Reuters | May 20, 2022 |

View of Dampierre nuclear power plant (Stock Image)

Uranium miners are racing to revive projects mothballed after the Fukushima disaster more than a decade ago, spurred by renewed demand for nuclear energy and a leap in yellowcake prices after Russia’s invasion of Ukraine.

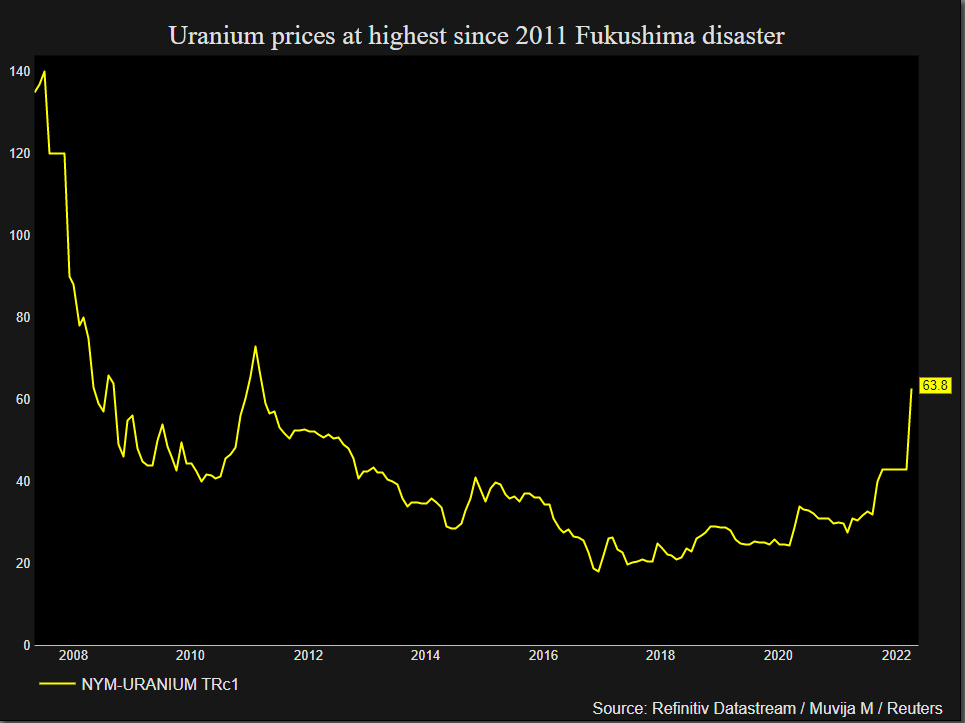

Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

“Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business,” Tim Gitzel, CEO of Canada’s Cameco, which mothballed four of its mines after Fukushima, said on a May 5 earnings call.

Uranium prices began to rise in mid-2021 as several countries seeking to limit climate change said they aimed to move back to nuclear power as a source of carbon-free energy.

A quest for secure energy supplies has added to the potential demand.

Unrest in January in Kazakhstan, which produces 45% of primary global uranium output, had already driven prices further when Moscow’s Feb. 24 invasion of Ukraine spurred a 50% rally.

Russia accounts for 35% of global supply of enriched uranium.

READ ALSO: Skyharbour buys into Rio Tinto’s Russell Lake uranium project

Prices have retreated since a peak in April, but John Ciampaglia, CEO of Sprott Asset Management, which runs the Sprott Physical Uranium Trust, told Reuters Moscow’s invasion had “shifted the energy markets dramatically”.

“Now the theme is about energy security, energy independence and trying to move away from Russian origin energy supply chains,” he said.

There are about 440 nuclear power plants around the world that require approximately 180 million pounds of uranium every year, according to the World Nuclear Association.

Uranium mines produce about 130 million pounds, a deficit that mining executives predict will widen even if idled capacity by major producers such as Cameco and Kazakhstan’s Kazatomprom comes back online.

The supply gap used to be filled by stockpiled material, much of which came from Russia.

Now, miners are dusting off feasibility studies for mothballed mines and reviving projects.

In Australia, uranium producers – including Paladin Energy Ltd which aims to restart its Langer Heinrich uranium mine in Namibia, idled over a decade ago – have raised close to A$400 million ($282.08 million) in share sales over the last six months to fund exploration and resuscitate mines on three continents.

“With all of the additional demand that’s coming from the new nuclear (plants), the thesis is that over a five or 10-year period, that additional demand will just dwarf those volumes coming back to market,” said Regal Funds Management analyst James Hood.

China plans to build 150 new reactors between 2020 and 2035 and Japan also aims to boost nuclear capacity as does South Korea.

In Europe, Britain has committed to build one new nuclear plant every year while France plans to build 14 new reactors and the European Union has proposed counting nuclear plants as a green investment.

Easier said than done?

Delivering the new reactors, however, will be a challenge as repeated delays and cost-overruns could be exacerbated by the supply chain problems following the pandemic and the additional disruption of the Ukraine war, making demand for uranium hard to predict.

Many environmental campaigners, especially in the West, also remain opposed to nuclear energy because of the waste it generates even though atomic power is emissions-free.

Advocates of nuclear energy say small modular reactors are a solution to the difficulty of bringing on new capacity.

Keith Bowes, managing director of Lotus Resources, which owns the idled Kayelekera uranium mine in Malawi, says modular reactors will be a major source of growth from 2028 onwards.

Others say the traditional obstacle of high cost is less of a problem given the sharpened focus on security of supply.

“No longer is price the determinant, it’s now security of supply,” Duncan Craib, managing director at Boss Resources told the Macquarie Australia conference on May 9.

Boss will make a final investment decision soon on developing the Honeymoon uranium mine in South Australia, aiming for first production 18 months after any go-ahead.

Sprott’s Ciampaglia said uranium could hit $100 per pound in the long run. Prices peaked around $140 per pound in 2007.

This year’s rally has taken them to levels last seen in 2011 in part as a result of Sprott’s activity in the market with its uranium funds growing from near zero last year to about $4 billion now.

Ciampaglia said Sprott’s buying is in response to investor demand: “The Trust provides investors with a vehicle to express their view on physical uranium.”

Smaller uranium developers also want to get involved, but will need prices of at least $60 a pound to ensure the economic viability of projects, industry watchers said.

Even then there would be risks. The restart of idled capacity from uranium giants could disproportionately hit smaller players while community opposition in some areas remains.

“No mine development or restart of an idled mine is easy or without challenges,” said Guy Keller, manager of Tribeca Investment Partners’ Nuclear Energy Opportunities Fund.

($1 = 1.4180 Australian dollars)

(By Praveen Menon and Sonali Paul; Editing by Barbara Lewis)

Cecilia Jamasmie | May 20, 2022 |

The Moore uranium property is Skyharbour’s flagship project. (Image courtesy of Skyharbour Resources.)

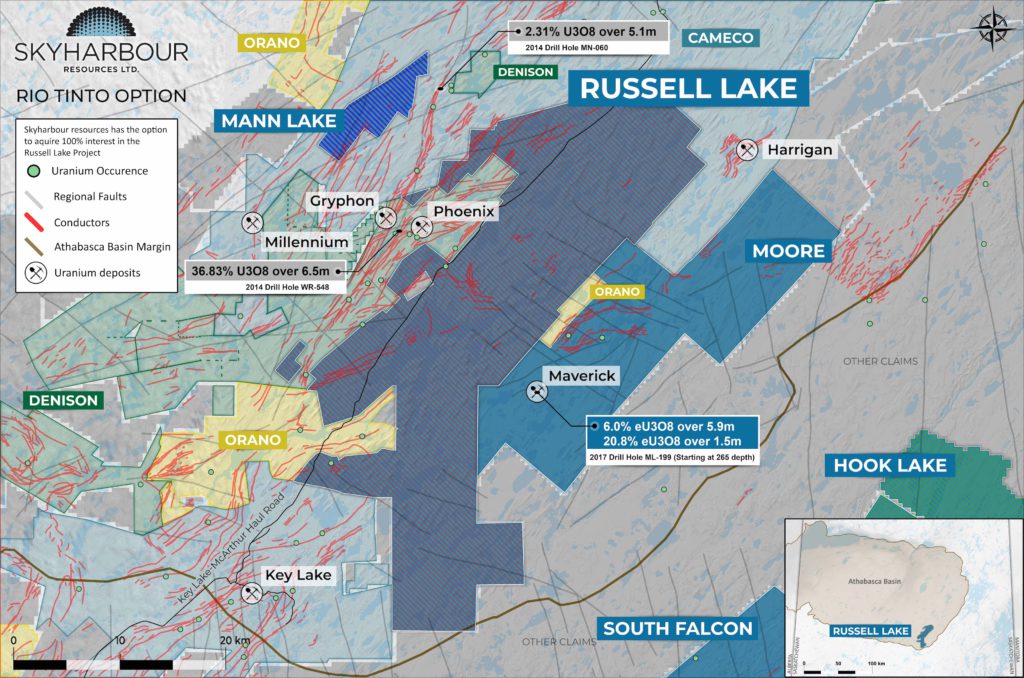

Canadian explorer Skyharbour Resources (TSX-V: SYH) has inked a cash and shares deal to acquire an initial 51% stake in Rio Tinto’s (ASX: RIO) Russell Lake uranium project, in the Canadian province of Saskatchewan.

The Vancouver-based miner has the option of becoming the sole owner of the property, which is in the uranium-rich Athabasca basin, between two of Orano Mining’s properties and near Cameco’s (TSX: CCO) (NYSE: CCJ) Key Lake and McArthur River assets.

Russell Lake is also next to Skyharbour’s flagship Moore project, which makes it especially attractive, the junior said.

“Uranium properties with the pedigree and prospectivity of Russell Lake are few and far between,” president and CEO Jordan Trimble said in the statement. “[It is in a] very strategic location, notable historical exploration and findings, as well as the numerous property-wide targets with the potential to generate new discoveries,” he said.

Under the terms of the agreement, Skyharbour can earn a 51% stake in Russell Lake via a cash payment of $500,000 and the issuance of 3.6 million shares, along with $5.7 million in exploration spend over three years.

An additional 19% may then be earned via a $1.6 million cash payment or the issuance of 2.2 million shares, and $6.4 million in exploration spend over two years.

Skyharbour can then earn the remaining 30% interest in the property by paying to Rio Tinto $33 million in cash or via 42.6 million shares of the company, provided Rio’s ownership doesn’t exceed 19.9% of Skyharbour.

While there has been historical exploration carried out at the Russell Lake, the junior noted that most of it happened before 2010.

“The property has been the subject of over 95,000 metres of drilling in over 230 drill holes. The property’s claims are in good standing for 2-22 years with assessment credits built-up from previous programmes,” the company said.

Market revival

After years of depressed prices and halted production, the uranium market is experiencing a revival on supply worries steaming from sanctions against Russia’s state-owned atomic energy company, Rosatom.

Earlier this month, Cameco and Orano increased their stakes in the Cigar Lake uranium mine in northern Saskatchewan by buying Idemitsu Canada Resources’ 7.9% interest in the asset for C$187 million (about $144m).

Spot prices have doubled from lows of $28 per pound last year to $64 in April, motivating the reactivation of projects that were set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

Cameco is also restarting its McArthur River mine and Key Lake mill this year, which have been on care and maintenance since mid-2018.

“Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business,” CEO Tim Gitzel said on a May 5 earnings call.

For years, Canada was the world’s largest uranium producer, accounting for about 22% of world output, but in 2009, was overtaken by Kazakhstan.

Credit: Energy Fuels Inc.

United States and Canadian-based uranium companies are set to soar on a coming Russian production ban in the Western world, GoldSilver.com’s senior precious metals analyst, Jeff Clark, told an industry audience at the VRIC conference in Vancouver on Tuesday.

“Uranium is already in a bull market,” Clark said. “Yes, those prices have come down just like the others have, but for fundamental key reasons such as supply-demand … growing globally for uranium and nuclear power,” he said.

He believes Russian uranium, which still accounts for about 50% of U.S. consumption, will soon be banned in retaliation for Russia’s invasion of Ukraine. “They’ve done it for oil and gas, but they haven’t done it for uranium. But that is coming. That is a done deal. It’s going to happen,” he said.

According to Clark, in the US, there’s widespread political support for a ban from every party except for a minority. “It will lift and make the U.S. and Canadian uranium companies very, very attractive,” the analyst pointed out.

“They’re still reliant on Russian uranium, yet the ban is coming. It will make U.S. and Canadian companies all that more attractive,” he said.

Clark said likely to benefit from the move are Uranium Energy Corp (NYSE American: UEC) and enCore Energy (TSXV: E.U.; USOTCQB: ENCUF). He holds large positions in both companies, which are in pre-production.

“Not only are they going to be more favoured because of bandwidth, whenever it comes, but they’re also going to be in production next year,” said Clark.

Clark also highlighted Boss Energy (ASX: BOE) in Australia and Fission Uranium Corp. (TSX: FCU) in British Columbia, both projected to go into production in the next year.

.jpg?ext=.jpg) How the VTR could look (Image: INL)

How the VTR could look (Image: INL).jpg?ext=.jpg) PSFC's vision of SPARC (Image: PSFC)

PSFC's vision of SPARC (Image: PSFC).jpg?ext=.jpg) A rendering of a spacecraft powered by Ultra Safe Nuclear's EmberCore (Image: USNC)

A rendering of a spacecraft powered by Ultra Safe Nuclear's EmberCore (Image: USNC).jpg?ext=.jpg) Westinghouse's vision for eVinci (Image: Westinghouse)

Westinghouse's vision for eVinci (Image: Westinghouse).jpg?ext=.jpg) The Hinkley Point C construction site, pictured in November 2021 (Image: EDF Energy)

The Hinkley Point C construction site, pictured in November 2021 (Image: EDF Energy).jpg?ext=.jpg) The existing Trawsfynydd plant site (Image: Magnox Ltd)

The existing Trawsfynydd plant site (Image: Magnox Ltd)