Donald Trump is on the warpath again, threatening Greenland, Iran, Canada, and Cuba. Will he be TACO—Trump Always Chickens Out—or will he carry through on the threats—seizing Greenland, seeking to overthrow the Iran and Cuba regimes, destabilizing Canada? Let’s take a look.

Greenland: A “Core National Security Interest”

Jeff Landry, the Trump administration’s envoy to Greenland—he’s also governor of Louisiana—has written an op-ed for the New York Times January 29 that tells us the US intends to dominate the island.

“When President Trump took office last year, he recognized an uncomfortable fact that many others have avoided: America must guarantee its own unfettered and uninterrupted access to key strategic territories in the Western Hemisphere, including both Greenland and the Panama Canal.”

Pairing those two locations is revealing, since Landry proposes that “Greenland fits squarely within” the idea behind the Monroe Doctrine for Latin America. Now that Trump believes he has a “framework for a future deal” on Greenland, the US will use it to (in Landry’s words) “set the rules in one of the world’s most strategically consequential regions in perpetuity.”

“American dominance in the Arctic is nonnegotiable,” writes Landry. “Greenland is a core national security interest for the United States,” repeating what Trump said at Davos. That’s an extraordinary statement: It elevates Greenland to the level of Europe’s or the US homeland’s defense, among other national interests.

And it’s wrong. Chinese and Russian activities in and around Greenland hardly amount to a national security threat. Contrary to Trump’s statement in a January 9 press conference, there are no Chinese and Russian destroyers circling Greenland, nor “Russian submarines all over the place.” Nor, finally, are there any indications that Russia or China plans to “occupy” Greenland. All we see are Russian and Chinese fishing boats.

Nevertheless, the US is going to build more bases in Greenland, establish a “Golden Dome” missile defense, build more icebreakers, and vigorously patrol the Arctic waters to prevent a Russian or Chinese takeover. These plans may conceal a long-term design on Greenland and its mineral resources. After all, governments typically are prepared to go to war over “core national security interests.”

Iran: Make a Deal or Perish

Once again, President Trump is threatening to attack Iran. Just a few weeks ago, the threat turned on Iran’s reaction to massive protests and the possible execution of protesters. The US was “locked and loaded”; protesters could count on the US. But Trump was evidently persuaded by Arab countries and the US military not to attack.

Now Trump, having failed to back up his promises as thousands of protesters were killed or jailed, is saying Iran has revitalized its nuclear weapon capability. That’s the capability he had claimed was “obliterated” in US attacks last June. Trump has ordered US military vessels to the Middle East, saying that “like with Venezuela, it is ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary.”

News reports indicate Trump is considering various options, including putting US troops into Iran. Evidently, Trump has become so enamored with the successful seizure of Venezuela’s leader that he thinks Iran can be as easily dealt with. Yet Trump also says he hopes to avoid the use of force. In short, more gunboat diplomacy.

Iran is responding, as in the past, with threats of its own and offers to talk. If the US attacks, Iran says it will spark a regional war and that Israel and US bases in the region will be targets.

But Iran’s foreign minister, Abbas Araghchi, has also said Iran was “ready to begin negotiations if they take place on an equal footing, based on mutual interests and mutual respect.” He said there were no immediate plans to meet with US officials, adding: “I want to state firmly that Iran’s defensive and missile capabilities will never be subject to negotiation.”

In the past, Iran has also said its nuclear enrichment program is off the bargaining table. That point collides with the demand made by Steve Witkoff, Trump’s special Middle East envoy, that Iran stop its enrichment program and transfer all its enriched uranium out of the country.

Will Trump order another attack on Iran? More bombing is certainly possible, whereas a direct intervention in Iran would invite disaster. Trump’s war threats have activated some in the Senate to craft a resolution that would remove US military forces “from hostilities within or against the Islamic Republic of Iran” unless authorized by Congress. Prospects for stopping Trump by resolution or the War Powers Act seem dim considering that these measures were not enacted to prevent his Venezuela adventure.

Canada: Squeezing with Separatism and Tariffs

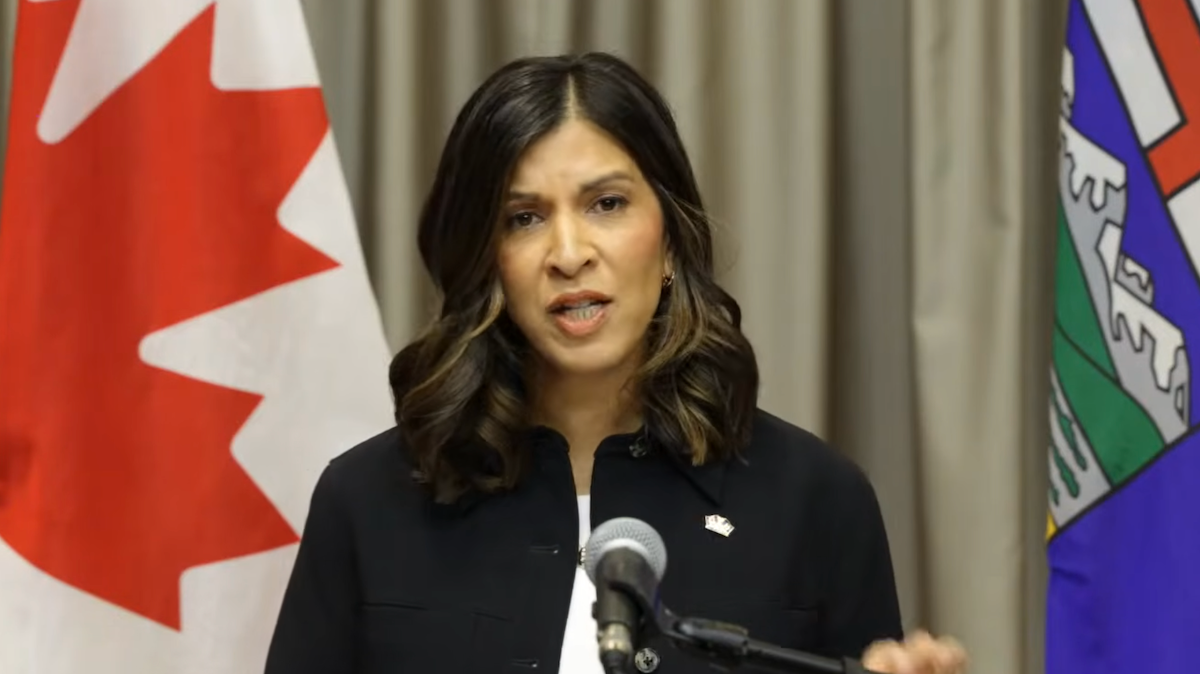

Angered by Prime Minister Mark Carney’s upstaging him at Davos, Canada’s trade deal with China, and Canada’s supposed refusal to certify Gulfstream business jets, Trump’s team has looked for ways besides high tariffs to pressure Carney’s government. US treasury secretary Scott Bessent recently

suggested US support for a separatist group in Alberta, arguing that the province is a “natural partner” of the US.

That support apparently extends to the highest level of the US government, according to an account in The Daily Beast. “Very, very senior” officials in the Trump administration have had secret meetings with far-right Canadian separatists trying to shake the foundations of the country. The covert meetings between high-ranking U.S. officials and the Alberta Prosperity Project,” says the report, “have met U.S. State Department officials in Washington, D.C. three times in the last nine months.”

One member of that project who attended the meetings claimed: “The US is extremely enthusiastic about a free and independent Alberta. We’re meeting very, very senior people leaving our meetings to go directly to the Oval Office.” The group is hoping to place a referendum on independence on the ballot.

US officials deny supporting this movement, but the State Department acknowledges that meetings did take place. The US officials’ denials ring hollow. The very fact that US officials would engage with Canadian separatists is a shocking level of interference in Canadian affairs. It shows that if Trump cannot fulfill his dream of making Canada the 51st state, he may still try to pry off one province.

Cuba: Economic Warfare or Regime Change?

Following up on Marco Rubio’s threats to Cuba, the island’s oil imports are drying up. Trump has made sure Venezuelan oil is no longer available, threatening to raise tariffs on any country that might provide it. Cuba’s usual sources of oil, Mexico and Angola among them, are being closed down, almost certainly under US pressure.

Mexico’s President Claudia Scheinbaum insists the decision is a sovereign one, and that Mexico will continue to provide oil as humanitarian assistance. But when we consider that Trump has threatened to go after drug cartels in Mexico, and that the US-Mexico-Canada free trade agreement is up for renewal shortly, it is hard to credit Scheinbaum’s claim.

Trump has made clear the US strategy for regime change: an economic blockade. “Cuba will be failing pretty soon,” he boasted. Indeed, by some estimates, Cuba has only about 3 weeks of oil, after which a humanitarian crisis is being predicted. Diesel is essential to producing electricity and for transportation, water delivery, and agriculture.

During the Cold War, the US embargo of Cuba was justified by Cuba’s support of revolutionary movements in Latin America and Africa. Now the pretext is that Cuba is a national security threat because it provides “a safe haven for transnational terrorist groups, such as Hezbollah and Hamas”. No evidence has been offered in support of this charge—and I doubt any evidence exists.

TACO Time?

A president who began his second term riveted on dismantling democracy and doing away with the rule of law has now become an imperialist, with military interventions and weaponizing tariffs the main instruments for accomplishing US goals. How far will he go in each of the four cases?

Trump has a history of backing off from threats, but the Venezuela experience has clearly made him think he has license to intervene abroad with impunity, especially in Latin America where weak regimes are in no position to resist. There’s a good chance he will overreach, as imperialists do, facing pushback that he and his advisers had not foreseen in Greenland and NATO, in Iran, and in Canada.

He will also face domestic political costs as independents and even some MAGA supporters resent his overseas adventures for taking money and attention away from a corroding economy. So, TACO time or wartime?

Either way, Trump will threaten world peace and stability, alienate traditional friends, and possibly spark new wars. Increasingly unpopular at home, he may just be desperate enough to authorize more outrageous actions abroad.

Mel Gurtov, syndicated by PeaceVoice, is Professor Emeritus of Political Science at Portland State University.

Venezuela and Iran: Oil and Survival

A Final Toast – by Mr. Fish

Venezuela, under threat following the attacks of January 3, and in perspective alongside the historical mirror that is Iran, allows us to study the models of classic oil nationalism and pragmatic resistance. But beyond the economy, some analysts have put forward the theory that Venezuelan and Iranian oil is not just a business, but vital ammunition in the war scenario being proposed by the United States.

The 2026 Reform: Privatization or Tactical Lifeline?

To understand the current reform, we must look at the red numbers. In 2014, Venezuela had annual oil revenues of close to $40 billion. Following US sanctions and the financial blockade, that figure plummeted to just $740 million in 2020. The state, owner of the resource, was left without the capacity to extract it and without banks to collect payment.

The response was the Anti-Blockade Law of 2020, which gave rise to the Petroleum Participation Contracts (CPP). According to the inputs from the recent high-level meeting, CPPs are not traditional concessions. They are service agreements where the private sector invests and operates, collecting its investment directly through physical production (barrels), eliminating the financial transaction that the US could block.

The government defends the success of the model: revenues in five years increased to a record $14 billion in 2025, which, although far from historical revenues, were considerably higher than the $740 million at the worst point in 2019. The reform now seeks to give this mechanism legal status, removing it from the realm of exceptionality, which often placed the Venezuelan state at a disadvantage. Jorge Rodríguez, president of the National Assembly, sums it up as a “flexibilization of tariffs” in which the private sector provides the capital and the state maintains sovereignty over the oil field. While Caracas discusses the new legal basis for adapting to the new conditions of energy relations with the US, Donald Trump sent a message from Washington on 23 January confirming the US president’s change of stance on oil geopolitics: “Venezuela has the largest oil reserves in the world… larger than Saudi Arabia’s,” suggesting that the US could make “a lot of money” from this pragmatic relationship.

The Clash of Visions and Internal Criticism

The reform has sparked some criticism. Former oil minister Rafael Ramírez, who faces corruption charges in Venezuela, described the measure on January 27 as a “repeal of the 1976 nationalization.” For those who have historically defended oil nationalism, the CPPs, within the framework of the reform of the Hydrocarbons Law, hand over operational control—which they consider to be the real value—to transnational corporations.

The government counters with “war pragmatism”: the 2006 model (with 90 percent of revenue going to the state) was ideal in peacetime, but unviable under siege. The new scheme ensures between 65-70 percent of revenue and, most importantly, keeps the industry alive. This represents a forced retreat due to circumstances in order to avoid total suffocation.

The New Cold War: the China factor

This is where the global dimension comes into play. Why are Donald Trump and Washington now showing tacit tolerance for this Venezuelan model (as seen through the licenses granted to Chevron) while maintaining their tough rhetoric? The answer may lie in the goal of containing China.

Several analyses, including those by conservatives such as Tucker Carlson, have put forward a thesis that resonates in the media and geopolitical think tanks: the United States is preparing for a large-scale kinetic or trade conflict with China. In this scenario, control of Venezuelan oil reserves ceases to be a market issue and becomes a matter of pure national security.

Carlson warns that the Trump administration finds it unacceptable that the world’s largest reserves (Venezuela) and one of the keys to the Persian Gulf (Iran) are supplying China. “The oil is going to China… it should be coming to us,” is the underlying interpretation of Washington’s new doctrine.

From this perspective:

Cutting off resources to the enemy: The goal is no longer just to “change the regime” in Caracas for “democratic” reasons, but to decouple Venezuela from China. If the CPPs and licenses allow Venezuelan crude to flow to the Gulf of Mexico (US) instead of Shanghai, Washington wins a strategic battle without firing a bullet.

The Iranian Case: With Iran, the situation is more volatile. Carlson suggests that hostility toward Tehran seeks to cut off China’s main secure energy artery in the Middle East. Controlling or neutralizing Iranian oil leaves China’s industrial and military machinery vulnerable to a naval blockade. And at the same time, controlling the supply routes.

This “New Cold War” explains the current paradox: the US, while turning the Caribbean into a large military base, is allowing Venezuela to breathe economically (through Chevron and, in the future, the participation of other large US companies), because it prefers a pragmatic Venezuela that sells to the North, rather than an unaligned Venezuela that is a secure energy supplier to China and, financially, contributes to putting the nail in the coffin of the dollar as a global currency.

The Historical Mirror: Iran and Venezuela (The “Petroleumscape”)

This dynamic is not new. Venezuela and Iran share a historical “petroleum landscape.” Both suffered Western-orchestrated coups when they attempted to nationalize their resources (1948 and 1953). Both founded OPEC in 1960 to defend themselves.

In recent years, the Caracas-Tehran alliance has been existential. Iran taught Venezuela how to navigate sanctions (covert fleets, refinery repairs, among others). Now, both countries find themselves in the vortex of the US-China dispute. The legal reform in Venezuela is, at its core, a maneuver to survive on this chessboard: ensuring its own cash flow to alleviate the US threat, even though the geopolitical gravity inevitably pushes for greater pressure from Washington on both countries.

This Story Has Been Going On For More Than 100 Years.

The partial reform of the Hydrocarbons Law is much more than a technical adjustment; it is an act of survival on the eve of a major global conflict. Venezuela is sacrificing part of its income and operational control (which it was already doing via the CPP with the Anti-Blockade Law) to reinsert itself into the Western market and try to circumvent the blockade.

Ultimately, in the war for global hegemony waged by Washington, which sees Beijing as its main contender, Venezuelan and Iranian oil are the ultimate strategic trophies. Venezuela and its 100-year history of oil, as we began to study, is one of the battlefields.

Carmen Navas Reyes is a Venezuelan political scientist with a master’s degree in Ecology for Human Development (UNESR). She is currently pursuing a doctorate in Our America Studies at the Rómulo Gallegos Foundation Center for Latin American Studies (CELARG) in Venezuela. She is a member of the International Advisory Council of the Tricontinental Institute for Social Research.

This article was written by Globetrotter.