It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Saturday, November 22, 2008

Auto Solution II

KEN LEWENZA

national president, Canadian Auto Workers union

November 20, 2008

Your editorial demands CAW concessions as part of any deal to restructure the North American auto industry (Keeping A Foot In The Car Door - Nov. 19).

The CAW was the first major player in the North American industry to respond pro-actively to the devastating effects of the financial crisis and credit crunch. Our new three-year contract freezes wages, suspends cost of living protection, and introduces, once fully implemented, savings totalling $300-million per year (or more than $10,000 per worker, per year) for Canadian auto makers.

Auto labour costs are significantly lower in Canada than in the U.S., Germany and Japan - yet our productivity is higher (at least 10 per cent better than in America).

We didn't write the free trade deals, we don't manage the companies, we don't design the vehicles - we just build them. The best thing we can do as auto workers is to keep building vehicles in the most efficient, high-quality plants in the hemisphere, at competitive costs.

CAW Ken Lewenza says; "We didn't write the free trade deals, we don't manage the companies, we don't design the vehicles - we just build them." And that's the problem. The solution to the auto crisis is not more concessions from the workers, thats been tried and it hasn't worked. Just as federal provincial aid have not helped because we lack a made in Canada Industrial strategy.

Jim Stanford, chief economist at the CAW, said newly signed contracts between the union and the Canadian arms of the Detroit automakers include several unprecedented givebacks, such as an 18-month suspension in cost-of-living increases.

A lack of policy attention from governments in both Canada and the United States have contributed to Detroit's collapse as much as anything else, he said.

"In Japan and Germany and Korea and now China, governments proactively nurture and support high-value export industries like autos. In North America, for the last two decades, we haven't bothered."

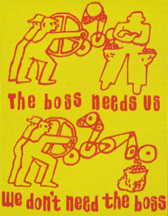

Rather the solution is right in front of all of us the workers should control auto manufacturing in Canada they should manage and design the cars not just 'build them'.

Ken if you don't want to discuss concessions then you better start talking about workers control of the means of production.

If there is to be a bailout, let it be for us, the workers. Who dare say we’re unqualified? In the 1920s Italian workers at Fiat and Alfa Romeo took over the plants, and they made cars without bosses. Even as we speak, workers in Venezuela are taking over plants and running them.

And I would add to that the Paris Revolution of 1968 and the Hot Autumn of 1969 when auto workers in France and Italy along with student radicals took over factories and universities and put them under worker control.

Capitalism is in a crisis it is time to socialize capital under workers control.

November 20, 2008

A suggestion for Big Three and UAW (updated)

Michael Nadler

My conceptual solution to the auto company bailout question is as follows:

The federal government makes a one-time only injection of the requested $25 billion into the Big Three in return for a proportionate ownership stake in the companies. Based on the current market capitalization of GM and Ford and my estimate of the market value of privately-held Chrysler, that would give the government about 80% ownership in the 3 companies. (A discount from the market price could be justified for such an investment, providing a higher ownership stake.)

The $25 billion cash injection is conditioned on the United Auto Workers (UAW) accepting a gift of the 80% (or higher) ownership stake from the government, giving the UAW absolute control of the 3 auto companies which will then be exempted from any anti-trust restrictions on consolidations, etc. The fate of the Big 3 and its workers will then be entirely in the hands of the UAW, which could strike the appropriate balance between compensation and competitiveness, as well as the many other issues that will determine the fate of the auto companies it now owns, the jobs they provide and the workers it represents. In that regard, the obligations of the PBGC might be limited as part of this grand bargain.

Workers' control of the means of production?

One of the most influential books on my political outlook when I was first getting politically aware was Geoff Hodgson's The Democratic Economy, published by Pelican Books in 1984. In it he advocated an economy predominantly consisting of worker-owned enterprises: market collectivism, to use a phrase of Jaroslav Vanek. In a Market Collectivist economy, argues Hodgson(p.177), "The workers are self-managed: they do not work under the direct or indirect control of a capitalist...the workers (collectively) own the product of their labour, which they bring to the market for sale."

SEE:

We Own GM

Auto Solution

tags

MGuinty, GM, concesssion bargaining, unions, trade union, Marx, Ontario, Corporate Welfare, Canada, cars, automobilie, production, taxes, tax credit, investment, environment, hybrid, self-valorization,, self-management,, workers control,, autoworkers,, KEN LEWENZA,,CAW, Big Three Auto,, libertarian socialism, automobile, Frank Stronach, Magna, business unions, auto parts, workers, layoffs, plant-closings, workers-control, unions, labour, Canada

Friday, November 21, 2008

We Own GM

As the Toronto Star reported Saturday, GM's actuaries estimated the pension plan for hourly workers would have been short $4.9 billion if the company had gone out of business at the end of November, 2007. But because the pension fund is heavily invested in stocks, the recent fall in stock markets would have left the fund short another $1.5 billion, assuming no other changes in the meantime.

Paul Duxbury, an actuary who has advised GM pensioners in the past, said yesterday that such a shortfall would cost Ontario's guarantee fund as much as $3 billion, if the province provided the money.

The General Motors of Canada Ltd. pension funds had a shortfall of $4.5-billion as of last November - before the stock market collapse - creating a massive financial headache for the Ontario government and pension cuts for retired employees if the company falls into bankruptcy protection.

Senior GM officials revealed the shortfall between the assets in the company's unionized and salaried plans and their liabilities in a meeting yesterday with the editorial board of The Globe and Mail. The shortfalls are measured on a solvency deficiency basis, which would apply if the plans have to be wound up in the event of bankruptcy.

SEE:

Auto Solution

Whiners and Losers

Business Unionism Offers No Solution To Capitalist Crisis

Concessions Don't Work

And Then There Was One

Pension Rip Off

Buzz Off

Unions=Competitiveness

McGuinty Corporate Welfare

Is Delphi the Oracle of things to come?

How Ford Screwed Up

What's good for GM is bad for Workers

Unions the State and Capital

Chrysler Made In Canada?

tags MGuinty, GM, concesssion bargaining, unions, trade union, Marx, Ontario, Corporate Welfare, Canada, cars, automobilie, production, taxes, taxcredit, investment, environment, hybrid, self-valorization,, self-management,, workers control,, autoworkers,, Buzz Hargrove,,CAW, Big Three Auto,, libertarian socialism, automobile, Frank Stronach, Magna, business unions, auto parts, workers, layoffs, plant-closings, workers-control, unions, labour, Canada

Wednesday, November 19, 2008

Auto Solution

Make union pay cuts mandatory for auto aid

They claim that that Toyota and other import car manufactureres in the U.S. can produce cars cheaper then America's own. Well that is true. However the elephant in the room in this debate is the fact where Toyota and other import auto manufacturers set up shop is in Right To Work States, states which use right to work laws to ban unions.

As for Health Care costs this is the other elephant, in Canada and around the world the government provides health care except in two countries America and China. In the US the healthcare cost is a burden born by business and labour.

So what would a solution be do ya think? Hmm how about passing the the proposed first union contract law that was pending in the Senate; Employee Free Choice Act. You know the one that in the last days of the Presidential campaign became an issue for McCain.

And instead of either Clinton's of Obama's weak tea HealthCare reform, a universal healthcare program was adopted in the U.S. like it is in Canada.

Unionization of Toyota and other import car companies American workers would level the playing field as would creating a universal healthcare program.

While these would go a long way to really changing the auto industry in North America the only real solution is nationalization the auto industry under workers control. Something no one is talking about, including the UAW and CAW.

CAW President Ken Lewenza said the failure of even one of those companies would be a "devastating blow to the economy, a devastating blow to consumers out there and quite frankly devastating to our members."

Ontario, especially, would suffer, he told CTV Newsnet.

"It's not even imaginable what would happen in communities like Oshawa, Windsor, St. Catharines, Oakville. These communities are dominated by the auto industry."

Lewenza said the union has done its part to respond to the Detroit Three's shrinking market share, giving up hundreds of millions of dollars in concessions in collective bargaining.

However, Lewenza didn't blame management either, saying "nobody anticipated at the beginning of this business year we would be selling 12 to 13 million vehicles in the United States, when most people were anticipating 16 or 17."

Oh come on now quit apologizing for your bosses incompetence. What part of Climate Crisis did you miss? I mean for christ sakes the NDP proposes a Green Vehicle plan three years ago and what does CAW get fromall its politcal pull and lobbying? An investment in GM by the Ontario Government for a Camaro plant. Is that counter intuitive or what.

If we are going to produce green vehicles then it will take a complete restructuring of the industry based not on concession bargaining but on workers control and workers ownership.

SEE:

Whiners and Losers

Business Unionism Offers No Solution To Capitalist Crisis

Concessions Don't Work

And Then There Was One

October Surprise Was The Market Crash

No Austrians In Foxholes

Pension Rip Off

tags

MGuinty, GM, concesssion bargaining, unions, trade union, Marx, Ontario, Corporate Welfare, Canada, cars, automobilie, production, taxes, taxcredit, investment, environment, hybrid, self-valorization,, self-management,, workers control,, autoworkers,, Buzz Hargrove,,CAW, Big Three Auto,, libertarian socialism, automobile, Frank Stronach, Magna, business unions, auto parts, workers, layoffs, plant-closings, workers-control, unions, labour, Canada

Friday, November 14, 2008

Huh?

History has shown that the greater threat to economic prosperity is not too little government involvement in the market - but too much.

Huh?

Hoover proves lack of government involvement led to the Great Depression. Here is Republican historical revisionism in it most blatant stupidity.Right wing American ideologues whether Republican, Conservative or Libertarian all try and avoid this obvious fact instead blaming the Smoot Hawley Act which was protectionist for the long Depression. In fact it was Hoovers hands off approach to the markets for three years that created the spiral downward. Smmot-Haweley and protectionist measures in Europe only agrivated that downward rush.

Bush, the Republicans, heck the liberals and the Libertarians in America live in a cloud cookoo land, one that imagines an artisan/farmer free market, free of monopolies, cartels and special business interests tied to the state. A time that is a fiction, a myth, of American Capitalism.

Ain't ever been such a creature nor is it the nature of American Capitalism and Imperialism.

Bush admits that capitalism is in a crisis; Faced with the prospect of a global financial meltdown

nations have responded with bold measures, and at Saturday's summit, we will review the effectiveness of our actions. This crisis did not develop overnight, and it will not be solved overnight.

And his solution is to keep on keeping on, capitalism is great, yep it has crisis, but heck its still the best system ever devised by humans.

This is a decisive moment for the global economy. In the wake of the financial crisis, voices from the left and right are equating the free enterprise system with greed, exploitation, and failure. It is true that this crisis included failures - by lenders and borrowers, by financial firms, by governments and independent regulators. But the crisis was not a failure of the free market system. And the answer is not to try to reinvent that system. It is to fix the problems we face, make the reforms we need, and move forward with the free market principles that have delivered prosperity and hope to people around the world.

Like any other system designed by man, capitalism is not perfect. It can be subject to excesses and abuse. But it is by far the most efficient and just way of structuring an economy. At its most basic level, capitalism offers people the freedom to choose where they work and what they do, the opportunity to buy or sell the products they want, and the dignity that comes with profiting from their talent and hard work. The free market system also provides the incentives that lead to prosperity – the incentive to work, to innovate, to save and invest wisely, and to create jobs for others. And as millions of people pursue these incentives together, whole societies benefit.

A nation that gave the world the I-Pod which is manufactured in China. Because as Reason magazine announced in 1999 that the world of the 21 Century was no longer America as the producer nation but America the consumer/service industry nation. A predicition that failed to understand that this would ultimately lead to a credit crisis, when a nation fails to produce value but rather lives on the value produced by others and lent to them.

Free market capitalism is far more than an economic theory. It is the engine of social mobility – the highway to the American Dream. It is what makes it possible for a husband and wife to start up their own business, or a new immigrant to open a restaurant, or a single mom to go back to college and begin a better career. It is what allowed entrepreneurs in Silicon Valley to change the way the world sells products and searches for information. And it is what transformed America from a rugged frontier to the greatest economic power in history - a nation that gave the world the steamboat and the airplane, the computer and the CAT scan, the Internet and the I-Pod.

Bush went on to defend capitalism, specifically post WWII American Capitalism, which itself is not a free market economy, but one of protectionism combined with state capitalism of the Military Industrial Complex. America subsidizes its aircraft manufacturerers, its agribusiness cartels, its auto industry, and has since WWII. To hear the President proclaim the glory of free markets and free peoples, is to also deny the hisorical reality which is American Capitalism. He further equates Japan's economic boom with American Capitalism, when in reality it is the result of State Capitalism. Japan used the Military Industrial Banking model for its development.

Ultimately, the best evidence for free market capitalism is its performance compared to other economic systems. Free markets allowed Japan - an island nation with few natural resources - to recover from war and grow into the world's second-largest economy. Free markets allowed South Korea to make itself one of the most technologically advanced societies in the world. Free markets turned small areas like Singapore, Hong Kong, and Taiwan into global economic players. And today, the success of the world’s largest economies comes from their embrace of free markets.

South Korea which itself is an other model of State Capitalism, with Military and Finance capital under a pro-USA military dictatorship finally evolving into a manufacturing fordist economy modeled on the success of Japan. As for Singapore and Hong Kong these two islands of free market economies are ruled by dictators, proving that capitalism can function without democracy.

Meanwhile, nations that have pursued other models have experienced devastating results. Soviet communism starved millions, bankrupted an empire, and collapsed as decisively as the Berlin Wall. Cuba, once known for its vast fields of cane, is now forced to ration sugar. And while Iran sits atop giant oil reserves, its people cannot put enough gasoline in their cars.

Oh sure free markets really work well, except Cuba is rationing sugar because they cannot compete with American subsidized sugar and the American led economic boycott of their country. No free market here.

As for the Soviet Union it collapsed because it lost the military race under Reagans expansion of military spending, the USA Military Industrial Complex defeated the Soviet Unions Military Industrial Complex. Capitalism did not defeat Communism, rather the American model of State Capitalism proved to be more flexible than the autarchic command economy model used in the Soviet Union. Unfortunately China proves that this autarchic command model can be flexible, and now American Capitalism is beholden to China for its national debt.

But Bush was not the only one to proclaim that Capitalism may be melting down but its still not the problem. In listening to their Republican masters voice, our own Finance Minister and PM echoed Bush's doctrine that capitalism has not failed.

In a piece in the Financial Times, meanwhile, Mr. Flaherty too had rare kind words for the invisible hand, downplayed grand global financial architectural plans and suggested that reform -- like charity -- should begin at home. "The open market system did not fail in this crisis," he said.

Prime Minister Stephen Harper is expected to join U.S. President George W. Bush in a defence of free-market capitalism and resistance to international calls for dramatic re-regulation of financial markets.

The ruling class recongizes that capitalism has once again failed, the bubble burst, the market crashed, what goes up must come down, the business cycle has not been superceded by globalization. The elephant in the room is socialism. The Republican Libertarian argument is to let the market decide, except contrary to their Libertarian dogma that market has come cap in hand to its State to bail it out. Opps. Guess real capitalism does not like the discipline of the marketplace. In attempting to not bail out the working class who is really suffering from this crisis with record home foreclosures, record unemployment and the very real threat of the meltdown of America's core manufacturing centre; Michagan, Bush and Harper need to couch the argument as a question of state intervention. The strawman they set up is to equate state capitalism, state intervention as socialism. Which it is not.

Capitalism cannot continue as it is. Temporary fixes like increased regulation, government bailouts etc. are not a solution to the crisis nature of capitalism. Socialization of capital is what is required. The fact that workers create captial, not business which only produces 'jobs', without workers capitalism collapses. This was clearly seen in Alberta last year during the height of the boom, when neither for love nor money could businesses find enough workers.

The result was many small businesses, you remember them they are the core of the economy according to Bush and Harper. closed.

Workers create captial, they circulate that capital by home purchases and by consuming the products they produce. They fund capital through their pension and benefit plans, pensions are called institutional investors in Wall Street, one of the largest sources of capital available currently.

The Canada Pension Plan fund said Wednesday it ended its latest quarter with a loss of more than $10 billion in the value of its assets, primarily because of the stock market turmoil that has battered share prices around the world.

But president and CEO David Denison said Canadians shouldn't worry that the loss will affect their current or future retirement benefits.

"This fund is designed to be able to withstand this short-term market volatility that we are living through, quite frankly better than any other fund in this country," Denison said in an interview with The Canadian Press.

Here is the true source of capital the working class blue, white and green collar, that produce and consume. And it is the means to change capitalism, the use of workers productive value matched by their pension funds and the corporate pension liabilities which are owed them, with capital from public pension funds, workers can then fund the corporations and run them themselves.

In Quebec there are labour funds as well as the Cassie Popular, the credit unions which have enormous reserves of workers capital to be able to use for promoting workers control of industry. In the rest of Canada workers whose credit unions are mimicing banks, need to take control of them and use this vast reserve of capital to invest in worker controled industries.

With the socialization of capital under workers control, the question of bail outs and regulation of the market become moot.

This is the socialism that Bush and Harper fear. This is why they distort the definintion of socialism equating it with state capitalism and command economies. Which socialism never was about. It is about the need to socialize captial to benefit those who create it; the working class.

It is the working class who are the real investors in capitalism, not those investors on Wall Street who play the market. The working class exists because of capitalism and capitalism exists because of the working class. As this crisis deepens and government intervention fails to stop the melt down, the only solution that will become clear is the need for socialization of capital under workers control.

SEE:

STFU 'W'

October Surprise Was The Market Crash

No Austrians In Foxholes

CRASH

The Return Of Hawley—Smoot

Canadian Banks and The Great Depression

U.S. Economy Entering Twilight Zone

What Goes Up...

Wall Street Mantra

Bank Run

Tags

unionization, labour, , economy, trade union, recession,

socialism,

capitalism,

workers control,

George W. Bush,

asset-backed commercial paper ,, goldhomes, mortgages, housing, bubble, US, economy, oil prices, sub-prime mortgage, Wall Street, crash, recession,Bernanke, Inflation, Staglation, Stock-Market, US, Federal-Reserve-Chairman, Oil, gold, commoditiesSmoot-Hawley, protectionism, tariffs, Herbert Hoover, U.S., U.S. economy, Canada, Great Depression, John McCain, market crash, free trade, Republicans, recession,

Tuesday, November 11, 2008

Business Unionism Offers No Solution To Capitalist Crisis

'Job killing' EI premiums hurt workers, employers as manufacturing sector lags

Critics say the current EI program fails jobless workers, many of who don't qualify for EI benefits because they have not worked the required number of hours, as well as employers, who worry about having to pay what Liberal MP John McCallum, an economist, calls 'job killing' EI premiums.

On the employee side of the debate, the push is for more generous benefits.

Not surprisingly, one of the few things employer and employee representatives agree is the need to refrain from increasing the 2009 EI premiums for employees or employers. The chief actuary of the EI commission has already recommended a freeze for 2009, and the commission is expected to take the advice when it announces the 2009 rates this week.

Corinne Pohlmann, vice-president of national affairs for the Canadian Federation of Independent Business, said the commission should go further and cut employer premiums. Continuing surpluses in the EI fund, estimated at $600 million for the last year, should be used to reduce the rate from the current of $2.42 per $100 of insurable earnings, she said in an interview.

The federation also wants the formula rewritten so employers and employees share the cost of the EI plan 50/50, or so that the government picks up a share of the cost. Employer premiums are currently 1.4 times higher than the $1.73 paid by employees.

The business federation and the CLC have both advocated - unsuccessfully so far - to give employers a 'premium holiday' for a period of time if they use the money to train employees.

The Conservative government's plan to move to a new system for setting EI premiums, starting in 2010, is causing jitters in some circles too. A newly-created EI financing board will set the premium rate each year "to generate just enough premium revenue during that year to cover expected payments" and to ensure a $2-billion reserve is maintained, according to government documents. Legislation establishing the new system became law last June.

Diane Finley, named last week to her former post as human resources minister, declined requests to discuss the EI system on grounds she is still getting briefed on the portfolio.

But Georgetti and McCallum said the system means that if the country's jobless rate worsens, as is expected, the board will either have to raise premiums the following year or cut benefits to meet its mandate.

"It has to be one or the other," said Georgetti. "That's the only way I have ever learned to balance the books. And neither one, in this environment, is the way to go."

Once upon a time the labour movement opposed child labour now they decry unemployment of the youth sector of the economy. These are kids working at Wal-Mart, MacDonalds etc., all of course in the non unionized sector.

Canadian Labour Congress: Public Works!

Now That the Election is Over, it's Time to Invest in Jobs That Last

Young workers, many of whom work in accommodation and food services, took a big hit in October. In total, 34,400 workers aged 15 to 24 lost their jobs. At the same time 27,000 people who earned their livelihoods in the accommodation and food services sector were out of a job last month.

And in their recently released paper on the global meltdown they sound more like economic apologists for capitalism than the voice of the working class. There is no discussion of using public and workers pension funds to finance the creation of worker controlled take overs of manufacturing in Canada. Showing that Canada's labour movement has lost the vision of building a new world within the shell of the old. Instead true to its nature as business unions the CLC calls for the state to bail out its bosses.

The Meltdown, Seen from Below

What union leaders, labour experts and anti-poverty activists say needs to be done.

The CLC has just issued a paper on its response to the current crisis titled "Global Capitalism: On the edge of the abyss." The paper says the global economy is now "almost certainly headed for a deep and prolonged recession," and notes that global markets have already fallen as far as they did in the Great Crash of 1929.

The labour group blames deregulated global finance for the crisis, pointing to what it calls "the unregulated shadow banking system of investment banks, hedge funds and private equity funds," and decrying the creation of "fiendishly complex and sometimes outright fraudulent products." The face value of these highly abstract and uncertain financial instruments, the paper notes, was recently estimated at over $50 trillion.

The CLC paper quotes Nouriel Roubini, professor of economics and international business at the Stern School of Business at New York University: "The crisis was caused by the largest leveraged asset bubble and credit bubble in the history of humanity.... a housing bubble, a mortgage bubble, an equity bubble, a bond bubble, a credit bubble, a commodity bubble, a private equity bubble, a hedge funds bubble are all now bursting at once in he biggest real sector and financial sector deleveraging since the Great Depression."

The CLC paper calls on Canada to play a role in creating a co-ordinated international response to the crisis that features re-regulation of both local and cross-border transactions and the imposition of a small transaction tax on all securities trading, including commodity futures. This Tobin Tax, named for the Nobel Prize winner who first suggested it, is designed to discourage short term speculation and to raise the government revenues that will be necessary to fund appropriate investments in social services and infrastructure repair.

Bail out tied to regulation

While many critics of the official response so far are asking why so much money is going into the banks and finance houses that created the crisis, the CLC endorses some bail-out activity as necessary to avert a systemic collapse. The bail out money must come, it cautions, tied to effective regulatory rules.

The CLC wants Canada Mortgage and Housing to re-finance distressed Canadian home mortgages at lower rates, dismissing the view that Canada is not experiencing a housing bubble as a myth. The $10 billion a year in new infrastructure investment the CLC calls for, says the paper, would create 200,000 new Canadian jobs rebuilding roads and bridges, mass transit projects, water works and the like as well as replenishing the country's diminished stock of social housing. A public letter recently signed by 80 prominent Canadian economists has echoed this call for an active and interventionist response by government to the economic crisis.

Further corporate tax cuts should be cancelled, the paper argues, in favor of direct government support for new investments in machinery and equipment, research, development and training.

Even if all these reforms are put into place, says the CLC paper, Canada may well experience serious increases in unemployment, which will expose weaknesses of the Employment Insurance program. Far fewer workers are eligible for EI as it now exists than was true in years past, and maximum rates and time allowed for coverage are both inadequate, according to the paper, which calls for broadened eligibility, higher maximum payouts and longer terms of coverage for the unemployed. The EI system currently has a surplus of over $50 billion.

Call for new pension protection

The CLC paper predicts the current financial crisis will create a severe pensions crisis, and a follow-up paper issued on Oct. 29 calls for the creation of a new pension benefit insurance scheme (financed by the proposed tax on financial transactions) to insure annual pension and RRSP benefits for individual Canadians up to $60,000 a year.

Pensions are a concern for Bill Saunders, too. Saunders, the president of the Vancouver and District Labour Council, says that Canadian workers and their pensions are more exposed to risk during market trouble because of the successful campaign over the past decades to move from defined benefit pensions, which guarantee a certain monthly amount when you retire, to defined contribution plans, promoted by market enthusiasts.

Contribution plans shovel a defined amount every month into mutual funds and other stocks, creating pension payouts that can vary widely depending upon the health of the market, as many Canadians are discovering this year as their RRSP holdings have shrunk dramatically.

"Twenty years ago," said Saunders, "60 per cent of Canadian private pension plans were defined benefit. Now that share has been cut in half. Defined contribution plans just don't deliver the goods for workers the way defined benefit plans do, and the current crisis illustrates that."

The final irony is that despite calls by the CLC to meet with Harper government it appears that labours agenda was accepted by the Premiers and the PM at their first ministers te'te' today.

Harper, premiers agree on infrastructure, pensions

Once again proving Herr Doctor Professor Marx correct:Trades Unions work well as centers of resistance against the encroachments of capital. They fail partially from an injudicious use of their power. They fail generally from limiting themselves to a guerilla war against the effects of the existing system, instead of simultaneously trying to change it, instead of using their organized forces as a lever for the final emancipation of the working class that is to say the ultimate abolition of the wages system.Karl Marx, Value, Price and Profit, Addressed to Working Men, The First International Working Men's Association, 1865.

SEE:

Concessions Don't Work

And Then There Was One

October Surprise Was The Market Crash

No Austrians In Foxholes

Pension Rip Off

Tags

unionization, labour, CLC, Ken Georgetti, economy, trade union, recession, EI, business unions,

CLC

Labour

Monday, November 10, 2008

Whiners and Losers

Now the Feds are denying the obvious as Jim Flaherty explains about a pending bail out for the auto industry in Canada, with nary a recongition that yes he indeed just did pick winners and losers in Canada's auto industry. Canada: Government is open to selective industry support

Mr. Flaherty said most economists would consider a bailout unwise, since such a

package puts government in the dicey business of choosing winners and losers.

Rather, he said, he would be guided by which plants have the best chance of

remaining viable over the long term.

"So if General Motors is going to build a hybrid car in Oshawa, people can understand that that is a good investment for the longer term. Operating a large truck plant, pickup trucks - probably not a good investment of taxpayers' money," Mr. Flaherty said.

His top priority, however, is to ensure that banks are lending to each other, and that credit is

available to corporate and household borrowers at a decent price. A

well-functioning credit market, he said, will help the manufacturing sector as

much as any kind of direct aid.

David Paterson, vice-president of corporate and environmental affairs for

General Motors of Canada Ltd., said the largest auto maker in Canada has not

outlined specific proposals to Ottawa, but supports calls for both immediate

assistance and a longer-term Canadian program similar to an existing $25-billion

fund Washington created this year. That fund is supposed to help the industry

develop more environmentally friendly technologies.

Mr. Paterson said GM is in the midst of transforming its business in Canada

to meet the sustainability objective Mr. Flaherty has outlined.

There ya go Jim ya picked a winner. But of course this is not a real industrial policy, nor what is needed to create a Made In Canada Auto Industry. Which of course is workers control of production through 'workers cooperatives owning the factories. Now that would be worth taxpayers dollars. Anything is else is the same old same old neo-con crap; public funding of private capitalism.

SEE:

Concessions Don't Work

And Then There Was One

October Surprise Was The Market Crash

No Austrians In Foxholes

Pension Rip Off

Deja Vu

The Failure of Privatization

Find blog posts, photos, events and more off-site about:

US, Auto, GM, Delphi, UAW, Pensions, layoffs, workers, bankruptcy, Chapter11,MGuinty, GM, Buzz, Hargrove, Camaro, Oshawa, Ontario, CorporateWelfare, Canada, cars, automobilie, production, taxes, taxcredit, investment, environment, hybrid, self-valorization,, self-management,, workers control,, autoworkers,, Buzz Hargrove,,CAW, Big Three Auto,, libertarian socialism, automobile, Frank Stronach, Magna, business unions, auto parts, workers, layoffs, plant-closings, workers-control, unions, labour, Canada,

Great Depression, John McCain, market crash, free trade, Republicans, recession, asset-backed commercial paper ,, goldhomes, mortgages, housing, bubble, US, economy, oil prices, sub-prime mortgage, Wall Street, crash, recession,October Surprise, Inflation, Staglation, Stock-Market, US, Federal-Reserve-Chairman, Oil, gold, commoditiesSmoot-Hawley, protectionism, tariffs, Herbert Hoover, U.S., U.S. economy, Canada, Flaherty, tax cuts, corporate tax cuts, politics, Conservativestaxes, tax-credit, budget, economy, government, Conservatives, Flaherty, HarperSalaries, Canada, wages, Economy,

Saturday, November 08, 2008

And Then There Was One

The collapse of the North American Big Three Automakers means that by the end of this collapse of capitalism there will be one left standing. And it won't be Ford, GM or Chrysler. It will be Toyota. Which means its time for a made in Canada auto industry, nationalized under workers control and producing green cars.

The collapse of the North American Big Three Automakers means that by the end of this collapse of capitalism there will be one left standing. And it won't be Ford, GM or Chrysler. It will be Toyota. Which means its time for a made in Canada auto industry, nationalized under workers control and producing green cars. After all the automobile industry in North America is actually an integrated oligopoly, its devolution to monopoly will threaten jobs and workers investments; such as their retirement pensions. The current crisis in production is based on the industry focusing on trucks and SUV's. Even Toyota has been affected.

What we see is the falling rate of profit, which was artificially kept up by consumer spending through credit. You now have finance capital dominating productive captial, and the result is that when the financial markets crashed so did the captial base for production. Its not like there is not real capital; workers and production facilities, availble for use production but rather they have been sold off to casino capitalists; hedge funds and private equity firms who are interested in making money off them by cutting them up and selling them. Those firms are directly linked to the ruling class in America, in particular the Republican Party, as Cerbeus management shows.

The fact that Cerbeus, a private investment firm, owns both Chrysler and GMAC, and wants to divest itself of both, with not a care about the impact on the real economy; workers lives, shows that capitalism is still as rapacious as ever, even as it approaches its state for hand outs.

The fact is that workers have invested capital and labour into these businesses, through concession bargaining, with their pension funds and with investment funds tied into their employers companies. Idle factories and laid off workers means a disaster for the real economy in Canada. Instead the government along with the unions should nationalize all car production in Canada, under control of the workers and through the investment of their pension funds, and the unpaid pension liabilities they are owed.

Workers control would mean direct worker management and control of the board of the corporation, and would mean a more flexible manufacturing regime that responded to consumer market choices. Canadians are buying smaller more efficient cars, and the market failed to respond in time to that fact. Under workers control factories would be more efficient and more productive as Alcan workers proved in Quebec when they took over control of their factory which was about to be closed and for several months made a profit and retrofitted the factory to be more environmentally sound, something Alcan had failed to do.

The elephant in the room is that capitalism will continue to face these economic meltdowns until it becomes socialized. While private capital asks the state to fund its failures it offers nothing to the workers that make their profits. The reality is that in order to really affect economic change, capitalism must evolve into socialism; that is worker control of production, and the socialization of investment and profit.

After all private capital is already reliant on workers benefit plans, pension plans, mutual fund investments, securities investments for retirement and in the U.S.; health care plans. As corporations bail out of these plans they look to the state to bail them out. But the state has failed to protect the investors; the workers. Rather than bail outs of capitalist finaciers it would be better that capital be socialized and invested in local production and national/international distribution under workers control.

The auto industry is being pummeled from all sides — by high gas prices that have soured consumers on profitable S.U.V.’s, by a softening economy that has scared shoppers away from showrooms, and by tight credit that is making it difficult for willing buyers to obtain loans. Both G.M. and Chrysler have been struggling with product lineups that are out of sync with consumer demand for smaller, more fuel-efficient cars.

If G.M., the nation’s largest automaker, combined operations with Chrysler, the smallest of Detroit’s Big Three, they would create an auto giant that would surpass Japan’s Toyota Motor Company, which recently has been battling G.M. for bragging rights as the world’s largest automaker.

GM, Ford losses worse than expected, burning cash

Losses force GM to slash 3600 jobs in Canada, US

Warning of cash crunch, GM cuts jobs and halts Chrysler talks

GM dealers feel squeeze from GMAC

With credit tight, GM's 'captive finance arm' is tightening terms on dealers and customers.

Auto major General Motors's already distressed sales are being hurt even more due to the conservative lending regime at its former captive financing arm GMAC Financial Services, according to Dow Jones.

GMAC Leaves Individuals Holding Car Lender's Junk (Update2)GMAC LLC may leave thousands of individuals on the hook for about $15 billion of junk-rated debt unless the auto and home lender finds a way to pay its bills.

GMAC, the largest lender to car dealers of General Motors Corp., issued more than $25 billion of debt called SmartNotes over the past decade to retail investors. While GMAC has paid off the debts as they matured, five straight unprofitable quarters raised doubt about GMAC's survival, and SmartNotes due in July 2020 have lost about three-quarters of their value.

``An investment like this is totally unsuitable for the retail investor,'' said Sean Egan, president of Egan-Jones Ratings Co. in Haverford, Pennsylvania, who rates GMAC bonds junk, or below investment grade. ``You're selling it to the widows and orphans who think of GMAC as being this strong, long- standing corporation when the reality is far from that.''

GMAC's losses since mid-2007 total $7.9 billion, driven by record home foreclosures and auto sales that GM has called the worst since 1945. Stomaching some of Detroit-based GMAC's deficit are individuals who purchased SmartNotes through brokers at firms including Merrill Lynch & Co., Fidelity Investments and Citigroup Inc.'s Smith Barney unit.

Chuck Woodall, 66, who lives with his wife in Columbus, Ohio, amassed $200,000 of SmartNotes starting eight years ago, and they now equal about 25 percent of his investments. At the time, the securities were rated investment-grade and they paid more interest than government bonds or certificates of deposit. They also were backed by Detroit-based GM, the biggest U.S. automaker.

Safe Ride

Woodall, a former owner of apparel stores and a pet-supply business, holds SmartNotes due in 2018 that he says have lost about 80 percent of their value. He said his Merrill broker told him that in more than 20 years, no client had lost money on bonds.

``He assured me they were safe,'' Woodall said. ``I just wasn't aware enough and didn't have my hand on the pulse.''

GMAC said Nov. 5 its mortgage unit may fail and analysts have questioned the viability of the entire company, which is now 51 percent-owned by New York-based Cerberus Capital Management LP. GM controls the rest.

Of GMAC's $64 billion in debt outstanding at the end of June, about $15 billion was in SmartNotes. They rank equal to senior unsecured debt, which recovers an average of about 40 cents on the dollar in bankruptcy cases, according to Mariarosa Verde, an analyst at Fitch Ratings in New York.

GMAC spokeswoman Gina Proia said the company ``has honored its commitments and intends to continue honoring its commitments to investors.'' She declined to elaborate.

Bonds Drop

SmartNotes maturing in July 2020 fell 6.5 cents on the dollar, or 20 percent, to 26.7 cents at 4 p.m. New York time, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority. The debt yields 35.8 percent, or 32 percentage points more than similar-maturity Treasuries, Trace data show.

Brokers traditionally handle the task of determining whether an investment is suitable for a particular investor, depending on factors such as assets, sophistication and tolerance for losses. Merrill spokesman Mark Herr, Steve Austin from Fidelity and Citigroup's Alex Samuelson declined to comment.

SmartNotes were introduced in 1996 by ABN Amro Holding NV's Chicago-based LaSalle Bank, which is now part of Bank of America Corp. in Charlotte, North Carolina. The notes include features designed to appeal to investors seeking interest income -- a concern for older people and retirees.

Prosperous Times

The notes were sold in denominations of $1,000 and offered a ``survivor's option,'' allowing spouses to sell the bonds back to the issuer if the owner dies. The SmartNotes program opened to European investors in 2004.

GMAC and LaSalle said in statements from 1998 through 2003 that the notes were intended for individual investors. Patrick Kelly, a LaSalle managing director, described the buyers in a 2003 interview as ``mom-and-pop investors.''

``If Wal-Mart sold bonds, these would be the bonds they would sell,'' Kelly said.

Back then, SmartNotes may have been safer bets. GMAC debt was rated BBB by Standard & Poor's, GM and GMAC were profitable, and the lender was still a wholly owned unit of the automaker. Sales of GMAC SmartNotes reached $1 billion in 1998, doubled the following year and exceeded $25 billion in 2003, when GMAC was on its way to earning $2.8 billion for the year.

`Gold-Plated'

``GM was considered a can't-miss company,'' said Thomas Smicklas, a retired high school principal and now a homebuilder in Wadsworth, Ohio, who started buying SmartNotes in 2003. Smicklas said he owns about $75,000 of short-term SmartNotes and hasn't lost any money. ``When the GM name is on something, many investors assumed it's gold-plated.''

By 2005, GMAC's debt was reduced to junk -- Moody's Investors Service now rates the firm seven levels below investment grade -- and GMAC continued offering SmartNotes as late as 2007. Today, S&P downgraded GMAC to CCC from B-, citing the lender's ``dire situation.'' Analysts have also raised concerns about the survival of GM, which today reported a $4.2 billion third-quarter operating loss and said it may not have enough cash to make it through the year.

Tom Ricketts helped create SmartNotes at ABN Amro before leaving in 1999 to start Chicago-based Incapital LLC, which earlier this year bought LaSalle's retail bond unit. Ricketts said his firm doesn't issue GMAC notes and sticks with investment-grade bonds. He recommends that individuals who buy them own a wide variety of assets.

Circumstances Change

``When you don't diversify in any portfolio, you expose yourself to risk that you're not getting paid for,'' Ricketts, 43, said in an interview. ``Typically, investment-grade corporate bonds are very good investments.''

GMAC and underwriters of its debt were sued in a 2005 class action that claimed the lender misrepresented SmartNotes in financial statements. A federal judge in eastern Michigan dismissed the case in February 2007, and the plaintiffs are appealing.

``In corporate bonds, time has shown that volatility, credit ratings and potential deterioration in credit means you may own something very different than what you thought you owned,'' said Michael W. Boone, founder of MWBoone & Associates, an investment advisory and money management firm in Bellevue, Washington. Boone said individuals should hold corporate debt only in mutual funds, ``where they have instant diversification and management.''

GM Workers' Risky Savings PlanForbes, NY - 6 Nov 2008It's bad enough that General Motors employees and retirees risk losing their jobs and their retirement benefits if the automaker runs out of cash and can't and can't scare up more bailout money in Washington. But many insiders also are in danger of losing $3.9 billion in savings through an investment once deemed as good as cash.

These investments, called GMAC Demand Notes, have been marketed over the years as a safe place for GM employees, retirees and others to park their money. For as little as $1,000, investors could buy a note paying well above most money-market accounts. (The current rate is 5.25%.) Many GM insiders have squirreled away their college and retirement funds in these notes.

Without a bailout, some industry analysts say GM--and perhaps Ford and Chrysler as well--could be forced to file for bankruptcy. If all three collapsed, the fallout would spread quickly to suppliers and would even temporarily shut down the U.S. factories of healthier foreign automakers. The Center for Automotive Research in Ann Arbor, Mich., says 3 million Americans would lose their jobs in one year, costing the government $60 billion in lost tax revenue.

Cerberus may give up GMAC control to get bank status: Bloomberg

NEW YORK (Reuters) - Cerberus Capital Management may pass its control of GMAC LLC to its investors so the financing unit can convert to a bank and get access to government funds, Bloomberg reported on Thursday, citing three people familiar with the matter.

A source familiar with private equity firm Cerberus said no determination had been made about the structure of GMAC.

Bloomberg reported that Cerberus is mulling a plan to distribute its 51 percent stake in embattled GMAC among investors in its funds.

By forfeiting its control of the company, Cerberus may help GMAC become a bank and get funding from the U.S. Treasury and Federal Reserve without requiring Cerberus to submit to banking regulations, Bloomberg said.

Cerberus led a group in 2006 that paid General Motors Corp $7.4 billion in cash for 51 percent of Detroit-based GMAC. GM owns the other 49 percent.

Dan Quayle offers hints about possible Chrysler-GM merger

Dan Quayle told a group of Phoenix businessmen that consolidation in the beleaguered auto industry is unavoidable, but provided few details on a possible merger of Chrysler Corp. and General Motors Corp.

“The analysts are looking at it,” the former U.S. vice president and current chairman of New York private equity firm Cerberus Capital LLC told attendees at an Enterprise Network breakfast Thursday morning. Cerberus owns Chrysler. “We’re not going to do the deal unless it’s a positive for our investors,” he said.

Quayle in 1999 unceremoniously dropped out of politics after George H.W. Bush, the man he served under, backed his son’s run for presidency.

But the international ties Quayle made during those four years in the White House proved invaluable when he returned to the private sector. Since his tenure at Cerberus began in 2000, Quayle has been instrumental in setting up offices in Japan –– a country he visits at least seven times a year –– and across Europe.

“You’ve got to know the people you’re doing business with,” he said.

Lobbying Washington

Chrysler Chief Executive Bob Nardelli joined GM CEO Rick Wagoner and Ford CEO Alan Mulally on Thursday in meetings with US House Speaker Nancy Pelosi and Senate Majority Leader Harry Reed. The three automakers lobbied the Democratic lawmakers, who increased their power in Tuesday's election that also saw Barack Obama elected president, for up to $50 billion in federal aid, sources said. The push for aid has been accompanied by increasingly dire warnings from industry executives and their political allies about the cost of inaction and the risk of a failure that would cost tens of thousands of manufacturing jobs. Chrysler does not release financial information. While executives, including Vice Chairman and President Tom LaSorda, once touted that lack of disclosure as a strength, the same lack of transparency could now complicate the automaker's efforts to seek aid under a federal rescue package. In addition, analysts have said Chrysler's ownership by Cerberus poses a political problem as a federal rescue could be criticized as a bailout for a secretive Wall Street firm known for its political contacts. Cerberus is chaired by former Bush administration Treasury Secretary John Snow and its board includes Dan Quayle, who was vice president under former president George H W Bush.

Quayle calls bailout necessary

Dan Quayle says he would never have believed that the Bush administration would bail out the nation's financial institutions, but that it was a necessary move for a precarious global situation.

"The whole international financial situation is one that was extraordinarily precarious," Quayle said Thursday. "That is why (Treasury Secretary Henry) Paulson did what he had to. We'll be reading books in a year or so about really how close I think we were to significant financial instability, much worse than what we're experiencing right now."

But Quayle said he expected things to turn around as the financial world figures out its comeback.

The former U.S. vice president is now chairman of Cerberus Capital Management, a New York private-equity firm that owns interests in Chrysler, GMAC Financial Services and about 50 other firms worldwide.

"We're in the great spots to be - automobiles, finance, real estate," Quayle joked.

The Case Against Giving GM and Chrysler a Hand

Here's a hot potato for the new commander in chief: Having just scored $25 billion in low-cost federal loans to develop fuel-efficient vehicles, General Motors and Chrysler are back, hat in hand, looking for more billions to assist their proposed merger. George W. Bush decided to pass on this one, leaving it to you. Can you blame him?

The biggest potential political problem here has nothing to do with Detroit and everything to do with Wall Street -- specifically Cerberus, a private-equity firm based in New York. Mr. Bush's former Treasury secretary, John Snow, is chairman; ex-vice president Dan Quayle has been a prominent spokesman; and the firm's chief executive, Stephen Feinberg, gives generously to Republican causes. Cerberus bought Chrysler from Germany's Daimler and owns 51% of General Motors' GMAC finance unit. It's hard to imagine a much riper target for Democrats and maverick Republicans looking for a scapegoat for the excesses that brought on the financial meltdown.

Now let's imagine some kind of GM/Chrysler bailout, which would inevitably be a Cerberus bailout. Our tax money would be going to help Messrs. Feinberg, Snow and Quayle out of a tight fix of their own making, Cerberus having shown spectacularly bad timing in plunging into a U.S. auto industry that's only getting worse by the month. Hmmm. I can just imagine what Lou Dobbs would do with that one. No doubt Cerberus will trot out a list of investors that includes pension funds, hospitals, universities and other worthy causes, all of whom stand to benefit, too. Good luck to them. Most people will see only private equity, the secretive, high-return, high-leverage, exorbitantly compensated vehicles that are off-limits to ordinary mortals.

Now let's imagine some kind of GM/Chrysler bailout, which would inevitably be a Cerberus bailout. Our tax money would be going to help Messrs. Feinberg, Snow and Quayle out of a tight fix of their own making, Cerberus having shown spectacularly bad timing in plunging into a U.S. auto industry that's only getting worse by the month. Hmmm. I can just imagine what Lou Dobbs would do with that one. No doubt Cerberus will trot out a list of investors that includes pension funds, hospitals, universities and other worthy causes, all of whom stand to benefit, too. Good luck to them. Most people will see only private equity, the secretive, high-return, high-leverage, exorbitantly compensated vehicles that are off-limits to ordinary mortals.

This is even before a new president gets to the merits of the proposed merger, which strikes me as even more wrong-headed than the Sears-Kmart combination, which I derided at the time. The idea that the combined company would get government assistance and still be headed by GM's Rick Wagoner, the man who bet the store on SUVs, is an affront to common sense. Better to keep Chrysler's Robert Nardelli, the blunt ex-Home Depot chief executive, who at least brings fresh ideas to the table. As for auto workers, the only way something like this could possibly work would be to slash car models -- and that means slashing jobs.

merger would limit the bleeding

Let's look at damage-control scenarios for the key actors in this drama one by one:

• Cerberus Capital Management. The sharpies at the New York-based private equity firm are trying to salvage whatever they can from their ill-timed purchases of 80% of Chrysler and 51% of GMAC. Initially, Chrysler looked like a cheap fixer-upper that Cerberus could flip at a nice profit in five years. But the global financial meltdown has turned Detroit's No. 3 automaker into a money pit with little chance of survival on its own. That means what was once the Big Three must now become the Detroit Two.

• GM has Chrysler's problems on a grander scale: too many brands, too many dealers, too much reliance on trucks and SUVs, and dwindling cash reserves that could dry up next year. GM also has strong sales in Asia and South America, solid technology and promising products if it can survive until 2010. For GM, a Chrysler merger is all about snaring extra cash -- from Cerberus and possibly Uncle Sam -- and cementing its position as an industrial icon the government cannot allow to fail.

• The UAW. President Ron Gettelfinger has been in damage-control mode for some time, bargaining soft landings for legions of UAW members jettisoned in recent years. Now he's hired Steve Girsky, an ex-adviser to GM and recent partner with the UAW in resurrecting parts supplier Dana Corp. from Chapter 11 bankruptcy, to help steer the union through the current storm.

• The next president of the United States. Neither Barack Obama nor John McCain wants to preside over the collapse of GM, Ford, Chrysler -- or all three -- during his first months in office. So you can count on the talks among GM, Cerberus, Ford, the White House, Treasury, Commerce, the Federal Reserve, congressional leaders, the UAW and Wall Street to be on again as of Wednesday.

What is happening, during this confluence of global financial crisis and a U.S. presidential election, is the climactic chapter in the consolidation of the domestic auto industry from three companies to two.

"Chrysler, as we know it, will cease to exist very soon," auto industry consultant Kimberly Rodriguez of Grant Thornton said last week.

PE exec to help UAW on potential GM/Chrysler deal: source

NEW YORK (Reuters) - Stephen Girsky, a veteran auto-industry analyst and private equity executive, is working with the United Auto Workers union with regards to any potential General Motors Corp and Chrysler LLC deal, a source familiar with the situation said on Sunday.

Girsky is president of Centerbridge Industrial Partners, LLC., the industrial unit of private equity firm Centerbridge Partners.

The Wall Street Journal reported earlier on Sunday that the union recently retained Girsky to help "level the playing field" in any discussions about changes in its current contract that could be needed in a tie-up of the two auto makers.

Girsky is expected to help UAW President Ron Gettelfinger evaluate the deal and shape the union's strategy, the WSJ said, citing sources.

Sources told Reuters last week that a deal to merge General Motors and Chrysler LLC hit an impasse after the Bush administration ruled out funding for it.

Advisers on Cerberus' side are JP Morgan and Citi and on the GM side are Morgan Stanley and Evercore, a person familiar with the talks previously told Reuters.

The UAW may be troubled by the fact that some estimates put the job loss of the merger at 60,000. Since the union seems to have fewer members every year, that is a lot of people to have leave. At some point, the UAW's bargaining power is going to move toward zero.

The UAW does not only have to help its current workers, it has to protect funds that are to be supplied by the car companies for benefits and retirement payments. It is not clear whether that capital could be threatened in a marriage of two car companies or not.

GM may not be able to get $10 billion to close the Chrysler deal, and a lot of that money would go to severance. But if a deal goes down, workers might rather keep their jobs than get a buyout which will only carry them for a few months in a recession.

GM-Chrysler merger: United Auto Workers union prepares another betrayal

Recent reports reveal that the United Auto Workers bureaucracy is preparing to further integrate itself within the business framework of the US auto industry at the expense of the livelihoods of the tens of thousands of autoworkers it nominally represents.

Industrial analysts believe that the Big Three US auto companies—General Motors, Ford Motor Co., and Chrysler Corp.—may all face bankruptcy within the next year. The financial crisis has been most acute for GM and Chrysler, and the largest and third-largest US automakers are now carrying on urgent merger negotiations that, if carried through, would lead to the rapid purging of 50,000 jobs.

According to insiders, the deal being pushed forward by GM and Cerberus Capital Management, the giant private equity firm that controls Chrysler, would result in the transfer to GM of Chrysler in exchange for turning over to Cerberus a larger share of GMAC, the financial wing of GM. Cerberus already owns 51 percent of GMAC. Chrysler has reportedly backed out of merger talks with the Franco-Japanese combination Renault-Nissan.

The Big Three, who have suffered through decades of declining market share, are now beset by a shortage of cash that may soon impinge upon day-to-day operations. Due to low incomes and layoffs, large numbers of Americans have stopped buying new cars, especially big and inefficient Sport Utility Vehicles (SUV) and trucks that have in recent years provided the main source of profit for the Big Three.

In October, auto sales plunged by 31 percent from a year ago, reaching their lowest level in 15 years. Michael DiGiovanni, sale analyst for GM, said that relative to the size of the US population, October was “the worst month in the post-World War II era. This is clearly a severe, severe recession.”

A GM-Chrysler merger will require the UAW to suppress rank-and-file opposition and to inflict a new round of concessions on autoworkers. An article published in Monday’s Wall Street Journal, “UAW Vies to be Central Player in GM-Chrysler Deal,” reveals that UAW President Ron Gettelfinger has been holding meetings with GM Chief Operating Officer Fritz Henderson on a potential merger. “Mr. Gettelfinger’s approval,” the article states, “could sway banks and lawmakers considering pitching into the deal.”

In a related development, the New York Times reported Monday that the Treasury Department has turned down GM’s request for an additional $10 billion to assist the merger with Chrysler. The money would have come from the $700 billion Wall Street bailout pushed through in October. Treasury officials were said to fear being directly identified with mass layoffs in the auto industry as a result of the merger, and they opposed extending to industrial firms money from the vast allocation intended for financial concerns.

The $10 billion is needed “to cover the cost of jobs cuts and plant closures that would result from a merger,” according to the Journal. If the federal government does not come through with the funds, the UAW may be asked to allow GM and Chrysler to get out of as much as $14 billion in promised payments into the union-managed “Voluntary Employee Beneficiary Association” (VEBA), the retiree health care system now run by the UAW. Without cash, the two corporations could rapidly wind up in bankruptcy.

This threat to the business interests of the UAW will likely propel Gettelfinger and the UAW bureaucracy to pressure the next administration to give handouts to the auto industry as part of a merger agreement. Democratic Party presidential candidate Barack Obama has indicated he is favorably disposed toward handouts, although such utterances must be taken in the context of the current election cycle, where both candidates have sought advantage in Midwest “battleground” states such as Michigan, Ohio, Missouri, Indiana, and Wisconsin, where much of the US auto industry is located.

The UAW no doubt will publicly lament the mass layoffs that will inevitably result from the merger. Behind the scenes, however, they will work energetically to see that the merger goes through and that the federal government foots the bill, so as to protect the multibillion-dollar VEBA fund the union oversees.

The setting up of the VEBA was the latest stage in the decades-long transformation of the UAW from a union into an out-and-out business. In exchange for tens of thousands of jobs cuts, billions of dollars in benefits reductions, and the suppression of rank-and-file resistance, the Big Three handed over to the UAW control of the auto industry’s retiree health care system.

The VEBA fund was dependent for its survival on the continued profitability of the American auto industry, which put the UAW into an openly adversarial relationship with its own workers. But now that the very survival of the US auto industry has been thrown into doubt, so too has the UAW’s VEBA scheme.

In an indication of its enthusiasm for the consolidation of the auto industry, the UAW has recently hired, as a personal adviser to Gettelfinger, business executive and industry analyst Stephen Girsky. Girsky was a former managing partner at the now defunct Wall Street investment bank Morgan Stanley. In 2006, GM head Richard Wagoner brought on Girsky where, according to the Wall Street Journal, he played a “pivotal” role in launching GM’s buyout program, whereby experienced workers were encouraged to retire and were replaced by low-wage workers. The Journal concluded that Girsky “is expected to help … Gettelfinger evaluate the deal and shape the union’s strategy.”

That the UAW feels no shame in bringing such an open opponent of the interests of its workers into a position of power within the union suggests not only that it is preparing to support the merger of GM and Chrysler. It also shows just how openly the UAW now presents itself as a business hostile to the workers it purports to represent.

A case for workers’ control: Can workers stop the illegal sale of Chrysler?

By Martha Grevatt, UAW Chrysler worker for 21 yearsNov 1, 2008, 09:19

While rumors continue to swirl, workers at General Motors and Chrysler hunger for concrete information concerning the possible sale of Chrysler, the number three U.S. automaker, to GM or some other entity.

Chrysler: "...more than 25 percent of salaried positions—that’s 5,000 jobs—are being terminated"They’ve heard not a peep at GM, but [workers] at Chrysler have received two “messages from our leader,” CEO Bob Nardelli. In the latest, workers were informed that they were in “truly unimaginable times” but that “working as a team, we have been right-sizing our organization to become as competitive as possible.” Therefore, more than 25 percent of salaried positions—that’s 5,000 jobs—are being terminated “in a socially responsible way, with respect and gratitude to those who have contributed so much to our company over the years.” What bull!

The salaried cuts were announced just days after workers in Newark, Del., learned that their plant would be closed at the end of this year, a year ahead of schedule. Whole shifts are being cut at assembly plants in Toledo and Windsor, Ontario, Canada. Are these aggressive moves to make the company leaner and more attractive to a prospective buyer?

Eager for some definitive word, the Phoenix Business Journal pressed former Vice President Dan Quayle, now chair of global operations for Chrysler LLC’s parent company, Cerberus. All Quayle would spell out was that “we’re not going to do the deal unless it’s a positive for our investors.” (Oct. 23)

The United Auto Workers union has been left out of the discussions, while financiers, including JP Morgan Chase, have had a seat at the table for at least a week. It’s their call whether any deal goes forward. (That’s nothing new. During the 1937 sit-down strikes the UAW rightly called GM “a Morgan-DuPont dictatorship.”) The big banks favor a merger that would increase GM’s market share while drastically reducing labor costs. Yet the banks and GM appear unwilling to finance any acquisition without government aid. According to the Detroit News, “General Motors Corp. is in talks with government officials about obtaining about $5 billion to help fund a possible merger with Chrysler LLC. GM Chairman and CEO Rick Wagoner was in Washington last week to meet with U.S. Treasury Department officials and make a case for a quick release of funds.” (Oct. 28) This would be on top of the $25 billion the Energy Department plans to loan the Big Three, who are lobbying to get that amount doubled.

Now is the time to raise the slogan of workers' control. The taxpayers should not give the bosses a penny. The funds set aside to help the industry should go to the workers to run the plants themselves. The first step to restore employment levels could be a shorter work week with no cut in pay.

Workers’ control is not as abstract as it sounds. In the period shortly before and after the Russian Revolution, workers kicked the bosses out and then ran the factories, with the support of the Soviet government. In Italy in the 1920s the workers took over the plants of Fiat and Alfa Romeo and made vehicles without supervision. In Venezuela today the Bolivarian government grants workers funds to run the plants after they occupy them.

It should not be assumed that a workers’ takeover would be illegal, even here. In 1912 the federal government established a Commission on Industrial Relations to investigate the causes of strike violence. The commission unanimously blamed John D. Rockefeller for the deaths of more than 60 miners, their wives and children during the 1913 strike in Ludlow, Colo. Remarkably, four of the nine commissioners, including Commission Chair Francis P. Walsh, recommended “that private ownership of coal mines be abolished; and that the National and State Governments take over the same, under just terms and conditions, and that all coal lands shall thereafter be leased upon such terms that the mines may be cooperatively conducted by the actual workers therein.”

Furthermore, in 1937 both Michigan Governor Frank Murphy and U.S. Secretary of Labor Frances Perkins challenged GM’s insistence that the 44-day occupation of its plants was illegal.

The class struggle here is not at the stage where workers establish control and demands for workers’ control arise organically. Nevertheless, the slogan can be raised now, in advance of battles sure to come.

Pillars of Japan showing some cracks

TOKYO -- They are the champions of Japanese business, giant companies with famous names like Toyota, Nissan, Canon and Sony. For years, their exports of cars, cameras, video cameras and other high-end products kept Japan's economy alive when domestic industries were languishing.

Now, hit by the global economic crisis, Japan's big exporters are beginning to show signs of weakness, undermining one of the last pillars of the shaky Japanese economy. The announcement yesterday that Toyota was cutting its profit forecast in half was only the latest bit of bad news for Japan's major-league export firms.

Toyota, the country's biggest company, said its annual net earnings would fall to a nine-year low. It also announced a 69-per-cent drop in profit for the most recent quarter, a big setback for a renowned company - sometimes called the world's best - that has seen profit rise year after year for a decade and is vying with General Motors for the title of world's biggest car maker. Its stock promptly dropped 10 per cent, pushing the Nikkei stock index to a 6.5-per-cent loss.

In the past few weeks, Nissan, Honda, Sony and Canon have all reported poor results, the consequence of a double whammy of falling consumer demand in the United States and a sharp rise in the yen. The yen's rise against the dollar makes Japanese exports less affordable for Americans while, at the same time, reducing the yen value of the profits exporters earn overseas. Toyota says its U.S. sales in October dropped a dramatic 23 per cent.

"It's an overused phrase, but it really is a kind of perfect storm at the moment," said Nissan spokesman Simon Sproule. In the United States, "people have just stopped buying cars. It's incredible."

Until recently, Japan seemed likely to come through the global credit crunch better than many countries because its banks were less exposed to the subprime mortgage market in the United States. But there are more and more signs that Japan may in fact be hit hard.

The stock market hit a 26-year low last week. A Reuters poll of economists found that most thought Japan had already joined much of the industrialized world in recession, with the economy unexpectedly contracting for a second consecutive quarter. Acknowledging the spreading pain, the government has announced a $248-billion (U.S.) package to help small businesses and hand out cash to households. Meanwhile, the central bank has cut interest rates for the first time in seven years - to a rock-bottom 0.3 per cent.

The spreading impact of the downturn on export-oriented Japanese countries has helped put paid to the notion that Asian economies had become "decoupled" from the U.S. market. Nissan, for example, which is Japan's third-biggest car maker, still relies on North American car buyers for 35 per cent of its sales, even though it builds cars all over the world. Nissan has cut its profit forecast for the fiscal year in half. It is eliminating 2,500 jobs in the United States and in Europe and laying off 1,000 temporary workers in Japan

Any country would be troubled by faltering results in its biggest, most successful companies, but the bad news is especially upsetting for Japan because its depends so heavily on its major exporters.

Domestic industries have never fully recovered from the bursting of Japan's asset bubble in the early 1990s. Consumers have never regained their confidence, either. The health of the big-name exporters was one of the few things Japan's economy still had going for it. Exports produce 18 per cent of Japan's gross domestic product.

"If the global economy keeps slowing down, Japan is very vulnerable," said Kristine Li, an analyst at KBC Securities.

The shaky results being announced by exporters come as a special shock because they seem to have so many things in their favour. Most have cleaned up their balance sheets over the past decade, reducing debt and building up big cash reserves.

Toyota's magic slips a gear

Toyota Motor Corp. shares plunged nearly 20% in New York trading yesterday after the Japanese automaker said it set up an emergency committee to boost profits and warned it would make almost no money in the second half of its fiscal year.

The development underscores just how bleak market conditions are becoming for automakers worldwide, ravaging even a manufacturer with a strong product lineup and a history of delivering steady returns to investors.

In September, Toyota announced it would delay indefinitely plans to ramp up a new Canadian assembly plant, in Woodstock, Ont., to full capacity because of the slowdown in U. S. sales. The factory is scheduled to open this year with one shift of workers building 75,000 RAV4 sport-utility vehicles to start.

Developments at Toyota yesterday were much worse than some analysts had expected. The automaker reported operating losses in both North America and Europe and said it will cut the number of its temporary contract workers in Japan by half, to 3,000 by next March.

Unlike Japanese rival NissanMotorCo.,Toyota has not offered employee buyouts or issued layoffs in North America, preferring to keep 4,500 factory workers at two idled truck plants in San Antonio and Princeton, Ind., active even if the assembly lines are not.

Toyota Slashes Annual Profit Forecast

The lowered forecast was the latest sign that the recession that began in the United States was spreading, threatening even fast-growing markets like India and China, once seen as immune to an American downturn.

While Toyota recorded growth in Asia and other developing areas, it was not enough to overcome steep declines in the developed markets of North America, Japan and Europe.

“This is another sign of the collapse of the decoupling theory,” said Yasuaki Iwamoto, an auto analyst at Okasan Securities in Tokyo. “The whole world is down because of the North America troubles. That hurts even a company with a more global revenue base, like Toyota.”