ByStavros Atlamazoglou

Published 3 days ago

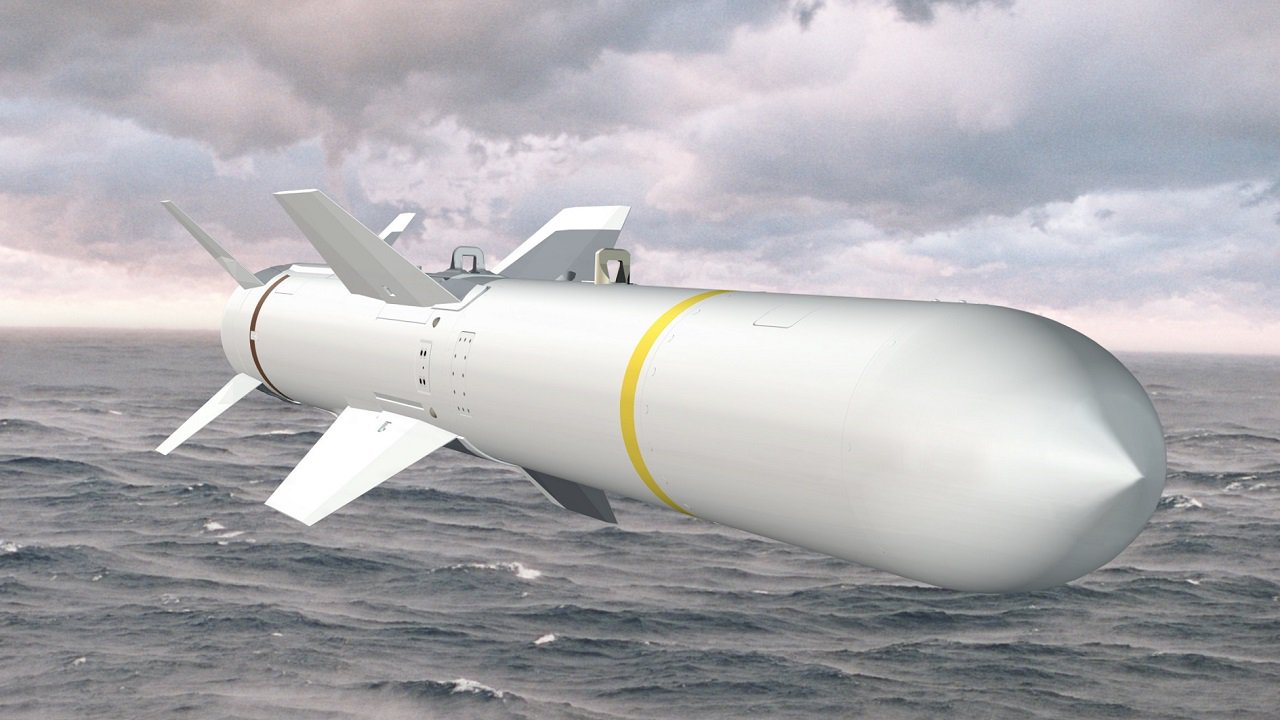

Harpoon Block II. Image Credit: Boeing.

How much aid can we send to Ukraine? Over the past couple of months, the Ukrainian military has been expending vast amounts of long-range fire ammunition to support its defensive operations in the Donbas and its counteroffensive in the direction of Kherson.

To replenish the Ukrainian ammo stocks, the White House has greenlighted another security package, the 17th since the war began, to Ukraine.

More Ammo for Ukraine!

The new security package comprises ammunition for the High Mobility Artillery Rocket Systems (HIMARS) and the M-777 155mm howitzers solely. Both weapon systems have been critical in the Ukrainian military’s operations, but the HIMARS particularly has been a game-changer, taking out Russian targets miles behind the frontlines.

-75,000 rounds of 155mm artillery ammunition;

-Additional ammunition for High Mobility Artillery Rocket Systems (HIMARS).

“Today, the Department of Defense (DoD) announces the authorization of a Presidential Drawdown of security assistance valued at up to $550 million to meet Ukraine’s critical security and defense needs. This authorization is the Biden Administration’s seventeenth drawdown of equipment from DoD inventories for Ukraine since August 2021,” the Department of Defence said in a press release.

In the last two years, the U.S. has committed to providing Ukraine with approximately $8.8 billion in military aid (and billions more in economic and humanitarian assistance), with approximately $8.1 billion of that security assistance given since the conflict started more than five months ago on February 24.

In the last two months alone, the U.S. has committed almost $3 billion of security assistance to Ukraine. And since 2014, when Moscow first attacked Ukraine in Crimea and the Donbas, the U.S. has provided Kyiv with more than $10 billion in security assistance.

“To meet its evolving battlefield requirements, the United States will continue to work with its Allies and partners to provide Ukraine with key capabilities,” the Department of Defense added.

Weapons, Weapons, Weapons Headed to Ukraine

Since the Russian invasion started, the U.S. has provided or committed to providing Ukraine with the following weapon systems, munitions, military supplies, and non-lethal equipment:

Over 1,400 Stinger anti-aircraft systems;

Over 6,500 Javelin anti-armor systems;

Over 20,000 other anti-armor systems;

Over 700 Switchblade Tactical Unmanned Aerial Systems;

126 155mm Howitzers and up to 486,000 155mm artillery rounds;

72,000 105mm artillery rounds;

126 Tactical Vehicles to tow 155mm Howitzers;

NATO Stinger missile. Image Credit: Creative Commons.

22 Tactical Vehicles to recover equipment;

16 High Mobility Artillery Rocket Systems and ammunition;

Four Command Post vehicles;

Two National Advanced Surface-to-Air Missile Systems (NASAMS);

20 Mi-17 helicopters;

Counter-battery systems;

Hundreds of Armored High Mobility Multipurpose Wheeled Vehicles;

200 M113 Armored Personnel Carriers;

Over 10,000 grenade launchers and small arms;

Over 59,000,000 rounds of small arms ammunition;

75,000 sets of body armor and helmets;

Approximately 700 Phoenix Ghost Tactical Unmanned Aerial Systems;

Laser-guided rocket systems;

Puma Unmanned Aerial Systems;

U.S. Soldiers assigned to the 65th Field Artillery Brigade, and soldiers from the Kuwait Land Forces fire their High Mobility Artillery Rocket Systems (U.S.) and BM-30 Smerch rocket systems (Kuwait) during a joint live-fire exercise, Jan. 8, 2019, near Camp Buehring, Kuwait. The U.S. and Kuwaiti forces train together frequently to maintain a high level of combat readiness and to maintain effective communication between the two forces. (U.S. Army photo by Sgt. James Lefty Larimer)

Unmanned Coastal Defense Vessels;

26 counter-artillery radars;

Four counter-mortar radars;

Four air surveillance radars;

Two harpoon coastal defense systems;

18 coastal and riverine patrol boats;

M18A1 Claymore anti-personnel munitions;

C-4 explosives, demolition munitions, and demolition equipment for obstacle clearing;

Tactical secure communications systems;

Thousands of night vision devices, thermal imagery systems, optics, and laser rangefinders;

Commercial satellite imagery services;

Explosive ordnance disposal protective gear;

Chemical, Biological, Radiological, Nuclear protective equipment;

Medical supplies to include first aid kits;

Electronic jamming equipment;

Field equipment and spare parts;

Funding for training, maintenance, and sustainment.

How much aid can we send to Ukraine? Over the past couple of months, the Ukrainian military has been expending vast amounts of long-range fire ammunition to support its defensive operations in the Donbas and its counteroffensive in the direction of Kherson.

To replenish the Ukrainian ammo stocks, the White House has greenlighted another security package, the 17th since the war began, to Ukraine.

More Ammo for Ukraine!

The new security package comprises ammunition for the High Mobility Artillery Rocket Systems (HIMARS) and the M-777 155mm howitzers solely. Both weapon systems have been critical in the Ukrainian military’s operations, but the HIMARS particularly has been a game-changer, taking out Russian targets miles behind the frontlines.

-75,000 rounds of 155mm artillery ammunition;

-Additional ammunition for High Mobility Artillery Rocket Systems (HIMARS).

“Today, the Department of Defense (DoD) announces the authorization of a Presidential Drawdown of security assistance valued at up to $550 million to meet Ukraine’s critical security and defense needs. This authorization is the Biden Administration’s seventeenth drawdown of equipment from DoD inventories for Ukraine since August 2021,” the Department of Defence said in a press release.

In the last two years, the U.S. has committed to providing Ukraine with approximately $8.8 billion in military aid (and billions more in economic and humanitarian assistance), with approximately $8.1 billion of that security assistance given since the conflict started more than five months ago on February 24.

In the last two months alone, the U.S. has committed almost $3 billion of security assistance to Ukraine. And since 2014, when Moscow first attacked Ukraine in Crimea and the Donbas, the U.S. has provided Kyiv with more than $10 billion in security assistance.

“To meet its evolving battlefield requirements, the United States will continue to work with its Allies and partners to provide Ukraine with key capabilities,” the Department of Defense added.

Weapons, Weapons, Weapons Headed to Ukraine

Since the Russian invasion started, the U.S. has provided or committed to providing Ukraine with the following weapon systems, munitions, military supplies, and non-lethal equipment:

Over 1,400 Stinger anti-aircraft systems;

Over 6,500 Javelin anti-armor systems;

Over 20,000 other anti-armor systems;

Over 700 Switchblade Tactical Unmanned Aerial Systems;

126 155mm Howitzers and up to 486,000 155mm artillery rounds;

72,000 105mm artillery rounds;

126 Tactical Vehicles to tow 155mm Howitzers;

NATO Stinger missile. Image Credit: Creative Commons.

22 Tactical Vehicles to recover equipment;

16 High Mobility Artillery Rocket Systems and ammunition;

Four Command Post vehicles;

Two National Advanced Surface-to-Air Missile Systems (NASAMS);

20 Mi-17 helicopters;

Counter-battery systems;

Hundreds of Armored High Mobility Multipurpose Wheeled Vehicles;

200 M113 Armored Personnel Carriers;

Over 10,000 grenade launchers and small arms;

Over 59,000,000 rounds of small arms ammunition;

75,000 sets of body armor and helmets;

Approximately 700 Phoenix Ghost Tactical Unmanned Aerial Systems;

Laser-guided rocket systems;

Puma Unmanned Aerial Systems;

U.S. Soldiers assigned to the 65th Field Artillery Brigade, and soldiers from the Kuwait Land Forces fire their High Mobility Artillery Rocket Systems (U.S.) and BM-30 Smerch rocket systems (Kuwait) during a joint live-fire exercise, Jan. 8, 2019, near Camp Buehring, Kuwait. The U.S. and Kuwaiti forces train together frequently to maintain a high level of combat readiness and to maintain effective communication between the two forces. (U.S. Army photo by Sgt. James Lefty Larimer)

Unmanned Coastal Defense Vessels;

26 counter-artillery radars;

Four counter-mortar radars;

Four air surveillance radars;

Two harpoon coastal defense systems;

18 coastal and riverine patrol boats;

M18A1 Claymore anti-personnel munitions;

C-4 explosives, demolition munitions, and demolition equipment for obstacle clearing;

Tactical secure communications systems;

Thousands of night vision devices, thermal imagery systems, optics, and laser rangefinders;

Commercial satellite imagery services;

Explosive ordnance disposal protective gear;

Chemical, Biological, Radiological, Nuclear protective equipment;

Medical supplies to include first aid kits;

Electronic jamming equipment;

Field equipment and spare parts;

Funding for training, maintenance, and sustainment.

WRITTEN BY Stavros Atlamazoglou

1945’s Defense and National Security Columnist, Stavros Atlamazoglou is a seasoned defense journalist with specialized expertise in special operations, a Hellenic Army veteran (national service with the 575th Marine Battalion and Army HQ), and a Johns Hopkins University graduate. His work has been featured in Business Insider, Sandboxx, and SOFREP.

1945’s Defense and National Security Columnist, Stavros Atlamazoglou is a seasoned defense journalist with specialized expertise in special operations, a Hellenic Army veteran (national service with the 575th Marine Battalion and Army HQ), and a Johns Hopkins University graduate. His work has been featured in Business Insider, Sandboxx, and SOFREP.