Phil Rosen

Tue, November 15, 2022

Illustration photo shows a smart phone screen displaying the logo of FTX, the crypto exchange platform, with a screen showing the FTX websiteOLIVIER DOULIERY/AFP via Getty Images

BlockFi is preparing for possible bankruptcy amid "significant exposure" to failed exchange FTX, WSJ reported.

BlockFi last week paused withdrawals and limited activity on the exchange, and is preparing for layoffs, per the report.

FTX filed for bankruptcy last Friday after failing to line up a rescue amid a liquidity crunch.

Crypto lender BlockFi preparing for a potential bankruptcy filing as the repercussions of FTX's downfall continue to spread, according to a Tuesday report from the Wall Street Journal.

The company is also preparing for possible layoffs, sources familiar with the matter told the Journal. The firm said in a blog post on Monday that it has financial exposure to Sam Bankman-Fried's FTX, which filed for chapter 11 bankruptcy on Friday. BlockFi said that it had assets in the exchange as well as obligations owed by FTX's affiliated trading firm, Alameda Research.

"There are a number of scenarios that may be available to us, and we are doing the work now to determine the best path forward," the blog post noted, adding that it has the necessary liquidity to explore all options for what comes next.

BlockFi halted withdrawals and limited activity on its platform last week, blaming uncertainty around FTX's liquidity issues.

This summer, BlockFi was among a handful of crypto projects that agreed to a rescue from FTX as the market was rattled by the steep drop in the price of crypto assets. FTX furnished a $400 million revolving credit facility for BlockFi, which also included an option to acquire the company, the Journal reported.

Meanwhile, a separate Tuesday report from the Journal revealed that Bankman-Fried has been reaching out to potential investors in attempt to raise money to repay FTX customers. The 30-year-old, who stepped down from his position as CEO the week prior, spent the weekend with several staffers doing outreach for financial commitments that could make up some of the company's $8 billion shortfall.

The collapse of the cryptocurrency exchange will cost investors billions. But why would anyone give money to a man who plays video games in important meetings?

Tue 15 Nov 2022

Do you ever get the impression that the entire economy is an elaborate scheme and nobody in charge actually knows what the hell they’re doing? I’ve been getting that feeling a lot lately. In just the past couple of weeks, we’ve been treated to the spectacle of Elon Musk dramatically running Twitter into the ground and the wild implosion of FTX.

If you haven’t been following the FTX drama, a quick summary: in 2019 a twentysomething called Sam Bankman-Fried launched a cryptocurrency exchange that got people who get excited about that sort of thing very excited indeed. All of the big players in venture capital, including Sequoia Capital, whose early-stage investments include Apple, Google and YouTube, basically lined up to throw money at the kid. SBF (as he is sometimes known) was routinely described as the “next Warren Buffett” and predicted to be “the world’s first trillionaire”.

It seems, however, that FTX was doing some very dubious things: namely, furtively shifting customer funds to Alameda Research, a firm also operated by Bankman-Fried, which then gambled them away on risky trades. Instead of becoming the world’s first trillionaire, SBF saw his net worth plummet from $16.2bn to about $3 overnight. Former US Treasury secretary Larry Summers has likened FTX’s collapse to the Enron scandal, saying that from the reports, there were “whiffs of fraud” about it.

SBF lost it all in style, mind you: he lived in a luxury compound in the Bahamas with nine of his employees. According to reports, “all 10 are, or used to be, paired up in romantic relationships with each other.”

This would all be extremely amusing – the Fyre festival of finance – were it not for the fact that a lot of ordinary people stand to lose money because of FTX going bankrupt. The Ontario Teachers’ Pension Plan, for example, invested $75m in FTX. Also unamusing is the fact that my bank apparently does more due diligence when I buy a sofa than Silicon Valley’s most high-profile investors appear to have done before giving billions of dollars to a scruffy twentysomething who liked to nap on beanbags.

Why on earth did some of the supposedly smartest minds in venture capital give Bankman-Fried so much money and provide so little oversight? Two reasons, I think. The first is that nobody understood what on earth the guy was talking about and decided that that meant he was a genius. Secondly, they just liked his vibe.

“I don’t know how I know, I just do. SBF is a winner,” wrote Adam Fisher, a business journalist, in a glowing profile of Bankman-Fried that was published on Sequoia’s website in September and yanked from it very recently. The same 13,000-word hagiography also reveals that SBF’s big vision for FTX – the description that made all these fancy finance guys open their pockets – was that it would be a place where “you can do anything you want with your next dollar. You can buy bitcoin … You can buy a banana.” SBF, by the way, delivered this amazing pitch while playing League of Legends in the meeting.

Was Sequoia annoyed that SBF was playing video games while asking them for money? Nah, they loved it. “We were incredibly impressed,” one funder said, according to Fisher’s profile. “It was one of those your-hair-is-blown-back type of meetings.”

I don’t know about you, but I’m having one of those want-to-tear-my-hair-out-with-frustration moments right now. Can you imagine a woman playing video games in a meeting and being handed billions by investors? That would never happen. Last year, female founders secured only 2% of venture capital in the US and I’ll bet you everything I have that those founders were as buttoned-up as you can get. I’ll bet you they didn’t get a billion dollars because people “just liked their vibe”.

I’ll grant you that Elizabeth Holmes conned a lot of important people out of money, but she at least put a little effort into her meetings. Maybe it’s time we stop fetishising tech founders and realise that being able to raise lots of money doesn’t actually make you a genius.

Arwa Mahdawi is a Guardian columnist

George Glover

Tue, November 15, 2022

Sam Bankman-Fried, founder of bankrupt FTX.Tom Williams/Getty Images

Institutional investors owned most of the crypto funds on FTX, experts told UK lawmakers Monday.

The exchange's collapse is likely to hit them hardest, with Galaxy Digital losing $77 million.

Billions of dollars in customer funds has disappeared in the implosion of bankrupt FTX.

Institutional investors are likely to be the most at risk of losing money from FTX's collapse, crypto industry insiders have told British lawmakers.

The bulk of the funds on the crypto exchange weren't from individual holders, but from some of the biggest and most knowledgable investors in the world, the experts said Monday.

"What we're hearing — and this is speculation, I'm just giving my view — the majority of the funds in that platform were from institutional investors," Ian Taylor, head of trade body CryptoUK, told the Treasury Select Committee.

FTX filed for Chapter 11 bankruptcy Friday, saying its CEO Sam Bankman-Fried had resigned. The exchange's collapse has vaporized between $1 billion and $2 billion of customers' funds, media reports said.

"We've lost $77 million at this point," Tim Grant, EMEA head for major crypto investor Galaxy Digital, told the lawmakers. "And we don't feel good about that."

"Primarily, the users were institutional. But also the cap table of equity investors were among the most sophisticated and largest investors in the world," he added.

"So there were a lot of very experienced eyes on this, and what it tells us is that this was a bad actor who was doing things behind very closed doors that we had no view into as a broader group."

"That's the same as Bernie Madoff and other instances like that, and they were in regulated industries."

CryptoUK's Taylor called for more regulation, such as audits, given the problems at FTX.

"Perhaps if we'd had some regulation, some of these recent events may not have taken place, where we've seen some pretty poor business practices, and perhaps over the forthcoming weeks we might see some criminal behavior," he said.

In the UK, the losses will likely be limited to large institutions because the Financial Conduct Authority has refused to grant a license to Bankman-Fried's company. In the UK, 10% of people hold crypto as an investment, according to Taylor.

Financial services regulator FCA warned Monday that it would be unable to help FTX customers recover their money because the exchange was not "authorized, regulated or registered" in the UK.

Read more: Billions of dollars seem to have disappeared with the collapse of FTX. How does that even happen?

Phil Rosen

Tue, November 15, 2022 at 12:53 PM·4 min read

Shark Tank's Kevin O'LearyO'Leary Ventures

In an interview with Insider, Kevin O'Leary explained his next move now that FTX, a company he invested in, filed for bankruptcy.

The "Shark Tank" investor said he's moving his assets to Canada, and will no longer keep funds in unregulated exchanges.

He also broke down details of his phone call with FTX founder Sam Bankman-Fried.

"Shark Tank" investor Kevin O'Leary has had his hands full lately, deciding where to put his money after gauging interest in a potential rescue of FTX that ultimately fell through.

A paid spokesperson and investor in the bankrupt exchange, the market veteran spent the weekend on calls trying to sort through rumors surrounding founder Sam Bankman-Fried and determine how much of his money could be recovered.

"I'm writing that all down to zero," O'Leary told Insider. "It's not clear what can be recovered. There's a lot of allegations flying around. But frankly, I've seen this movie before. It's a difficult situation, there's no question about it. There'll be a mountain of litigation."

On Tuesday, the Wall Street Journal reported that Bankman-Fried is trying to raise money to pay back clients, while FTX warned that it could have more than 1 million creditors.

The company's collapse rattled trust across the cryptocurrency sector, and O'Leary, a native Canadian, has started moving his assets elsewhere. Canada is the only country that offers fully-regulated broker-dealer exchange accounts, he said.

In his view, unregulated exchanges aren't safe, regardless of their size, so he's turned to crypto exchange WonderFi, which is regulated by the Ontario Securities Exchange. He's a shareholder in the parent company, and it was also the first crypto-trading platform on the Toronto Stock Exchange.

"We have confidence that the regulatory environment in Canada scrutinizes accounts that can't be commingled," O'Leary said. "I can't find another place on Earth right now safer than Canada."

A phone call with Bankman-Fried

O'Leary said he doesn't think the market has seen the bottom of the FTX fallout yet, marking a stark reversal from two-and-a-half years ago, when FTX's management team approached him to arrange a 30-minute meeting with Bankman-Fried.

That turned into a three-hour lunch. O'Leary then met Bankman-Fried's parents — both lawyers — and gained more confidence from seeing other large, global investors backing FTX.

While federal regulators are reportedly investigating FTX and Bankman-Fried, who last week resigned as CEO, for potentially mishandling client funds, O'Leary maintains he's never met a more brilliant mind when it comes to crypto and blockchain.

"He's a savant," he said. "He's probably one of the most accomplished traders of crypto in the world, and so I was very impressed."

Given his astuteness, O'Leary finds it hard to believe Bankman-Fried didn't realize the risks he was taking, as reports say he transferred billions in FTX client funds to his Alameda Research trading arm. The 30-year-old founder will have a "fair amount of explaining to do" when all the facts emerge, he said.

O'Leary said he spent last Thursday fielding calls from prospective investors in FTX. Sovereign wealth funds were interested to the tune of $6 billion-$8 billion, according to O'Leary, but there wasn't clarity on which was the correct amount. O'Leary messaged Bankman-Fried asking about it, and he received a call immediately.

"He confirmed that it was $8 billion, and that's the number I took forward," O'Leary explained. "We had a brief conversation. He was very rational. We discussed a few things about, you know, the timing on that $6 to $8 billion. But it was enough information for me to go back to the interested sources and confirm the number was eight."

Bankman-Fried also said on the call, according to O'Leary, that regulators were going to "come down hard" on the situation.

But as reports swirled that the Securities and Exchange Commission and other global regulators were closing in on FTX, rescue offers dried up shortly after the pair's phone call.

"All of those interested parties were gone," O'Leary said. "I texted that back to Sam. I did not have a conversation with him, and I told him that was not going to be an option."

Still, O'Leary believes that if a sovereign wealth fund or other buyer had put in roughly $4 billion, then investors would've again felt safe keeping their assets in FTX.

"So really what was on the table and being debated all around the world was you could buy a $32 billion asset for $4 billion," he said.

Ethereum cofounder Vitalik Buterin says it's a mistake to dismiss everything FTX's Sam Bankman-Fried did despite 'fraud

Phil Rosen

Tue, November 15, 2022

Vitalik Buterin.John Phillips/Getty Images for TechCrunch

Ethereum cofounder Vitalik Buterin cautioned critics of FTX's Sam Bankman-Fried to be more discerning.

"Automatically downgrading every single thing SBF believed in is an error," he tweeted on Tuesday.

He added: "Don't be the guy who would have tried to cancel vegetarianism in 1945."

Ethereum cofounder Vitalik Buterin cautioned critics of FTX's Sam Bankman-Fried to be more discerning, even as he suggested the crypto exchange's collapse was due to fraud.

Buterin, a vocal supporter of widespread crypto adoption and blockchain technology, said it would be a mistake to dismiss everything Bankman-Fried did, even as his crypto empire collapses amid federal probes into the potential mishandling of customer funds.

"Automatically downgrading every single thing SBF believed in is an error," Buterin tweeted. "It's important to actually think and figure out which things contributed to the fraud and which things didn't."

Market commentators have compared the FTX crash to the Lehman Brothers bankruptcy as well as infamous cases of fraud like Theranos, Bernie Madoff and Enron.

After failing to secure a rescue, FTX and 130 affiliates last week filed for Chapter 11 bankruptcy and Bankman-Fried stepped down from his position as CEO.

Still, for those who do broadly dismiss SBF, Buterin appeared to reference Adolf Hitler, who was a vegetarian.

"Don't be the guy who would have tried to cancel vegetarianism in 1945," the crypto cofounder wrote.

When crypto markets went into freefall earlier this year, Buterin tried to find a silver lining. After the token Terra had collapsed in May, he said that was something that could actually bode well for the sector.

He wrote in a blog post that the turmoil could be an opportunity to go back to "principles-based thinking," and warned against expectations for limitless growth in the cryptocurrency market.

Buterin urged investors to "evaluate how safe systems are by looking at their steady state, and even the pessimistic state of how they would fare under extreme conditions and ultimately whether or not they can safely wind down."

Shaurya Malwa

Tue, November 15, 2022

Whoever was behind last week’s $600 million exploit of crypto exchange FTX started moving millions of dollars in stolen funds during European morning hours on Tuesday.

The funds were siphoned from FTX's crypto wallets late Friday. Soon after, the exchange said on its official Telegram channel that it had been compromised, instructing users not to install any new upgrades and to delete all FTX apps.

Multiple addresses connected to the accounts drainer today transferred over 21,555 ether (ETH), or over $27 million, to a single address. These were later converted to stablecoin DAI on the swapping service CowSwap, blockchain data shows.

The addresses, over several transactions, amassed over $48 million of DAI and swapped it all into 37,000 ether. The address now holds over 288,000 ether and is the 35th-largest owner of the cryptocurrency, blockchain data pointed out by security firm PeckShield shows.

Separately, some stolen 7,420 BNB tokens, worth just above $2 million, were converted to 1,500 ether using BNB Chain-based exchange PancakeSwap. The exploiter then bridged the converted ether to the Ethereum network.

Marco Bello / reuters

Steve Dent ·Reporter

Tue, November 15, 2022

Bankruptcy documents filed by the crypto exchange FTX indicate that it currently faces more than 100,000 creditors, but that number could expand to over one million, The Financial Times has reported. The company also stated that it has been in contact with US federal prosecutors, as well as "dozens of federal state and international regulatory agencies" over the last few days.

FTX filed for bankruptcy last week following the sudden collapse of its exchange. Today, the Securities Commission of The Bahamas said it had received court approval to appoint two partners from the Bahamas and Hong Kong to oversea the unwinding of FTX Digital Markets, a key part of FTX. The filing called the state of affairs "unprecedented," noting that "barely more than a week ago, FTX, led by its co-founder Sam Bankman-Fried, was regarded as one of the most respected and innovative companies in the crypto industry."

In addition, the Royal Bahamas Police confirmed yesterday that they were working "to investigate if any criminal misconduct occurred," according to the FT. The day after the bankruptcy was filed, the company reported that millions of dollars went missing from crypto wallets following "unauthorized transactions." In addition, at least $1 billion worth of customer funds vanished from FTX prior to that.

FTX's troubles started after the price of its native FTT token plunged and numerous users withdrew their cryptocurrency. After it was reported that FTX was facing a liquidity crisis, rival Binance said it would sell off around over $500 million worth of FTT, all but wiping out the token's value. Binance then said it would take over FTX, but backed out of the deal a day later, citing concerns that emerged while carrying out due diligence. Bankman-Fried said he plans to eventually publish an account detailing exactly what happened to FTX.

LEON NEAL

Krisztian Sandor

Mon, November 14, 2022

The beleaguered crypto exchange FTX suffered a $400 million hack over the weekend, and at least one blockchain expert says the clues are point to a high-level insider who committed an amateur misstep that might have inadvertently revealed their identity.

The attacker appears to have “had access to all the cold wallet storages which he exploited,” Dyma Budorin, co-founder and chief executive of blockchain security auditing firm Hacken, said Monday in an interview with CoinDesk TV.

Hacken investigated blockchain transactions and found that the looter tried to send tether (USDT) stablecoin on the Tron blockchain multiple times unsuccessfully because they didn’t have enough TRX, the Tron network’s native token, in the wallet to pay for transaction fees. So the looter used their verified personal account on crypto exchange Kraken to send 500 TRX to the compromised wallet address to cover the transaction.

“He made a stupid mistake,” Budorin said.

Because of Kraken’s “know-your-customer” or KYC measures – part of the anti-money-laundering compliance requirements – and verification process, the exchange had information on who owns the personal wallet the TRX was sent from, revealing the identity behind the exploit.

Hacken immediately contacted Kraken’s security team about the transaction, Budorin said.

“We know the identity of the user,” Nick Percoco, chief security officer of crypto exchange Kraken, said in a tweet Saturday. Percoco added he was told that FTX or the exchange’s founder and former chief executive, Sam Bankman-Fried, will release an official statement.

Budorin said that the exploit demonstrated that the way FTX managed its cold wallets was “very poor.”

FTX suffered a hack late Friday night, resulting in more than $600 million in digital assets leaving the exchange's wallets in a flurry of withdrawals. FTX's new CEO, John Ray acknowledged that the exchange had been "compromised," and said that it was taking “precautionary steps…to mitigate damage upon observing unauthorized transactions.” Hacken found that one entity, which Budovin suspects to be an insider, siphoned about $400 million from the exchange.

Read more: 'FTX Has Been Hacked': Crypto Disaster Worsens as Exchange Sees Mysterious Outflows Exceeding $600M

New details about the exploit led to speculation on crypto Twitter that possibly FTX owner Sam Bankman-Fried or someone in his close circle could have been behind the exploit, given the access to FTX's cold wallets.

Asked whether Bankman-Fried was the owner of the compromised wallet the exploit originated from, Budorin said that “this is confidential information,” but he added that the wallet’s owner is a U.S. citizen. Budorin did not return CoinDesk’s request for additional comment at publication time on how he obtained information about the hacker’s citizenship and whether Kraken shared any personal data with Hacken of the account’s holder.

A Kraken spokesperson said that the exchange is “in contact with law enforcement, and has frozen Kraken account access to certain funds we suspect to be associated with ‘fraud, negligence or misconduct’ related to FTX,” according to a statement sent in email.

Of course, blockchain-savvy criminals can be sophisticated, so it’s possible that the mistake was a red herring the looter intentionally provided to mislead the investigation – by stirring some confusion.

“It’s very common for a scammer to use a fake KYC (know-your-customer) account so that authorities go chasing the wrong person,” Cryptogle, a blockchain sleuth, told CoinDesk.

Top exchange FTX and its corporate-sibling trading firm Alameda Research were the crown jewels of Bankman-Fried’s crypto empire, which imploded in spectacular fashion last week after a bank run on FTX’s deposits revealed that it had lost billions of dollars of digital assets that belonged to customers.

The whole conglomerate, 138 firms altogether, filed for bankruptcy protection Friday after rescue plans failed, triggering several investigations.

LEON NEAL

Krisztian Sandor

Mon, November 14, 2022

The mysterious looter of bankrupt crypto exchange FTX, who is likely an insider according to a blockchain expert, holds $339 million of digital assets that they drained from the exchange late Friday, according to crypto intelligence platform Arkham Intelligence.

Arkham found that the wallets associated with the exploiter hold $215 million in ETH, the native token of the Ethereum blockchain, $48 million in Maker’s stablecoin DAI, $44 million in BNB, the Binance ecosystem’s native token, $4 million in Tether’s USDT stablecoin on the Avalanche blockchain and $3.8 million of MATIC on Polygon’s Matic bridge.

Some $20 million in PAXG, a Paxos stablecoin linked to the price of gold, was frozen when Paxos was ordered to blacklist the accounts by U.S. authorities, preventing the holder from moving or cashing out the tokens.

Late Friday night, the insolvent crypto exchange FTX of Sam Bankman-Fried, suffered suspicious outflows exceeding $600 million, as CoinDesk reported. One entity at the center of the exploit siphoned off about $400 million from the exchange’s crypto wallets. The attack came after FTX, and the other 137 firms of Bankman-Fried’s crypto conglomerate, filed for bankruptcy protection the same day.

The hacker acted hastily based on their behavior on the blockchain, according to Arkham’s report. They used various decentralized exchanges to convert tokens, including UniSwap, 1inch and CowSwap, and struggled to dump coins such as MATIC, LINK and PAXG divided into smaller amounts to prevent losses from slippage.

After tracing the attacker’s blockchain transactions, Arkham found that they “appeared to be in panic” and “lost a large amount of their token holdings” when they moved assets across different chains to avoid getting caught. In a likely attempt to consolidate their holdings, they also converted tokens to ETH and DAI on the Ethereum network, movements that cannot be easily sanctioned by authorities.

“It is becoming clearer by the day that the FTX exploiter is not very sophisticated,” Miguel Morel, chief executive of Arkham Intelligence, told CoinDesk. “They've hastily tried to do whatever they can with the funds, seemingly without much of a plan.”

The attacker also seemingly committed at least one amateur misstep. They flippantly tapped their verified personal account on crypto exchange Kraken to send enough TRX tokens to cover transaction fees, according to Dyma Budorin, CEO of blockchain security audit firm Hacken.

The unsophisticated maneuvers imply that there may be some hope to reclaim the funds the hacker took.

“I think it's only a matter of time before they're discovered due to their use of various off-ramps, and at that point it will just be about recovering the funds,” Morel said.

Brian Evans

Mon, November 14, 2022

Binance CEO Changpeng Zhao.

Changpeng Zhao called out FTX's Sam Bankman-Fried for the crypto exchange's collapse last week.

The Binance CEO said Bankman-Fried "lied to his users, his shareholders, regulators."

CZ also said SBF should shoulder most of the blame for the fall of FTX, which filed for bankruptcy on Friday.

Binance CEO Changpeng Zhao said Monday that Sam Bankman-Fried is largely responsible for the collapse of FTX, which filed for bankruptcy last week.

During a Twitter AMA event, Zhao was asked if Binance was partly to blame for FTX's crash by investing in it and giving it legitimacy.

He replied that he doesn't want to create a situation where Binance steps in anytime something goes wrong in the crypto industry, adding that "if a bad actor just wants to be a bad actor, you can't prevent it."

And in the case of FTX, "I think they were lying," Zhao said.

"They lied. FTX lied. I think Sam lied to his employees, his users, his shareholders, regulators all around the world and all the users. So yes, he should take most of the blame," he said.

Requests for comments were not immediately returned by FTX.

But Zhao also acknowledged that venture capital firms and others that invested in FTX, including Binance, should carry some responsibility as they didn't discover the problems in the crypto exchange, though they shouldn't compensate FTX users for losses.

Binance was engulfed in talks last week to rescue the faltering FTX from a liquidity crisis with a takeover plan.

But after signing a non-binding letter of intent last Tuesday to purchase FTX, Binance backed out of the deal the next day after finding more cause for concern when conducting due diligence.

Since then, FTX has gone from one of the crypto world's shinning examples of growth to filing for bankruptcy. Founder Bankman-Fried has also resigned as CEO.

Meanwhile, the Securities and Exchange Commission, the Commodity Futures Trading Commission and the Justice Department are reportedly investigating FTX, and the SEC is also reportedly investigating Bankman-Fried himself.

He was also interviewed over the weekend by the Bahamian police, which said it's scrutinizing any "criminal misconduct" at FTX.

The fall of cryptocurrency exchange FTX has drawn numerous comparisons to the collapse of Lehman Brothers, which sparked the 2008 financial crisis.

But a former Securities and Exchange Commission official likened FTX to the Theranos and Bernie Madoff debacles. Meanwhile, former Treasury Secretary Larry Summers said it's more like the collapse of Enron.

Tracy Wang, Nick Baker

Mon, November 14, 2022

Best-selling author Michael Lewis may have lucked into the story of a lifetime – quite the development given he has already published a long string of hit books including “The Big Short” and “Flash Boys.”

Lewis, according to a letter from Creative Artists Agency circulating in Hollywood, has just spent the past six months or so “traveling with and interviewing Sam Bankman-Fried,” the former billionaire whose cryptocurrency empire dramatically blew up this month after a CoinDesk scoop spurred fear that his business was built on a house of cards.

The Ankler, an entertainment industry newsletter, was first to report on the existence of the letter, saying it was sent Friday to potential buyers of film rights for the book. CoinDesk subsequently verified that the letter was indeed sent.

“His childhood, early success on Wall Street, embrace of effective altruism and the creation of a crypto empire that catapulted him in record time into the ranks of the richest people in the world seemed more than sufficient for a signature Michael Lewis book,” the letter said. “The events of the past week have provided a dramatic surprise ending to the story.”

The letter added: “Michael hasn’t written anything yet, but the story has become too big for us to wait.”

A voicemail message left with a senior publicist at Lewis’ publisher, W. W. Norton & Co., wasn’t returned.

There has been speculation for months that Lewis was profiling Bankman-Fried. When asked about that by CoinDesk in September, Bankman-Fried declined to comment.

Lewis is one of the most successful and famous non-fiction writers around. His first book, “Liar’s Poker,” was about his time working as a bond trader. “The Big Short” told the story of investors who successfully bet on the housing market blowing up in 2008, and “Flash Boys” described how computer-driven traders transformed Wall Street and highlighted an effort to fight back.

Lewis often builds his books around scrappy upstarts who challenge the status quo, like baseball executive Billy Beane from “Moneyball,” who helped popularize a more analytical approach to evaluating players, or Brad Katsuyama from “Flash Boys,” whose startup IEX – which Bankman-Fried’s FTX US agreed to invest in this year, creating a connection of sorts to Lewis – took on Wall Street incumbents like the New York Stock Exchange.

Lewis already said he planned to write a book that would discuss crypto. “I found a character through whom I can write about – it weirdly links up ‘Flash Boys,’ ‘The Big Short’ and ‘Liar’s Poker,’” he told Financial News in an interview published in August.

“I guess it is possible it will be framed as a crypto book, but it won’t be a crypto book,” Lewis told Financial News. “It’ll be about this really unusual character. You’ll learn all about crypto and you’ll learn about what screwed up market structure in the United States and so on.”

Lewis interviewed Bankman-Fried on stage in the Bahamas – where Bankman-Fried ran the business – at an FTX conference held in April. “There’s a status upheaval in the financial world, and you’re sitting right in the middle of it,” Lewis said to Bankman-Fried. Lewis was later seen sitting in the audience writing in his notebook.

Bankman-Fried’s business failed partly because Changpeng Zhao, the CEO of bigger crypto exchange Binance, said he planned to sell his holdings of a token issued by FTX. Chaos ensued, and Binance announced a deal to bail out FTX – which was withdrawn the next day.

Referring to Bankman-Fried and Zhao, the letter circulating in Hollywood said Lewis ”likens them to the Luke Skywalker and Darth Vader of crypto.”

Read more: Bankman-Fried’s Cabal of Roommates in the Bahamas Ran His Crypto Empire – and Dated. Other Employees Have Lots of Questions

NOV 14, 2022

Days after the FTX debacle, all eyes are now on rival Crypto.com.

Investors worried about the magnitude of the consequences caused by this shock wonder if there are not other corpses in the drawers of the crypto industry. Speculation is therefore rife.

For some Crypto.com could be the next cryptocurrency company to face a severe liquidity crisis as the collapse and bankruptcy of FTX is prompting greater scrutiny in the digital assets industry.

But the Singapore-based exchange’s CEO Kris Marszalek said the company’s exposure to crypto exchange FTX was minimal and had a “tremendously robust balance sheet.”

"We never needed to raise any funds,” he said during an interview hosted on its YouTube channel.

Marszalek claimed Crypto.com has an exposure of under $10 million to FTX when the firm went bankrupt on Nov. 11. Other investors have reported larger losses: venture capitalist Sequoia Capital said it lost $210 million to FTX, while the Japanese firm Softbank has quantified its losses at $100 million.

The chief executive officer said that Crypto.com had in the past sent $1 billion to FTX for the purchase of stablecoins, which are digital currencies whose prices move very little. But that the company had recovered almost all this sum before the bankruptcy of FTX.

"We've recovered everything,” Marszalek claimed. "Our exposure is less than $10 million. Those are the facts."

He did not say when Crypto.com got the money back.

'We've Never Used It'

The insolvency of FTX, which filed for Chapter 11 bankruptcy on Nov. 11, appears to have occurred when its founder Sam Bankman-Fried reportedly transferred $10 billion of customer funds from FTX to his cryptocurrency trading platform Alameda Research, according to Reuters, which cites two sources that "held senior FTX positions until this week."

FTX faces a shortfall of $1.7 billion, one source told Reuters, while the other source said between $1 billion and $2 billion was missing. Bankman-Fried, who resigned as CEO, was once hailed as the savior of the sector during the liquidity crisis of last summer. His company was valued at $32 billion in February and is now insolvent.

But Crypto.com is facing massive sell-offs in its Cronos (CRO) token, which is in free fall and down 41.6% over the last seven days, according to data firm CoinGecko. CRO has plummeted by 92.8% from its all-time high as investors are worried it could be the next crypto company to fail due to a lack of liquidity.

CRO was not used as collateral in any loans, not "even once,” Marszalek said.

"We’ve never used it and we haven’t needed to use it,” he said.

CRO is a "native currency of the decentralized Cronos blockchain with Crypto.com being one of the open-source contributors to a vibrant and growing ecosystem,” a Crypto.com’s spokesperson told TheStreet.

The downfall in the price of CRO is due to a "number of market factors,” she said. "We expect cryptocurrencies in general to continue fluctuating following the ongoing impact of the bear market and now compounded with the ripple effect caused by FTX.”

The price of CRO will not impact the liquidity and future profit margins of the company, the spokesperson added.

"However, its price has no impact on our ability to operate or our profitability. We are finishing our second year in a row at over $1B in revenue with more than 70M users worldwide, and our balance sheet is strong and we are cash flow positive."

Valuation of CRO rose on Nov. 14 by 13% at $1.7 billion, according to CoinGecko but this market value has fallen by nearly $17 billion compared to its all-time high reached in November 2021.

The market value of tokens issued by a crypto firm is an indication of the capitalization of the firm itself. In addition, FTX had used its FTT token as collateral on loans.

Trading Volumes Are Down

Customers of Crypto.com are also wary of buying and selling digital assets through the exchange as its daily volume dipped from highs of $4 billion in 2021 to about $284 million in October, according to data from Nomics. Investors have also increased the number of withdrawals from the platform, fearful of the stability of crypto exchanges.

The company’s audit is undergoing, but the timeline for its completion will not be immediate since audit firms "don’t work at crypto speed,” Marszalek said.

Criticism was heaped onto the company when it agreed to spend $700 million in a 20-year deal to rename the former Staples Center, home of the NBA franchise Los Angeles Lakers.

The company also spent millions to run ads during the Super Bowl, never mentioning the word crypto, but featured basketball superstar LeBron James who goes back in time to 2003 to tell himself "if you want to make history, you got to call your own shots.”

The Crypto.com tagline is: "Fortune favors the brave.”

Some of the ads during the Super Bowl were sold for $7 million for 30 seconds, NBC said.

The crypto exchange also invested money in using Matt Damon as a brand ambassador.

But Marszalek said the sponsorship was not a large investment.

"We pay a small amount every year, which amounts to around 10% of our revenue,” he said. "This is not crazy compared to other companies. "Growth to 70 million users is not possible without some investment into brand awareness.”

Sports teams welcomed the multi-million dollar partnerships in 2021 from cryptocurrency companies like FTX. Investors have often been wary of companies purchasing naming rights to stadiums because of the large investment. Many of those deals involving naming rights appear to be cursed and the companies who spent hundreds of millions of dollars wind up filing for bankruptcy protection in the future.

In 2021, FTX agreed to a 19-year deal to pay $135 million to change the name of the home of the NBA's Miami Heat to FTX Arena. The Miami Heat cut ties on Nov. 11 with the exchange.

Jocelyn Yang

Mon, November 14, 2022

Call it the “Alameda gap.”

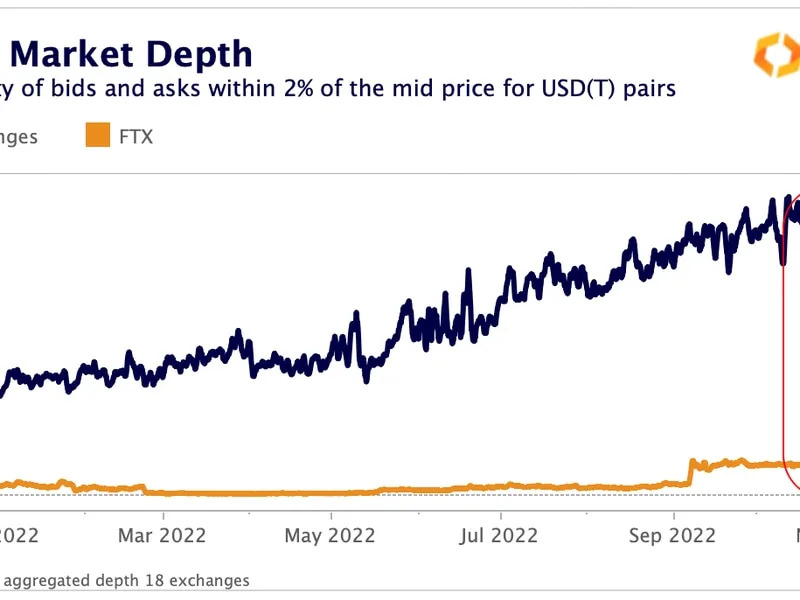

Last week’s collapse of Sam Bankman-Fried’s trading firm, Alameda Research, has left such a big hole in cryptocurrency markets that trading liquidity has thinned noticeably, according to a new report from Kaiko.

The drop in liquidity over the past week is far larger than in any previous market drawdown, and it could be “here to stay” in the short term, according to Kaiko – especially since other trading firms including Amber Group and Genesis Trading have reported funds being trapped on FTX.

Since Nov. 5, bitcoin liquidity within 2% of the mid-price has fallen from 11,800 BTC to 7,000 BTC, the lowest since early June, according to Kaiko, which analyzed data from 18 crypto exchanges.

Kraken’s bitcoin (BTC) market depth has fallen by 57%, Bitstamp’s by 32%, Binance’s by 25%, and Coinbase’s by 18%, according to the report.

Bitcoin market depth has fallen following the collapse of Alameda Research. (Kaiko)

Kaiko said ether (ETH) markets were also affected by the collapse, with 2% market depth, falling to late May levels.

BTC’s price fell more than 21% in the past seven days, trading around $16,200 as of Monday midday, while ETH was down 23% over the past week to $1,210.

Altcoins get hurt more

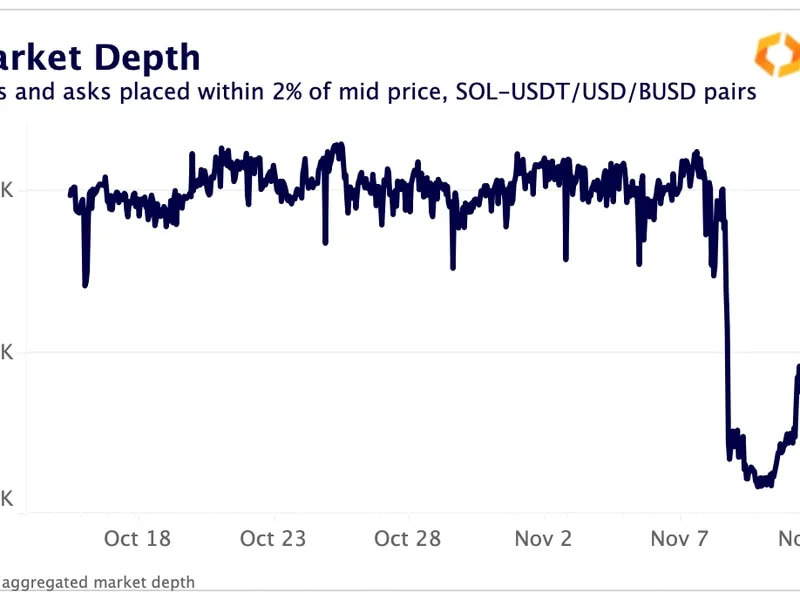

Kaiko said liquidity in altcoins might be “more concerning,” especially those that were significant holdings of Alameda, such as Solana’s SOL.

SOL’s total market depth has fallen 50% from 1 million SOL to under 500,000 SOL aggregated across all order books, according to Kaiko: “This drop was felt on every single exchange.”

Solan's SRM and MAPS tokens have also seen a plunge in depth, the report noted.

SOL’s total market depth has also fallen sharply following the collapse of Alameda Research. (Kaiko)

Solana’s SOL token dropped as low as $12.08 in the past 24 hours, hitting its lowest level in over 20 months, before settling back to about $13 Monday. SRM was one of the biggest losers in the CoinDesk Market Index (CMI) as its price fell 22% in the past 24 hours to $0.16.

“Alameda held a huge amount of illiquid tokens while (almost certainly) being a market maker for these same tokens, which put the firm in a nearly impossible position when faced with insolvency,” the report added.

Joe DiPasquale, CEO of BitBull Capital, said that market liquidity levels may stay under pressure until the Federal Reserve tempers its campaign to tighten monetary conditions.

“Even though the sentiment has been dented overall, the market will eventually recover, especially as macro contributors, like the Fed easing up on interest hikes, become dominant,” he said. “We expect the liquidity to remain relatively dry until the market begins to pick up and market confidence is restored.”

Tage Kene-Okafor

Mon, November 14, 2022

African web3 startup Nestcoin has laid off some employees as FTX's demise impacted its business. This information was shared by the startup's CEO, Yele Bademosi, who, in a tweet, said FTX's fall from grace affected his one-year-old startup, which held assets (cash and stablecoins) in the now-defunct crypto exchange to manage operational expenses.

Since Sam Bankman-Fried's crypto empire -- made up of FTX, Alameda Research and FTX Ventures -- collapsed last week, there have been various reports of companies whose money is stuck in FTX, its crypto exchange platform. Some of them include Galois Capital, a hedge fund with half of its capital stuck at the collapsed crypto exchange; Genesis Trading, which had about $175 million locked on the crypto exchange; and Multicoin Capital, the famed crypto and web3 venture capital firm that has nearly 10% of its assets under management trapped. Nestcoin joins that growing list (more names are becoming known by the day); it appears most, if not all, of its assets, are stuck in FTX.

According to several reports, companies with money stuck on FTX might get their money back depending on how much FTX's assets are ultimately worth. From its 23-page bankruptcy filing, FTX has more than 100,000 creditors, with assets in the range of $10 billion to $50 billion and liabilities within the same range.

Nestcoin raises $6.45M pre-seed to accelerate crypto and web3 adoption in Africa and frontier markets

Nestcoin, which Bademosi described in an interview with TechCrunch as a venture collective, is one of a handful of African startups that have received venture capital from FTX and Alameda Research, alongside 200+ foreign-based startups and investment firms, including Circle and Sequoia Capital. FTX, for instance, led a $150 million Series C extension round in Chipper Cash, an African cross-border payments company. Alameda Research, on the other hand, has backed Nigeria- and Kenya-based web3 company MARA; South African crypto exchange startup VALR; Congolese web3 startup Jambo; and Nigerian crypto exchange platform Bitnob. It's still unclear if these other startups held their assets in FTX, but there's a slight chance that might be the case, given what's come to light with Nestcoin, even though Alameda Research, its investor, has less than 1% equity.

"We used the closely-associated exchange, FTX, as a custodian to store a significant proportion of the stablecoin investment we raised, i.e., our day-to-day operational budget," said Bademosi in his tweet. "We were not undertaking any trading, but simply custodied our assets on the FTX exchange. While there are uncertainties, including the outcome of our assets held at FTX, we as a company have to adjust our plans, rethink our strategy and take steps to better position ourselves for the future."

To that end, Nestcoin, which Bademosi launched last February to build, invest and operate web3 and non-custodial products for customers in frontier markets across Decentralized Finance (DeFi), media, digital art and gaming, has had to reduce its headcount. According to two people familiar with the matter, Nestcoin layoffs will affect at least 30 employees from sub-departments, including Breach, its media arm; Brunch, a group messaging app with a crypto wallet; and Metaverse Magma (MVM), a gaming DAO that raised $3.2 million at a $30 million valuation two months ago. The remaining employees will see their salaries slashed by as much as 40%, the people said. On the other hand, Nestcoin noted that its products are DeFi protocols & non-custodial; thus, it has never held customer funds, and "this incident has no impact on our customers financially."

The rest of Bademosi's tweet reads:

While this is a challenging time for us and the industry as a whole - we see this as a wake up call to focus on building a more decentralized crypto future where no one organization or person can amass enough power to influence a nascent industry that has the potential to do good.

In the past few days I've strengthened my resolve and remain committed to "doing crypto" in line with its true spirit and founding ethos.

At Nestcoin we have a renewed sense of purpose -- we realize that for crypto to truly go mainstream, we must accelerate the transition to self custody by building compelling trustless crypt products. To succeed, we will remain relentless, resourceful and flexible as we navigate these hard times.

This is a developing story...

RIP to FTX?

Tristan Bove

Mon, November 14, 2022

Valerie Plesch—Bloomberg/Getty Images

It’s been called crypto’s Lehman Brothers moment, but the FTX crash has done little to dent the optimism of the industry’s remaining big players.

FTX—among the world’s largest cryptocurrency exchanges, which was once valued at $32 billion—filed for bankruptcy last week after reports that founder and CEO Sam Bankman-Fried had mishandled customer funds. Most of FTX’s assets were liquidated in the space of days. The collapse has eroded trust in the industry, and is a blow to investment firms, celebrity endorsers, and many of the 5 million users who stored their digital assets with FTX.

“A lot of consumer confidence is shaken, and I think basically we’ve been set back a few years,” Changpeng Zhao, CEO of rival exchange Binance, who is also known as CZ, said last week. He added that comparing the FTX crash to the 2008 financial crisis was “probably an accurate analogy.”

But despite depleted faith in the sector, several of its high-profile backers argue that FTX’s collapse does not mark the end of the line for crypto overall, even if it shows that the industry has a lot of growing up to do.

“We will prove all the naysayers—and there are many of these right now on Twitter over the last couple of days—we will prove them all wrong with our actions,” Kris Marszalek, CEO of exchange Crypto.com, said during a live Q&A session on YouTube on Monday.

Crypto’s backers

The FTX meltdown has been compared to the bursting of a market bubble, one that had been built on consumer belief but little substance, and that risks wide-reaching implications for the broader crypto industry.

But many long-standing supporters continue to be hopeful for crypto, despite acknowledging that more regulation is needed to avoid another collapse like that of FTX. Last week, for example, Binance’s CZ said that the market is likely to “heal itself,” but will need to become a much “healthier” industry through more regulation.

“Now regulators will rightfully scrutinize this industry much, much harder, which is probably a good thing, to be honest,” he said.

During his Q&A, Marszalek tried to differentiate Crypto.com from FTX by describing it as safe. He said it never engaged in any “irresponsible lending practices,” referring to the allegations levied against FTX and Bankman-Fried that they used customer funds to finance the investment operations of sister company Alameda Research.

“It’s not only important to look at how a certain company behaves during times of such stress, I think it's important to look at how we have behaved over the past couple of years and what actions we have taken as a company,” Marszalek said. He described Crypto.com as the “single most regulated company in the space,” citing licenses the company has recently obtained to operate in France, the U.K., and Canada.

Yet while praising Crypto.com’s safety, the company came under fire over the weekend when the CEO disclosed mistakenly sending Ethereum worth over $400 million to a wrong account three weeks ago. In a Twitter post, Marszalek wrote that the funds had been returned—just the latest in a series of snafus that also included mistakenly sending a woman $10.5 million instead of a $100 refund and only realizing it seven months later.

Many people have criticized U.S. regulators—primarily Securities and Exchange Commission Chair Gary Gensler—for failing to clamp down early enough on cryptocurrency companies. They say the lax oversight allowed for FTX’s implosion and the high-profile failures of a number of other crypto companies, including lenders Celsius and Voyager Digital.

Crypto’s growing pains

“The industry needs to grow up, and the regulators are coming into this space,” Michael Saylor, founder and current executive chairman of software company MicroStrategy and longtime cryptocurrency defender, told CNBC on Thursday.

When asked about what the FTX collapse meant for the crypto industry, Saylor said the future of digital assets is still promising, but only if regulators step in to steer the industry and protect users. “The marketplace is waiting for the regulators to say: ‘This is how you register a digital currency. This is how you register a digital commodity,’” he said.

Saylor also said that cryptocurrency is transitioning from its early “Wild West” stage dominated by small companies and startups to an “institutional digital asset stage” during which regulators and traditional banks are the leaders.

“We’re all just going to grow up, and the world is going to benefit from that,” he said.

Saylor—a major investor in Bitcoin, the largest cryptocurrency by market capitalization—argued that the poor track record of some digital currencies and crypto companies is tarnishing the rest. Those bad actors, he emphasized, do not reflect the industry as a whole.

“Speaking for all the Bitcoiners, we feel like we are trapped in a dysfunctional relationship with crypto, and we want out,” he said.

Saylor resigned as MicroStrategy’s CEO after his bets on Bitcoin led the company to lose over $900 million in one quarter.

Bitcoin, in 2009, was among the first decentralized cryptocurrencies to debut, and is also considered to be one of the more conservative and predictable digital assets. Last month, before the FTX chaos, Bitcoin’s volatility level—a metric of daily price changes—fell below that of the S&P 500 and Nasdaq for the first time in two years.

El Salvador President Nayib Bukele has also continued to back Bitcoin amid the current market downturn. Bukele made international headlines last year when he made Bitcoin legal tender in his country, the first nation ever to do so. Although the experiment has had mixed results, his enthusiasm for Bitcoin over other cryptocurrencies is still strong despite FTX’s crash.

“FTX is the opposite of Bitcoin,” Bukele wrote on Twitter Sunday. “Bitcoin’s protocol was created precisely to prevent Ponzi schemes, bank runs, Enrons, WorldComs, Bernie Madoffs, Sam Bankman-Frieds.”

This story was originally featured on Fortune.com

Stacy Elliott

Mon, November 14, 2022

In the past 24 hours, Alameda Research has moved $2.7 million worth of Serum, FTX, and Uniswap tokens into a wallet where the now-bankrupt trading desk has amassed $89 million worth of assets, according to on-chain data.

As of this writing, none of the wallets—all labeled as belonging to Sam Bankman-Fried’s crypto trading firm Alameda Research by blockchain analytics firm Nansen—have tried to move the funds since yesterday.

The transactions are just the most recent unexplained transfers by wallets belonging to Alameda Research following the Chapter 11 bankruptcy filing of FTX Group, which includes FTX.com, West Realm Shires (the parent company of FTX U.S.), and Alameda Research.

On Saturday, Alameda Research moved $36 million worth of funds—$31 million worth of BitDAO tokens (BIT), $5 million worth of SushiBar tokens, and $1 million worth of Render token

Alameda purchased 100 million BIT tokens last year from BitDAO, the decentralized autonomous organization that was founded last year by Singapore-based exchange Bybit and backed by Peter Thiel, the Thiel-founded Founders Fund, Pantera Capital, and Dragonfly Capital.

Alameda used FTT to purchase the BIT tokens and, as part of their agreement, the organizations agreed that neither would sell the other’s tokens before November 2024. Earlier this month, BitDAO demanded that Alameda prove it hadn’t liquidated the tokens after BIT suddenly dropped 20%. Now, all 100 million of the BIT tokens appear to be in the wallet where Alameda has been transferring funds from its other wallets.

Alameda, founded in 2017 by Bankman-Fried and Tara Mac Aulay, is a quantitative trading firm and the sister company to FTX. Bankman-Fried founded FTX in 2019 but didn’t step back from the day-to-day at Alameda Research until July 2021. When he did, Caroline Ellison and Sam Trabucco were appointed co-CEOs. Trabucco stepped down in August, saying on Twitter that he couldn’t “personally continue to justify the time investment of being a central part of Alameda.”

Alameda Research Co-CEO Sam Trabucco Steps Down to 'Relax'

Although Bankman-Fried maintained that Alameda Research, the trading desk, and FTX, the exchange, were separate entities, a leaked balance sheet has shown that Alameda was heavily dependent on being able to borrow customer assets from FTX.

The bulk of the assets in the wallet where Alameda has been sending funds consisted of $32 million worth of Tether and the $31 million BIT on Monday morning. Yesterday, the firm also tried to move $1.7 million worth of Ethereum from four separate wallets, but Etherscan says that the transfers failed because the wallets didn’t have enough funds to cover the gas.

Gas is the fee the Ethereum network charges in order to process transactions. Because crypto transactions don’t go through third parties, like banks or credit card companies, people sending funds pay network validators directly for processing their transactions. Those gas fees vary depending on how busy the network is or how quickly the sender wants the funds to reach their destination.

For example, when one of the Alameda Research wallets tried to move 936 ETH, worth approximately $1 million at the time, Etherscan shows the gas fee on the failed transaction would have been 46 gwei. That’s fractions of a penny (one gwei amounts to one-billionth of 1 ETH).

The wallet should have had enough ETH to cover it, but users are able to specify how much they’re willing to pay towards gas for a transaction. So it could hypothetically be the case that whoever controls that Alameda Research wallet didn’t want to pay 46 gwei to move the funds.

Adam Landis, the attorney representing FTX Group in its bankruptcy proceedings, did not immediately respond to a request for comment from Decrypt.

FTX has been under a lot of scrutiny for its on-chain activity since Friday, when the exchange and 134 other entities filed for bankruptcy. But hours later, $650 million worth of funds left wallets controlled by FTX in what it said were “unauthorized” transactions.

“Among other things, we are in the process of removing trading and withdrawal functionality and moving as many digital assets as can be identified to a new cold wallet custodian,” Ryne Miller, FTX General Counsel, wrote on Twitter in a statement from FTX CEO John Ray. “As widely reported, unauthorized access to certain assets has occurred.”

Since then, Bahamian authorities have said they did not order FTX to allow withdrawals from Bahamian users, as the exchange previously claimed on Twitter. On Thursday, after withdrawals had otherwise been disabled for all users, millions started moving off the exchange.

The Securities Commission of The Bahamas said on Thursday that it froze FTX’s assets and asked the Supreme Court to appoint a liquidator. By Saturday, after the unauthorized transactions, the Bahamas Police announced that they were investigating potential “criminal misconduct.”

Trouble started for FTX when a report surfaced showing that at least $5 billion of Alameda Research’s $14 billion balance sheet was in FTT, the utility token used to get discounts on trading fees on FTX’s crypto exchange. Both FTX and Alameda were founded and are owned by FTX CEO Sam Bankman-Fried, but he has always maintained that the two entities were separate.

Hundreds of Millions of Dollars Drained From FTX Overnight in 'Unauthorized' Transfers

Apart from the revelations about FTT, Alameda’s balance sheet also revealed that most of the company’s assets were held in highly illiquid tokens, such as Serum—the native token of the Solana-based decentralized exchange founded by Bankman-Fried.

The news prompted Binance to announce that it would be liquidating its FTT position, worth $580 million at the time. The news rattled investors, who withdrew billions from FTX over the course of 48 hours. Eventually, FTX ran out of funds to honor withdrawals and announced that Binance had expressed its intent to acquire FTX. But within a day, that deal fell apart and on Friday FTX filed for bankruptcy.

Annie Massa

Mon, November 14, 2022

(Bloomberg) -- In hindsight, Sam Bankman-Fried’s April interview with Bloomberg’s Odd Lots podcast was a harbinger of his epic collapse last week. He described a “box” that has value only because other people put money in it, and, when confronted with the idea that he described a Ponzi scheme, admitted there was a “depressing amount of validity” to that.

But what’s only now becoming clear is just how much of his cash, which ascribed value to countless crypto projects out of thin air, was coming from his complex web of 130-plus now-bankrupt entities.

A prominent example is Serum, one of the largest assets on FTX’s balance sheet. The exchange had $2.2 billion of the near-worthless token on its books before Bankman-Fried’s empire went bust last week, according to people with knowledge of the firm’s balance sheet. It also held similarly insignificant coins called Maps.me and Oxygen, said the people, who added that the document may not provide a full granular picture.

The most striking thing of all: It’s not clear who, if anyone, at the highest levels of FTX or Alameda Research, Bankman-Fried’s trading house, seemed aware of or involved in how much money they were giving to Serum projects, where it came from, or what it’d be funding.

Some specifics are emerging about the “magic impact” that Bankman-Fried described months ago. Interviews with people familiar with Serum and documents reviewed by Bloomberg News provide a glimpse of the missing accountability that played a central role in both Bankman-Fried’s rise and how he could tear an $8 billion hole in FTX’s balance sheet.

“At the time we did them, we thought those investments were positive expected value investments on their own merits,” Bankman-Fried said Monday in an emailed statement.

In the fallout, thousands of customers, employees, investors and brand ambassadors are processing why they put so much faith in one man, in a system meant to be trustless and transparent.

“Everyone thinks accounting and auditing is boring -- until something like this happens,” said Gabriella Kusz, chief executive officer of Global Digital Asset & Cryptocurrency Association, an industry consortium.

Within weeks of Bankman-Fried’s appearance on Odd Lots, the $60 billion TerraUSD and Luna crypto ecosystem collapsed. The aftershock contributed to the bankruptcies of hedge fund Three Arrows Capital, lender Celsius Network and broker Voyager Digital, among others, and rattled even digital-asset diehards. Bankman-Fried went on a bailout bender, configuring deals worth $1 billion.

If there was ever a full-blown crisis of confidence across the crypto industry, judging by the $200 billion of losses in the digital-asset market over the past week, that time is now.

Too Easy

For one founder building a project using Serum, getting tens of thousands of dollars from Bankman-Fried’s orbit was almost too easy.

The harder part was figuring exactly where the money was coming from.

The person, who spoke on the condition of anonymity for fear of retaliation, describes an increasingly unsettling process unfolding after securing an online introduction to Alameda Ventures, the firm’s VC arm, through an acquaintance.

A team of faceless Telegram correspondents associated with FTX-linked entities appeared in a group chat. One of them, identified only by the initials “JHL,” approved a grant without anything more than a slide deck, asking no questions about what the money would fund, according to messages reviewed by Bloomberg News.

No compliance review. No handshakes. No strings attached. The only condition: To receive the grant, they had to open an FTX.com account first.

A separate slug of money also raised alarm bells.

The official investment contract was signed by someone the founder had never met, nor interacted with, who had a listed address on the 21st floor of a business plaza in Panama, according to the document viewed by Bloomberg News.

Stranger still, when six figures’ worth of USDC stablecoin arrived, it became clear it originated from a crypto wallet belonging to FTX.com.

The person said they wondered privately whether the money could have been drawn down from customers’ assets on the platform.

They didn’t probe further.

Investigations Underway

FTX’s lax oversight, ad hoc spending and potential mishandling of customer funds are at the heart of what regulators in the US and Bahamas are now investigating. Even after filing for bankruptcy on Nov. 11, analysts say about $662 million in tokens mysteriously flowed out of both FTX’s international and US exchanges.

The collapse is already drawing comparisons to Lehman Brothers, Enron and Bernie Madoff’s Ponzi scheme -- another “vast explosion of wealth that nobody quite understands where it comes from,” as former Treasury Secretary Larry Summers put it.

Bankman-Fried could yet be in a league of his own.

FTX.com, a Bahamas-based exchange that took in customer money directly, ran up a $32 billion valuation since its founding in 2019, drawing in the biggest names in venture capital including Sequoia Capital, Tiger Global Management and SoftBank Group Corp. and using endorsements from Gisele Bundchen and Tom Brady to tout its services.

It lured more than 1 million traders from all around the world by allowing them to borrow large sums for highly speculative wagers on the price movements of more than 300 virtual currencies.

Even though Bankman-Fried assured customers that they were protected, the reality is they were at the mercy of oftentimes violent swings in the crypto markets. The day before its bankruptcy filing, FTX held $900 million in liquid assets against $9 billion of liabilities, according to the people familiar with its balance sheet.

That shortfall ballooned in large part because many of the tokens, like Serum’s, hold no obvious inherent value -- as Bankman-Fried himself explained. The Serum protocol, built on the Solana blockchain, emerged two years ago with a vague promise to offer an order book-based decentralized exchange. In return, investors including Tiger Global showered the project with tens of millions of dollars.

A Tiger Global representative didn’t immediately reply to a request for comment.

Hype Man

But in the brave new world of decentralized finance, or DeFi, it was Bankman-Fried who proved to be the biggest hype man of all for new ideas.

Projects sprouted up all the time with his support -- Maps.me and Oxygen among them.

This new world of investing and protocols came with its own lexicon (multi sig wallets, Merkle trees, crosschain interoperability), making it difficult for outsiders to cut through to the underlying meaning, if it existed in the first place.

Oftentimes, it was Bankman-Fried who stepped up to break it all down, whether through professorial-sounding Twitter threads or with his signature banter on any number of podcasts and online videos.

In one interview, proselytizing Serum, he explained why it made sense to use Solana for the project.

“This gets back to, what’s the vision here?” he said. “If the vision here is to support the current power users as much as possible, then I think Ethereum makes a ton of sense. If the vision is to grow out the DeFi ecosystem to 10,000 times as big as it is right now, then I think not only do you have to look at alternatives, but I think there are fewer costs to doing so.”

Serum’s Struggles

Though the Serum protocol was supposed to hold so much promise as recently as January, when it received funds from 18 investors, development nearly ground to a halt just months after it began. Like many promising projects Bankman-Fried imagined, it didn’t fully materialize before FTX unraveled.

Other tokens left hanging on the FTX balance sheet tell a similar tale. Maps.me token, which claimed to be part of an “omnichain infrastructure” and listed on FTX ten months ago, comprised more than $600 million of its “less liquid” holdings. A sister token, Oxygen, was similarly billed as a pivotal piece of the rapidly developing DeFi infrastructure, with prime broker functions.

The tokens collapsed in the wake of FTX’s Chapter 11 filing, and are each worth fractions of a penny.

Just about every coin is feeling the pinch. Crypto altcoin Solana dropped as much as 14% on Sunday, while other altcoins including Polkadot, Avalanche and Tron fell between 1.7% and 5.4%. Dogecoin tumbled as much as 7.5%. Bitcoin remains near a two-year low and Ether is still down more than 70% from its peak.

For much of the past two years, crypto served as an extreme reflection of the mood in financial markets broadly. Not anymore: the S&P 500 posted its best week in more than four months as digital assets buckled and FTX hurtled into bankruptcy.

To blunt the crypto contagion effect, Binance CEO Changpeng “CZ” Zhao -- whose dumping of FTX’s FTT coin precipitated Bankman-Fried’s demise -- said on Monday that his exchange plans to set up an industry recovery fund. He didn’t specify how big it might be, or what it would take for a project facing a liquidity crisis to qualify.

It’s the kind of position in the crypto world previously assumed by Bankman-Fried.

Money Made

One of the key questions as FTX’s bankruptcy progresses is who got rich from FTX’s money spigot.

It’s an open secret that crypto, with its loose regulations, is fertile ground for pump-and-dumps, often called “rug pulls.”

But more pertinent to FTX is its close ties with Alameda -- a relationship it boasted about in its public white paper. Bankman-Fried claimed Alameda booked $1 billion in profit in 2021. Without the kind of guardrails keeping traditional financial institutions in check, the possible avenues of mischief are numerous.

Could Alameda view the levels of FTX customers’ margin, giving it knowledge of where to push prices to force customer positions to unwind? What boundaries existed to prevent the firm from jumping ahead of FTX users’ trades? With two corporate entities rolling up to Bankman-Fried, was the temptation to share information too tantalizing to resist?

Bankman-Fried and Alameda CEO Caroline Ellison, whose Massachusetts Institute of Technology and Stanford University imprimaturs and coveted roles at Jane Street, had an aura of untouchable genius and credibility with even the wonkiest math geeks. As more details come to light, it looks as if what they were doing wasn’t particularly sophisticated at all.

Regulators are scrutinizing whether it was above board.

The Bahamian police are working with the Bahamas Securities Commission to investigate whether there was any criminal misconduct in the collapse of FTX. He was questioned by Bahamian police and regulators Saturday, according to a person familiar with the matter.

Bankman-Fried and Ellison shrugged away concerns over conflicts earlier this year.

“We definitely have a Chinese wall in terms of information sharing” between the two, Ellison said when asked for a Bloomberg News article in September.

Yet four executives at FTX and Alameda are said to have known about a backdoor between the exchange and trading firm, according to a Wall Street Journal report.

As for Serum, it and other crypto projects are a long way removed from the “summer of DeFi” that it declared in a white paper around mid-2020. That was just as digital assets were on the brink of an epic boom that spawned Super Bowl ads, stadium naming rights and crypto bandwagoners who were all-too-eager to tell non-believers to “have fun staying poor.”

The paper also contained a note of caution for anyone willing to listen during those heady times.

“Serum isn’t perfect; nothing is.”

--With assistance from Yueqi Yang.

Binance proposes fund to save crypto from future failures

NEW YORK (AP) — Cryptocurrency exchange giant Binance is proposing the creation of a rescue fund that would save otherwise healthy crypto companies from failure, aiming to stave off the cascading effects of last week's implosion of FTX, the world's third-largest crypto exchange.

Binance founder and CEO Changpeng Zhao posted on Twitter Monday that his company would create “an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis."

Zhao provided no details on the fund's size or scope, or how the funds would be distributed.

The entire cryptocurrency universe is reeling from the bankruptcy of FTX, which was besieged with withdrawal requests in what has been the cryptocurrency equivalent of a bank run. It's the latest failure of a cryptocurrency firm this year, as the prices for Bitcoin, Ethereum and other cryptocurrencies have collapsed in value.

The broader effects of FTX's failure are still too early to determine, but there are other firms now facing withdrawal requests straining their systems. BlockFi and Crypto.com both said they were facing high withdrawal requests after FTX's failure.

Cryptocurrencies have no government backing, so there's no equivalent of deposit insurance or government backstop. What Zhao is proposing may be something similar to deposit insurance or a central bank-like entity for cryptocurrencies.

BY TRACY WANG AND COINDESK

November 11, 2022

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during the Institute of International Finance (IIF) annual membership meeting in Washington, DC, Oct. 13, 2022.

TING SHEN—BLOOMBERG VIA GETTY IMAGES

“Shocking” is a word that aptly describes the rapid fall of Sam Bankman-Fried’s cryptocurrency empire. To a surprising degree, it’s a sentiment that pours out from people who worked for him, people who you’d think would’ve had a clue.

How can that be? It may have something to do with a luxury penthouse in the Bahamas. That’s where 30-year-old Bankman-Fried is roommates with the inner circle who ran his now-struggling crypto exchange FTX and trading giant Alameda Research.

Many are former co-workers from quantitative trading firm Jane Street, others he met at the Massachusetts Institute of Technology, his alma mater. All 10 are, or used to be, paired up in romantic relationships with each other. That includes Alameda CEO Caroline Ellison, whose firm played a central role in the company’s collapse – and who, at times, has dated Bankman-Fried, according to people familiar with the matter.

CoinDesk spoke to several current and former FTX and Alameda employees who agreed to talk on the condition of anonymity, citing ongoing harassment and death threats due to the exchange’s solvency issues. And they said essentially this: It’s a place full of conflicts of interest, nepotism and lack of oversight.

“The whole operation was run by a gang of kids in the Bahamas,” a person familiar with the matter told CoinDesk on the condition of anonymity.

FTX and Alameda employees CoinDesk interviewed say they have been kept in the dark about the events of the past week, adding that only CEO Bankman-Fried’s inner circle may have had knowledge that the exchange, as reported by the Wall Street Journal, siphoned customer funds into corporate sibling Alameda.

“It’s been radio silence from Sam,” a second Bankman-Fried employee told CoinDesk on Wednesday. “When we saw the CZ [CEO Changpeng Zhao] tweet saying Binance was going to buy FTX, we honestly thought it was fake. But then Sam’s tweet just confirmed it.”

Bankman-Fried finally addressed employees later on Wednesday — a week after a CoinDesk article set the crisis in motion — writing, “I completely understand if you want to step away,” per an internal message to employees viewed by CoinDesk.

Among his nine housemates are FTX co-founder and Chief Technology Officer Gary Wang, FTX Director of Engineering Nishad Singh and Ellison of Alameda, Bankman-Fried’s trading business that’s at the center of the current chaos and on which the Wall Street Journal reported got $10 billion of FTX customer money. The remaining six are also FTX employees.

“Gary, Nishad and Sam control the code, the exchange’s matching engine and funds,” the first person familiar with the matter said. “If they moved them around or input their own numbers, I’m not sure who would notice.”

A third person familiar with how the company operated said: “They’ll do anything for each other.”

Bankman-Fried and Ellison did not respond to a request for comment sent directly to them. Wang and Singh could not be reached for comment. A spokesperson for FTX was also asked to pass on CoinDesk’s request for comment to Bankman-Fried, Ellison, Wang and Singh.

Bankman-Fried’s father, Stanford Law professor Joseph Bankman, also plays a role at the company. He appeared on an episode of the “FTX Podcast” in August, describing charity and regulation-related projects in which he was involved.

Wang, Singh and Ellison also comprise the board of Bankman-Fried’s FTX Foundation, the philanthropic arm of the company. Several housemates, including Bankman-Fried and Ellison, are active participants in effective altruism, a movement that “aims to find the best ways to help others,” possibly through philanthropy.

In the Bahamas, FTX and Alameda’s offices are also located steps apart in a coworking compound in the Bahamas that also housed Solana developers and other crypto incubation projects.

“All of the stakeholders would have a hard look at FTX governance,” tweeted Bankman-Fried on Thursday. “I will not be around if I’m not wanted.”

While some FTX employees have voiced approval for Bankman-Fried’s more frequent communication of late, others are not so consoled.

“Some employees kept their life savings on FTX,” the second anonymous employee told CoinDesk. “We trusted that everything was fine.”