Deutsche Bank studied 34 past U.S. recessions to identify key warning signs and found that all 4 are flashing red right now

Will Daniel

Thu, September 28, 2023

Predicting recessions is hard. There are simply too many incalculable, volatile variables—as we’ve seen with the war in Ukraine and COVID-19—that can throw a wrench in even the most well-respected of economists’ forecasts. And as Albert Edwards, a strategist at French investment bank Société Générale, explained in a recent note: “History shows that, to the (limited) extent economists do actually predict a recession, its tardiness usually means they give up waiting just at the point it arrives.”

Deutsche Bank’s economists aren’t giving up their recession prediction, however, despite the ongoing resilience of the U.S. economy. As the first major investment bank to forecast a U.S. recession back in 2022, experts at the 153-year-old German institution have stuck to their guns this year, warning of another unpleasant and unavoidable American “boom and bust cycle.”

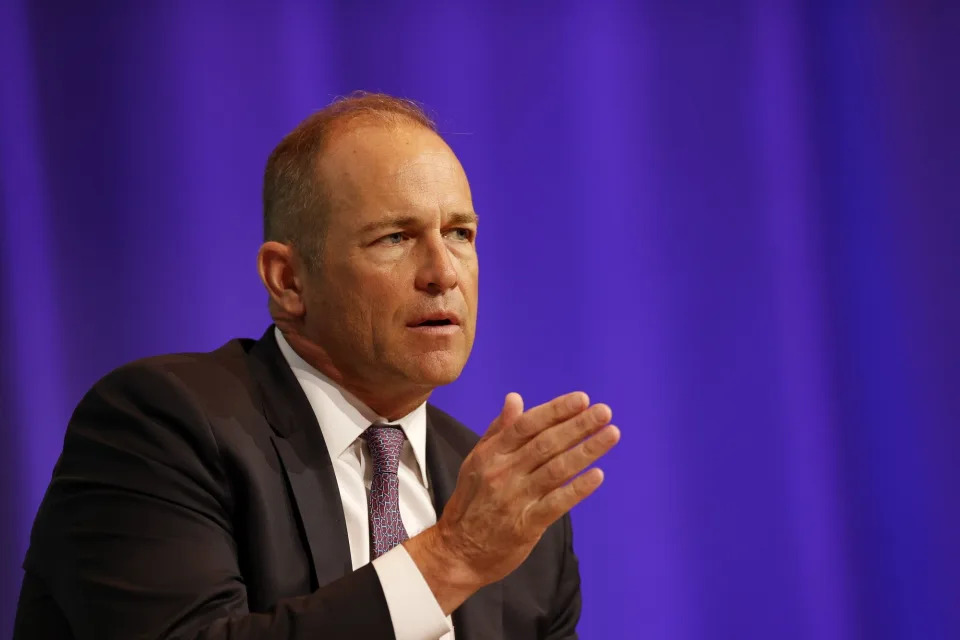

To back up their forecast, a Deutsche Bank team led by Jim Reid, head of global economics and thematic research, earlier this month analyzed 34 U.S. recessions dating back to 1854, looking for patterns in economic history. From the study, the group highlighted four key macroeconomic triggers that have caused recessions in the past: rapidly rising short-end interest rates, surging inflation, inversions of the yield curve, and oil price shocks.

For each trigger, Reid and his team calculated a historical “hit ratio”—or the percentage of times when these events occurred that led to a recession. They found that no single macroeconomic trigger can accurately predict a recession, but all four of the ones that are most commonly associated with recessions are happening right now.

“It’s impossible to accurately predict every recession using macro triggers,” Reid wrote in a follow-up discussion of the study on Thursday. “But it’s fair to say that the most significant ones [triggers] have been breached this cycle and that the U.S. tends to be more sensitive to these historically.”

Here’s a look at Deutsche Bank’s recession triggers and their “hit ratios” when it comes to predicting a recession.

A rapid rise in interest rates – 69%

First and foremost, rising interest rates tend to weigh on economic growth by raising the cost of borrowing for businesses and consumers, which often leads to recessions. In the U.S., since 1854, when short-term interest rates have risen by 2.5 percentage points over a 24-month period, there has been a recession within three years around 69% of the time, according to Deutsche Bank’s study.

Over the past 18 months, the Federal Reserve has increased the Fed funds rate roughly 5.2 percentage points in an effort to tame inflation. Historically, as Deutsche Bank demonstrated in its study, this hasn’t ended well for the economy.

“The U.S. seems to have the most sensitivity to interest rates,” Reid wrote Thursday of the data, adding that “the U.S. cycle has historically been more boom and bust than others in the G7.”

An inflation spike – 77%

Inflation soared to a four-decade high above 9% in June of 2022, but it has since retreated to a much milder 3.7%. Still, historically, the U.S. economy hasn’t managed spikes in inflation very well. Since 1854, a three percentage point rise in inflation over a 24-month period has caused a recession within three years 77% of the time.

The U.S. economy “seems to have the most sensitivity to inflationary spikes,” Reid explained, noting that France, the U.K., and Germany all have lower hit ratios when it comes to high inflation starting recessions.

An inverted yield curve – 74%

Typically, the yield on long-term bonds is higher than the yield on short-term bonds because investors are taking on more risk lending their money out for a longer period of time. But sometimes, that equation can flip for a variety of reasons. When this happens, and short-term bonds end up yielding more than long-term bonds, it’s called a yield curve inversion.

U.S. Treasuries have been stuck in inversion since July 2022, and according to Deutsche Bank that hasn’t been a good sign for the economy historically. “On yield curve inversions, the U.S. again has the highest hit ratio at 74.1%,” Reid explained. “And focusing just on the period since the 1953 recession, that rises to 79.9%.”

An oil price shock – 45%

Brent crude oil prices have soared roughly 33% since June to over $95 per barrel, leading many economists to fear inflation could prove to be more difficult to tame than the Federal Reserve might have imagined.

However, Deutsche Bank actually found that oil price shocks are less likely to signal recessions than other macroeconomic triggers, at least in the U.S. When oil prices have spiked 25% over a 12-month period, the U.S. has experienced a recession 45.9% of the time historically. And even when oil prices have spiked 50% over a two-year period, a recession has only occurred 48.2% of the time.

This story was originally featured on Fortune.com