Analysis: if Bertelsmann, owner of Penguin Random House, buys US publisher, writers expect smaller deals and less choice for readers

AJ LEIBLING

If Bertelsmann does buy Simon & Schuster, authors will have one less publisher to sell new books to, creating downward pressure on advances.

Photograph: Alamy

Alison Flood

Mon 22 Mar 2021 THE GUARDIAN

Alison Flood

Mon 22 Mar 2021 THE GUARDIAN

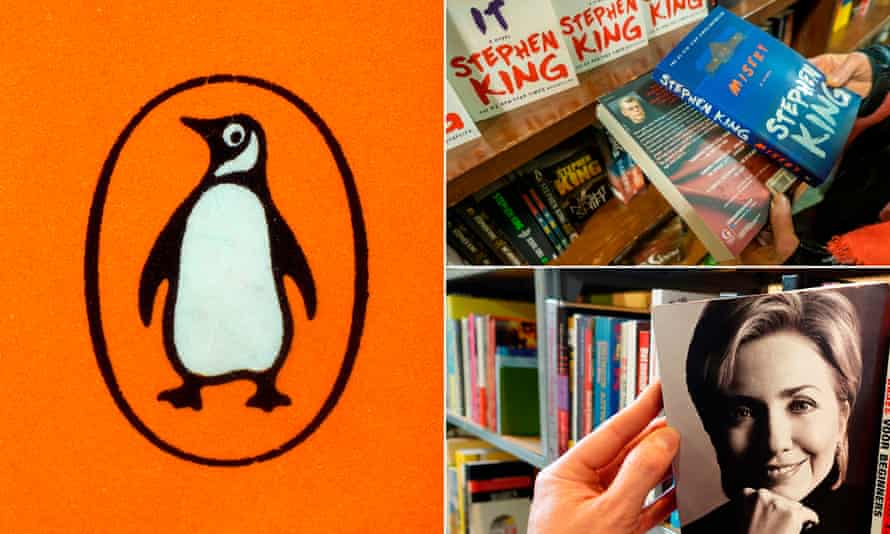

Jokes circulated online when, in 2013, Penguin and Random House merged: would the new mega-publisher, which became the world’s biggest trade publishing group, be known as Random Penguin? Penguin House? Now, as the prosaically named Penguin Random House’s parent company Bertelsmann’s $2.17bn acquisition of Simon & Schuster comes under scrutiny in the UK, the jokes are fewer and further between.

Authors have made it abundantly clear that they fear the fallout if the deal goes ahead. When it was first announced last November, the Authors Guild in the US was quick to register its objections. The acquisition, which would bring heavyweight S&S authors including Hillary Clinton, John Irving, Stephen King and Bob Woodward under the PRH umbrella in the US, would “creat[e] a huge imbalance in the US publishing industry”, it warned, calling on the US justice department to step in.

The Authors’ Guild’s UK equivalent, the Society of Authors, followed suit last month, urging the Competition and Markets Authority to take a look at a deal, which it warned could have “a generally anti-competitive effect on prices

for consumers and significantly adverse contractual terms for authors”.

The Authors Guild believes the combined Penguin Random House Simon & Schuster would account for approximately 35% of all book units sold in the US; Bertelsmann argues that it would be less than 20% in the US, and that the deal is therefore approvable.

THE GUILDS ARE NOT THE WRITERS UNIONS, WHICH WERE NOT CONTACTED NOR ARE THEY WRITERS ONLY DEFENSE THEY

HAVE PEN AS WELL, NOT ATTRIBUTED IN THIS ARTICLE

For the publishers, the increased size would give them extra clout in their all-important dealings with behemoth Amazon, and with other book shop chains. But, for authors, reducing the so-called “big five” publishers in the US to four would cut down their options, giving them fewer bidders for their manuscripts, thus driving down advances and making it harder for them to negotiate better deals.

The effect would be similarly profound in the UK, argues the Society of Authors, even though S&S is the ninth largest publisher in the UK in 2019, according to sales monitor Nielsen BookScan, with sales of £27m, compared with Penguin Random House’s £346m.

The UK competition watchdog has listened and is investigating; all eyes will now be on the US.

No comments:

Post a Comment