Freeport mine setback risks fraying relations with Indonesia

A halt in production at the giant Grasberg copper mine in Indonesia looks set to strain the fractious relationship between miner Freeport-McMoRan Inc. and its host nation, at a time when the Jakarta government was already looking to take greater control.

Freeport declared force majeure on contracted supplies on Wednesday, two weeks after about 800,000 tons of mud flooded underground tunnels. Two workers were killed, while five more remain missing. The US-listed company slashed its production guidance, dragging its shares down 17% and pushing copper futures to the highest level in more than a year.

Grasberg has long been a flashpoint as Jakarta tries to gain a greater say over its resources. The state controls 51% of the local entity — after a lengthy battle over ownership — but officials have sporadically continued to demand an increased share. That clamor may now intensify.

The accident also comes at a challenging time for President Prabowo Subianto, who took office last year and has faced violent street protests, as well as a struggle to fund his costly plans for Southeast Asia’s largest economy. With copper and gold near record highs, Grasberg is a critical source of revenue for the authorities — last year, Freeport’s local unit paid out $462 million to the government and region.

“If output does indeed diminish markedly for numerous months, there will definitely be tensions with the government, which will want revenue to resume and will wish to avoid the discontent arising from a prolonged downturn,” said Kevin O’Rourke, principal at Jakarta-based consultancy Reformasi Information Services. “With Freeport McMoRan in a minority position since 2018, the US company has much weaker negotiating power with the government.”

Prabowo’s government has vowed to curb excesses in the mining sector, and both foreign and local operators have had to contend with higher royalty payments and crackdowns on permit infractions. A forestry task force earlier this month seized a small part of the country’s largest nickel mine, owned by Tsingshan Holding Group Co. and France’s Eramet SA.

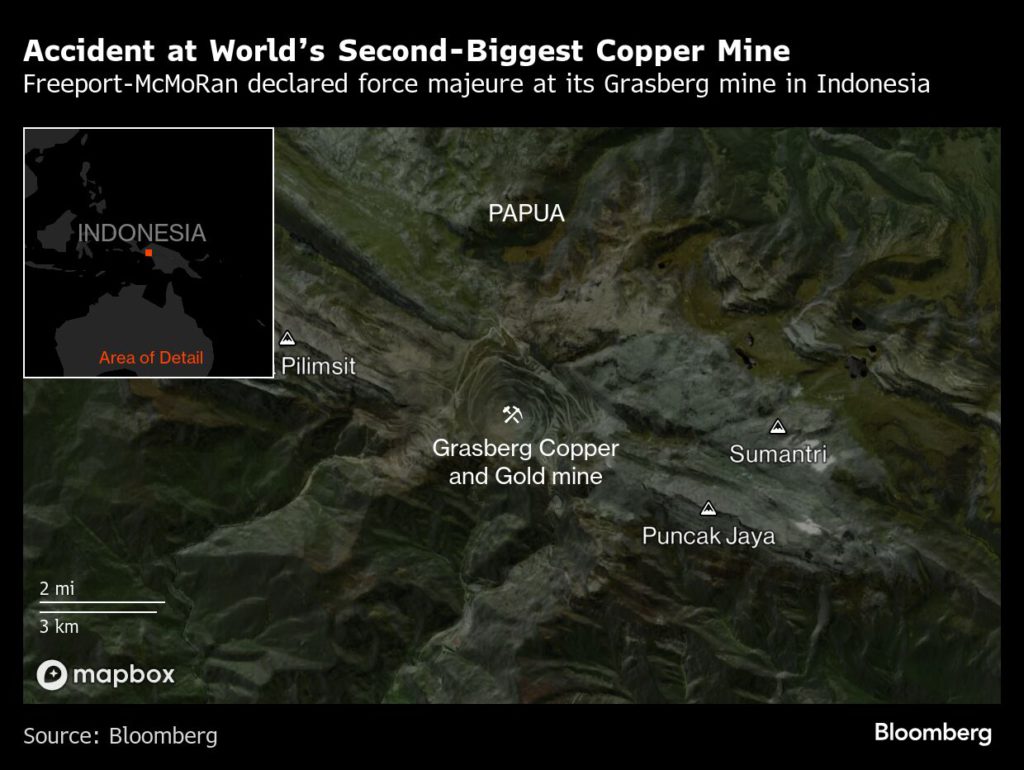

Sitting more than 4,000 meters above sea level in the mountains of Central Papua, Grasberg contains one of the world’s largest deposits of copper and gold. Despite the remote location, the high purity of its ore makes it an alluring and profitable asset.

Those riches, at a time when copper has only become more scarce, account for the US miner’s efforts to maintain its stake, despite government interference and investor pressure over its environmental impact and safety record. Dozens of workers have died at the site this century alone, most notably in 2013, when a tunnel collapse killed 28, drawing reprimands from local politicians and unions.

Grasberg has also been a lightning rod for a separatist sentiment in Papua, due to low perceived return of profits to the region, as well as its environmental damage. Indonesian security forces and rebels have sporadically clashed near the mine, resulting in many deaths.

PT Freeport Indonesia, the miner’s local unit, and Indonesia’s Ministry of Energy and Mineral Resources did not respond to requests for comment. State-owned mining company MIND ID, which holds the majority stake in Freeport Indonesia, also did not immediately respond to text-message queries. Sovereign wealth fund Danantara declined to comment.

Greatest trouble

It’s with the central government in Jakarta that Freeport has faced its greatest troubles. Under former President Joko Widodo, Indonesia began to prioritize retaining a greater share of its natural resources by forcing overseas miners to invest in value-added processing, and by taking greater control of key assets. Among the targets was Grasberg.

Executives and officials clashed for years over everything from tax rates to the way Freeport disposed of tailings, or waste from the mine. Production was halted for weeks in 2017 after the government banned concentrate exports, while the US miner threatened to take Indonesia to arbitration over new mining laws it said had violated its contract.

Eventually in 2018, following high-stakes negotiations, a deal was reached under which the government would take majority ownership of the mine, while Freeport’s partner in Grasberg, Rio Tinto Plc, would exit. Freeport also agreed to build a copper smelter in Indonesia, which became emblematic of Jokowi’s initiative to push into mineral processing.

Still, the project faced long delays to its completion, drawing pressure from the government and leading to repeated negotiations over pauses to a final ban on concentrate exports. Even after being finished last year, the facility now looks like a white elephant amid a vast expansion of capacity globally that’s destroyed margins in smelting.

A fire at the site last year further delayed its long awaited ramp-up, forcing the company back into talks over the export ban. After months of delays, Indonesia in March granted a further six-month reprieve that expired last week.

Freeport’s current contract to operate the mine lasts until 2041, but after the latest accident officials have made clear they want a greater stake in return for a 20-year extension. Last week, Rosan Roeslani, chief executive officer of Danantara, said Indonesia now expects more than the initially touted 10% additional holding that would be transferred to the country “free of charge.”

Any further deal may also be complicated both by the accident and by US President Donald Trump’s increasingly defensive attitude toward American companies abroad. Trump has been willing to invoke tariffs to counter taxes that he says unfairly target American firms, and highlighted access to Indonesian copper as a key factor in recent trade negotiations.

(By Veena Ali-Khan and Eddie Spence)

No comments:

Post a Comment