How is the green economy reacting to the Spending Review and National Infrastructure Strategy?

25 November 2020, source edie newsroom

Green groups have dubbed the Spending Review a "missed opportunity" for the green recovery movement and net-zero transition, urging more new investment and clarity on climate requirements for the national investment bank.

Sunak was originally meant to unveil the NIS at the Budget in March.

25 November 2020, source edie newsroom

Green groups have dubbed the Spending Review a "missed opportunity" for the green recovery movement and net-zero transition, urging more new investment and clarity on climate requirements for the national investment bank.

Sunak was originally meant to unveil the NIS at the Budget in March.

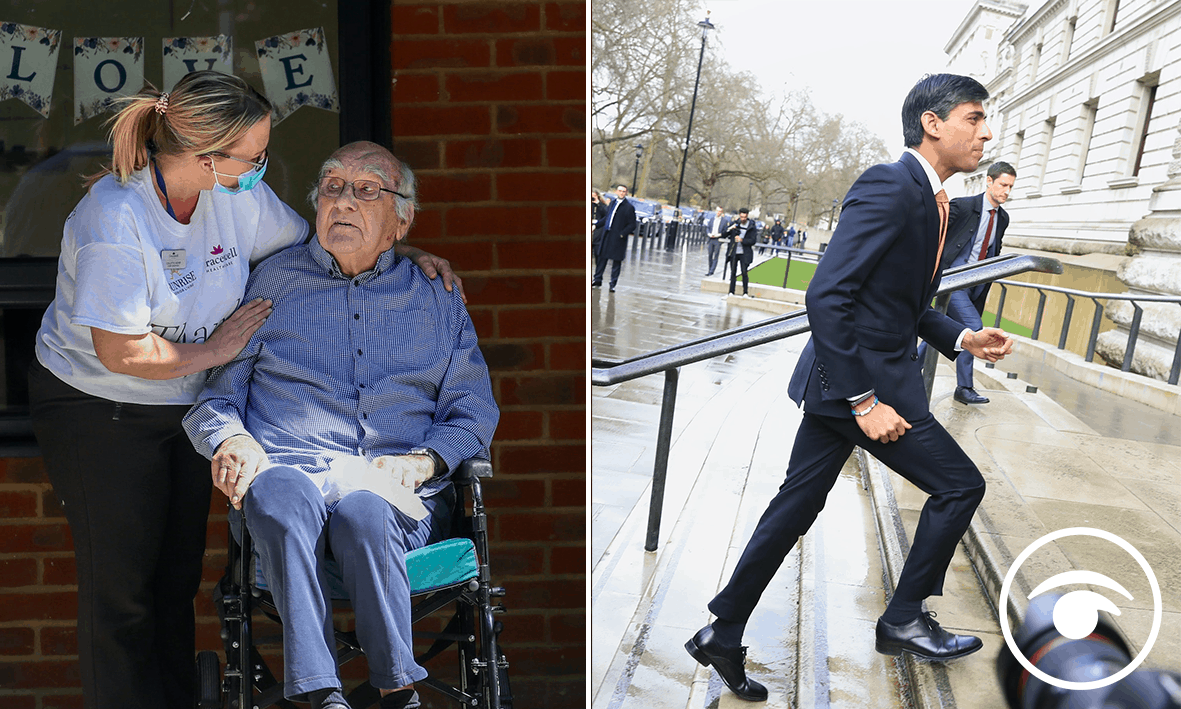

Image: Parliament Live TV

Chancellor Rishi Sunak today (25 November) delivered the spending review, prompting mixed reactions among MPs and the general public on issues ranging from NHS worker pay to foreign aid.

While the priority of the Review was to outline further measures for the UK’s Covid-19 recovery, including new investments in vaccines and new job creation and retention measures, Sunak also announced several measures which will impact the UK’s net-zero transition and businesses across the green recovery.

He confirmed that £100bn will be spent on infrastructure in the next financial year as part of the National Infrastructure Strategy (NIS) – which was due at the 2020 Budget in March but delayed to give the Treasury the chance to introduce new net-zero requirements.

While £12bn has been earmarked for low-carbon sectors like active transport and electric vehicle infrastructure, green campaigners are divided on whether this overlaps with the ten-point plan announced by Boris Johnson earlier this month. Disappointment has also been voiced about funding to deliver what Sunak described as the UK’s biggest road-building scheme – and the decision not to attach net-zero “strings” to a £4bn “levelling up” fund, to be allocated competitively.

Sunak also confirmed that the UK will host a national investment bank from 2021 and that this organisation will have a net-zero remit. This was a measure recommended by groups including UK100 and the Aldersgate Group.

With all this in mind, edie rounds up the ways in which key green figures and organisations have reacted to the announcement.

The Country Land and Business Association’s (CLA) president Mark Bridgeman:

“We understand the Chancellor continues to firefight the economic fallout of Covid-19. But this Spending Review did little to show the Government’s mantra of ‘building back better’ will apply to the rural economy.

“Rural productivity is 16% less than the national average. If Government takes steps to close that productivity gap, then £43bn will be unlocked into the economy, creating jobs and strengthening communities. This week’s spending review will do nothing to boost economic growth in the countryside.

“The truth is that for the rural economy to achieve its vast potential, Government will need to do a great deal more. We need to see Ministers from the Treasury, Defra, the Ministry of Housing, Communities and Local Government and other key departments to work together, and with the industry, to identify and deliver new policies specifically designed to create jobs and grow businesses in the countryside.”

The Wildlife and Countryside Link:

“This Spending Review is a missed opportunity for nature jobs. A National Nature Service could create work for people across England. We will continue to make the case for nature’s role in a green recovery, and the impact it can have for people and communities.”

Caroline Lucas, Green Party MP:

“A week after the Prime Minister’s ten-point plan, the Chancellor seems to have forgotten about the climate and nature crises.

“The biggest ever investment in new roads does not deliver a greener future – and nature was not mentioned once. This won’t put us on the path to 1.5C.”

Ed Miliband, Labour MP and Shadow BEIS Secretary:

“Any hopes that the Government would meet the jobs and climate emergency with the investment required or show international leadership on climate were dashed by the Chancellor today. The climate crisis was almost invisible in today's statement.

“Government documents confirm that only £3bn of new money has been allocated to a green stimulus to tackle the unemployment crisis. Taking into account all of their green investment, the Government is still miles behind the tens of billions committed by France and Germany.”

The Aldersgate Group’s executive director Nick Molho:

“The Spending Review’s commitment that the UK’s economic recovery ‘must be green’ sends a positive signal. We welcome the creation of a national infrastructure bank and would urge that the net-zero target, the Environment Bill targets and the levelling up agenda are all central to its mandate.

"The Government’s confirmation that the UK will have an emissions trading scheme from January 2021 which will be aligned with the UK’s net-zero target will send a reassuring signal to investors. However, a key task for the Government in the near future will be to introduce new regulations and market mechanisms to drive private low-carbon investment in critical areas such as buildings, heavy industry and nature restoration."

Greenpeace UK’s head of politics Rebecca Newsom:

“The Chancellor appears not to have pledged a single extra penny towards a green economic recovery today while wasting tens of billions on polluting new roads. This would be a failure for jobs, the economy and the future of our planet. France and Germany get it. They’re throwing a combined £63bn towards carbon-cutting stimulus measures. Whereas we’re spending £27bn building new roads. Where’s the logic?

“Also, the decision to cut the aid budget will fundamentally undermine the UK’s climate leadership. It will hinder poorer countries' ability to tackle and adapt to the climate emergency, and sour the UK's diplomatic relationships in the run-up to COP26.”

BLCP’s head of energy, environment and infrastructure Mark Richards:

“The announcement of the National Infrastructure Bank is interesting but currently there’s no shortage of capital in the market for well-structured and developed infrastructure projects. However, there is a huge need for early-stage capital for development projects and infrastructure deploying new and unproven technologies, it will be interesting to see if the new infrastructure bank will address this market need for early-stage development capital.”

“Changes to the Green Book are welcomed as is the desire to promote infrastructure projects making a real difference to local economies throughout England. I believe our private sector clients are keen to get involved and help deliver these projects through private capital investment, hopefully there is the opportunity for true public and private collaboration to aid both levelling up and net-zero targets.”

EDW’s energy partner Darren Walsh:

"Whether we accept that the Chancellor's Spending Review and the Prime Minister's ten-point plan for net-zero Carbon provides a £12 billion shot in the arm for our green revolution, or £4 billion as some commentators believe, what is clear from today's Spending Review is that Government is striving to achieve its Paris Agreement commitments by 2050 or sooner.

“The reality is that this will not be achievable without significant private sector investment and winning the hearts and minds of the UK population. The Spending Review supports the Prime Minister's ten Point Plan, which provides a framework for how this might be achieved, but there remains a significant amount of work to do to implement this plan so as to meaningfully achieve its ambitions."

WWF-UK’s head of climate change, Gareth Redmond-King:

“There are no new green recovery numbers in the Spending Review today, beyond the Prime Minister’s speech, by the looks of it.

“New Treasury green book guidance on checking policy against net-zero may be the first tentative step towards a net-zero test; some greater accountability across government for aligning commitments to UK climate targets. But it will need some teeth if it is to be able to bite on actual decisions.”

The RSPB:

“It was quite right that the Chancellor focus on people and jobs today, but we should be making a down-payment on our future health and wellbeing. No new money for nature is a missed opportunity to build a healthier, cleaner and better future for all.

“£92m for trees is not enough. We need to invest £615m per year for ten years to restore and expand woodland, peatland and other habitats to meet nature priorities and tackle the climate crisis.”

The IPPR’s lead for the Environmental Justice Commission Luke Murphy:

“The announcement of the National Infrastructure Bank is very welcome – it is essential that achieving net-zero and restoring nature are a core part of its remit.

“But cutting international aid in the year of COP26, when a core part of the remit as host is to increase support to vulnerable countries, is bad policy and a terrible signal to send.”

Enzen Group’s head of UK and Europe Sanjay Neogi:

“The new National Infrastructure Strategy and the proposed infrastructure bank are steps in the right direction, but it’s detail that matters. Large infrastructure projects require careful planning and orchestration to ensure funds are well spent, create value and delivered on time. It is also equally important we keep firmly on the path to net-zero and ensure sustainability is at the heart of every infrastructure project.”

PwC UK’s energy transition leader Janine Freeman:

“The need to decarbonise how we power and heat our homes, businesses and transport is indisputable, but how it will be paid for is a big question. We estimate that £400bn of investment into net-zero infrastructure will be required over the next decade alone or, to put it another way, over £1,000 per individual taxpayer, per year, for the next 10 years. Private capital will have a crucial role to play in financing this essential, green infrastructure.

“A new National Infrastructure Bank to channel public funds into net-zero capital projects may enable the government to ‘pump prime’ private investment in nascent, clean energy projects. But to attract the quantities of private capital required, the government will also need to provide a stable regulatory, financial and investment environment to attract investors who are looking around the world to allocate their capital to net-zero.

"These interventions, alongside continued acceleration of the decommissioning of legacy carbon assets, such as fossil fuel cars, through incentives like car scrappage schemes and clean air zones, will unleash the economic and job creation opportunities of a net-zero future for people across the UK.”

The Climate Coalition's campaigns manager Clara Goldsmith:

"The Chancellor had a major opportunity to boost and future-proof the UK economy whilst delivering a green recovery that sets us on a pathway to limit global temperature rise to 1.5C.

"While we welcome some announcements - such as the new public investment bank and ‘Levelling Up Plan’ - these must have climate action at their heart to grow the industries and sectors that will power the economy of tomorrow. The decision to cut overseas aid funding undermines this government’s own position as host of next year’s crucial UN climate talks, and will impact communities on the frontlinea of a climate crisis they did not cause."

The Nuclear Industry Association's chief executive Tom Greatrex:

“Meeting net-zero by 2050 is incompatible with the flawed analysis offered by the National Infrastructure Commission. It is right that today the UK government have rejected John Armitt’s group in clear and stark terms – nuclear alongside other low carbon technologies will be required to decarbonise, and it was never a sound position to suggest otherwise. The focus now must be on delivering the infrastructure required to meet net-zero – and avoiding wasting further time, effort and attention in seeking to pit low-carbon technologies against each other.”

E3G's clean economy program leader Pedro Guertler:

“The Chancellor has confirmed vital extra funding for greening buildings next year but missed the opportunity to set out multi-year funding which is so desperately needed to give the supply chain the confidence to invest. With £100bn invested in infrastructure in 2021, the £1.1bn for green buildings is only 1% of that total budget. This will not be enough to get on track to net-zero.”

Ashurst's energy partner Antony Skinner:

"Having a clear policy and regulatory framework is essential for potential investors in the different sectors that are a part of the Government's decarbonisation strategy, so having a clear commitment from Government about the areas it is seeking investment in, as well as a timetable for publication of the Energy White Paper, which is to be published in the next three months, with strategies for different sectors to follow in the next 12 months, is definitely a step in the right direction."

Edie Staff

Chancellor Rishi Sunak today (25 November) delivered the spending review, prompting mixed reactions among MPs and the general public on issues ranging from NHS worker pay to foreign aid.

While the priority of the Review was to outline further measures for the UK’s Covid-19 recovery, including new investments in vaccines and new job creation and retention measures, Sunak also announced several measures which will impact the UK’s net-zero transition and businesses across the green recovery.

He confirmed that £100bn will be spent on infrastructure in the next financial year as part of the National Infrastructure Strategy (NIS) – which was due at the 2020 Budget in March but delayed to give the Treasury the chance to introduce new net-zero requirements.

While £12bn has been earmarked for low-carbon sectors like active transport and electric vehicle infrastructure, green campaigners are divided on whether this overlaps with the ten-point plan announced by Boris Johnson earlier this month. Disappointment has also been voiced about funding to deliver what Sunak described as the UK’s biggest road-building scheme – and the decision not to attach net-zero “strings” to a £4bn “levelling up” fund, to be allocated competitively.

Sunak also confirmed that the UK will host a national investment bank from 2021 and that this organisation will have a net-zero remit. This was a measure recommended by groups including UK100 and the Aldersgate Group.

With all this in mind, edie rounds up the ways in which key green figures and organisations have reacted to the announcement.

The Country Land and Business Association’s (CLA) president Mark Bridgeman:

“We understand the Chancellor continues to firefight the economic fallout of Covid-19. But this Spending Review did little to show the Government’s mantra of ‘building back better’ will apply to the rural economy.

“Rural productivity is 16% less than the national average. If Government takes steps to close that productivity gap, then £43bn will be unlocked into the economy, creating jobs and strengthening communities. This week’s spending review will do nothing to boost economic growth in the countryside.

“The truth is that for the rural economy to achieve its vast potential, Government will need to do a great deal more. We need to see Ministers from the Treasury, Defra, the Ministry of Housing, Communities and Local Government and other key departments to work together, and with the industry, to identify and deliver new policies specifically designed to create jobs and grow businesses in the countryside.”

The Wildlife and Countryside Link:

“This Spending Review is a missed opportunity for nature jobs. A National Nature Service could create work for people across England. We will continue to make the case for nature’s role in a green recovery, and the impact it can have for people and communities.”

Caroline Lucas, Green Party MP:

“A week after the Prime Minister’s ten-point plan, the Chancellor seems to have forgotten about the climate and nature crises.

“The biggest ever investment in new roads does not deliver a greener future – and nature was not mentioned once. This won’t put us on the path to 1.5C.”

Ed Miliband, Labour MP and Shadow BEIS Secretary:

“Any hopes that the Government would meet the jobs and climate emergency with the investment required or show international leadership on climate were dashed by the Chancellor today. The climate crisis was almost invisible in today's statement.

“Government documents confirm that only £3bn of new money has been allocated to a green stimulus to tackle the unemployment crisis. Taking into account all of their green investment, the Government is still miles behind the tens of billions committed by France and Germany.”

The Aldersgate Group’s executive director Nick Molho:

“The Spending Review’s commitment that the UK’s economic recovery ‘must be green’ sends a positive signal. We welcome the creation of a national infrastructure bank and would urge that the net-zero target, the Environment Bill targets and the levelling up agenda are all central to its mandate.

"The Government’s confirmation that the UK will have an emissions trading scheme from January 2021 which will be aligned with the UK’s net-zero target will send a reassuring signal to investors. However, a key task for the Government in the near future will be to introduce new regulations and market mechanisms to drive private low-carbon investment in critical areas such as buildings, heavy industry and nature restoration."

Greenpeace UK’s head of politics Rebecca Newsom:

“The Chancellor appears not to have pledged a single extra penny towards a green economic recovery today while wasting tens of billions on polluting new roads. This would be a failure for jobs, the economy and the future of our planet. France and Germany get it. They’re throwing a combined £63bn towards carbon-cutting stimulus measures. Whereas we’re spending £27bn building new roads. Where’s the logic?

“Also, the decision to cut the aid budget will fundamentally undermine the UK’s climate leadership. It will hinder poorer countries' ability to tackle and adapt to the climate emergency, and sour the UK's diplomatic relationships in the run-up to COP26.”

BLCP’s head of energy, environment and infrastructure Mark Richards:

“The announcement of the National Infrastructure Bank is interesting but currently there’s no shortage of capital in the market for well-structured and developed infrastructure projects. However, there is a huge need for early-stage capital for development projects and infrastructure deploying new and unproven technologies, it will be interesting to see if the new infrastructure bank will address this market need for early-stage development capital.”

“Changes to the Green Book are welcomed as is the desire to promote infrastructure projects making a real difference to local economies throughout England. I believe our private sector clients are keen to get involved and help deliver these projects through private capital investment, hopefully there is the opportunity for true public and private collaboration to aid both levelling up and net-zero targets.”

EDW’s energy partner Darren Walsh:

"Whether we accept that the Chancellor's Spending Review and the Prime Minister's ten-point plan for net-zero Carbon provides a £12 billion shot in the arm for our green revolution, or £4 billion as some commentators believe, what is clear from today's Spending Review is that Government is striving to achieve its Paris Agreement commitments by 2050 or sooner.

“The reality is that this will not be achievable without significant private sector investment and winning the hearts and minds of the UK population. The Spending Review supports the Prime Minister's ten Point Plan, which provides a framework for how this might be achieved, but there remains a significant amount of work to do to implement this plan so as to meaningfully achieve its ambitions."

WWF-UK’s head of climate change, Gareth Redmond-King:

“There are no new green recovery numbers in the Spending Review today, beyond the Prime Minister’s speech, by the looks of it.

“New Treasury green book guidance on checking policy against net-zero may be the first tentative step towards a net-zero test; some greater accountability across government for aligning commitments to UK climate targets. But it will need some teeth if it is to be able to bite on actual decisions.”

The RSPB:

“It was quite right that the Chancellor focus on people and jobs today, but we should be making a down-payment on our future health and wellbeing. No new money for nature is a missed opportunity to build a healthier, cleaner and better future for all.

“£92m for trees is not enough. We need to invest £615m per year for ten years to restore and expand woodland, peatland and other habitats to meet nature priorities and tackle the climate crisis.”

The IPPR’s lead for the Environmental Justice Commission Luke Murphy:

“The announcement of the National Infrastructure Bank is very welcome – it is essential that achieving net-zero and restoring nature are a core part of its remit.

“But cutting international aid in the year of COP26, when a core part of the remit as host is to increase support to vulnerable countries, is bad policy and a terrible signal to send.”

Enzen Group’s head of UK and Europe Sanjay Neogi:

“The new National Infrastructure Strategy and the proposed infrastructure bank are steps in the right direction, but it’s detail that matters. Large infrastructure projects require careful planning and orchestration to ensure funds are well spent, create value and delivered on time. It is also equally important we keep firmly on the path to net-zero and ensure sustainability is at the heart of every infrastructure project.”

PwC UK’s energy transition leader Janine Freeman:

“The need to decarbonise how we power and heat our homes, businesses and transport is indisputable, but how it will be paid for is a big question. We estimate that £400bn of investment into net-zero infrastructure will be required over the next decade alone or, to put it another way, over £1,000 per individual taxpayer, per year, for the next 10 years. Private capital will have a crucial role to play in financing this essential, green infrastructure.

“A new National Infrastructure Bank to channel public funds into net-zero capital projects may enable the government to ‘pump prime’ private investment in nascent, clean energy projects. But to attract the quantities of private capital required, the government will also need to provide a stable regulatory, financial and investment environment to attract investors who are looking around the world to allocate their capital to net-zero.

"These interventions, alongside continued acceleration of the decommissioning of legacy carbon assets, such as fossil fuel cars, through incentives like car scrappage schemes and clean air zones, will unleash the economic and job creation opportunities of a net-zero future for people across the UK.”

The Climate Coalition's campaigns manager Clara Goldsmith:

"The Chancellor had a major opportunity to boost and future-proof the UK economy whilst delivering a green recovery that sets us on a pathway to limit global temperature rise to 1.5C.

"While we welcome some announcements - such as the new public investment bank and ‘Levelling Up Plan’ - these must have climate action at their heart to grow the industries and sectors that will power the economy of tomorrow. The decision to cut overseas aid funding undermines this government’s own position as host of next year’s crucial UN climate talks, and will impact communities on the frontlinea of a climate crisis they did not cause."

The Nuclear Industry Association's chief executive Tom Greatrex:

“Meeting net-zero by 2050 is incompatible with the flawed analysis offered by the National Infrastructure Commission. It is right that today the UK government have rejected John Armitt’s group in clear and stark terms – nuclear alongside other low carbon technologies will be required to decarbonise, and it was never a sound position to suggest otherwise. The focus now must be on delivering the infrastructure required to meet net-zero – and avoiding wasting further time, effort and attention in seeking to pit low-carbon technologies against each other.”

E3G's clean economy program leader Pedro Guertler:

“The Chancellor has confirmed vital extra funding for greening buildings next year but missed the opportunity to set out multi-year funding which is so desperately needed to give the supply chain the confidence to invest. With £100bn invested in infrastructure in 2021, the £1.1bn for green buildings is only 1% of that total budget. This will not be enough to get on track to net-zero.”

Ashurst's energy partner Antony Skinner:

"Having a clear policy and regulatory framework is essential for potential investors in the different sectors that are a part of the Government's decarbonisation strategy, so having a clear commitment from Government about the areas it is seeking investment in, as well as a timetable for publication of the Energy White Paper, which is to be published in the next three months, with strategies for different sectors to follow in the next 12 months, is definitely a step in the right direction."

Edie Staff