Texas is taking steps that could cost BlackRock Inc., UBS Group AG and eight other finance firms business with the state after finding them to be hostile to the energy industry.

Glenn Hegar, the Republican state comptroller, on Wednesday named the firms he considers to “boycott” the fossil fuel sector. The move ends roughly six months of suspense that led Texas municipal-bond issuers to avoid banks whose status was unclear amid the office’s probe into companies’ energy policies. Governmental entities should use the list as a “filtration system” when entering contracts, Hegar said in an interview.

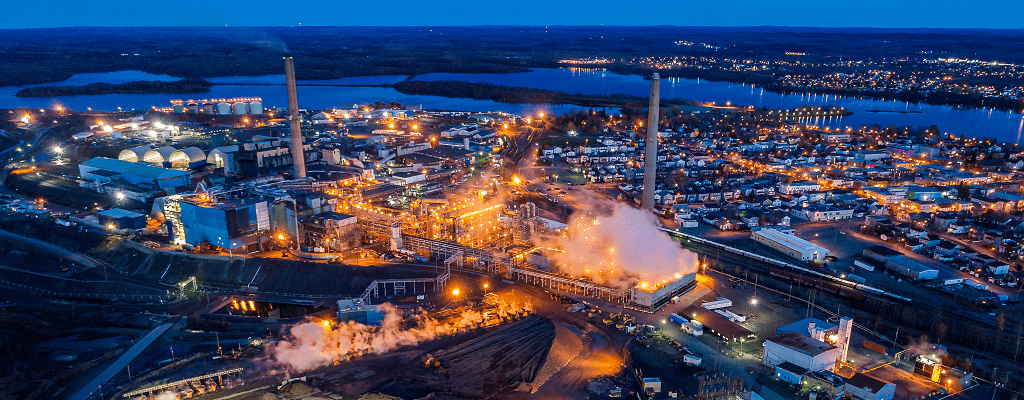

The comptroller sent inquiries to more than 150 companies in March and April, requesting information on whether they were shunning the oil and gas industry in favor of sustainable investing and financing goals. The survey was triggered by a GOP-backed state law that took effect on Sept. 1, 2021, and which limits Texas governments from entering into certain contracts with firms that have curbed ties with carbon-emitting energy companies. Texas is the nation’s top producer of crude and natural gas.

“The environmental, social and corporate governance (ESG) movement has produced an opaque and perverse system in which some financial companies no longer make decisions in the best interest of their shareholders or their clients, but instead use their financial clout to push a social and political agenda shrouded in secrecy,” Hegar said in a statement.

The announcement is the latest salvo in Republicans’ escalating fight against financial companies that have stepped into political and social issues. On Tuesday, Florida Governor Ron DeSantis eliminated ESG considerations for the state’s pension funds, passing a resolution along with other officials specifying that investments “must be based only on pecuniary factors.”

HEGAR'S LIST

The other companies on the list are BNP Paribas SA, Credit Suisse Group AG, Danske Bank A/S, Jupiter Fund Management Plc, Nordea Bank ABP, Schroders Plc, Svenska Handelsbanken and Swedbank AB. In addition, the comptroller’s office also designated nearly 350 funds that are subject to the same investment rules.

BlackRock, the world’s largest asset manager, said in an emailed statement that the company disagrees with the comptroller’s assessment.

“This is not a fact-based judgment,” the statement said. “BlackRock does not boycott fossil fuels -- investing over US$100 billion in Texas energy companies on behalf of our clients proves that. Elected and appointed public officials have a duty to act in the best interests of the people they serve. Politicizing state pension funds, restricting access to investments, and impacting the financial returns of retirees is not consistent with that duty.”

A spokesperson for UBS said the company also disagrees with the decision. “We provided their office with extensive information on our policies and practices, demonstrating that UBS does not boycott energy companies even under a broad interpretation of Texas law,” the statement said.

A Schroders spokesperson said the company doesn’t boycott fossil fuels and has US$19 billion allocated to companies active in the energy sector globally.

A Credit Suisse representative said the company would look to engage with the comptroller to resolve the matter, saying it doesn’t boycott the energy industry.

“As we noted in our response to the Texas comptroller, Credit Suisse is not boycotting the energy sector as the bank has ongoing partnerships and strong client relationships in the energy sector,” the statement said.

Spokespeople for BNP, Danske, Jupiter Fund Management, Nordea, Svenska Handelsbanken and Swedbank didn’t respond to requests for comment.

State pension funds including the Teacher Retirement System of Texas will be required to divest from the companies, though the law includes exceptions, according to Hegar. Within 30 days, state entities like pensions will be required to notify the comptroller of any holdings on the divestment list. The teacher’s pension had US$201 billion of investments in 2021, according to the system.

The list may be modified and the comptroller’s office said it will review information on an ongoing basis.

ESG SHIFT

The dust-up has its roots in a shift by some asset managers and banks to prioritize policies that take ESG factors into account. The firms say they’re simply responding to customer demand for strategies intended to do good for the world while also enriching investors. Because of their contributions to pollution and greenhouse gases that help fuel climate change, oil and gas companies are often excluded from ESG funds.

Dozens of firms defended their policies in responses to Hegar’s survey, saying they don’t boycott the energy industry but are required to act in their customers’ interests.

Hegar said in a statement that financial institutions are guilty of “doublespeak” as they “engage in anti-oil and gas rhetoric publicly yet present a much different story behind closed doors.”

BlackRock told Hegar in a May letter that it’s committed to helping clients invest in the energy industry. The firm said it oversees about US$310 billion of investments in energy firms worldwide, including in Texas companies.

The money manager landed on the list after being targeted by conservative lawmakers from a bevy of states. In August, 19 state attorneys general, including Texas’s, wrote a letter accusing BlackRock Chief Executive Officer Larry Fink of pursuing sustainable investments instead of shareholders’ profits.

To be sure, it’s unclear how the list will impact firms currently doing business with Texas and how exactly the statute’s provisions would be implemented. Lawyers will likely be wading through the details for months, examining allowed exceptions and parsing the fine print. One exception written into the new law says pensions aren’t required to divest from the banned companies if doing so would hurt their performance.

The law, Senate Bill 13, bars governments from entering into contracts of US$100,000 or more with companies unless the firms verify that they don’t boycott the energy industry. There are exemptions for that portion of the law, too. Municipalities can sidestep it if they determine that compliance would violate the government’s constitutional or statutory duties related to the sale of debt or management of funds.

Some Texas muni issuers had been skittish toward companies caught up in the comptroller’s probe, and now that the list is out, some underwriters that avoided being named by Hegar may find they’re freer to do business again.

The state’s public-finance market, one of the nation’s biggest, has also been roiled by a separate GOP-backed law targeting Wall Street for taking on policies around firearms. Bank of America Corp., Goldman Sachs Group Inc., and JPMorgan Chase & Co. haven’t underwritten a municipal-bond deal by the state or its municipalities since the gun law took effect in September.

Texas isn’t alone in attempting to punish Wall Street for pursuing ESG-focused initiatives.

States including Oklahoma, West Virginia and Kentucky have passed legislation this year targeting companies that engage in “boycotts” of the oil and gas industry. In July, West Virginia said it wouldn’t award state banking contracts to five firms: JPMorgan, Wells Fargo, Goldman Sachs, BlackRock and Morgan Stanley.