It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Wednesday, July 08, 2020

Wednesday, November 24, 2021

"NAFTA's legacy of granting multinational corporations special rights to sue governments taking action to protect the environment lives on."

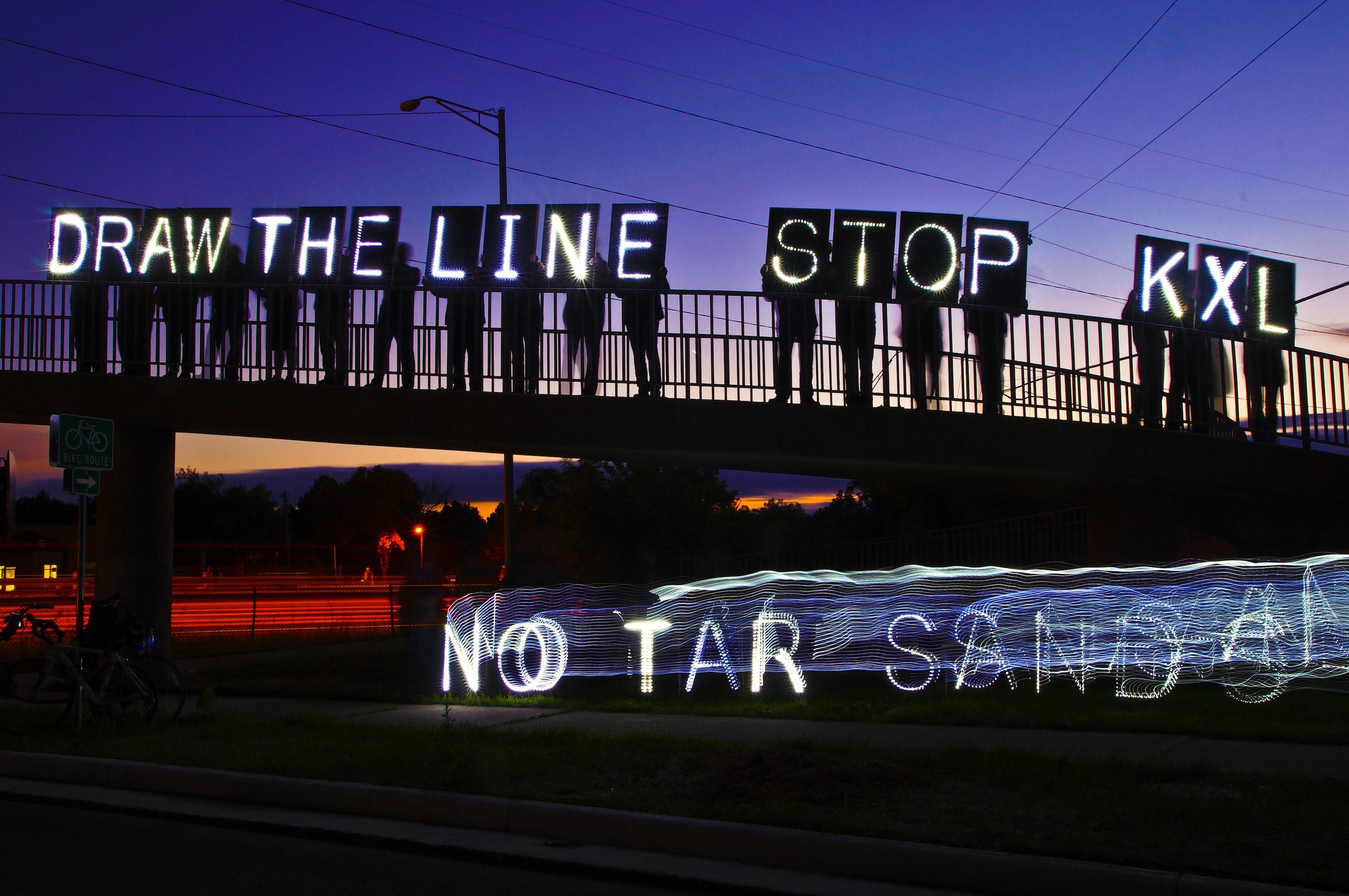

Climate activists hold signs against the Keystone XL project at a September 20, 2013 protest.

ANDREA GERMANOS

The Canadian company behind the canceled Keystone XL pipeline filed a formal request for arbitration this week under the North American Free Trade Agreement to seek over $15 billion in economic damages over the Biden administration's revocation of the cross-border oil project's permit.

In its Monday filing, TC Energy criticizes the permit's cancellation as "unfair and inequitable" and argues the U.S. government should pay damages for the "regulatory roller coaster" the company endured while seeking to build the pipeline.

"Action on the climate crisis will require trade reforms, including killing these investor provisions."

Erin LeBlanc, a lecturer at the Smith School of Business in Kingston, Ont. told CBC News that amount represents "the largest claim for a Canadian organization against the U.S. government."

The company said in a statement announcing its filing that it "has a responsibility to our shareholders to seek recovery of the losses incurred due to the permit revocation, which resulted in the termination of the project."

The pipeline project, which would have transported tar sands from Alberta, Canada to the U.S. Gulf Coast, was first proposed in 2008. Following sustained grassroots pressure, the Obama administration ultimately rejected the pipeline—prompting a since-dropped NAFTA claim. That permit rejection was reversed by the fossil fuel-promoting Trump administration.

President Joe Biden then canceled the permit in his first hours in office—a move attributed to relentless Indigenous-led activism and heralded by climate groups as "a huge win for the health and safety of Americans and our planet."

Related Content

After 'Incredible First Steps' on KXL and Paris, Biden Urged to 'Go Further' on Climate

Jessica Corbett

In July, a month after it declared the project dead, TC Energy filed its intent to use the NAFTA Chapter 11 investor-state dispute settlement (ISDS) provisions to recoup perceived economic losses.

As such, the new filing is not surprising, author and water rights expert Maude Barlow noted in a Tuesday tweet. "This awful practice," she added, referring to the ISDS mechanism, "was grandfathered in the old NAFTA."

While the ISDS provision of NAFTA was "gutted" under the replacement U.S.-Mexico-Canada Agreement (USMCA), the company is making a "legacy" NAFTA claim. According to advocacy group Public Citizen, ISDS is "totally rigged" in favor of corporations.

As the group explains on its website:

Under ISDS, [a tribunal of three corporate lawyers] can order U.S. taxpayers to pay corporations unlimited sums of money, including for the loss of "expected future profits" that the corporation would have earned in the absence of the public policy it is attacking.

The multinational corporations only need to convince the lawyers that a law protecting public health or the environment violates their special “trade” agreement rights. The corporate lawyers' decisions are not subject to appeal. And if a country does not pay, the corporation can seize a government's assets—bank accounts, ships, airplanes—to extract the compensation ordered.

Addressing the TC Energy-U.S. government dispute, Bloomberg reported that "the tribunal cannot compel a country to change its laws over the matter nor force approval of the pipeline, but it could award damages for lost profits and costs incurred by the company."

In a Tuesday tweet, Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy, put TC Energy's filing in the context of the planetary climate emergency.

"NAFTA's legacy of granting multinational corporations special rights to sue governments taking action to protect the environment lives on," he wrote. "Action on the climate crisis will require trade reforms, including killing these investor provisions."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

Monday, July 03, 2023

Ottawa urged to back U.S., not TC Energy, in $15B lawsuit over demise of Keystone XL

James McCarten , The Canadian Press

U.S. President Donald Trump, centre, looks over at Prime Minister Justin Trudeau's document as they and Mexico's President Enrique Pena Nieto sign the new United States-Mexico-Canada Agreement in Buenos Aires, Argentina, Friday, Nov. 30, 2018. THE CANADIAN PRESS/AP-Martin Mejia

A progressive public policy think tank is urging the federal government to side against oil and gas transmission giant TC Energy in its ongoing dispute with the United States over the ill-fated Keystone XL project.

The Calgary-based company is seeking to recoup US$15 billion in lost revenue from the on-again, off-again cross-border pipeline expansion, which President Joe Biden killed off for good in 2021 on his first day as commander-in-chief.

The lawsuit is based on the investor-state dispute rules in the now-expired NAFTA, as well as that deal's successor, the U.S.-Mexico-Canada Agreement, which included a three-year extension of those rules for so-called "legacy" investors.

A new report to be released Wednesday by the Canadian Centre for Policy Alternatives recommends Ottawa back the U.S. defence: that TC Energy has no legal recourse under North American trade rules, past or present.

"Though the TC Energy dispute pits a Canadian company against the U.S. state, it does not follow that it is in Canada's interest for TC Energy to prevail," the report reads.

Rather, it argues, the case represents an important chance for both governments to defend their ability to pursue climate-friendly public policy without being forced to "unjustly" enrich impacted investors.

"The Keystone XL case is a clear example of a company wanting to be compensated for making a risky bet," wrote senior researcher Stuart Trew and Queen's University professor Kyla Tienhaara, the report's co-authors.

The gamble, they say, was on the 2020 re-election of former president Donald Trump, who championed and resurrected the project in 2017 after it had been rejected by the Obama administration two years earlier.

"This bet didn't play out."

Ottawa is keeping tabs on the Keystone XL case, said Shanti Cosentino, a spokesperson for International Trade Minister Mary Ng. But she equivocated on the question of whether the government would pick a side.

"We are actively monitoring this case and expect this dispute to play out through the legal mechanisms established," Cosentino said in a statement.

"This government has always and will continue to advocate for Canadian commercial interests abroad."

The dispute is being heard by the International Centre for Settlement of Investment Disputes, a World Bank offshoot based in Washington, D.C., that registers dozens of investor-state clashes from around the globe each year.

At the moment, it's about jurisdiction: TC Energy wants to apply the now-defunct investor-state dispute settlement mechanism in NAFTA, which expired in 2020, since the project traces its lineage as far back as 2008.

The company hopes to use a three-year grace period for NAFTA disputes that was included in the new USMCA, known in Canada as CUSMA. By the report's count, some 15 investors including TC Energy lodged their disputes after NAFTA expired but before the grace period ended April 30.

Five of those cases, including Keystone XL, are based on alleged violations of NAFTA rules that occurred after the agreement expired — in TC Energy's case, Biden's decision to withdraw the presidential permit in January 2021.

The U.S., however, is arguing that the grace period was not intended as a "sunset clause" for NAFTA disputes, but "an orderly way to resolve prior disputes" that were left outstanding after the deal's expiration.

"The U.S. argues that, had the CUSMA parties wanted to simply extend NAFTA's investment rules and ISDS procedures for another three years, they would have done so through a boilerplate sunset clause," the report says.

TC Energy is disputing that interpretation, arguing it hasn't been floated before and that there is no evidence to suggest that U.S., Canadian and Mexican negotiators envisioned anything other than a sunset clause for resolving disputes.

There is more at stake than just TC Energy's eye-popping damages claim, the report says: An early dismissal of the suit would mitigate the ongoing cost of the global energy transition, not just for the U.S. but the rest of the planet.

A host of other legacy cases under the USMCA rules are still outstanding, and amount to compensation claims in excess of US$23 billion.

"This is why Canada’s next move, and that of Mexico, is so important," the report says.

"A win for TC Energy would send a devastating message to countries around the world, most of which cannot afford to finance the transition to clean energy while also paying off the fossil fuel industry."

Canada has two options to influence the tribunal, the report notes.

One is to work with the U.S. and Mexico on an official, binding interpretation of the rules from the USMCA Free Trade Commission, while the other would be a "non-party submission" directly to the tribunal itself.

"Due to the novelty of the U.S. argument and its fundamental importance to the operation of the CUSMA, a no-show from Canada at this stage of the arbitration would signal to the tribunal that the U.S. position on the legacy provisions is not credible," the report says.

"It would also demonstrate that the government is more interested in bowing to the interests of the oilpatch than in the correct interpretation of treaties."

This report by The Canadian Press was first published June 28, 2023.

Sunday, August 21, 2022

CBC

Sat, August 20, 2022

Kushner, right, as his father-in-law announces a new NAFTA deal on Oct. 1, 2018.

Members of the Trump administration would rant at their Canadian counterparts during the renegotiation of NAFTA about the frequency of leaks that appeared in the press.

The Americans insisted those trade talks be allowed to unfold discreetly at the negotiating table. They avoided news conferences, rarely spoke to reporters and let Donald Trump's occasional ill-tempered tweets speak for the U.S.

A new memoir lays out the U.S. perspective on those closed-door talks.

The book by presidential son-in-law and senior-staffer Jared Kushner earned the literary equivalent of a ritualized execution in a vividly unflattering New York Times book review that mocked its wooden writing and wilful blindness to the seedier aspects of the Trump legacy.

The book does fill in some gaps on a significant historical event for Canada: it describes the false-starts in the trade talks; frustrations with the Canadians; and how the deal wound up with two tongue-twisting acronyms for a name.

Breaking History, Kushner's book, describes a method to Trump's madness, crediting the president's sporadic threats to cancel NAFTA with creating valuable pressure on Canada and Mexico.

It also acknowledges the madness in the method.

An angry tweet from Trump stalled talks before they even began. In early 2017, the North American countries planned an amicable announcement of new trade negotiations at a three-country event at the White House.

When Kushner called Prime Minister Justin Trudeau's chief of staff to confirm plans, Katie Telford asked whether it was still on: "Didn't you see his tweets this morning?"

In fact, Kushner had not seen his father-in-law's public threat to cancel meetings with the Mexican leader unless Mexico paid for a new border wall; the meeting was cancelled.

Later in the day he said Trump realized that might have been a mistake and half-jokingly told Kushner: "I can't make this too easy for you."

Carlos Barria/Reuters

The tweets, then the drama

Months later, there was another bumpy launch. Trump asked staff to draw up documents to terminate the original NAFTA.

Trump was actually undecided about whether to go through with it when someone — Kushner suspects it was White House trade skeptic Peter Navarro — leaked the news to the Politico website, hoping to pressure the president to do it.

Aspects of what happened next are already public knowledge: Trudeau and his Mexican counterpart Enrique Peña Nieto called Trump, pleading with him not to, warning it would cause chaos, and after a frantic few hours everyone agreed to launch renegotiation talks.

What's less well-known is that Trump engineered those calls, according to the book.

What had happened was the pro-trade Agriculture Secretary Sonny Perdue had already persuaded Trump not to cancel NAFTA; he showed Trump a large map and explained it would crush farmers in the rural areas that support him.

Trump needed a face-saving way to back down from his threat.

The solution? Get those foreign leaders on the phone to plead with him; Kushner called Telford and a Mexican colleague and said their bosses should urgently phone Trump.

"Sensing that Trump was looking for a solution, I [said]: 'What if I get President Peña Nieto and Prime Minister Trudeau to call right now and ask you not to cancel NAFTA, and then you can put out a statement that says you will give them time to negotiate,'" Kushner wrote.

"The immediate crisis abated."

That was in April 2017. Formal talks began later that summer. After months of negotiations, the Americans grew increasingly annoyed at Canada 's alleged unwillingess to budge on key issues.

Kushner said he enlisted billionaire businessman Steve Schwarzman to call Trudeau and tell him the Canadians were taking a serious risk: "They are playing chicken with the wrong guy," he said he told Schwarzman.

He said the businessman called him back a few hours later: "Trudeau, he said, 'Got the message loud and clear.'"

A Canadian team flew down to Washington and Telford says there were three impediments to a deal: U.S. steel tariffs on Canada, the need for a dispute mechanism, and dairy.

Kevin Lamarque/Reuters

U.S. team erupts at Freeland

The book describes how U.S. officials grew annoyed in the final bargaining sessions with Canada's lead politician in the talks, Chrystia Freeland.

It's been reported that one American erupted up at Freeland for slow-walking during those sessions, losing his patience when she started discussing whaling rights for Inuit people.

The book places the U.S. narrative on the public record.

"An increasingly frustrating series of negotiations," is how Kushner described it. He said Freeland would read notes scribbled in ink on her hand, then let her officials spar with U.S. trade chief Robert Lighthizer over the technical details.

"All the while [she was] refusing to commit to any substantive changes," Kushner wrote.

"Following this theater, she would walk to the steps of the USTR [U.S. Trade Representative] building and hold an outdoor press conference, uttering platitudes like 'I get paid in Canadian dollars, not U.S. dollars.'"

At this point the U.S. prepared for two outcomes: a Mexico-U.S. deal or a three-country one. Kushner says Peña Nieto also told Trudeau his representatives were moving too slowly and that Mexico would sign.

Then, on Sept. 26, Trump trashed Freeland at a press conference and threatened to punish Canadian autos with tariffs.

Kushner writes: "Less than an hour later, the Canadians gave us an offer in writing. After 16 months of stalling, they were finally ready to talk specifics."

Yet when he showed the Canadian offer to Lighthizer, the U.S. trade chief said: "This is all rubbish! They don't want to make a deal." Kushner said he suggested calling Telford to explain why it was unworkable: "'No,' Lighthizer shot back."

Kevin Lamarque/Reuters

'I want it to be called the USMCA'

After meetings the next morning, however, Kushner called Telford, and they settled some longstanding irritants. Trudeau's chief of staff called back an hour later and said: "The prime minister is going to take the deal."

With the deal done, Trump made one final request.

"I want it to be called the USMCA, like [the] U.S. Marine Corps."

Freeland and the rest of the Canadian government have refused to use that name, continuing to call it, "the new NAFTA," or by the acronym, CUSMA.

Kushner credits the president's style for producing a better deal for the U.S.: the new agreement sets caps on low-wage auto production in Mexico; lets slightly more U.S. dairy into Canada; and forces once-a-decade reviews of the pact.

"Negotiating a trade deal is like a game of chicken, with real consequences. The other side has to believe you are going to jump off a cliff. We succeeded because Trump was absolutely prepared to terminate NAFTA — and Mexico and Canada knew it," he writes. "His style made many people uncomfortable, including his allies in Congress, foreign leaders and his own advisers, but it led to unprecedented results."

One Canadian official involved in the talks said Ottawa knew exactly what it was doing by stalling: Canada was aware the U.S. wanted a deal quickly, before late 2018.

Canadian official: We intentionally drained the clock

Trump's team hoped to conclude talks while Republicans still controlled Congress before the 2018 midterms, and before a new Mexican president took office.

"The truth is we were draining the clock," said one Canadian involved. "Trudeau never instructed us to make a final deal. He always said [get] the right deal or no deal."

The Canadian government was more circumspect when asked for an on-the-record comment about Kushner's book: in an emailed statement, a spokeswoman for Freeland said the Canadian team worked hard for a good deal and was vindicated by its firm approach.

The juicier parts of Kushner's book include chronicles of rampant back-stabbing and turf wars in the Trump White House.

Kevin Lamarque/Reuters

In particular, he portrays ex-aide Steve Bannon as a volatile schemer who set out to get Kushner fired by leaking unflattering half-truths about him to the press.

He writes that Bannon dishonestly brands himself as the keeper of the Trumpian ideological flame, and Kushner as a liberal interloper, when, in reality, Bannon joined the Trump team late in the 2016 campaign, long after his policies were set.

Sidestepping Jan. 6

The historic events of Jan. 6, 2021, barely merit a mention. Kushner says he was travelling back from the Middle East and didn't realize until late in the day the seriousness of the storming of the Capitol.

Leah Millis/Reuters

The New York Times review assailed Kushner's book as self-servingly selective, its prose soulless, sidestepping the key unflattering details of Trump's political epitaph.

"Kushner almost entirely ignores the chaos, the alienation of allies, the breaking of laws and norms, the flirtations with dictators, the comprehensive loss of America's moral leadership, and so on," said the review.

"This book is like a tour of a once majestic 18th-century wooden house, now burned to its foundations, that focuses solely on, and rejoices in, what's left amid the ashes: the two singed bathtubs, the gravel driveway and the mailbox. Kushner's fealty to Trump remains absolute."

Tuesday, May 23, 2023

Kyla Tienhaara, Canada Research Chair in Economy and Environment, Queen's University, Ontario

Mon, May 22, 2023

US$20 billion: That’s how much American investors think Canadian taxpayers should fork over to compensate them for their failed bid to develop a liquefied natural gas (LNG) facility in Québec.

That’s almost a fifth of the province’s total budget for this year.

Ruby River Capital LLC, the U.S.-based owner of GNL Québec Inc., filed a claim against Canada under the North American Free Trade Agreement (NAFTA) after its Énergie Saguenay project failed to pass a federal environmental impact assessment.

The proposed LNG terminal had already been rejected by the Québec government over concerns that it would increase greenhouse gas emissions and negatively impact First Nations and marine mammals.

Canada faces a no-win situation — a catch-22. If the government does not rapidly phase out fossil fuels, it will fail to meet its commitments under the Paris Agreement to address the climate crisis. But when it takes steps to do so, foreign investors invoke international trade and investment agreements like NAFTA and threaten to drain public coffers.

Paying the polluters

Unlike environmental treaties, trade and investment agreements have teeth. They are enforceable through a system known as Investor-State Dispute Settlement (ISDS) that allows foreign investors to bypass local courts and bring claims for monetary compensation to a panel of three arbitrators. More than 1,200 ISDS cases have been launched against governments around the world in the last 25 years.

Read more: World Bank ruling against Pakistan shows global economic governance is broken

Between 1996 and 2018, Canada was sued more than 40 times by American investors through the investment chapter in NAFTA. To date, Canada has lost or settled (with compensation) 10 claims. Canadian governments have paid out more than $263 million in damages and settlements.

When NAFTA was replaced in 2018 with the U.S.-Mexico-Canada Agreement (USMCA), it did not include an ISDS mechanism between Canada and the U.S. Chrystia Freeland, the then-deputy prime minister of Canada, noted at the time that the removal of ISDS “strengthened our government’s right to regulate in the public interest, to protect public health and the environment.”

Ruby River was only able to launch its case because USMCA allowed firms that had made investments before NAFTA’s termination — on July 1, 2020, — to continue to bring ISDS claims for three years — until June 30, 2023.

Importantly, Ruby River spent only about CDN$165 million on the Énergie Saguenay project proposal. However, the firm is permitted within the ISDS system to seek “lost future profits” based on speculation about the performance of notoriously volatile oil and gas markets.

Risks to climate policy

Québec is a member of the global Beyond Oil and Gas Alliance and is the first jurisdiction in the world to ban all oil and gas production. The province is being sued over this ban by several fossil fuel firms — seeking more compensation than was offered — in Québec’s Superior Court.

Had these companies been foreign, and thereby qualified for the protection of an investment treaty, they likely would have chosen ISDS instead. This is because ISDS generally provides broader scope for claims — and larger awards — than domestic courts.

Other jurisdictions need to follow Québec’s lead. The global carbon budget has no room for new coal, oil or gas developments. Construction of new fossil fuel infrastructure also needs to be limited, as it would lock in continued extraction long into the future.

Despite clear messages to this effect from the Intergovernmental Panel on Climate Change and the International Energy Agency, investors continue to propose new fossil fuel projects. They do so in full knowledge that governments need to act to curb emissions in line with their international commitments and that future climate policies may negatively impact their investments.

Allowing these companies to demand billions in compensation creates moral hazard and could dampen necessary policy action.

Read more: A secretive legal system lets fossil fuel investors sue countries over policies to keep oil and gas in the ground – podcast

Governments are increasingly aware of this risk and many are taking action. The European Union is seeking to withdraw from the Energy Charter Treaty, the largest investment treaty in the world, because it “is not aligned with the Paris Agreement, the EU Climate Law or the objectives of the European Green Deal.”

The Biden administration is committed to not signing up to new agreements with ISDS and a number of Democrats are calling for the removal of the mechanism from existing deals. Other countries such as Australia and New Zealand have worked to exclude ISDS from some of their trade agreements.

Future threats

Canada will soon escape from the legacy of NAFTA. However, the government remains exposed to the threat of ISDS through other trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), as well as dozens of bilateral investment treaties.

When the U.K. officially joins the CPTPP, the risk of ISDS claims from fossil fuel firms will increase dramatically.

The idea that public finance, desperately needed for the energy transition and climate adaptation, will be redirected to compensate fossil fuel firms currently making record profits is offensive.

In light of the increasing body of evidence that documents how the industry has actively obstructed climate action and helped to spread disinformation about climate science, it is communities impacted by climate change that should be compensated by fossil fuel firms, not the other way around.

The Canadian government should adopt a consistent approach to ISDS. The exclusion of ISDS from USMCA should be emulated in any future agreements, and Canada should work with treaty partners to remove access to the system in all current ones.

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. The Conversation has a variety of fascinating free newsletters.

It was written by: Kyla Tienhaara, Queen's University, Ontario.

Read more:

Coastal GasLink and Canada’s pension fund colonialism

A bridge to nowhere: Natural gas will not lead Canada to a sustainable energy future

Kyla Tienhaara receives funding from the Canada Research Chairs Program and SSHRC (Government of Canada). She collaborates with and provides pro bono advice for a number of non-profit organizations working on climate and investment issues.

Thursday, November 21, 2024

Free Trade’s Legacy of Grief for Families of the Disappeared in Mexico

November 21, 2024

Facebook

Cover art for the book Call the Mothers: Searching for Mexico’s Disappeared in the War on Drugs by Shaylih Muehlmann

In Mexico today, thousands of families are searching for loved ones who have disappeared amid the violence associated with “the war on drugs.” Although disappearances in Mexico trace back to the Cold War and the repression of guerrilla movements in the 1960s and 1970s, they have expanded in scale and taken on new dimensions in the neoliberal era. Trade agreements like NAFTA, intended promote economic growth, have inadvertently fueled drug-trafficking across the U.S.-Mexico border, contributing to a crisis of violence that disproportionately impacts marginalized communities—those already vulnerable due to poverty and limited political power.

As I conducted research for my new book Call the Mothers, on women searching for their disappeared relatives in Mexico, I was struck by how deeply intertwined free trade policies and the crisis of disappearances have become. Trade agreements like NAFTA and its successor, USMCA (United States-Mexico-Canada Agreement), created conditions that allowed criminal organizations to thrive—and ordinary people have paid the price.

While NAFTA was designed to open up economic opportunities and strengthen North American trade, it also created new channels that could be exploited by organized crime. By facilitating cross-border commerce and reducing trade barriers, NAFTA provided new routes for drug smuggling, allowing criminal organizations to expand their influence and power. As Mexico faced an increase in drug trafficking and criminal activity, the response from both Mexico and the United States leaned heavily toward militarization, with initiatives like the Mérida Initiative  funneling resources into Mexico’s security forces to combat this surge.

funneling resources into Mexico’s security forces to combat this surge.

Ironically, this militarized approach has only deepened the violence. Under pressure to secure the flow of trade and protect corporate interests, the militarized strategy quickly shifted from targeting drug cartels to influencing many aspects of life in Mexico, especially for the most vulnerable communities. Disappearances—a practice with a long history in Latin America during times of political repression—reemerged and took on new dimensions. Today, victims of disappearances are no longer limited to political activists or dissidents. They include a broad spectrum of individuals, from Indigenous people and migrants to professionals and human rights defenders. And the perpetrators include both organized crime and security forces.

Indigenous and rural communities, in particular, have suffered the impacts of this convergence between violence and free-trade policies, as neoliberal reforms made their lands and resources lucrative targets for exploitation by corporate interests and criminal enterprises alike. Amidst this violence and impunity, the line between state and non-state actors often blurs, as corruption and collusion between authorities and drug-trafficking organizations become pervasive. In this climate, disappearances have become tragically commonplace, with entire communities left vulnerable to both exploitation and violence.

As we mark the 30th anniversary of NAFTA, it’s important to ask: “What does free trade cost?” For the families of the disappeared in Mexico, the price has been incalculable—a legacy of violence, profound grief, and enduring impunity. In Call the Mothers, the stories of those navigating this devastating reality reveal how free trade’s promises have left too many families searching for justice and resolution.

This post was originally published on the University of California Press blog and is reprinted here with permission.