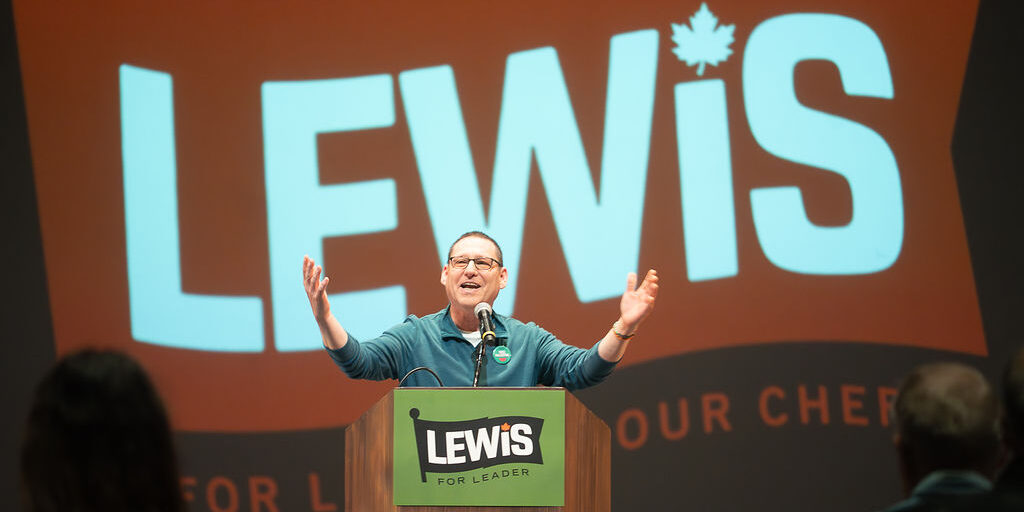

Avi Lewis answers rabble’s NDP leadership questionnaire

February 23, 2026

rabble is asking each of the candidates for the NDP leadership seven questions on party strategy, Indigenous issues, dealing with Donald Trump and more. Here are the answers from Avi Lewis.

Please tell our readers three policies you would champion as NDP leader.

As NDP leader, I would champion the creation of public options in every sector of our economy where the market is failing. While one-in-four Canadians live in food-insecure households and food bank usage skyrockets, Galen Weston, the owner of Loblaws, is worth $18 billion. This is classic market failure, and shows who benefits and who suffers in our current economy, where every sector is dominated by a handful of colluding corporations. It’s why our campaign is proposing a public option for cell phones, internet, postal banking, and groceries. Think Costco run as a public service – a public network of 50 grocery stores across the country would offer 30 to 45 per cent cheaper food prices and cost $300 million a year to run. That’s just one half of one percent of the defence budget.

Second, we are running on a Green New Deal to create over a million good-paying union jobs in every corner of this country by investing two per cent of Canada’s GDP in tackling the climate emergency, creating decades of employment for trades workers, care workers, transportation workers, youth, scientists, fossil fuel workers, and more. This work will be supported by a new generation of green public corporations like neighbourhood utilities, heat pump manufacturers and installers, the care economy (care work is low carbon!) electric bus factories and more.

Thirdly, a national rent cap that will give power back to renters and put an end to steep rent hikes. The cap will mean that rent cannot be raised by more than the rate of inflation in each province or territory including for vacant units, so landlords cannot jack up rents between tenants. The federal government can do this by implementing backstop legislation that strengthens provincial and territorial rent controls.

Which Carney government legislative initiatives would you change, if you could, and in what way?

First of all, I would repeal the major projects provisions in Bill C-5. It allows the federal government to approve projects, including fossil fuel infrastructure, while bypassing consultations and environmental assessments. It’s the type of bill that would make Stephen Harper blush, ignoring Indigenous rights and flagrantly disregarding the fact that we’re in a climate emergency. We need powerlines, not pipelines – especially not if they’re rushed through over the objections of communities who are trying to protect our air, water and land.

Additionally, Bill C-12 is an assault on the fundamental rights of migrants, refugees, and all Canadian citizens. Rather than keeping us safe, this bill creates a deportation machine that drags us ever closer to the horrors happening in the US. This law opens the door to a new wave of human rights abuses, and tears at the social fabric of communities. We should scrap this law and follow the lead of Spain, who are giving legal status to half a million migrant workers.

Finally, I’m deeply concerned by provisions in Bill C-9 that restrict our constitutional right to peacefully protest. Bill C-9 is an attack on our civil liberties and charter rights. It is designed to limit freedom of expression and the ability of people to organize and speak out for justice, including and especially those organizing for justice in Palestine. I support the cross-country, multi-faith coalition of organizations – including many civil society groups and the Canadian Labour Congress, who are calling on the federal government to withdraw this dangerous legislation.

How would you combat separatism in Quebec and Alberta?

The stoking of Alberta separatism by Danielle Smith, who has cleared the way for a referendum to be held is a dangerous development. This is a cause that appears to be fuelled by American foreign interference, with Trump administration officials meeting with leading separatists. We must strongly reject these efforts, and do everything we can to help Naheed Nenshi win the next provincial election. In my meeting with Mr. Nenshi, I emphasized how I will do everything I can to make this happen, and thanked him for his and the Alberta NDP’s steady work opposing the most right-wing government in this country.

In addition to being dangerous, it’s also a distraction from Danielle Smith’s agenda of cuts and privatization. The UCP government recently passed Bill 11, a blueprint for American style two-tier health care in Alberta. It is an open invitation to US health insurance companies to come in and cannibalize our precious public health care system. We must not let this happen. That’s why the federal government needs to start strongly enforcing the Canada Health Act, to stop this sell off of medicare dead in its tracks.

Regarding Quebec separatism, the key to addressing it for the NDP is by demonstrating that we are a viable option for Quebec’s progressive majority. This includes having a leader who can not only communicate with people in Quebec in French, but also a leader who understands Quebec’s unique culture and politics. It means upholding the Sherbrooke Declaration and connecting with Quebeckers on the basis of shared social democratic values and ideas. I’m proud to have the support of Charles Taylor, who kept the flame alive for the NDP in Quebec decades before the Orange Wave. The task of reconnecting with Quebec would be fundamental if I have the honour of serving as leader.

What would your conditions be for supporting a Liberal minority government?

If the NDP holds a clear balance of power under my leadership I would like to go in with just one demand: proportional representation. Not a commitment to studying it further, doing it later, holding a referendum or some other way for the Liberals to wriggle out of the commitment – but its full implementation after a citizens’ assembly to decide the exact type of electoral system. It is the reform that unleashes all of the other reforms, and it will end once and for all the phenomenon of “strategic voting” where people feel pressure to vote against something, rather than voting for whichever party or candidate truly aligns with their values.

It is also vital to preventing false majorities where a party that wins 36 per cent of the vote wields almost absolute power. What happens if Poilievre wins the next election in such a scenario? All of the progress made by the NDP in the last parliament, from dental care to the first steps on pharmacare, will be put at risk. This is why electoral reform is so important. Rather than a menu of demands, the NDP should have one clear condition next time and it should be proportional representation.

If you were in charge of Canada-U.S. relations, what would your strategy be for dealing with the Trump administration?

We need an independent foreign policy that pursues alliances with a host of like-minded countries. There is strength in numbers, and we should prioritize deepening ties with progressive governments including Mexico, Brazil, Colombia and Spain, to stand up to Trump collectively. All of these countries have not hesitated to chart their own course on the world stage, including by condemning the genocide in Palestine and standing up against the bullying of smaller nations in the Western Hemisphere by the Trump administration. The Carney government has been silent on these matters, and the NDP must be a principled voice for human rights and justice without exceptions. In addition, we should not be pursuing deeper military integration with the United States, like the “Golden Dome” missile defence system, which Prime Minister Carney continues to entertain.

As well as an independent foreign policy, we must also build an independent and resilient domestic economy that can withstand the shocks of Trump’s tariffs. Our economy has become far too intertwined and reliant on our neighbour to the south. That’s why we’re running on a plan to expand public ownership, creating new Canadian crown corporations to deliver affordable services from groceries to telecoms to postal banking. And finally, we need to push back against the tariffs with a tax on oil and gas exports to the US, which will also help fund the creation of sustainable jobs and finance the transition to clean energy that we desperately need.

Our campaign is putting forward a comprehensive tax plan for the 99 per cent to tackle inequality and raise the money that we need to properly fund our public services. Inequality in this country has reached unfathomable levels. The top one per cent own almost a quarter of Canada’s net wealth. Meanwhile, the six biggest banks raked in $70 billion in profits last year. Fountains of wealth are being generated, but it’s not trickling down to working people, it’s stuck at the top. We need a government with the courage and political will to finally go after it.

That’s exactly what our plan proposes. The centrepiece of it is a wealth tax of one per cent on the top one per cent, rising to three per cent on the largest fortunes. Such a tax would impact only a small number of people, but it could generate $40 billion a year in new revenue. In addition, we’re calling for capital gains income to be treated the same as employment income, a tax on inheritance of wealth over $5 million, a new income tax bracket for the richest Canadians, a tax on excess corporate profits, and giving the CRA the resources it needs to go after tax cheats.

On the income support side, we would lift people out of poverty with a major increase to income support for disabilities (raising the Canada Disability Benefit to $2150 per month), seniors, families with children and low income adults. We would also create a national framework for a guaranteed liveable basic income, as proposed by Leah Gazan in Bill C-223, to establish a social floor below which no one can fall.

What measures are necessary to empower Indigenous communities in Canada and assure their prosperity?

Empowering and supporting Indigenous communities is threaded throughout our campaign platform on many levels – from our vision of an electric bus revolution that re-connects communities and addresses safety on every Highway of Tears in this land to investing in the care economy, including culturally-appropriate childcare and elder care, to ensuring that impacted Indigenous communities benefit from the wealth generated by mining on traditional territories.

When it comes to development on Indigenous lands, the UN Declaration on the Rights of Indigenous Peoples principle of Free, Prior, and Informed Consent must be fully respected and honoured. This requires true, meaningful consultation in partnership and collaboration with First Nations, Métis, and Inuit governments, including with traditional governance systems and structures. Meaningful consultation includes ensuring that all community voices who wish to participate are included in the formal process for projects, but additionally that communities are able to have continued dialogue with the federal government should new issues arise during project development and operations.

Another absolutely crucial element is adopting a “For Indigenous, By Indigenous” Housing Strategy. The housing crisis affecting First Nations, Inuit and Métis communities is a national emergency. Nearly one in six Indigenous people live in homes needing major repairs that are considered unsuitable for the number of people living there. This is a denial of fundamental human rights, and it has dire consequences for people’s health and wellbeing. The strategy would close the housing gap between Indigenous and non-Indigenous communities, through massive investments in urban, rural and Northern Indigenous housing projects, working alongside Indigenous leadership.

Finally, I would like to acknowledge Tanille Johnston’s plan for Indigenous reconciliation and empowerment, it’s an outstanding document that I fully support.