Bloomberg News | January 5, 2024 |

A coal mine pit located in Qinghai Province, China. Stock image.

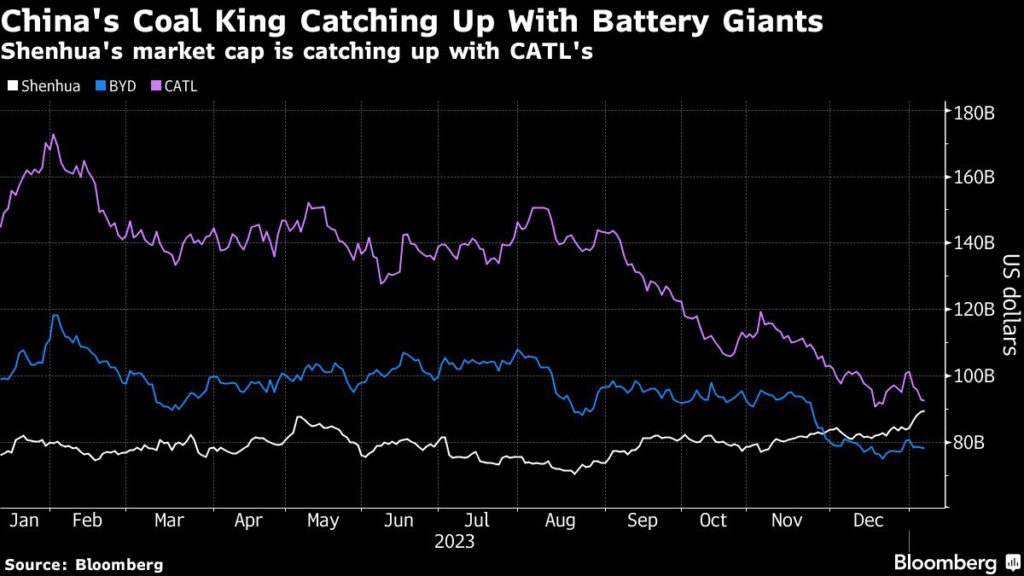

China’s battery giants are at the forefront of the global energy transition, but on the stock market they’re being outshined by the dirtiest fossil fuel.

Coal miner China Shenhua Energy Co.’s market capitalization is closing in on that of Contemporary Amperex Technology Co. Ltd. after surpassing BYD Co. in late November. It’s a stark difference from February last year, when CATL’s valuation was more than double that of Shenhua’s.

The diverging fortunes underscore the staying power of fossil fuels even as the world tries to decarbonize. Shenhua, China’s largest listed coal miner, has seen its shares rise 23% in the past year as authorities pushed mining output to record highs in a drive for energy security. The company’s shares in Hong Kong are near the highest level in more than a decade.

CATL and BYD’s share prices have plunged even as they’ve experienced real-world success. CATL dominates global battery sales, but increased competition has sent prices for energy storage devices falling. BYD overtook Tesla Inc. last quarter to become the world’s biggest electric vehicle producer, but is mired in a price war with rivals.

Still, analysts are betting on a rebound for the companies behind the energy transition. The average 12-month price targets for CATL and BYD are 74% and 61% above current levels, according to data compiled by Bloomberg. By contrast, Shenhua shares closed just above the average target on Thursday.

(By Dan Murtaugh)

No comments:

Post a Comment