a few weeks ago, we showcased one of these interviews immediately after some much-ballyhooed Israel air strikes into Lebanon. The claim was that Israel had sent in 100 planes and destroyed Hezbollah rocket launchers right before a planned Hezbollah attack, defanging it.

This is what Crooke reported:

Whatever you’ve read is almost certainly wrong. It’s a narrative…..First of all, it all happened at around 4 o’clock in the morning on Sunday. The Israelis started to see people moving in Lebanon and moving towards platforms. Hezbollah was planning the operation to fire drones and rockets at 5:15 on Sunday morning. And Israel started to, an attack, a direct attack. It involved I think about a hundred aircraft.

But contrary to what the Israeli propagandists at the IDF are saying, and I know this not from Hezbollah but I know this from inside Lebanon, people who are on the ground there, it was chaotic twenty minutes. Israel just bombed various valleys where they imagined the ballistic missiles were. But they’d been cleared out of there some time ago. There were no ballistic missiles. You can check that, there are people on the ground who know what’s happened. There are no missiles. So when they said they destroyed thousands of missile launchers, this is a complete lie. Because first of all, there are no missiles, no ballistic missiles, no large missiles south of the Litani River. What you have is drones and small rockets. And none of these have launchers. And they destroyed none of them. It was just a show, a show of force and it only lasted about twenty minutes…..

On top of that, the Hezbollah attack that Sunday morning, in retaliation for the assassination of senior Hezbollah military official Fuad Shukr in Beirut, did take place. Israel immediately clamped down on all reports. At first, Israel claimed the Hezbollah strikes were ineffective (there was Twitter fun about Hezbollah striking a chicken coop, which does seem to have occurred). However, it finally came out that Hezbollah was successful in striking a building in the military airport near Tel Avis that housed Unit 8200, which is akin to our NSA. Hezbollah believed Unit 8200 planned the killing of Fuad Shukr. “Successful” as in some Unit 8200 members died (there is speculation that Hezbollah got a very top level official; I’ve not seen anything convincing either way).

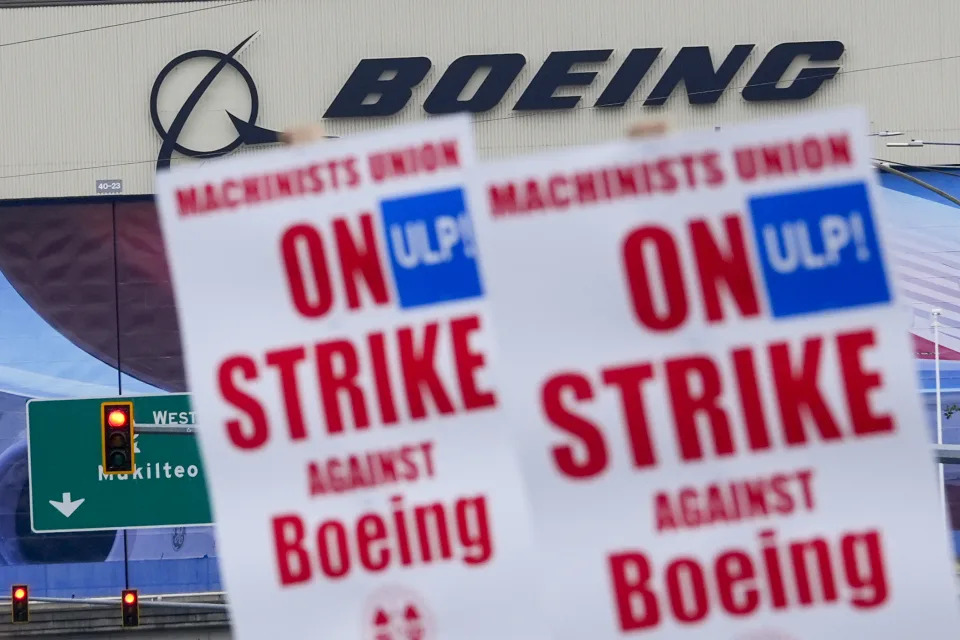

Now let us turn to the series of exchanges that started with barbarism-by-pager. Per Moon of Alabama:

Last week Israel launched a terror attack on Hizbullah operatives who were using pagers to receive alarms and orders. These people were part of the civil administration side of Hizbullah and not its armed fighters.

But since a new trope coming out of the bogus claim that the Hezbollah militia used pagers and didn’t even inspect them is (just like Russians!) that this proves that they are incompetent. So let’s again turn to Alastair Crooke:

The notion that Hizbullah’s communications are crippled is wishful thinking that fails to distinguish between what may be called civil-society Hizbullah, and its military arm.

Hizbullah is a civil movement, as well as a military power. It is the Authority over a significant slice of Beirut and a country – a responsibility that requires the Movement to provide civil order and security. The pagers and radios were used primarily by its civil security forces (effectively a civil police managing security and order in Hizbullah-controlled parts of Lebanon), as well as used by its logistics and support branches. Since these personnel are not combat forces, they were not seen to require truly secure communications.

Even before the 2006 war, Hizbullah ended all cellphone and landline communications in favour of their own dedicated optic cable system and hand-courier messaging for the military cadres. In short, Hizbullah’s communications at the civil level took a major hit, but this will not unduly impact upon its military forces. For years, the Movement has operated on the basis that units could continue with combat, even in the event of a complete rupture of optic communications, or the loss of a HQ.

So again in a close parallel to Ukraine, the real reason for this attack appears to be to try to break the will of the long-suffering Lebanese people and turn them against Hezbollah, just as some collective Ukraine officials fantasize that if they cause enough pain to Russian civilians, they will turn on Putin. At least so far, Lebanese citizens instead appear to be pulling together. Journalist Laith Marouf, now in Beirut, told Rachel Blevins that thousands of citizens came to hospitals offering to donate one of their eyes to a victim of the cyber attack (starting at 9:20). Even though that’s beyond current medical technology, it’s an indication of the depth of public support. Marouf also contends that the Lebanese know what they are up against, that wars of decolonization take years.

A second leg of the attack, coming shortly after the device carnage, was an assassination attempt via precision air strike in Beirut against Hezbollah paramilitary leader Ali Karaki, reportedly one of the top three on Israel’s kill list. The press cheered his death. That turns out to have been premature. From Military Watch:

A senior commander for the Lebanese paramilitary group Hezbollah, Ali Karaki, has survived an Israeli assassination attempt, after a precision strike on a military headquarters in the capital Beirut was launched to eliminate him… Confirmation of his survival follows multiple reports from Western media outlets, citing Lebanese military sources, that the commander was eliminated during an Israeli attack on Beirut’s Madi neighbourhood.

It was a nice touch for Military Watch to point out that the initial Anglosphere accounts cited (or made up) “Lebanese military sources”. Admittedly, it is possible this was disinfo while Karaki was being moved to safety.

Now to the next Israel move, widespread air strikes that extended into Syria. The claim was that they were targeting rocket launchers, So far, they have killed nearly 500. But as for the rockets, we again turn to Alastair Crooke, here on Judge Napolitano. Starting at 9:00:

But for the moment, they have bet on escalation dominance, “escalating to de-escalate,” first the pagers, then the assassination on its heels, and then they’re banking on intelligence and firepower to push Hezbollah into an agreement. But first of all, there was no agreement. Amos Hochstein was in Lebanon but he was acting more for the Israelis and for the Americans, but it was a complete failure, the attempt for some sort of diplomatic route. I mean there isn’t one. It’s been talked about, but there was no agreement, Americans know that, Israelis know that too. So this is really what they are betting on is they can either push Hezbollah in. And to this extent, we’re seeing this massive air attacks taking place in the south and in the Bekka, that you just spoke about. But really what we’re talking about is ineffectiveness of air firepower in these circumstances, when put against deep, deep buried rockets and missiles. In the beginning, in ’23, Hezbollah was looking at losing about 10 men a day. Now they’re not really losing any. There were about 2 Hezbollah who were supposed to be killed but they were religious figures, they din’t have to do with Hezbollah per se, they sadly will be civilian losses.

They are heavily bombing the area, and although it’s being presented as being by intelligence as if they’re knocking out rocket launchers, that too is pretty much bunk. Because they too basically try and find launchers by combing the forest, because this is mountain area, forest area. Very difficult terrain. Deep valleys, little nooks and crannies. So they film all of this, looking for movements, and then they use artificial intelligence detection methodology to try to find where someone has moved. It’s not done by spies or intelligence per se. It is done by using AI, again, to spot some sort of movement. And Hezbollah for years, since 2006, have been adept at putting up ghosts and fake missile launchers, fake men, moving them around, fooling the Israelis who are basically bombing every spot in the forest, hills and valleys where it thinks possibly going to be a rocket launcher….

Crooke also stressed that even the death of a senior commander would only be a tactical loss. As 7:40, he explains that every top Hezbollah officer trains his successor.

Crooke turned to the Hezbollah response, which is to increase the range of territory in Israel that they consider to be fair game for attack. At 14:20:

Hezbollah has escalated too, just to be clear. Because one of the things they are facing again is Israel has put another big blackout notice on everything, no filming, no photos, no reporting at all from anywhere north of Haifa, which is in the center, right on the coast of Israel. No news is allowed to be presented. But you do get some because there are Israelis in the settlements that are sending videos. The point here is there is major destruction in Haifa, a major port. Hezbollah’s reported an attack on an airbase, there are attacks going on, there are rocket continuing. So with all this bombing, all this so-called carpet bombing, it’s actually quite ineffective. It’s not stopping Hezbollah. I emphasize here htat we are seeing rockets, [not sure of name] 1 and 2, which are probably similar to a HIMARS. They’re not guided, they’re not smart. Hezbollah hasn’t even begun to use its smart missiles. They’re using the rockets to create destruction of houses. Nearly a million Israelis were in the shelters last night [Sunday].

Dmitry Liscaris claims in this interview (at 15:13) that Hezbollah attacks took out one of Israel’s three airbases, the Ramat David airbase in the Golan Heights, and a major arms making plant, Rafael Military Industries complex, which makes air defense equipment, as well as hitting targets near Tel Aviv. He also said waves of drones were coming from Iraq.

It has not gotten as much mention in the (far from comprehensive) press I follow, but Twitter does confirm the drone attack:

Without trying to give a comprehensive account of the latest strikes and counter-strikes, Arab News reports a new attack on Beirut killed a different top Hezbollah commander, Ibrahim Qubaisi. With the news blackout in Israel, we don’t (and won’t for a while) have much news on damage and deaths there. Even though Crooke depicted Hezbollah as making a discrete, as opposed to open-ended escalation, such niceties may not count for much

.jpg)