Oil stocks are booming right now, which isn’t startling amid the economic recovery. What is more surprising is that the oil-stock boom might plausibly continue for years beyond the pandemic recovery phase.

“I think we’re in a multi-year bull market for oil,” argues Eric Nuttall, a prominent energy investment manager and partner at Ninepoint Partners LP.

You might think efforts to decarbonize the world economy would make oil a sunset industry with poor long-term prospects. The transition to renewable energy will likely take decades, however.

That leaves plenty of time for oil-stock investments to pay off handsomely, says Nuttall, lead portfolio manager for the Ninepoint Energy Fund, Canada’s largest oil-and-gas-sector mutual fund by asset size.

Constrained supply

While the world continues to use oil, its supply is constrained in surprising ways. Due to an unusual combination of environmentalist and shareholder pressures, oil companies are showing uncharacteristic restraint when investing in production, despite high prices.

“I see an environment where sufficient investment is no longer permitted, whether by environmental pressures or pressures from shareholders who want companies to prioritize returns over spending,” Nuttall says.

While no one can forecast what’s going to happen with much certainty, if supply is constrained while demand stays strong for an extended period, then prices should stay relatively high while those conditions prevail. If that’s the case, oil company profits and stock prices will likely do well.

Even though prices for many Canadian oil stocks have already doubled this year, valuations are still “ludicrously inexpensive,” says Nuttall. In many cases, current valuations are a fraction of typical historical levels. By one measure of valuation — enterprise value to operating cash flow — Canadian oil stocks are currently trading at a ratio of 2.0 to 3.5 times, versus typical historical figures of 7.0 to 9.0 times, Nuttall says.

Oil prices collapsed early in the pandemic, then mounted a gradual but strong recovery. U.S. benchmark prices reached more than $80 (all figures U.S.) per barrel in late October, the highest level since 2014. They’ve since settled back, partly from reaction to news of the Omicron variant, but oil prices were hovering just under $70 per barrel for most of last week, a relatively high level sufficient for healthy profits.

As the oil price recovery took hold earlier this year, companies first focused on paying down debt and repairing the damage to their finances. With finances now in better shape, Canadian oil companies are switching their focus more to buying back stock and big dividend increases. Among prominent examples, Suncor Energy Inc. recently doubled its dividend, fully restoring a cut made early in the pandemic. “Investors are just now getting that first taste of those juicy dividends,” says Nuttall.

Surprising allies

Supporting oil industry prospects is an unusual alliance of value-oriented investors and environmentalists, which for different reasons are both applying pressure to constrain investment in oil production. Since oil is a depleting resource, oil companies need to keep investing massive amounts in exploration and development to just maintain existing production levels, let alone add to it.

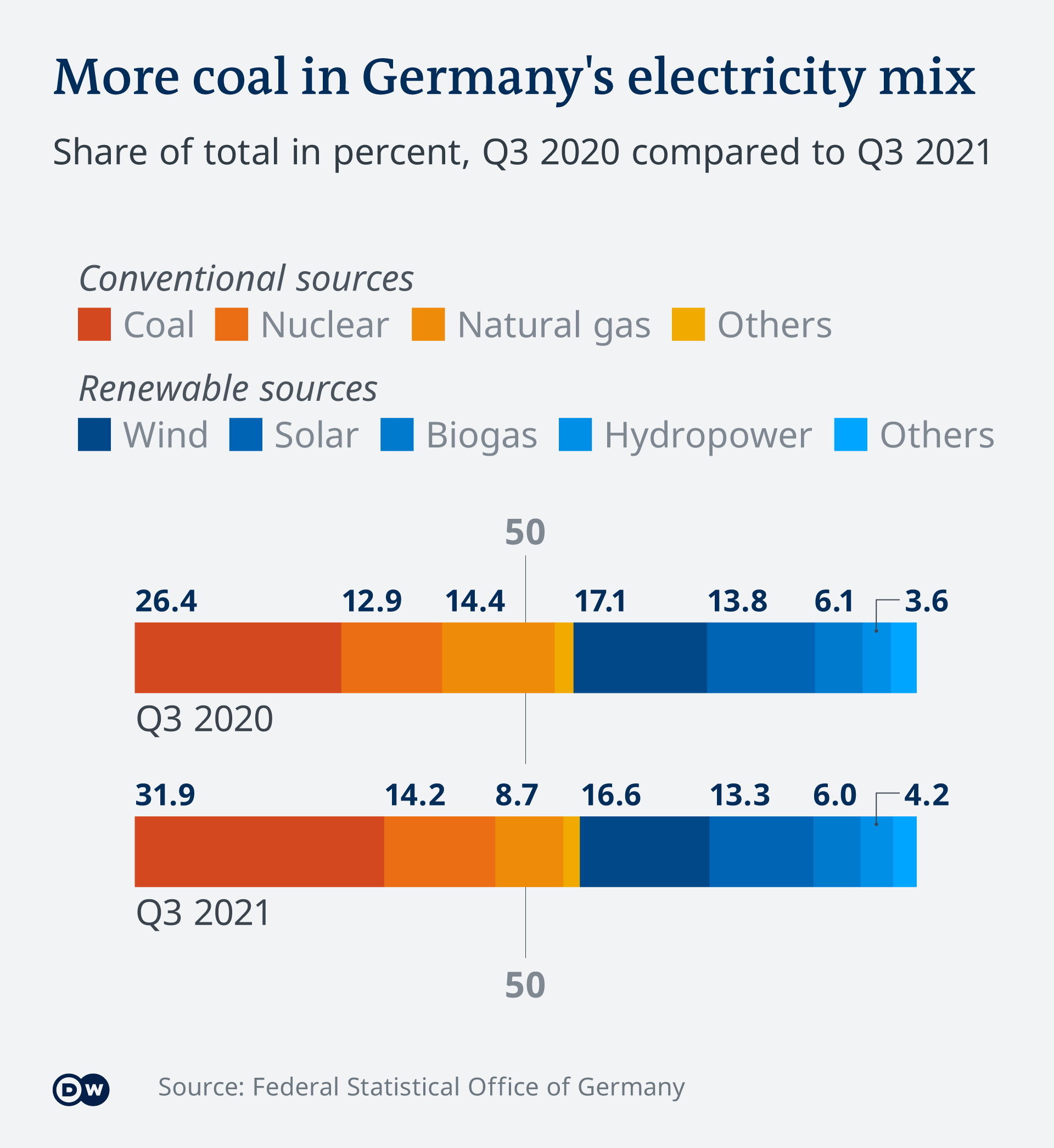

Environmentalists are out to reduce carbon emissions from oil any way they can, whether by constraining supply or impacting demand, but transitioning from oil to low-emissions energy sources will be gradual and problematic. It will take a while before everyone is driving electrical vehicles, which will require not only a massive transformation of the vehicle industry, but also decarbonizing and expanding the world’s electrical generating capacity, now heavily dependent on carbon-intensive coal and natural gas.

So the world will still need oil for quite a few years. The International Energy Agency’s World Energy Outlook released in October projects that even if all climate pledges by every country in the world were met in full and on time, oil production in 2030 would still be modestly higher than the pre-pandemic peak of 2019. It’s only in the 2030s that the IEA sees oil production declining significantly below 2019 levels based even on those aggressive assumptions.

A less aggressive IEA projection based on policies that governments have actually put in place would result in significantly higher oil production in 2030 compared to 2019, followed by a subsequent levelling off.

Yet the increasing array of environmental regulations, emissions caps, and carbon taxes combine to discourage oil companies from investing in production. Environmentalists are also pressuring banks and institutional investors to shift financing activity away from the industry and in favour of renewable energy. That makes it harder for oil companies to find financing at reasonable cost.

At the same time, value-oriented investors have increased sway over oil company management.High prices in the last oil cycle caused massive investment in additional production, notably in U.S. shale. But the resulting surge in world production swamped demand, crashing prices in 2014, followed by almost seven mostly lean years. So investors, having been burned, now pressure management to curtail investments in production, despite the high prices.

Oil companies around the world including the big U.S. shale producers and “supermajors” like BP PLC and Royal Dutch Shell PLC have mostly embraced this new discipline. BP is going so far as to sell off a major portion of its fossil-fuel assets to finance a shift into renewable energy. In many cases, companies aren’t investing enough to sustain production at current levels. Royal Dutch Shell reportedly expects to decrease oil production by one to two per cent per year until 2030. That plan remains unaffected by the recent oil price surge. “From my perspective, (the price rise) means nothing,” a Shell executive told the Economist.

Where company management tries to buck the trend, it faces intense investor pressure. This year a hedge fund called Engine No. 1 led a revolt among ExxonMobil Corp. investors opposing the company’s expansionary policies. With the support of big institutional investors like BlackRock and Vanguard, they succeeded in replacing three directors on the board, undercutting the likelihood of Exxon Mobil proceeding with big new projects.

The coalition of oil-producing countries known as “OPEC Plus” (members of OPEC plus allies like Russia) represent a potential wild card for world supply, but their recent disciplined behaviour in support of higher prices suggests they are unlikely to swamp the market with additional oil for the foreseeable future. They cut oil supply drastically in the early stages of the pandemic to help halt the plunge in prices. Since then, they have gradually added back oil supply in a disciplined manner that still allowed for price rises.

New emissions commitments

The Canadian oil industry’s recent climate-change commitments will require it to spend large amounts of money on emissions cuts instead of returning the money to shareholders.

Canadian oilsands, a large part of national production, have been shunned by environment-focused investors even more than regular oil companies because of particularly high carbon emissions. However, in October, Canada’s five largest oilsands producers pledged to reach net-zero emissions from oil production by 2050, with interim milestones in 2030 and 2040. Plans include a carbon capture network that would gather sequestered carbon dioxide from 20 oilsands facilities and ship it by carbon pipeline to a storage facility at Cold Lake Alberta.

For environmentalists, this doesn’t come close to resolving the Canadian oil industry’s environmental issues, but it is a big step in the right direction. “It’s very positive that the companies have all made net-zero commitments,” says Chris Severson-Baker, Alberta regional director for the Pembina Institute, a clean energy think tank.

Still, the lengthy time to achieve net zero means it “doesn’t mean a lot in the short-term,” says Chris Severson-Baker, a director at the Pembina Institute, a clean-energy think tank. And looking at the plans in detail category-by-category, “it’s overly optimistic.” What’s more, oilsands production still generates higher emissions than conventional oil, while conventional oil producers are also working to reduce emissions starting from a lower emissions base, he says. “I don’t see much relief for the oilsands sector from external pressure.”

So while the world will likely need oil for a long time, it’s not clear Canadian producers will get to keep their current share of world production in the face of environmental pressure. To achieve that, the Canadian industry will likely need to keep ramping up efforts to clean up emissions — and if companies can continue to earn healthy profits, that just might provide them with the means to do that while also keeping shareholders satisfied with buybacks and dividends.

(Oil stocks are risky investments. Do your own due diligence, and/or consult a financial adviser, before investing in them.)

David Aston, a freelance contributing columnist for the Star, is a personal finance and investment journalist. He has a Chartered Financial Analyst designation and is a Chartered Professional Accountant. Reach him via email: davidastonstar@gmail.com

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1305091835-6f160d825bec4467831a47f726710106.jpg)

:max_bytes(150000):strip_icc():format(webp)/Hydrogen_rating-786611af578d4363a43dd09097ff8ba7.jpg)

:max_bytes(150000):strip_icc():format(webp)/h2-report-1dfb1677193c4271904eb2a5062da75b.jpg)