PAID FOR BY KENNEY & UCP

KXL Pipeline Company Exploits NAFTA Provision to File $15 Billion Claim Against US"NAFTA's legacy of granting multinational corporations special rights to sue governments taking action to protect the environment lives on."

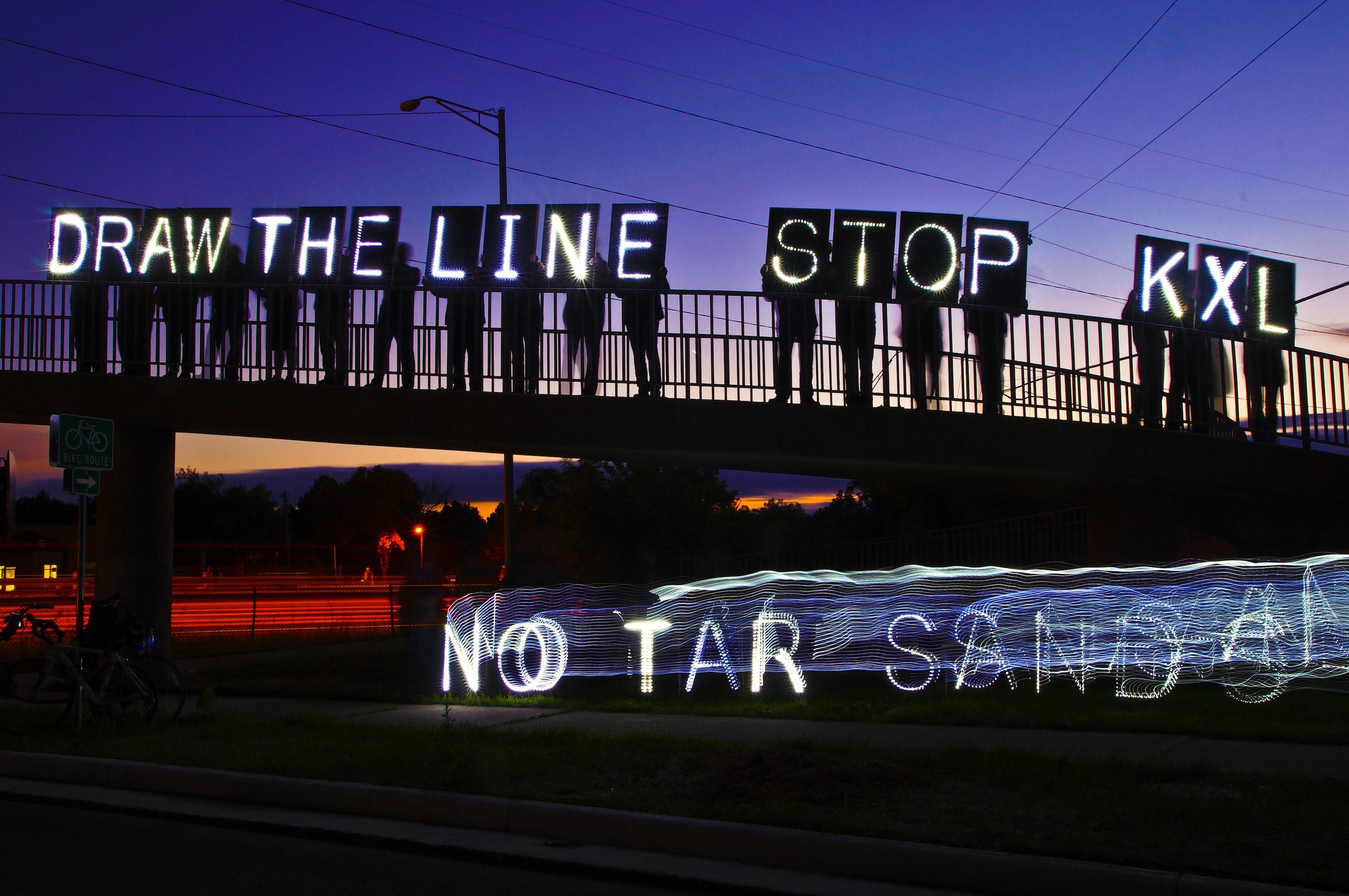

Climate activists hold signs against the Keystone XL project at a September 20, 2013 protest.

(Photo: Joe Brusky/CC BY-NC 2.0)

ANDREA GERMANOS

ANDREA GERMANOS

COMMONDREAMS

November 24, 2021

The Canadian company behind the canceled Keystone XL pipeline filed a formal request for arbitration this week under the North American Free Trade Agreement to seek over $15 billion in economic damages over the Biden administration's revocation of the cross-border oil project's permit.

In its Monday filing, TC Energy criticizes the permit's cancellation as "unfair and inequitable" and argues the U.S. government should pay damages for the "regulatory roller coaster" the company endured while seeking to build the pipeline.

"Action on the climate crisis will require trade reforms, including killing these investor provisions."

Erin LeBlanc, a lecturer at the Smith School of Business in Kingston, Ont. told CBC News that amount represents "the largest claim for a Canadian organization against the U.S. government."

The company said in a statement announcing its filing that it "has a responsibility to our shareholders to seek recovery of the losses incurred due to the permit revocation, which resulted in the termination of the project."

The pipeline project, which would have transported tar sands from Alberta, Canada to the U.S. Gulf Coast, was first proposed in 2008. Following sustained grassroots pressure, the Obama administration ultimately rejected the pipeline—prompting a since-dropped NAFTA claim. That permit rejection was reversed by the fossil fuel-promoting Trump administration.

President Joe Biden then canceled the permit in his first hours in office—a move attributed to relentless Indigenous-led activism and heralded by climate groups as "a huge win for the health and safety of Americans and our planet."

Related Content

After 'Incredible First Steps' on KXL and Paris, Biden Urged to 'Go Further' on Climate

Jessica Corbett

In July, a month after it declared the project dead, TC Energy filed its intent to use the NAFTA Chapter 11 investor-state dispute settlement (ISDS) provisions to recoup perceived economic losses.

As such, the new filing is not surprising, author and water rights expert Maude Barlow noted in a Tuesday tweet. "This awful practice," she added, referring to the ISDS mechanism, "was grandfathered in the old NAFTA."

While the ISDS provision of NAFTA was "gutted" under the replacement U.S.-Mexico-Canada Agreement (USMCA), the company is making a "legacy" NAFTA claim. According to advocacy group Public Citizen, ISDS is "totally rigged" in favor of corporations.

As the group explains on its website:

Under ISDS, [a tribunal of three corporate lawyers] can order U.S. taxpayers to pay corporations unlimited sums of money, including for the loss of "expected future profits" that the corporation would have earned in the absence of the public policy it is attacking.

The multinational corporations only need to convince the lawyers that a law protecting public health or the environment violates their special “trade” agreement rights. The corporate lawyers' decisions are not subject to appeal. And if a country does not pay, the corporation can seize a government's assets—bank accounts, ships, airplanes—to extract the compensation ordered.

Addressing the TC Energy-U.S. government dispute, Bloomberg reported that "the tribunal cannot compel a country to change its laws over the matter nor force approval of the pipeline, but it could award damages for lost profits and costs incurred by the company."

In a Tuesday tweet, Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy, put TC Energy's filing in the context of the planetary climate emergency.

"NAFTA's legacy of granting multinational corporations special rights to sue governments taking action to protect the environment lives on," he wrote. "Action on the climate crisis will require trade reforms, including killing these investor provisions."

The Canadian company behind the canceled Keystone XL pipeline filed a formal request for arbitration this week under the North American Free Trade Agreement to seek over $15 billion in economic damages over the Biden administration's revocation of the cross-border oil project's permit.

In its Monday filing, TC Energy criticizes the permit's cancellation as "unfair and inequitable" and argues the U.S. government should pay damages for the "regulatory roller coaster" the company endured while seeking to build the pipeline.

"Action on the climate crisis will require trade reforms, including killing these investor provisions."

Erin LeBlanc, a lecturer at the Smith School of Business in Kingston, Ont. told CBC News that amount represents "the largest claim for a Canadian organization against the U.S. government."

The company said in a statement announcing its filing that it "has a responsibility to our shareholders to seek recovery of the losses incurred due to the permit revocation, which resulted in the termination of the project."

The pipeline project, which would have transported tar sands from Alberta, Canada to the U.S. Gulf Coast, was first proposed in 2008. Following sustained grassroots pressure, the Obama administration ultimately rejected the pipeline—prompting a since-dropped NAFTA claim. That permit rejection was reversed by the fossil fuel-promoting Trump administration.

President Joe Biden then canceled the permit in his first hours in office—a move attributed to relentless Indigenous-led activism and heralded by climate groups as "a huge win for the health and safety of Americans and our planet."

Related Content

After 'Incredible First Steps' on KXL and Paris, Biden Urged to 'Go Further' on Climate

Jessica Corbett

In July, a month after it declared the project dead, TC Energy filed its intent to use the NAFTA Chapter 11 investor-state dispute settlement (ISDS) provisions to recoup perceived economic losses.

As such, the new filing is not surprising, author and water rights expert Maude Barlow noted in a Tuesday tweet. "This awful practice," she added, referring to the ISDS mechanism, "was grandfathered in the old NAFTA."

While the ISDS provision of NAFTA was "gutted" under the replacement U.S.-Mexico-Canada Agreement (USMCA), the company is making a "legacy" NAFTA claim. According to advocacy group Public Citizen, ISDS is "totally rigged" in favor of corporations.

As the group explains on its website:

Under ISDS, [a tribunal of three corporate lawyers] can order U.S. taxpayers to pay corporations unlimited sums of money, including for the loss of "expected future profits" that the corporation would have earned in the absence of the public policy it is attacking.

The multinational corporations only need to convince the lawyers that a law protecting public health or the environment violates their special “trade” agreement rights. The corporate lawyers' decisions are not subject to appeal. And if a country does not pay, the corporation can seize a government's assets—bank accounts, ships, airplanes—to extract the compensation ordered.

Addressing the TC Energy-U.S. government dispute, Bloomberg reported that "the tribunal cannot compel a country to change its laws over the matter nor force approval of the pipeline, but it could award damages for lost profits and costs incurred by the company."

In a Tuesday tweet, Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy, put TC Energy's filing in the context of the planetary climate emergency.

"NAFTA's legacy of granting multinational corporations special rights to sue governments taking action to protect the environment lives on," he wrote. "Action on the climate crisis will require trade reforms, including killing these investor provisions."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

No comments:

Post a Comment