For the first time, an international team, including researchers from the Karlsruhe Institute of Technology (KIT), researched how and why new transmission lines can also lead to grids becoming more unstable rather than more stable, as would be expected.

A sustainable energy supply requires the expansion of power grids. However, new transmission lines can also lead to grids becoming more unstable rather than more stable, as would be expected. This phenomenon is referred to as the Braess paradox. Researchers have now simulated this phenomenon in detail for power grids, demonstrated it on a larger scale, and developed a prediction tool, which is to support grid operators in decision-making.

The researchers' report has been published in the journal Nature Communications. At the posting date, the report is not behind a paywall and for those more than casually interested quite useful. There are graphics and a more descriptive look at the Braess paradox.

The sustainable transformation of the energy system requires an expansion of the grids to integrate renewable sources and transport electricity over long distances. Such an expansion calls for large investments and aims to make the grids more stable. However, by upgrading existing lines or adding new ones, the grid may become more unstable rather than stable, resulting in power outages.

Dr. Benjamin Schäfer, head of the Data-driven Analysis of Complex Systems (DRACOS) research group at the KIT Institute for Automation and Applied Informatics, said, “We then speak of the Braess paradox. This phenomenon states that an additional option leads to a worsening of the overall situation instead of to an improvement.”

Related: Officials Issue Warning To Texas Oil Country As “Freak Storm” Approaches

The phenomenon is named after the German mathematician Dietrich Braess, who first discussed it for road networks: Under certain conditions, the construction of a new road can increase the travel time for all road users. This effect has been observed in traffic systems and has been discussed in biological systems. For power grids, it has so far only been predicted theoretically and illustrated on a very small scale.

Researchers Simulate German Power Grid Including Planned Expansions

Researchers led by Dr. Schäfer now have simulated the phenomenon in detail for power grids for the first time and demonstrated it on a larger scale. They simulated the German power grid, including planned reinforcements and expansions.

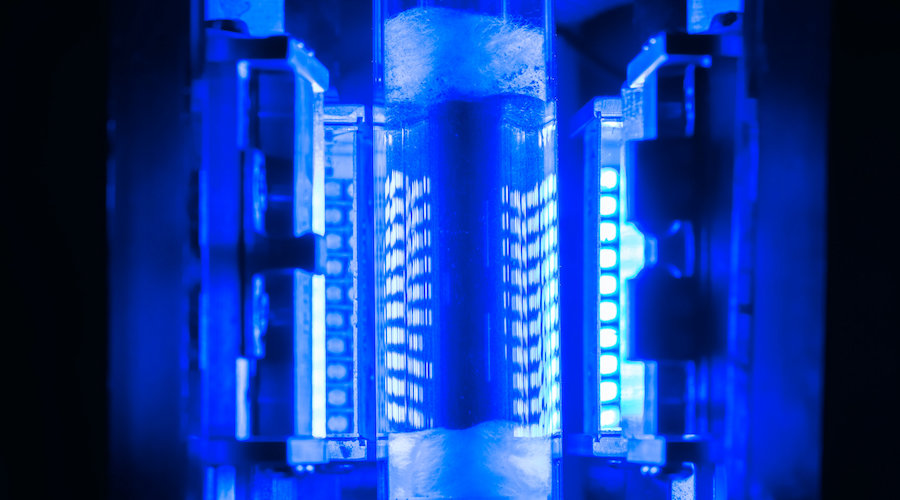

In an experimental setup in the laboratory showing the Braess paradox in an AC grid, the researchers observed the phenomenon in simulation and in experiments, placing special emphasis on circular flows. The latter is crucial to understanding the Braess paradox: A power line is improved, for example, by reducing its resistance and can then carry more current.

Schäfer explained, “Due to conservation laws, this gives rise to a new circular flow, and more current then flows in some lines and less in others. This becomes a problem when the most loaded line has to carry even more current, becomes overloaded, and eventually has to be shut down. This makes the grid more unstable and, in the worst case, it collapses.”

Intuitive Understanding Enables Fast Decisions

Most power grids have sufficient spare capacity to withstand the Braess paradox. When building new lines and during operation, grid operators examine all possible scenarios.

However, when decisions have to be made at short notice, for example to shut down lines or shift power plant output, there is only sometimes enough time to run through all scenarios. “Then you need an intuitive understanding of circular flows to assess when the Braess paradox occurs and thus make the right decisions quickly,” explained Schäfer.

With an international and interdisciplinary team, the scientist has therefore developed a prediction tool to help grid operators take the Braess paradox into account in their decisions. “The results of the research have enabled a theoretical understanding of the Braess paradox and provided practical guidelines for planning grid expansions sensibly and supporting grid stability,” Schäfer said.

***

At the time of writing, the grid situation is almost dire. In Europe, the crisis level is more pronounced than in the U.S. The war forced on Ukraine has impacted the entire world’s energy situation and no reports show any benefits. The rush to renewables in Europe has shown clearly that the demand levels and renewable production are very far apart and unlikely to close in the foreseeable future.

In the U.S. where the rush to renewables is less pronounced, the grid is still holding up. But the harshest part of winter weather is yet to come.

The war Russia has forced on the world has had two major impacts. The natural gas supply to Europe has stalled with heating issues starting and are sure to increase in severity. In the U.S., the current administration’s idyllic dream state about oil, gas and renewables hasn’t hit us quite yet. The pre-crisis clues are there, middle distillates such as diesel and home fuel oil are in very short supply, and the trend is headed for shortages. The fuel oil issue will impact the power grid, and the diesel shortage will affect everyone. There won’t be shortages of goods first, things will simply be undeliverable due to no truck fuel. The heavier crude oils needed to refine lots of diesel come from places like Russia.

The lesson is simple. The growth of new energy and fuel supplies is going to take Lots Of Decades, and no mandate from politicians or enthusiasm from special interest lobbyists is going to do anything but make things more expensive and worse.

Far better if you and I choose for ourselves. This winter, the lesson might sink in. Wishing you Good Luck and Wise Choices!

By Brian Westenhaus via New Energy and Fuel