Coscso Seeks 20% of Hutchison Deal as US Calls for Ouster from Panama

The political “tug-of-war” surrounding controls of the port terminals at the Panama Canal and CK Hutchison’s larger portfolio of 41 port operations worldwide continues with China exerting pressure and the U.S. reiterating its position to end the Panama concession. CK Hutchison confirmed last month that talks were ongoing and that a Chinese company would be invited into the discussions after the lockup period on the original deals expired in late July.

China’s Cosco, which is already a large port operator, is seeing at least a 20 to 30 percent share of the deal, according to a new report in today’s Financial Times. The paper cites two unnamed sources that said China has only permitted Cosco to enter the talks to maintain its leverage over the deal. China has made it clear that its position is that a Chinese company must be part of the deal to protect Chinese trade interests.

The Financial Times says several options are being discussed, including the possibility that Cosco would participate in the one deal that acquires Hutchison’s 41 global ports outside China and excluding the two terminals in Panama. The original agreement set parallel deals, one for the 41 ports, which is believed to be led by MSC’s Terminal Investments (TiL), while the second deal, led by BlackRock and with MSC as a minority investor, would acquire the Panama Ports Company, which operates the terminals in Balboa and Cristobal under long-term concessions.

Donald Trump had hailed the deal in March, saying it was returning the Panama Canal to the United States. A friend of the CEO of BlackRock, Larry Fink, Trump said the American company was acquiring many ports. Since then, the U.S. has remained largely quiet on its views of the deal.

U.S. Ambassador to Panama Kevin Marino Cabrera, on Wednesday, August 6, however, spoke out against CK Hutchison. He supported the legal actions taken by Panama’s Comptroller General to void the concession. He said that the U.S. was “excited” that Hutchison would soon be no longer operating the ports in Panama.

“Our position is that they are a bad operator; they haven't done a good job,” Cabrera told reporters during an event in Colon. “They are a company of the Chinese Communist Party… We are excited that those ports will soon be out of operation, and that good operators willing to contribute to the Panamanian people will come to the country.”

The Panama Ports Company dates to 1997 and was set up with CK Hutchison holding 90 percent, with Panama owning 10 percent. The company’s concession was renewed for an additional 25 years in 2021 in what is now a contested process.

Cabrera asserted that the Panama Ports Company (PPC) has not honored its agreements and owes Panama money. He also linked the company to the Communist government, although Hutchison is based in Hong Kong. Founder, Li Ka-shing, a Hong Kong billionaire, has frequently been at odds with the Chinese government, and this year it accused him of being disloyal and not acting in the interest of the state after the deals were announced to sell the port terminals.

Hutchison has defended its operations in Panama, saying the company has followed all the legal requirements. It asserts that it has contributed to the Panama economy. The company said in a statement in April that PPC has made significant investments that exceed $1,695 million, surpassing not only the $50 million investment required under the original concession contract, but also the $1,000 million agreed under the addendum, as confirmed by the Comptroller General of Panama.

The shipping industry continues to watch the developments as well. CMA CGM confirmed that it would be interested in some of the assets, and Maersk said it is also watching the deal closely. The Financial Times says none of the shipping companies have been invited into the negotiations, and it notes any bidder would need to involve the Chinese to win approval for an acquisition.

Panama to Require Full Traceability for Offshore Oil Transfers

[By: Panama Maritime Authority]

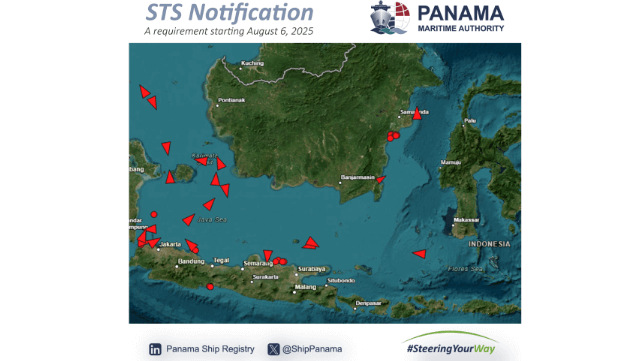

The Panama Ship Registry has become the first naval registry in the world to implement stricter controls and mandatory traceability for offshore ship-to-ship (STS) transfers of hydrocarbons. This new measure, which came into effect on August 6, 2025, is outlined in Resolution No. 106-035-DGMM issued by the Directorate General of Merchant Marine. According to Article 9 of the resolution, non-compliance—depending on its severity—may lead to the cancellation of a vessel’s Panamanian registration.

The regulation requires all Panamanian-flagged oil tankers with a gross tonnage of 150 or more to notify the Panama Maritime Authority (PMA) at least 48 hours in advance, providing full technical and logistical details of each STS operation.

The mandatory information includes:

- Name, flag, call sign, IMO number, and estimated time of arrival (ETA) of all vessels involved

- Date, time, and geographical coordinates of the operation’s start

- Type of maneuver: at anchor or underway

- Type and quantity of hydrocarbons to be transferred

- Estimated duration of the operation

- Contact information for each vessel’s Designated Person Ashore (DPA)

- Confirmation of an STS plan in accordance with Regulation 41 of the MARPOL Convention

If the estimated arrival time at the transshipment point varies by more than six hours, the vessel’s captain, owner, or DPA must update the notification to the PMA.

This measure responds to the increasing use of vessels in illicit activities such as covert crude transport, sanctions evasion, and operations lacking environmental controls—practices often associated with the so-called “shadow fleet.”

It aligns with International Maritime Organization (IMO) regulations and underscores Panama’s commitment as a responsible flag State, promoting maritime safety, operational integrity, and protection of the marine environment.

With this move, Panama reaffirms its global leadership in maritime regulation—enhancing trust in its registry, ensuring compliance with international standards, and contributing to the fight against the misuse of flags of convenience.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Panama is First Registry to Enforce Rules to Crack Down on STS Actions

The Panama Ship Registry started its new rules as of August 6, requiring reporting of planned ship-to-ship (STS) offshore oil transfers as the latest step in a series of crackdowns targeting the shadow tanker fleet. Panama had announced plans for the new rules in May, and highlights that with the rule now in effect, it has become the first registry in the world to implement stricter controls and mandatory traceability for offshore ship-to-ship (STS) transfers of hydrocarbons.

“This measure responds to the increasing use of vessels in illicit activities such as covert crude sanctions evasion, and operations lacking controls, practices often associated with the so-called “shadow fleet,” the Panama Ship Registry says in its announcement. It warns that “non-compliance—depending on its severity—may lead to the cancellation of a vessel’s Panamanian registration.”

The regulation requires all Panamanian-flagged oil tankers with a gross tonnage of 150 or more to notify the Panama Maritime Authority (PMA) at least 48 hours in advance, providing full technical and logistical details of each STS operation. In addition to the details on the vessels involved, they must supply the location, the type of transfer, and the quantity to be transferred. If the operation varies by more than six hours, the captain or shipping company must update the details reported to the PMA.

The shipping companies are also required to supply contact details for a designated person ashore. They must also confirm that the STS plans are in accordance with the IMO’s MARPOL Convention.

Putting the STS rule into effect follows another move by the registry this week, also targeting the shadow tanker fleet. It said it will no longer accept the registration of tankers (and bulkers) that are more than 15 years old. It said an analysis of data showed the older vessels accounted for most of the detentions.

Panama, under pressure from the U.S. and others, has moved to purge its registry and enacted new rules to make it faster and less complicated to remove ships that are sanctioned or have other violations. Demonstrating this, Panama reported this week it had removed 17 tankers sanctioned days earlier by the United States in a crackdown on an Iranian shipping network.

Panama is the latest in a growing number of jurisdictions seeking to tighten enforcement against the shadow tanker fleet. Greece, last year, closed a bay favored by tankers in the Russian oil trade. Last week, Malaysia, which is already known for its enforcement against illegal anchoring, announced new rules on another key area favored by shadow tankers to make transfers. Malaysia created new anchoring regulations and closed the area to most tankers. In Europe, efforts have focused on the enforcement of the requirements for insurance and proper certification.

Despite this, the shadow tanker fleet continues to grow. The latest estimates put it at over 1,100 vessels, although the EU and UK sanctions have driven some tankers from the trade.

The efforts to reduce STS will impact tankers both in the Russian oil trade and those supporting Iran. Both are known to use STS and other efforts to hide the origins of the oil or to mix it with other sourced oil to make the blend less identifiable.

No comments:

Post a Comment