Debates surround the actual water needs of nuclear power, with some arguing it uses more water than coal and renewables, while others claim water use can be managed with existing licenses and recycling.

Advancements in nuclear technology, including small modular reactors and future designs using gas or air cooling, offer potential solutions to reduce water dependency, but concerns about increased nuclear waste persist.

A global nuclear energy renaissance is unfolding. Around the world, the public and private sectors are warming to the idea of nuclear energy expansion to meet ballooning energy demand driven by data centers without throwing decarbonization accords out the window.

The International Energy Agency projects that the world will produce more nuclear energy in 2025 than ever before. “More than 70 gigawatts of new nuclear capacity is under construction globally, one of the highest levels in the last 30 years, and more than 40 countries around the world have plans to expand nuclear’s role in their energy systems,” says IEA director Fatih Birol.

In the United States, approval ratings for nuclear energy have risen at a steady clip to reach 61%, nearly an all-time high. This marks an increase of six percentage points since Gallup’s last poll in 2023. Italy just overthrew a 40-year ban on nuclear power, and even Japan, which swore off nuclear entirely in the wake of 2011’s Fukushima tragedy, has indicated that they will return to nuclear energy in the coming years.

This renewed interest is concurrent with significant advances in nuclear technologies. Some countries have started to roll out Small Modular Reactors (SMRs) which have been buzzed about for years now as far more cost efficient and safe alternatives to traditional nuclear plants. As the name suggests, these small reactors are built offsite in a factory setting and shipped to where they are needed, allowing for standardization and automation that promises to revolutionize the global nuclear energy sector. Plus, these systems have built-in safety mechanisms that proponents say make them even less likely to melt down than traditional plants.

However, next-generation nuclear does have some key drawbacks as well. For one, studies have shown that SMRs will create more nuclear waste than traditional models. This presents a tricky and expensive problem, as the highly radioactive waste material remains hazardous for thousands of years in the best of scenarios. For another, nuclear energy is an extremely thirsty form of power production, requiring huge quantities of water to cool down the reactors for optimal particle speed for fission, as well as to generate steam to create electricity.

According to Dave Sweeney, a nuclear policy analyst at the Australian Conservation Foundation, nuclear power uses more water than coal, and “massively more than renewables” on a per-kilowatt basis. Sweeney was speaking with the Guardian in reference to a recent conflict between political parties in Australia over planned nuclear expansion and water scarcity. A report commissioned by the organization Liberals Against Nuclear found that a whopping 90% of the nuclear generation capacity proposed by the opposing Coalition party lacks sufficient access to water for safe operations. “Half of the proposed nuclear capacity was already unfeasible given insufficient water, while a further 40% of the capacity would need to be curtailed during dry seasons,” the Guardian reported this week based on the findings.

However, Coalition representatives say that these concerns about nuclear power’s water use are vastly overblown. “The first question I asked when we were looking at developing a nuclear policy was what impact it would have on water and I have looked at how much water is already allocated to power generation and am confident that there will be little difference,” Nationals senator Perin Davey told the Guardian. “Unlike Labor who want to turn our water into green hydrogen, our nuclear plan’s water needs can be met through existing water licences,” she added.

And luckily, according to the Breakthrough Institute, “nuclear reactors don’t need to be so thirsty.” In order to support the expansion of nuclear power, more strict guidelines are needed for water recycling processes at power plants. Moreover, nuclear reactor design is continuing to evolve, and some future reactors will rely on gas instead of steam, while others will use ail cooling, requiring far less water to operate.

By Haley Zaremba for Oilprice.com

Despite sufficient uranium resources, urgent investment is needed in new mining, exploration, and processing.

Current uranium prices remain a major hurdle to greenfield development, with companies like Deep Yellow delaying projects until market conditions become more supportive.

The nuclear power industry will need additional uranium supply in the medium and long term to ensure adequate supply for the new era of nuclear energy.

Therefore, efforts must begin immediately to secure the supply of the key nuclear fuel, the OECD Nuclear Energy Agency (NEA) and the International Atomic Energy Agency (IAEA) said in their Red Book report prepared jointly every two years.

Nuclear energy has been booming since 2022 as many countries seek to add reliable but zero-carbon electricity generation capacity to meet growing power demand, including from AI and data centers. The complex geopolitical background in uranium supply could present challenges to some countries ensuring uranium for their nuclear power plants.

Investment in New Uranium Supply Needs To Grow

Global uranium production has rebounded since its low point in 2020 and 2021, and the current supply is sufficient, the report said. But the expected strong nuclear power growth in the coming decades needs investments in supply now, so that production could begin in a few years, given the long lead times from a project on the drawing board to actual mining and uranium processing operations.

“Sufficient uranium resources exist to support both the continued use of nuclear power and its significant growth through 2050 and beyond,” the report said.

“However, timely investments in new exploration, mining operations and processing techniques will be essential to ensure that uranium becomes available to the market when needed,” the authors of the Red Book added.

Following five years of declining production as major producing countries, including Canada and Kazakhstan, limited production in response to a depressed uranium market, production began to increase in 2022 in response to a strong uranium price recovery. This trend continued in 2023 and 2024, according to the report.

Kazakhstan remains by far the world’s largest producer, at 43% of global uranium production. In 2022 alone, Kazakhstan’s production was more than the combined production from the next four top producers, Canada, Namibia, Australia, and Uzbekistan.

Kazakhstan has boosted sales to Russia and China in recent years, although it keeps selling uranium to Western countries as it prefers to keep its uranium sales markets diversified.

Nuclear Capacity Set to Soar

The Red Book report expects global nuclear capacity to jump by 45% by 2050 compared to 2022 in the low demand case. The surge in the high-demand case is seen at 130%, suggesting that the global uranium fleet could more than double by 2050.

The rise could be even higher considering that this estimate in the biennial report takes into account policies and plans of January 1, 2023. In the two years since then, more countries have announced plans to return to nuclear power or boost nuclear generation capacity.

Amid plans for expansion in many countries, including in the United States, uranium demand is set to surge in the coming years and decades, while Western companies are seeing increased competition from China and Russia for supply.

Moreover, the biggest technology firms have started to back next-generation nuclear, hoping to have 24/7 zero-carbon energy power their data centers.

Many start-ups in the United States and Europe are vying to become the first to not only design but also put into commercial operation the next generation of advanced nuclear reactors, the so-called small modular reactors (SMR).

Nuclear power will be one of the most important new energy infrastructures that the world will need to meet the electricity demand from AI, Goldman Sachs said in a report earlier this year.

Investment Dilemma

While uranium resources will be enough to meet the nuclear power growth, even in the high-growth scenario, for a few more decades, the world needs to start investing now in new exploration, mining, and processing of uranium, according to the Red Book report.

“The uranium resource base is sufficient to meet the needs of a high-growth nuclear capacity through 2050 and beyond. However, this will require essential investments in new exploration, improved processing techniques and new production centres to replenish reserves,” the authors of the report noted.

Investment, however, isn’t easy to come by, especially when uranium prices aren’t supportive.

Just this week, Australian uranium miner Deep Yellow deferred the final investment decision for its Tumas project in Namibia “until improved uranium price incentive supports greenfield project development.”

“The demand outlook is undeniable, driven by decarbonisation efforts, forecasts of continued enormous energy demand growth, the prevailing structural supply shortages and now having to deal with the added, newly emerging requirements from the developers of energy hungry datacentres, give clear upside for the supply sector,” said John Borshoff, Deep Yellow’s managing director.

But he noted that “The reality is there are limited greenfield uranium deposits available for start-up globally over the next 10 years to satisfy projected demand, and new uranium supply will be virtually impossible to achieve in the current price environment.”

According to Borshoff, “Nuclear utilities cannot ignore the fact that unless uranium prices increase to appropriate levels and large amounts of capital become available to the supply sector, those greenfields projects will remain undeveloped.”

By Tsvetana Paraskova for Oilprice.com

Proposal for Norwegian SMR power plant progresses

The Norwegian government has commissioned several agencies to develop an Environmental Impact Assessment programme for the proposed power plant based on multiple small modular reactors in the municipalities of Aure and Heim.

_58870.jpg)

Norsk Kjernekraft submitted a proposal to Norway's Ministry of Energy in November 2023 for an assessment into the construction of the small modular reactor (SMR) plant. According to the preliminary plan, the plant will be located in a common industrial area - the Taftøy industrial park - in the border area between Aure and Heim. The plant is planned to consist of several SMRs, which together will produce around 12.5 TWh of electricity annually, if the plant is realised in its entirety.

The Ministry of Energy, the Ministry of Health and Care Services, the Ministry of Justice and Public Security, and the Ministry of Climate and Environment have now requested the Norwegian Water Resources and Energy Directorate (NVE), the Norwegian Radiation and Nuclear Safety Authority (DSA), and the Norwegian Directorate for Civil Protection (DSB) to prepare an Environmental Impact Assessment (EIA) programme for the proposed plant.

The ministries have requested that the recommendation be ready before the summer, and no later than September.

"The recommendation shall be based on the project owner's proposal for an assessment programme, received consultation statements and the directorates' own assessments," the Ministry of Energy said. "The purpose of the impact assessment is to elucidate the consequences of the planned measure and contribute to a basis for a well-informed and sound decision-making basis in any subsequent licence processes pursuant to the Atomic Energy Act and the Energy Act, respectively, as well as for permits under the Pollution Act and approvals pursuant to the Radiation Protection Act."

Norsk Kjernekraft said the assignment "marks a significant step in developing practical guidelines for the application of Norway's nuclear legislation. While Norway already has overarching nuclear legislation, this marks the first time it will be applied to commercial nuclear power".

"We are proud to have contributed to this historic milestone," said Norsk Kjernekraft CEO Jonny Hesthammer. "This is the first time Norway is taking concrete steps toward establishing nuclear power, an initiative that can deliver clean and sustainable energy for future generations. We see this as a critical step towards enhancing Norway's energy security, maintaining industrial productivity, and reducing greenhouse gas emissions. This project will not only strengthen our energy supply but also create jobs and promote sustainable economic growth."

Norsk Kjernekraft aims to build, own and operate SMR power plants in Norway in collaboration with power-intensive industry. It says it will prepare licence applications in accordance with national regulations and international standards. It will follow the International Atomic Energy Agency's approach for milestones, and focus on what creates value in the early phase. Financing will take place in collaboration with capital-strong industry and solid financial players.

Aure and Heim is one of four possible location for a nuclear power plant that Norsk Kjernekraft has announced, the other municipalities being Vardø, Øygarden and Halden.

In June 2024, the Norwegian government appointed a committee to conduct a broad review and assessment of various aspects of a possible future establishment of nuclear power in the country. It must deliver its report by 1 April 2026

'Great opportunities ahead' for fuel cycle

It is a time of great opportunity for nuclear - but fuel cycle players must work together to seize the moment and make sure the fuel cycle is ready to support a global tripling of nuclear energy. This was the message from the opening session of the World Nuclear Fuel Cycle 2025 conference.

Kicking off the annual event in Montreal on 9 April, World Nuclear Association Director General Sama Bilbao y León, Ontario Power Generation (OPG) President and CEO Nicolle Butcher and Cameco President and CEO Tim Gitzel explored Canada's nuclear energy experiences, from Ontario's phaseout of coal-fired generation over a decade ago to plans for new nuclear capacity including four small modular reactors (SMRs) and other new capacity.

The Canadian Nuclear Safety Commission recently announced its decision to authorise the first of those SMRs, but OPG's new build ambitions will be underpinned by a domestic supply chain that has been built and honed over the course of the 10-year project to refurbish the existing Darlington reactors, Butcher said. Keeping these major infrastructure projects on time and on budget has needed innovation, teamwork and investment, but success in refurbishment underpins OPG's confidence to go out and build SMRs, she said. In total, some CAD25 billion (USD17.8 billion) has been invested in Ontario's nuclear supply chain in the course of the refurbishment projects at OPG and Bruce Power's plants, and that supply chain is already in place and ready to support new build projects.

Gitzel pointed to a changing narrative that has gone from an emphasis on energy security to national security, and now - for the USA, at least - energy dominance. Cameco's 2023 acquisition of Westinghouse was perhaps a "risky" move at the time, but the company is "all in" on nuclear, Gitzel said, and means the company now has the "full suite" of technologies. "Canada has got all the elements to be a nuclear powerhouse, and that's what we're going to be," he said.

With growing support both politically and socially, and involvement of new end-users such as tech companies, the panellists were upbeat about the outlook for nuclear. "It is certainly good" to have diverse stakeholders supporting nuclear efforts, Bilbao y León said, as this brings "great opportunity". But the nuclear industry must work together to ensure the construction of many, many units beyond first, second and third of a kind, she said.

Staying global

The industry needs to stand "shoulder to shoulder" to ensure such success in responding to the opportunities for nuclear which "have never been better", Gitzel said.

And the nuclear industry has to remain global, Butcher said. "I don't think there's a technology anywhere that can be done within one country. We will always rely on other countries." OPG's SMR project, for example, will see Canadian reactors for the first time requiring uranium enrichment services - which are not available in Canada. "To be successful, we as an industry really have to step up above the politics and remain a global industry," she said.

Nuclear fuel cycle services will be needed to support a tripling of nuclear energy capacity. Cameco has maintained its strategy of supply discipline and the 5-10 year visibility offered by new build projects means it will be able to react in time to meet the demand. There is scope for production increases from the company's Tier 1 assets, and there are other assets on standby - including the Rabbit Lake mine and assets in Wyoming and Nebraska - that Cameco could bring online "if the market calls for it", Gitzel said.

"It all starts with the fuel cycle. Without the uranium, there is no nuclear," Gitzel said.

Moving forward with ambitious plans it is essential to look at all the pieces of the fuel puzzle, Bilbao y León concluded. "So yes, we will be building the reactors. But we will make sure that we have the fuel … and the entire system that is needed to make that happen," she said.

World Nuclear Fuel Cycle 2025, co-organised by the Nuclear Energy Institute and World Nuclear Association, is taking place in Montreal, Canada, from 9-10 April.

DOE selects first recipients of HALEU

The US Department of Energy has made conditional commitments to five advanced reactor developers to receive the first allocations of high-assay low-enriched uranium from its HALEU Availability Program.

_58785.jpg)

HALEU - uranium enriched to contain between 5% and 20% uranium-235 - will be used by many advanced reactors which are seen as essential to the USA's clean energy future and meeting its clean energy and climate goals. But the country currently lacks commercial HALEU enrichment capabilities to support the deployment of advanced reactors. These contracts are part of efforts by the US Administration to build a secure domestic HALEU supply chain, and follow the recent announcement of contracts to support HALEU deconversion services.

The HALEU Availability Program was established in 2020 to secure a domestic supply of HALEU for civilian domestic research, development, demonstration, and commercial use. The HALEU allocation process enables nuclear developers to request HALEU material from DOE sources, including material from the National Nuclear Security Administration.

DOE said it received HALEU requests from 15 companies. For this first round, the department identified five of those companies that met "prioritisation criteria", with three of them requiring fuel delivery in 2025. The selected companies are: Kairos Power, Radiant Industries, TerraPower, TRISO-X and Westinghouse.

"The allocated HALEU supports both Advanced Reactor Demonstration Program (ARDP) Pathway 1 award recipients, companies planning to demonstrate in the DOME test bed, along with some ARDP risk reduction awardees – reinforcing DOE's commitment to our industry partnerships," DOE said.

The department said it will now initiate the contracting process to allocate the material to the five companies, "some of which could receive their HALEU as early as this fall". It noted the allocation process is ongoing, and it plans to continue HALEU allocations to additional companies in the future.

Energy Secretary Chris Wright said: "The Trump Administration is unleashing all sources of affordable, reliable and secure American energy – and this includes accelerating the deployment of advanced nuclear reactors. Allocating this HALEU material will help US nuclear developers deploy their advanced reactors with materials sourced from secure supply chains, marking an important step forward in President Trump's programme to revitalise America's nuclear sector."

X-energy subsidiary TRISO-X, one of the first recipients, said it will receive the material for fuel fabrication at its future Oak Ridge, Tennessee, fuel fabrication plant. The company recently amended its special nuclear material licence application to the US Nuclear Regulatory Commission to reflect the required installation of additional equipment to receive the allocation.

"This first allocation is a critical step forward to bridge the HALEU availability gap in the nuclear supply chain with existing material," said TRISO-X President Joel Duling. "Coupled with the HALEU Availability Program and other efforts, we expect the commercial sector to further bridge the availability gap to support the delivery and scalability of the advanced reactor fleet. We are grateful for the administration's strong support for commercialising these next-generation technologies and the reliable, secure energy future we hope to build."

Kairos Power said it will use material provided by DOE to produce HALEU TRISO (tri-structural isotropic) fuel pebbles for the Hermes Low-Power Demonstration Reactor in partnership with the Los Alamos National Laboratory using manufacturing processes developed and optimised in Kairos Power laboratories.

Concreting of Pallas foundation under way

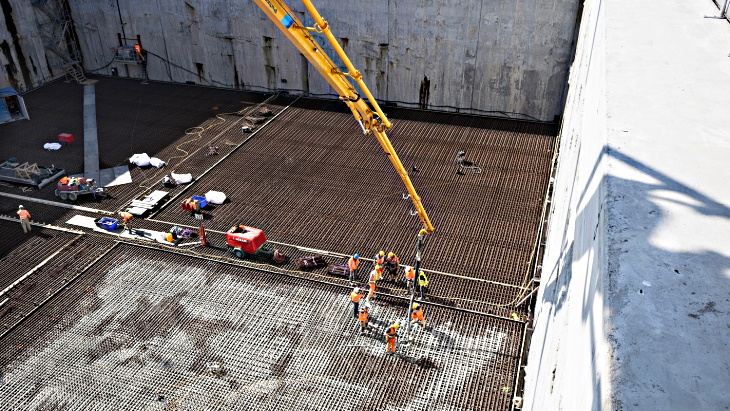

The pouring of concrete has begun to form the foundation for the reactor building of the Pallas research reactor in Petten, the Netherlands.

_21194.jpg)

NRG-Pallas applied in June 2022 to the Dutch regulator, the Authority for Nuclear Safety and Radiation Protection (ANVS), for a permit to construct and operate the Pallas reactor. ANVS granted a construction licence in mid-February 2023. Preparatory work on the foundation began in May 2023. This work is being carried out by Belgian construction firm Besix, which was awarded a contract in November 2022.

To create the construction pit, a hole of about 50 metres by 50 metres and 17.5 metres deep was dug in several phases. To do this, 30 trenches measuring one-and-a-half metres wide were dug, into which concrete was poured to create the so-called "diaphragm walls". The diaphragm walls are anchored with 380 bored piles placed within them. A ring beam has been placed around the top part of the walls to connect the walls together.

As part of the latest series of works at the bottom of the construction pit, a total of 790 tonnes of steel reinforcement bars have been placed in layers.

In the final step, a 1.5-metre-thick layer of concrete is now poured across the whole surface of the pit's bottom in five stages to form the foundation floor of the Pallas reactor.

(Image: NRG-Pallas)

"In coming months, the site will keep transforming: the construction staff office for 250 people will be installed, first works on the Pallas reactor, and its secondary cooling system building will commence," NRG-Pallas said.

Although funding has been allocated in the coming years for the construction of the Pallas reactor, the Dutch government has yet to make a final decision on its construction. Construction will be able to go ahead if the Dutch parliament does not object to the creation of a new state-owned company. The European Commission has already approved, under EU state aid rules, the Dutch government's plan to invest EUR2 billion (USD2.2 billion) in the construction of Pallas.

Former Minister of Health, Welfare and Sport Ernst Kuipers instructed the Pallas foundation not to take any irreversible steps, but to continue with the preparations for the project in the meantime to avoid unnecessary delays.

(Image: NRG-Pallas)

In January 2023, Pallas launched a tender procedure for the construction of the Pallas reactor and surrounding buildings under EU public procurement rules. Three pre-qualified candidates were selected to submit offers. In December, Spanish construction firm FCC Construcción was contracted to build Pallas.

The Pallas research reactor is to be built at Petten to replace the existing High Flux Reactor (HFR). The 45 MW HFR started operating in September 1960, since when its use has largely been shifted from nuclear materials testing to fundamental research and the production of medical radioisotopes. The reactor - operated by NRG on behalf of the European Union's Joint Research Centre - has for a long time supplied about 60% of Europe's and 30% of the world's use of medical radioactive sources.

Pallas will be of the "tank-in-pool" type, with a thermal power of around 55 MW, and able to deploy its neutron flux more efficiently and effectively than the HFR.

Hot testing of second Zhangzhou unit completed

Tests that simulate the temperatures and pressures which the reactor systems will be subjected to during normal operation have been completed at unit 2 of the Zhangzhou nuclear power plant in China's Fujian province. The unit is the second of four Hualong One (HPR1000) reactors under construction at the site.

_44666.jpg)

Hot functional tests involve increasing the temperature of the reactor coolant system and carrying out comprehensive tests to ensure that coolant circuits and safety systems are operating as they should. Carried out before the loading of nuclear fuel, such testing simulates the thermal working conditions of the power plant and verifies that nuclear island and conventional equipment and systems meet design requirements.

During the tests, the steam turbine generator of the unit was run to 1500 rpm for the first time and ran stably. "After inspection and confirmation by on-site staff, all systems on the conventional island ran smoothly during this run-in process, and all key technical indicators of the steam turbine met the acceptance standards, marking the successful completion of the non-nuclear run-in test," China National Nuclear Corporation (CNNC) said.

CNNC added that completion of the hot testing of Zhangzhou 2 "lays a solid foundation for the subsequent work of nuclear fuel loading, grid-connected power generation and other work of the unit".

Cold functional tests - which are carried out to confirm whether components and systems important to safety are properly installed and ready to operate in a cold condition - were completed earlier at Zhangzhou 2. The main purpose of those tests - which marked the first time the reactor systems were operated together with the auxiliary systems - was to verify the leak-tightness of the primary circuit.

Zhangzhou units 1 and 2 (Image: CNNC)

China's Ministry of Ecology and Environment issued construction licences for Zhangzhou units 1 and 2 on 9 October 2019 to CNNC-Guodian Zhangzhou Energy Company, the owner of the Zhangzhou nuclear power project, which was created by CNNC (51%) and China Guodian Corporation (49%) in 2011. Construction of unit 1 began one week after the issuance of the construction licence, with that of unit 2 starting in September 2020.

In September 2022, China's State Council approved the construction of two further Hualong One units as Phase II of the Zhangzhou plant. First concrete for the nuclear island of unit 3 was poured in February last year, with that for unit 4 following in September.

Six Hualong One units are planned for the Zhangzhou site.

"Currently, unit 1 has been put into commercial operation, and unit 2 is scheduled to be put into commercial operation in the fourth quarter of this year," CNNC said. "Units 3 and 4 have started construction in 2024, and the preliminary work of units 5 and 6 is being carried out in an orderly manner."

Aalo unveils microreactors option for data centres

US microreactor developer Aalo Atomics has launched the Aalo Pod - a 50 MWe "extra modular reactor" for powering data centres which is based on its Aalo-1 advanced reactor technology.

The Austin, Texas-based company says the Aalo Pod is "purpose-built to provide fast, reliable, clean, safe, and scalable on-site power for modern data centres" and "results from countless hours of market research, past experiences, and customer conversations".

It says: "Each Aalo Pod contains five Aalo-1 reactors, is fully modular (both the reactor and the plant) and can scale seamlessly to gigawatts. With a small physical footprint and no need for external water sources, the Aalo Pod is easy to co-locate onsite with the data centre. Aalo's ability to mass manufacture and ship the entire Aalo Pod via standard shipping methods significantly shortens installation time. Additionally, Aalo-1 reactors are sodium-cooled and use proven-safe, readily available low enriched uranium fuel (LEU+)."

The Aalo Pod is built around 50 MWe modular blocks, scalable up to gigawatt levels. Its compact footprint - 100 MWe on less than five acres — provides "unmatched site flexibility and optimal land utilisation, far surpassing solar, wind, and conventional nuclear solutions", Aalo claims.

The company said it expects to be able to deliver an Aalo Pod "within 12 months from order placement and a few months for each additional pod".

"We believe that to address today’s massive data centre market demand, another category of nuclear reactor is needed, one that blends the benefit of the factory manufacturing of microreactors, the power levels of small modular reactors, and the economic targets of a large reactor," said Aalo Atomics CEO Matt Loszak. “We call this category XMR, with the 'X' representing extra flexibility and modularity."

Last year, Aalo announced it had completed the conceptual design of the Aalo-1 - a factory-fabricated 10 MWe sodium-cooled microreactor using uranium zirconium hydride fuel elements. It is working on the construction of a non-nuclear test reactor (Aalo-0), at its Austin headquarters, and plans to build its first nuclear reactor - the Aalo Experimental reactor (Aalo-X) - at Idaho National Laboratory (INL) as part of its phased approach to development and deployment.

The launch of the Aalo Pod came as Aalo unveiled the first non-nuclear prototype of its Aalo-1 reactor, as well as a state-of-the-art manufacturing facility in Austin.

In December, Aalo announced that it had received official approval from the US Department of Energy (DOE) Idaho Operations Office to pursue DOE authorisation to locate its Aalo-X experimental reactor at the INL site. DOE granted the company a Siting Memorandum of Understanding earlier last year.

Aalo has signed a memorandum of understanding with Idaho Falls Power that sets the stage for the deployment of seven Aalo-1 reactors, totaling 75 MWe of power generation.

Aalo was also recently selected as one of four partners to develop up to 1 GW of nuclear energy generation capacity at the Texas A&M Rellis Campus.

"We are aiming to do for nuclear reactors what Henry Ford did for cars," Loszak said. "Currently, many utilities are shying away from building large nuclear plants because of the uncertainty in cost and schedule. By making reactors in factories, we make the process fast, repeatable, and predictable, decreasing costs without sacrificing quality or safety."

No comments:

Post a Comment