Andrew shared confidential information with Epstein as trade envoy, files suggest

Andy VerityBBC

Andrew Mountbatten-Windsor appears to have knowingly shared confidential information with Jeffrey Epstein from his official work as trade envoy in 2010 and 2011, according to material in the latest release of files in the US seen by the BBC.

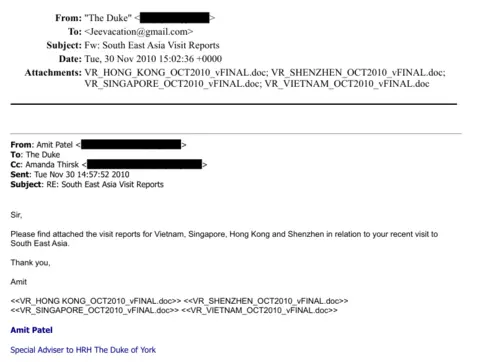

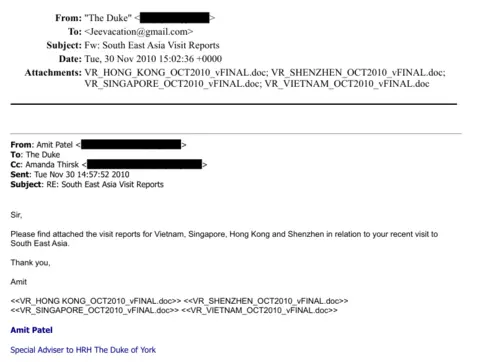

Emails from the recently-released batch of Epstein files show the former prince passing on reports of visits to Singapore, Hong Kong and Vietnam and confidential details of investment opportunities.

Under official guidance, trade envoys have a duty of confidentiality over sensitive, commercial, or political information about their official visits.

The former Duke of York, who served as trade envoy between 2001 and 2011, has been contacted for comment but is yet to respond.

Andrew has consistently and strenuously denied any wrongdoing. Being named in the Epstein files is not an indication of misconduct.

The emails indicate that on 7 October 2010, Andrew sent Epstein details of his official upcoming trips as trade envoy to Singapore, Vietnam, Shenzhen in China and Hong Kong, where he was accompanied by business associates of Epstein.

After the trip, on 30 November, he appears to have forwarded official reports of those visits sent by his then-special assistant, Amit Patel, to Epstein, five minutes after receiving them.

US Department of Justice

US Department of Justice

Andrew told BBC Newsnight in 2019 that he last saw Epstein in New York in early December 2010 to tell the disgraced financier he was breaking off the friendship.

However, on Christmas Eve that year, he emailed Epstein a confidential briefing on investment opportunities in the reconstruction of Helmand Province, Afghanistan, which was overseen at the time by British armed forces and funded by UK government money.

By this time, Epstein was already a convicted sex offender.

Sir Vince Cable, who was then business secretary, said: "I was unaware of Andrew... sharing information about investment opportunities [in Afghanistan] before, this is the first I've heard of it."

In a further email dated 9 February 2011, Andrew suggests Epstein might invest in a private equity firm he visited a week before.

Official terms of reference for trade envoys state that they "are not civil servants", adding: "However, the role of a Trade Envoy carries with it a duty of confidentiality in relation to information received. This may include sensitive, commercial, or political information shared about relevant markets/visits.

"This duty of confidentiality will continue to apply after the expiry of their term of office. In addition, the Official Secrets Acts 1911 and 1989 will apply."

Andrew has faced years of scrutiny over his past friendship with Epstein.

He was stripped of his royal titles in October last year following increasing numbers of questions about his links to the late, convicted sex offender.

Earlier in February, Andrew moved out of his home in Windsor to the Sandringham Estate in Norfolk.

Buckingham Palace had announced in October that he would be moving from Royal Lodge, at the same time his title of prince was removed.

The former prince left the property on Monday night and is currently living at Wood Farm on the Sandringham Estate while his new permanent home undergoes renovations.

Andrew Mountbatten-Windsor appears to have knowingly shared confidential information with Jeffrey Epstein from his official work as trade envoy in 2010 and 2011, according to material in the latest release of files in the US seen by the BBC.

Emails from the recently-released batch of Epstein files show the former prince passing on reports of visits to Singapore, Hong Kong and Vietnam and confidential details of investment opportunities.

Under official guidance, trade envoys have a duty of confidentiality over sensitive, commercial, or political information about their official visits.

The former Duke of York, who served as trade envoy between 2001 and 2011, has been contacted for comment but is yet to respond.

Andrew has consistently and strenuously denied any wrongdoing. Being named in the Epstein files is not an indication of misconduct.

The emails indicate that on 7 October 2010, Andrew sent Epstein details of his official upcoming trips as trade envoy to Singapore, Vietnam, Shenzhen in China and Hong Kong, where he was accompanied by business associates of Epstein.

After the trip, on 30 November, he appears to have forwarded official reports of those visits sent by his then-special assistant, Amit Patel, to Epstein, five minutes after receiving them.

Andrew told BBC Newsnight in 2019 that he last saw Epstein in New York in early December 2010 to tell the disgraced financier he was breaking off the friendship.

However, on Christmas Eve that year, he emailed Epstein a confidential briefing on investment opportunities in the reconstruction of Helmand Province, Afghanistan, which was overseen at the time by British armed forces and funded by UK government money.

By this time, Epstein was already a convicted sex offender.

Sir Vince Cable, who was then business secretary, said: "I was unaware of Andrew... sharing information about investment opportunities [in Afghanistan] before, this is the first I've heard of it."

In a further email dated 9 February 2011, Andrew suggests Epstein might invest in a private equity firm he visited a week before.

Official terms of reference for trade envoys state that they "are not civil servants", adding: "However, the role of a Trade Envoy carries with it a duty of confidentiality in relation to information received. This may include sensitive, commercial, or political information shared about relevant markets/visits.

"This duty of confidentiality will continue to apply after the expiry of their term of office. In addition, the Official Secrets Acts 1911 and 1989 will apply."

Andrew has faced years of scrutiny over his past friendship with Epstein.

He was stripped of his royal titles in October last year following increasing numbers of questions about his links to the late, convicted sex offender.

Earlier in February, Andrew moved out of his home in Windsor to the Sandringham Estate in Norfolk.

Buckingham Palace had announced in October that he would be moving from Royal Lodge, at the same time his title of prince was removed.

The former prince left the property on Monday night and is currently living at Wood Farm on the Sandringham Estate while his new permanent home undergoes renovations.

Brief sent by Andrew to Epstein included gold investments, file seen by BBC suggests

Sean Coughlan, Royal correspondent

James Landale, Diplomatic correspondent

The former Prince Andrew travelled the world as the UK's trade envoy

A document apparently sent by Andrew Mountbatten-Windsor to Jeffrey Epstein included information on investment opportunities in gold and uranium in Afghanistan.

The BBC has seen a briefing, prepared for Andrew by UK officials when he was a trade envoy, which he forwarded to the convicted sex offender in December 2010 and includes a list of "high value commercial opportunities" in Helmand province.

This comes after the BBC reported that the former prince had called the document "confidential," according to an email in the latest tranche of Epstein files.

Andrew has been approached for comment but has yet to respond. Previously he has strongly denied any wrongdoing in his associations with Epstein and rejected any suggestion he used his time as trade envoy to further his own interests.

Andrew shared confidential information with Epstein as trade envoy, files suggest

Police assessing claims about Andrew sharing confidential trade details

King 'ready to support' police as they assess Andrew claims over Epstein

Who is in the Epstein files?

Sir Vince Cable, who was business secretary at the time, described sharing the briefing as "appalling behaviour".

Thames Valley Police are already assessing whether to investigate the apparent sharing of documents related to Andrew's time as trade envoy.

In a new statement on Wednesday, police said: "We can confirm today that Thames Valley Police is leading the ongoing assessment of allegations relating to misconduct in public office.

"As part of this assessment, we have engaged in discussions with Specialist Crown Prosecutors from the CPS. We will provide updates as and when they are available, but at this stage it would be inappropriate to discuss further specifics of this work.

"During an assessment phase, information is evaluated to determine whether a criminal offence is suspected and whether a full investigation is required. Allegations of misconduct in public office involve particular complexities, and therefore an assessment must be conducted carefully and thoroughly."

As well as the Afghan document, Andrew also seems to have sent the disgraced financier official reports from his visits as a trade envoy to Singapore, Hong Kong and Vietnam, according to emails in the Epstein files seen by the BBC.

Emails in the files raise the possibility Andrew shared further trade documents with Epstein. One message indicates that a few seconds after sending the reports from the South East Asia visits, the former prince then sent a second batch of files called "Overseas bids".

These seem to be "Zip files" that usually contain many compressed pieces of information.

The Afghan document, which is in the Epstein files, was compiled by UK government officials specifically for the then Duke of York.

It provides an extensive overview of investment opportunities in Helmand province, at a time when the UK was militarily and politically committed to rebuilding Afghanistan.

As Andrew said in his note to Epstein, it's a "confidential brief produced by the Provincial Reconstruction Team in Helmand Province".

It was a briefing produced for Andrew - who was trade envoy between 2001 and 2011 - in the same month that he visited Helmand, where he saw UK troops based there.

It gives an assessment of the current local economy and the business opportunities, including "significant high value mineral deposits" and the "potential for low cost extraction".

This includes valuable natural resources such as marble, gold, iridium, uranium and thorium and also possible deposits of oil and gas, with the information prepared by UK government officials, working for the Helmand reconstruction team.

According to official guidance, trade envoys have a duty of confidentiality over sensitive, commercial, or political information about their official visits.

US Department of Justice

US Department of Justice

Sir Vince, who was seen as instrumental in ending Andrew's time as trade envoy, called for more transparency on Andrew's time as trade envoy.

"I have twice in the past asked to see the file on Andrew as trade envoy and, strangely, it is empty," he said.

"I met Andrew once as secretary of state, when I was invited to Buckingham Palace and he was asking me to find something useful for him to do. I didn't.

"Shortly after, in 2011, the first publicity appeared about his friend Epstein and I discontinued the envoy role," said Sir Vince.

The role of trade envoy is to promote the UK's business interests overseas and to encourage investment.

Speaking anonymously, a diplomatic source suggested that an envoy such as Andrew might legitimately have shared information with potential investors, encouraging them to support UK international business initiatives, which might have included in Afghanistan.

Andrew's apparent note to Epstein says he is going to "offer this elsewhere in my network (including Abu Dhabi)".

On the wider principle of sharing documents, a former senior trade official said many of the reports seen by a trade envoy would have been quite "pedestrian", but sometimes the former Duke of York had "really important meetings with really important people" that produced real commercial opportunities.

"So it is always possible that there were significant commercial things in the documents which would have been useful," the former official said.

"They were absolutely not for sending outside government and particularly not to somebody who might seek to use them for commercial purposes. This was certainly not something a trade envoy could possibly do and justify in any way."

The former prince continues to be dogged by his links to Epstein after the latest tranche of documents released by the US government included pictures of Mountbatten-Windsor, fully clothed, kneeling on all fours over a woman lying on the ground.

He is facing growing pressure to testify in the US about his links to Epstein and last week moved from his Windsor home to the Sandringham Estate in Norfolk.

On Monday a Buckingham Palace spokesperson said the King was ready to support the police as they consider allegations against his brother.

Sir Vince, who was seen as instrumental in ending Andrew's time as trade envoy, called for more transparency on Andrew's time as trade envoy.

"I have twice in the past asked to see the file on Andrew as trade envoy and, strangely, it is empty," he said.

"I met Andrew once as secretary of state, when I was invited to Buckingham Palace and he was asking me to find something useful for him to do. I didn't.

"Shortly after, in 2011, the first publicity appeared about his friend Epstein and I discontinued the envoy role," said Sir Vince.

The role of trade envoy is to promote the UK's business interests overseas and to encourage investment.

Speaking anonymously, a diplomatic source suggested that an envoy such as Andrew might legitimately have shared information with potential investors, encouraging them to support UK international business initiatives, which might have included in Afghanistan.

Andrew's apparent note to Epstein says he is going to "offer this elsewhere in my network (including Abu Dhabi)".

On the wider principle of sharing documents, a former senior trade official said many of the reports seen by a trade envoy would have been quite "pedestrian", but sometimes the former Duke of York had "really important meetings with really important people" that produced real commercial opportunities.

"So it is always possible that there were significant commercial things in the documents which would have been useful," the former official said.

"They were absolutely not for sending outside government and particularly not to somebody who might seek to use them for commercial purposes. This was certainly not something a trade envoy could possibly do and justify in any way."

The former prince continues to be dogged by his links to Epstein after the latest tranche of documents released by the US government included pictures of Mountbatten-Windsor, fully clothed, kneeling on all fours over a woman lying on the ground.

He is facing growing pressure to testify in the US about his links to Epstein and last week moved from his Windsor home to the Sandringham Estate in Norfolk.

On Monday a Buckingham Palace spokesperson said the King was ready to support the police as they consider allegations against his brother.

Investors Back Away from DP World as CEO's Links to Epstein Scandal Appear

While the shipping world seemed to be far removed from the growing U.S. scandal around convicted sex offender Jeffrey Epstein, logistics giant DP World is now coming under pressure due to revelations about its long-time Chairman and CEO. Two giant institutional investors have announced they are suspending future investments with the company until it addresses the situation.

Sultan Ahmed bin Sulayem has led the global giant for nearly 20 years and built its global portfolio. At first, the reporting of his friendship with sex offender Jeffrey Epstein seemed to be prurient curiosity, but as the U.S. Department of Justice continued to release large batches of material, it became clear that it was a long-running friendship that involved messages of a sexual nature and assisting Epstein. DOJ is quick to point out that inclusion in the files is not evidence in and of itself of a crime, but the CEO’s name reportedly appears many times over many years. The friendship appears to have continued after Epstein’s conviction in 2008 and until shortly before he died in 2019.

The pension fund of Quebec, Canada, and the second largest in Canada, La Caisse (Caisse de dépôt et placement du Québec), was the first to act. It noted that the individual and the company were separate, but that it would “pause additional capital deployment,” with DP World. It said it expects DP World to address “the situation and take the necessary actions.”

La Caisse, which currently has a portfolio worth US$366 billion, has a relationship with DP World dating back a decade. It announced that it would invest $3.7 billion in 2016 into the company’s ports and terminals. In 2022, it announced another $5 billion, including investments in the Dubai port of Jebel Ali, and in September 2025, reported it would partner with DP World for the Port of Montreal expansion at Contrecoeur.

Today, February 11, the British investment giant British International Investment, with a portfolio valued at over $9 billion, announced it would also be suspending investments with DP World. Reuters reports BII is currently invested in at least four African ports alongside DP World.

Bin Sulayem, age 70, is a prominent Emirati businessman and has a close association with the royal family, which oversees DP World and the country’s other major companies. He reportedly began working at the Jebel Ali port in the 1970s, which was also the origin of DP World. He became chairman of the company in 2007 and CEO and Chairman in 2016.

According to the company, under his leadership, the company undertook strategic investments and acquisitions, and today is responsible for approximately 10 percent of the global container trade. In 2006, DP World acquired the venerable British shipping company P&O for $6.8 billion. The company also made investments, including Imperial Logistics and Syncreon, and recently announced it would be unifying its operations under the DP World brand

Bin Sulayem, in his company profile, is reported to have also established Nakheel. The real estate and tourism company in Dubai is known for major projects including The Palm, built on an artificial island, the conversion of the liner Queen Elizabeth 2 into a hotel, and other businesses, including the Dubai Multi Commodities Centre.

The company’s profile says that it contributes more than 36 percent to the GDP of Dubai and about 12 percent to the GDP of the UAE. It operates in more than 80 countries. Last year, it reported nearly $20 billion in revenues.