IMO Moves Forward (Slowly) With Framework for Net-Zero Fuels and Fees

The eighty-first session of the Maritime Environment Protection Committee (MEPC) of the International Maritime Organization concluded on Friday after a week of meetings in London with what at best was being called a “step forward” or “progress toward the goals” for reducing shipping’s carbon emissions. While the meeting was not for the adoption of the regulations, many are still saying the progress is slow and highlights that much still needs to be done between now and the next MEPC meeting in the fall which calls for steps adopting the initiatives outlined in 2023.

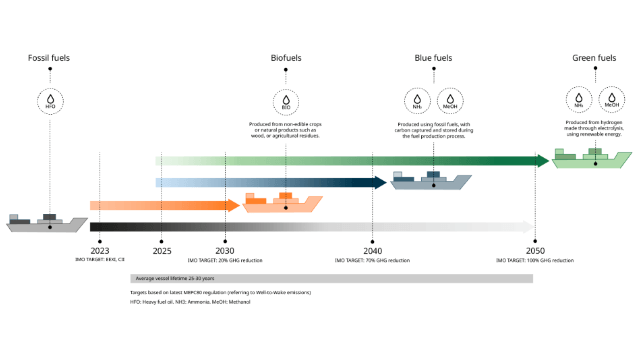

Member States met this week to debate and raise concerns about the key elements of the MEPC strategy adopted in July 2023. The IMO hailed last year’s efforts highlighting broad agreement for the climate roadmap that calls for reaching net-zero emissions "by or around, i.e. close to, 2050." The specific targets in the agreement include a 20 percent cut in emissions by 2030 and a much deeper 70 percent cut by 2040 (relative to 2008 levels).

In the nine months since then, the IMO has been working on a framework for the key elements while consensus emerged that the 2030 target was achievable. Many in the industry point to technical improvements that can be made to ships, better use of weather and route planning, slow steaming, and emerging fuels to get to the first hurdle, but the view is that the later goals are aspirational without clear steps and require additional support.

IMO General-Secretary Arsenio Dominguez, who himself had served as the director of the Marine Environment Division before his election last year, hailed the MEPC efforts saying “This week you made very important progress.” The IMO in its communications called the actions “agreement of a possible draft outline” and steps in the legal process towards adopting global regulations. They however noted that the framework could still be amended.

The key issues included a goal-based fuel standard regulating the phased carbon emission reductions and an economic mechanism to support the transition. They said this week’s meeting provided a starting point for consolidating several different proposals that are still being considered.

Five days of meeting concluded with a broad framework and a long list of tasks ahead (IMO)

At the conclusion of the sessions, the International Chamber of Shipping, which has been a strong advocate for the fees and a fund, said it welcomed the progress this week during “intensive negotiations.” The international trade association said, “We have gained a better understanding of the concerns of those governments who still have questions.”

The meeting concluded with a very early draft of the new chapter for the MARPOL regulations with most feeling there was a growing consensus on the broad parameters while much debate remains in the details. There was support for the concept of a pricing mechanism while some countries continue to argue against a flat price mechanism. The agreements left open elements on the final shape, timing, and scope of the regulations as well as the enforcement tools.

They agreed to launch a comprehensive impact assessment and formed groups tasked to develop a work plan on the development of a regulatory framework for the use of onboard carbon capture systems and to investigate Tank-to Wake methane and nitrous oxide emissions.

Some are coming away with a more positive view of the results and progress of the session. Consultancy UMAS issued a statement from Dr, Tristan Smith, Director of UMAS and Associate Professor at UCL Energy Institute, saying, “This meeting’s development of a new MARPOL chapter, and good progress and momentum towards a timely and robust implementation of robust IMO policy, including an effective GHG levy, seriously questions the wisdom of commercial strategy of ‘wait and see’, or that is dependent on IMO not delivering what it committed to in 2023.”

The meeting did have some specific achievements including approving new Emissions Control Areas in the Canadian Arctic and Norwegian Sea areas. They also approved new recommendations for the transport of plastic pellets after disastrous pollution events such as the loss of the X-Press Pearl off Sri Lanka. The meeting also endorsed a plan to develop guidelines for hydrogen and ammonia as fuels, reducing underwater noise and ballast water management.

MEPC gave itself a long list of tasks to complete in the next few months. The next session is scheduled to convene from September 30 to October 4 where the hope is to finalize details and move to adoption of the emission and pricing regulations.

Sustainable Shipping Fuels to Reach Cost Parity with Fossil Fuels by 2035

[By: Wärtsilä]

Sustainable shipping fuels could reach cost parity with fossil fuels as early as 2035 with the help of decisive emissions policy such as carbon taxes and emissions limits, according to a new report launched today by technology group Wärtsilä.

The report, titled ‘Sustainable fuels for shipping by 2050 – the 3 key elements of success’, reveals that the EU Emissions Trading Scheme (ETS) and FuelEU Maritime Initiative (FEUM) will see the cost of using fossil fuels more than double by 2030. By 2035, they will close the price gap between fossil fuels and sustainable fuels for the very first time.

Transporting 80% of world trade, shipping is the engine room of the global economy. However, despite being the most efficient and environmental way to transport goods, it emits 2% of global emissions, equivalent to the annual emissions of Japan. Without action, this could increase by more than 45% by 2050.

In 2023, the International Maritime Organization (IMO) set a target of achieving net zero emissions by 2050. Existing decarbonisation solutions, such as fuel efficiency measures, could cut up to 27% of emissions. Wärtsilä's report argues that sustainable fuels will be a critical step in eliminating the remaining 73% but radical action is needed to scale them. The industry suffers from a “chicken and egg” challenge – ship owners won’t commit to a fuel today that is expensive, only produced in small quantities, and may be usurped by another fuel that scales faster and more affordably. Meanwhile, it is difficult for suppliers to scale production without clear demand signals.

Wärtsilä has produced new modelling that shows a timeline of which fuels are likely to become widely available on a global scale, when and at what cost. To accelerate this timeline, the report argues that decisive policy implementation, industry collaboration, and individual operator action must coalesce to scale the production of these fuels.

Roger Holm, President of Wärtsilä Marine & Executive Vice President at Wärtsilä Corporation says: "Achieving net zero in shipping by 2050 will require all the tools in the toolbox, including sustainable fuels. As an industry, we must focus on coordinating action across policymakers, industry and individual operators to bring about the broad system change required to quickly and affordably produce a mix of sustainable fuels. Policy in Europe is showing just how impactful action at the international level can be, closing the cost gap between fossil- and low-carbon fuels for the first time.”

Decisive Policy: Wärtsilä’s modelling shows sustainable fuels will be 3-5 times more expensive than today’s fossil fuels in 2030. As ETS and FEUM show, policy is key to closing the price gap. The report argues that policymakers should:

- Maximise certainty: Set an internationally agreed science-based pathway for phasing out fossil fuels from the marine sector, in line with IMO targets.

- Boost cost competitiveness: Adopt a global industry standard for marine fuel carbon pricing.

- Collaborate: Increase global collaboration between governments on the innovation and infrastructure necessary to deliver sustainable fuels at scale worldwide.

Industry collaboration: The sector must collaborate with stakeholders from inside and outside shipping. The report calls on industry to:

- Pool buying power: Initiate sector-wide procurement agreements to pool demand from multiple shipping operators.

- Collaborate with other sectors: Convene with leaders in aviation, heavy transport, and industry to establish a globally recognised framework for the production and allocation of sustainable fuels.

- Share skills: Establish an industry-wide knowledge hub for the purpose of sharing expertise, skills and insights.

Individual actions: Every euro an operator saves in fuel costs at today's prices, could be worth 3-5 times that by 2030. That means companies such as Carnival Corporation, which made a 5-10% efficiency gain through its Service Power Upgrade Program, could cut its fleetwide fuel costs by as much as $750 million per year in 2030. All operators can benefit from improving the efficiency of their vessels – the technology is readily available today.

Holm adds: “If there is one take away from our report, it is that smaller operators need not feel powerless. They have a major role in accelerating towards net-zero emissions shipping. Taking steps to improve fuel efficiency and invest in fuel flexibility can deliver immediate returns, reducing both emissions and operating costs. But action must be swift – we have the lifecycle of just a single vessel to get this right.”

Investing in fuel flexibility is the most financially viable way to avoid the risk of stranded assets. Wärtsilä has been developing multiple fuel options. Most recently, Wärtsilä launched the first commercially available 4-stroke engine for ammonia fuel, which can immediately reduce emissions by over 70%, compared to diesel.

The report provides a roadmap for the future of sustainable fuels, identifying how the industry can more rapidly and affordably scale these fuels and achieve full decarbonisation by mid-century – within the lifetime of just a single vessel. You can access and download the report here.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Rem Orders First Methanol-Fueled Offshore Construction Vessel

The applications for methanol-fueled vessels meeting the future requirements for zero emissions continue to grow with offshore construction and services company Rem Offshore joining the expanding list of shipowners ordering dual-fuel methanol vessels. They are highlighting the vessel they are calling an Energy Subsea Construction Vessel as the first of the next generation due to the versatility of its design.

REM is returning to Norway’s Myklebust Verft for the construction of the vessel which is due to be delivered in 2026. The shipyard has delivered newbuilds to Rem in the past. Rem Offshore, which was incorporated in 2017 in Norway, currently has a fleet consisting of 19 vessels in operation and one vessel under construction. Rem also has an option to build one more ship at Myklebust.

The new vessel, which was designed by Skipsteknisk, is said to be the first of its kind because, in addition to the dual-fuel methanol engines, it is designed to perform heavy construction work in both offshore wind and subsea with net zero emissions.

“This is a big milestone for Rem Offshore. We are ordering our first net zero-emission vessel and taking a big step into the future. We are looking forward to being able to offer the vessel to the market, and believe that our customers will appreciate the opportunity for more efficient and sustainable operations,” said Lars Conradi Andersen, CEO of Rem Offshore.

The newbuilding is also designed to employ several solutions where energy consumption is almost halved compared to comparable tonnage in today's market, as well as meeting future requirements for zero emissions from end to end. In combination with the dual-fuel methanol engines, the ship will also have battery packs. All offshore lifting equipment, including a 250-tonne crane, will be electric and regenerates power to the batteries. The working deck will be over 1,400 m2, and it is also prepared for the installation of an offshore gangway for use in offshore wind.

The orderbook for methanol dual-fuel and methanol-ready vessels now stands at 236 ships due for delivery over the next five years according to data from DNV’s Alternative Fuels Insights database. While the majority of the orders are for containerships, as well as chemical tankers, bulkers, and car carriers, the offshore sector is also beginning to adopt methanol. The first orders have been placed for service vessels for the offshore sector and last year Boskalis even placed an order for a methanol-ready mega-sized hopper dredge.

No comments:

Post a Comment