Trade war risks copper investments needed to meet future demand

The copper industry is turning attention to how the escalating trade war between the world’s biggest economies will affect investments needed to meet future demand for the wiring metal.

US President Donald Trump’s efforts to re-balance global trade — including a 145% tariff on Chinese imports — and retaliation by Beijing are dimming the outlook for global growth, with credit costs on the rise amid wide bond-market swings. That’s a toxic combination for those tasked with multibillion-dollar decisions on expanding copper supplies.

Although such projects are based on long-term supply-and-demand forecasts, miners and their financiers are gun-shy after getting burned in previous busts.

Investors, especially in mining, need more certainty, especially with long-term investments,” Antofagasta Plc chief executive officer Ivan Arriagada said during the CESCO Week mining event in Santiago this week. “Therefore, this could reduce investments or delay some decisions.”

Less investment is the last thing the industry needs — assuming the trade war doesn’t have a significant impact on copper demand and the electrification trend helping to underpin it.

Additional demand from the energy transition, power-grid overhauls and an expected US data center boom, means the industry needs to churn out 7.5 million metric tons of copper over the next 10 years from projects that haven’t been sanctioned yet, according to CRU Group estimates.

The industry’s response at this week’s gathering was to stress the importance of collaboration, adopting newer technology, and spinning off or outsourcing ancillary work related to water and energy.

(By James Attwood)

Copper smelting activity fell sharply in March, satellite data shows

Global copper smelting activity fell sharply in March to the weakest reading so far in 2025 as some smelters in the world’s top copper refiner China entered the usual maintenance season early, data from satellite surveillance showed on Thursday.

Earth-i, which specializes in observational data, tracks smelters representing up to 95% of global production for its SAVANT service and sells data to fund managers, traders and miners.

Last month, an average of 12.6% of global copper smelter capacity monitored was inactive, up from 8.8% in February, the company said in a statement.

Smelter inactivity in China, home to over 40% of capacity covered by its services, rose by 4.5 percentage points to 9.6%, according to Earth-i.

Chinese copper smelters, which typically shut down for maintenance in April-May, have been hit by tight copper concentrate supply due to rising smelting capacity. The scramble for the raw material can be seen in the negative level of spot treatment and refining charges (TC/RCs).

Negative TC/RCs mean that smelters that are not integrated into a nearby large mining complex and instead source their concentrates from third parties are effectively paying for the right to process concentrates rather than being paid for their service.

Copper smelting activity outside China also fell in March, with the inactivity capacity index rising by 3.4 percentage points to 14.9%. This represented the largest single month increase since May 2023.

(By Polina Devitt; Editing by Joe Bavier)

China’s copper smelters rue Beijing’s curbs on US raw materials

Beijing’s response to punitive US tariffs could create yet another headache for Chinese copper smelters, already grappling with a shortage of raw materials and plummeting profits.

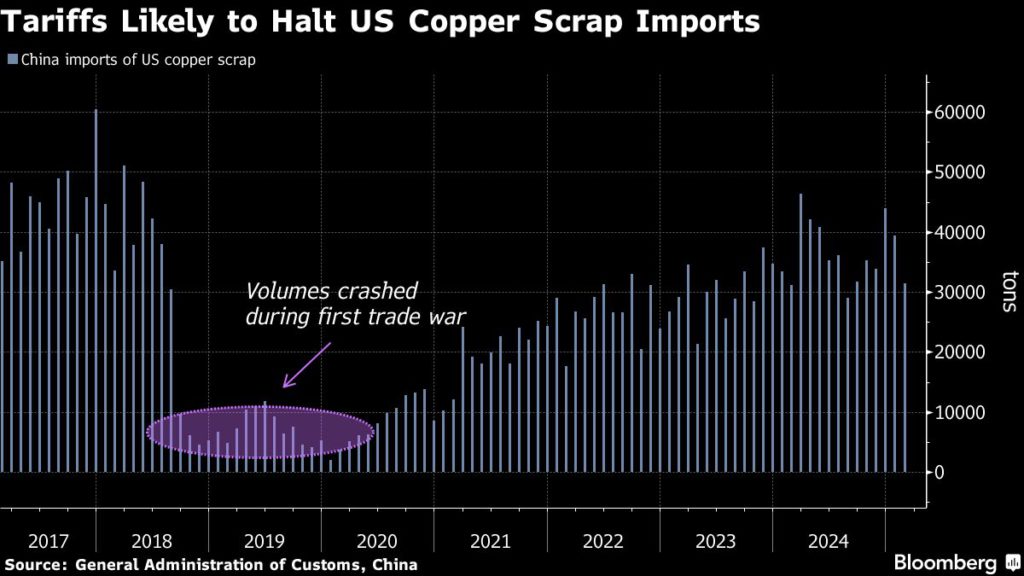

China’s swift retaliation in matching Washington’s blanket 34% levies is likely to bring US shipments of copper scrap to a halt from next month. The country last year accounted for about one-fifth of China’s overseas purchases, which have been used as a replacement feedstock for the copper ore that’s in short supply.

Imports of American scrap could top out at 100,000 tons or less in the first four months of the year, before China’s tariffs make the trade uneconomical, according to a forecast from Shanghai Metals Market. Imports last year were nearly 440,000 tons.

China has kept adding copper processing capacity despite the scarcity of ore from mines around the world. That’s led to a collapse in fees to negative levels, which has left smelters needing to pay to process concentrate into refined metal.

Using scrap metal instead has been a handy workaround and accounted for about 30% of refined copper production in 2023, according to the latest figures from the China Nonferrous Metals Industry Association.

US shipments to China also crashed during the trade war with the first Trump administration, before a gradual recovery in volumes. The onus now on exporters will be to find alternative buyers for their piles of scrap. The global shortage of ore could make that relatively easy — unless duties are levied in other countries, too.

If Trump 2.0 is successful in rebuilding America’s manufacturing base, including metals processing, it’s likely that future supplies end up only for domestic use.

Exports of US copper concentrate to China are also expected to slump to between 50,000 and 70,000 tons this year, according to SMM, compared to 460,000 tons in 2024. But that won’t have nearly as much impact as American supplies accounted for less than 2% of China’s purchases last year.

Aurubis to ramp up new US copper recycling facility

Aurubis will be ramping up its copper recycling smelter in the US this year, the German company’s CEO Toralf Haag told Reuters on Wednesday, adding Aurubis sees more potential for investment in future years.

Aurubus has invested $800 million building the project, which took four years. Haag said it will process 180,000 metric tons of complex copper scrap and produce 70,000 tons of refined metal annually.

“North America is an attractive market. There is no large recycling facility in North America up to now, the majority of the scrap is exported,” Haag said in an interview on the sidelines of the CESCO and CRU copper conferences.

The US exported nearly 960,000 tons of copper scrap last year, according to information provider Trade Data Monitor (TDM), of which 41% was shipped to China, 11% to Canada and 10% to Thailand.

US President Donald Trump has ordered an investigation on the potential for import tariffs on copper including scrap, aiming to encourage more local production of the metal used in the power and construction industries.

“The decision to invest in a recycling operation could play an even more important role now, having a facility in the US is beneficial for us,” Haag said, adding that the site in Richmond was Aurubis’ only operation in the US.

Aurubis could invest in further recycling capacity in the US. “Currently Aurubis focuses on delivering on the Richmond project,” Haag said.

Sources of copper scrap include the auto industry and cables from telecoms companies. Aurubis expects data centres to be a source of scrap in the future.

“Copper in data centres lasts three to five years, then it needs to be replaced because the technology is moving so fast.”

Data centres for artificial intelligence are expected to be a major source of future copper demand.

(By Pratima Desai; Editing by David Gregorio)

BHP gives Chile a $13 billion reason to cut red tape for mines

Bloomberg News | April 8, 2025 |

Cerro Colorado mine in Chile. Image from Consejo Minero.

BHP Group is ready to start spending $13 billion to overhaul its aging copper mines in Chile, but is grappling with red tape, an executive said Tuesday.

“As a country, we must act with a sense of urgency if we want to execute growth projects,” Alejandro Tapia, head of BHP’s Escondida mine, told an industry conference in Santiago. “Competition will be fierce, and Chile cannot lose this opportunity or its leadership position.”

Slow permitting has been a bane of the mining industry for decades, with frustration growing as heightened scrutiny of environmental and social matters coincide with projects getting more challenging and expensive to build. Chile’s government has proposed changes to speed up permitting, but the bill is yet to pass congress.

The Melbourne-based firm said it has the talent and financing in place to begin the pipeline of projects — starting with a $2.3 billion plant upgrade as part of a $10.8 billion pipeline of projects at Escondida, the world’s biggest copper mine.

“We are ready to begin construction this year if we obtain the necessary permits,” Tapia said at CRU’s World Copper Summit.

BHP is also evaluating options to restart its Cerro Colorado copper mine by 2028 at a cost of $1.3 billion. That mine was mothballed amid water supply issues. Another $1.3 billion has been earmarked for its Spence mine while the firm is also testing a new leaching technology.

BHP has said previously that the projects would take production to an average annual rate of about 1.4 million metric tons next decade in Chile. Without the investments, that output would drop to about 900,000 tons.

(By James Attwood)

No comments:

Post a Comment