Slow City Snail by Frits Ahlefeldt | Public Domain image via itoldya420.getarchive.net

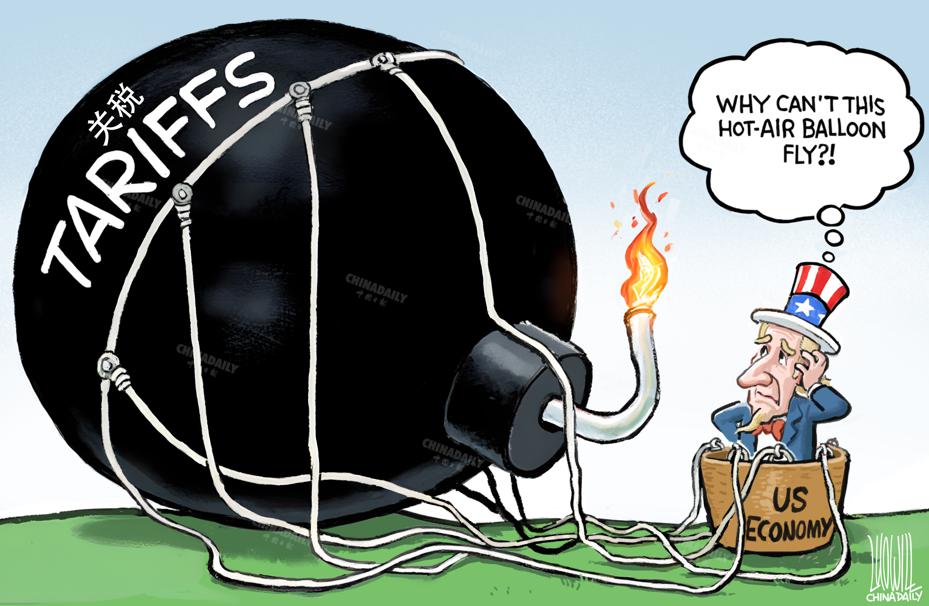

Where I live, in Palm Springs, California, Canadian snowbirds are selling off their properties and angrily vowing never to return to the United States. Once back home, our northern neighbors are pulling Kentucky bourbon and other US goods from the shelves and liberating themselves from the tariff-obsessed lunatic in the Oval Office. The same story is playing out across the globe, including with close friends in Europe, the United Kingdom, and Australia, where the most immediate result of our self-inflicted trade wars is the collapse of Tesla sales. The poet Robert Frost once wrote that “good fences make good neighbors,” but he should have added that bad trade policies make friends into enemies.

I’ve already written about why tariffs are a form of dumb localization. Today, I want to focus on how communities, both inside the United States and around the world, should respond to the escalating global trade wars. My recommendation is simple: Inoculate your community from the increasing unpredictability of the global economy by becoming as local as possible, as fast as possible. The more you can produce your own goods and services from your own resource base, the less vulnerable you’ll be.

In case you haven’t been paying attention (or you’ve been reading too much Tom Friedman), localization is already sweeping the planet, at least in developed countries. Some 70-80% of US households spend money on services, which are almost always competitive and inexpensive locally. That percentage has steadily expanded over the past fifty years and is one of the principal drivers of localization. (It’s also a driver of the shrinking importance of manufacturing, but that’s another essay.)

The remaining goods we purchase are primarily nondurable goods like food, lumber, and building materials. Nondurable means that they don’t last. Most of the nondurable goods we consume every year tend to be heavy and have a low dollar value per unit weight (compared to, say, microchips). Food, for example, our biggest nondurable good purchase, is mostly water, and it doesn’t make sense to ship water in the form of soybeans halfway around the planet if you can produce the same item yourself. Only highly specialized water, like scotch whiskey, is worth the shipping and transaction costs. This helps explain why local food movements are thriving in every country. It’s increasingly cost-effective for communities to produce their own food for local consumption.

Let’s just pause on the surprising bottom line: About 90% of what we spend is on services and nondurable goods and can easily be produced locally (or regionally, if you live in a small town). If your community is not 90% self-reliant now, tariffs are your invitation to get started—yesterday.

The only things that are really hard to produce locally are durable goods, like cars, phones, and refrigerators. This is only about ten percent of our spending. Where these items are made will be dramatically affected by the tariff wars, and localization strategies for these items are more challenging. I’ll focus a future essay on durable goods, but for now, let’s just concede that these items still must be imported.

A realistic action goal for a community trying to survive tariffs is this: How can we move our economy more quickly toward the 90% self-reliance that’s economic, practical, and already happening? Here are ten distinct strategies your community can and should deploy to achieve this goal:

(1) Leakage Analysis – Look systematically at where money is leaving your economy right now, and calculate which nonlocal purchases are leading to the greatest job losses. Maybe it’s professional services? Or fresh vegetables? Whatever you find, these should become the focus of economic development efforts to grow new businesses or expand existing businesses to provide these goods and services locally. Shockingly, almost no economic development agency follows this very simple methodology for setting priorities. They instead waste their time, staff, and your money trying to attract outside companies—a strategy that’s a proven loser for economic development.

(2) Asset Analysis – Your community should make a thorough inventory of all underused assets. Do you have farmland with nothing growing on it? Public properties with zero economic activity? Is a large segment of your workforce unemployed, underemployed, or unhappily employed? Copenhagen created a City & Port Development Corporation to develop its municipal land into huge new sources of wealth. Its development projects, such as the North Harbor (Nordhavn), have created space for 40,000 residents and 40,000 workers. Revenue generated from the land development funded major infrastructure projects, including an expanded metro system, further boosting economic activity and connectivity.

(3) Circular Economies – A very specific kind of asset foolishly overlooked by most economic developers is what we mistakenly call waste—garbage, pollution, excess heat, and so forth. These waste products are potentially valuable inputs for new industries. South Australia has grown its regional economy and improved the state’s fiscal health by charging fees on all waste products. This has incentivized industries to clean up and become more efficient, which has created more jobs. Funds collected from waste producers are then used to promote technologies and business designs that accelerate circular practices.

(4) Vertical Integration – Leakage analysis should be performed not only by the community but also by its local companies. Zingerman’s Community of Businesses in Ann Arbor, Michigan, dramatically expanded its deli business by creating other local businesses—a bakery, a creamery, a farm, a coffee roastery—that supply goods to the deli. It now employs more than 700 people. Economic development should help every business in the community expand in this way. Nudging your businesses to vertically integrate—a few jobs here, a few jobs there—is a much more reliable way to grow the economy than bringing in an outside factory.

(5) Anchor Institutions – Vertical integration is particularly powerful if it is deployed by anchor institutions, the largest companies in your community that might be publicly owned or nonprofits. These could include public schools, universities, sports teams, and hospitals. These institutions, however, are often uninterested in vertically integrating, so Plan B is to get them to focus their purchasing power on local goods and services, which is a powerful lever of change. Push the local hospital to buy food from local farmers, or public schools to purchase desks from local furniture producers. In Preston, in the United Kingdom, local procurement led by anchor institutions created more than 1,600 jobs.

(6) Business Partnerships – Local businesses can strengthen themselves by establishing partnerships with other businesses. Local restaurants, for example, can market themselves collectively and leverage their collective buying power to get better deals from wholesalers. Business partnerships can also enable small businesses to achieve better economies of scale. Local hardware stores, which might not be able to compete on their own, have been able to succeed by being part of the global Ace Hardware Producer Cooperative. (These global networks of local businesses, by the way, offer clues on how local companies can cost-effectively produce durable goods.)

(7) Local Credit Networks – Strengthening local banks can strengthen local businesses that borrow from them. Most cities take surplus revenues from taxes, transfer payments from the national authorities, and put them into global financial instruments that do no good at home. The Bank of North Dakota, for more than 100 years, has taken these revenues and put them on deposit in local banks and credit unions, enhancing credit available to local businesses. It receives interest from the deposits, and now clears more than $100 million in annual profits, which it uses for various economic development initiatives. The population of North Dakota is under 800,000, which suggests that hundreds of cities in the world of similar or greater size could benefit from this strategy.

(8) Local Investment – This is what we promote every week at The Main Street Journal. Shifting the investment of residents from global companies to local ones can powerfully stimulate the local economy. And cost-effectively! In Nova Scotia, local pension funds called Community Economic Development Investment Funds (CEDIF) are enabling residents to reinvest in various local businesses. My favorite CEDIF, called FarmWorks, invests in local farms and food businesses. Residents receive tax credits, and, true, this costs the provincial government some lost revenue. But a recent study found that the per-job cost of these programs was just over $500—about a thousand-fold cheaper than the cost of paying incentives to attract a large outside company.

(9) Innovation Centers – Key to a successful local economy is innovation, which doesn’t happen naturally. It happens when economic developers mindfully connect entrepreneurs with capital, mentors, technical assistance, support networks, courses, incubators, and accelerators. These efforts do best when they focus on locally owned companies, because nonlocal companies will happily take the assistance and run. A great example of the virtues of localizing innovation support is the Mondragon Cooperatives in the Basque Region of Spain. Started in 1956, Mondragon has grown into the largest network of worker cooperatives in the world, now employing more than 70,000 people. Central to Mondragon’s early success was a school offering support services that helped transform talented workers into entrepreneurs, all within the cooperative system.

(10) Global Partnerships – Finally, consider the strategy of global learning. The new mantra for localization should be “innovate locally, share globally.” Every business design that helps a city become a little more self-reliant, whether in food, energy, or bicycles, should be shared and spread with every other community around the world. As this sharing network expands, communities will benefit from best practices across the world. This is already happening informally and formally through organizations like the International Council for Local Environmental Initiatives and COPx. These networks should be deepened and integrated with local economic development policy.

As my examples suggest, these ten localization strategies are not hypothetical. They are already being implemented somewhere on the planet and showing impressive results. They are generating income, wealth, and jobs far more cost-effectively than current economic development strategies to “attract and retain” outside global businesses. Unfortunately, no community is implementing even two or three of these strategies, let alone all ten.

So I say to my friends in Canada, in Australia, in France, in Japan, and everywhere else in the world: Don’t succumb to our Mad King’s trade wars. Use this crisis as an impetus to accelerate localization in your economy. The same advice applies to communities inside the United States. Let’s work together to find the business designs and strategies that collectively reduce our vulnerability. The faster we can take our local economies out of the line of international fire, the more secure we will be—and the more our peoples will prosper.

Michael Shuman is director of research for Cutting Edge Capital, director of research and economic development at the Business Alliance for Local Living Economies (BALLE), and a Fellow of Post Carbon Institute. He holds an AB with distinction in economics and international relations from Stanford University and a JD from Stanford Law School. He has led community-based economic-development efforts across the country and has authored or edited seven previous books, including The Small Mart Revolution: How Local Businesses Are Beating the Global Competition (2006) and Going Local: Creating Self-Reliant Communities in the Global Age (1998). In recent years, Michael has led community-based economic-development efforts in St. Lawrence County (NY), Hudson Valley (NY), Katahdin Region (ME), Martha’s Vineyard (MA), and Carbondale (CO), and served as a senior editor for the recently published Encyclopedia of Community. He has given an average of more than one invited talk per week for 25 years throughout the United States and the world.