will probably be spared the choice of whether or not to stop or wait patiently for the renewable-energy revolution.

Shares in Siemens Gamesa Renewable Power rose 6.2% Monday after its majority shareholder,

on Saturday confirmed longstanding expectations that it wished to take the wind-turbine enterprise personal. It stated it could pay €18.05 a share, equal to $19.25, for the excellent 32.9% of its subsidiary. Price and income synergies are anticipated ultimately, however the main purpose it gave for the buyout was to speed up the persevering with turnaround.

Siemens Gamesa’s excessive mixture of near-term challenges and brilliant long-term prospects makes it trickier than normal for buyers to gauge whether or not the value is true. The valuation is a 27.7% premium to the corporate’s undisturbed share worth on Might 17, when Bloomberg reported deal talks, and exceeds the six-month quantity weighted common worth.

Nevertheless it has been a really powerful six months. The deal values Siemens Gamesa at about 1.2 occasions ahead gross sales, barely lower than the 1.4 occasions stock-market a number of of sector peer Vestas.

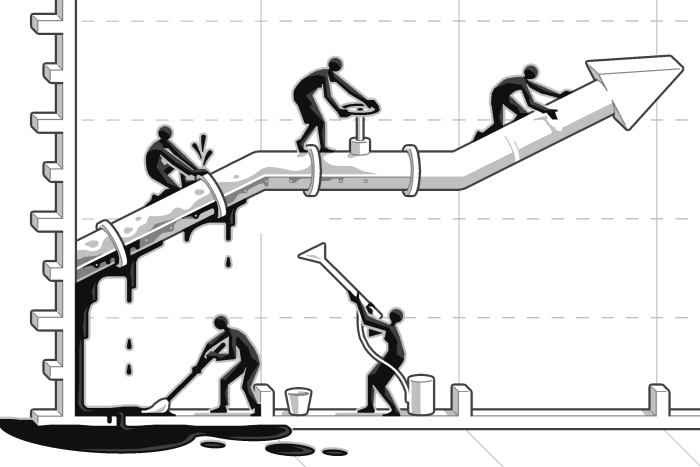

Siemens Gamesa shares peaked in January 2021 round €39 earlier than being hit by a collection of revenue warnings and broader investor skepticism towards green-energy investments. Wind-turbine makers, like many manufacturing industries, have felt margin stress from rising uncooked materials prices and bottlenecks in provide chains and logistics. Siemens Gamesa has had particular troubles, too: Its onshore division has underperformed and is scuffling with expensive delays within the launch of its new 5.X turbine.

Trying additional forward, there are causes for optimism. Siemens Power just lately changed key Gamesa executives with its personal individuals, who deliver turnaround expertise. Siemens Gamesa additionally has a large turbine service enterprise that continues to ship sturdy outcomes.

Most promising of all, it was lengthy the market chief in offshore wind generators, though onshore chief Vestas edged it out final yr. Offshore is a large potential market because it opens up entry to sturdy wind sources in lots of nations centered on decarbonizing energy manufacturing.

Siemens Power might afford to pay extra. Full acceptance of the present provide would price it €4 billion, funded with as much as €2.6 billion in new debt and fairness in addition to €1.4 billion from its money balances. It will possibly preserve its investment-grade credit standing with a ratio of web debt to earnings earlier than curiosity, taxes, depreciation and amortization of as much as 1.5 occasions, says its chief monetary officer.

The corporate had €1.7 billion in web money final quarter and analysts predict Ebitda of €1.5 billion this yr, in line with FactSet, so there may be room for a wholesome improve within the provide.

Nevertheless, simply because Siemens Power can increase its provide doesn’t imply it can. There may be an inevitable battle of curiosity between its roles as majority shareholder and bidder. Siemens Gamesa shares closed at €17.79 Monday, barely beneath the bid worth, so arbitragers don’t look like banking on a bump.

Some minority shareholders in Siemens Gamesa might consider its future prospects justify the next provide, however in a minority buyout which may not imply an excessive amount of.

Write to Rochelle Toplensky at rochelle.toplensky@wsj.com

Siemens Gamesa turnaround will take years, main owner says after $4.3 billion bid

Isla Binnie and Christoph Steitz

Sun, May 22, 2022,

A model of a wind turbine with the Siemens Gamesa logo is displayed outside the annual general shareholders meeting in Zamudio

By Isla Binnie and Christoph Steitz

MADRID/FRANKFURT (Reuters) -Siemens Energy warned on Monday that a turnaround at Siemens Gamesa will take several years, adding that a 4.05 billion-euro ($4.3 billion) bid to buy out minorities of the struggling wind turbine unit was the only way to fix the issues.

"It's nothing which will go fast," Siemens Energy Chief Executive Christian Bruch told journalists on Monday, less than two days after unveiling the offer. He added this meant "multiple years of really turning" Siemens Gamesa around.

Siemens Energy has faced pressure from shareholders to raise its stake in Siemens Gamesa from the 67% it inherited after a spinoff from Siemens AG.

Shares of Spanish-listed Siemens Gamesa rose 6.2% to about 17.79 euros at 1518 GMT, just below the 18.05 euro-per-share offer price. Siemens Energy fell 0.8%.

Siemens Gamesa, whose shares had fallen 20% since the start of the year until the offer was made, had issued three profit warnings in less than a year, dogged by product delays and operational problems.

Most European turbine makers have also racked up losses in a fiercely competitive market as metals and logistics prices surged due to COVID-19, import duties and Russia's invasion of Ukraine.

"There are not yet clear signs of a near-term recovery in the current setup," Bruch said, adding that Siemens Gamesa's financial performance was "really creating the need for action."

FULL CONTROL

Bruch said owning all of Siemens Gamesa would remove an arms-length relationship and give Siemens Energy more control over the asset as well as lead to cost savings and procurement efficiencies.

Asked about the onshore turbine business which has caused particular headaches, Bruch said there were no plans to sell it.

While Siemens Energy will be able to delist Siemens Gamesa once it owns 75%, Bruch said a full integration of the division, which was created from the merger of Siemens AG's wind business and Spain's Gamesa, was the clear goal.

The relatively low additional stake Siemens Energy needs for a delisting, however, is expected to provide at least a certain hurdle against potential attacks from hedge funds that could decide to buy in to Siemens Gamesa to push for a higher price, industry sources said.

Under a tentative timeline, the bid, which Credit Suisse analysts said was "disappointing," would launch in mid-September before an extraordinary general meeting rubber-stamps it in November, Siemens Energy said.

The funding of the deal is fully underwritten by Bank of America and JP Morgan. Perella Weinberg Partners is advising Siemens Energy on the transaction.

When asked why the offer was below the 20 euros Siemens paid for Iberdrola's stake in Siemens Gamesa in 2020, Bruch said that since then the situation at the division had deteriorated and that the offer was attractive.

($1 = 0.9431 euros)

BREAKINGVIEWS-Siemens Gamesa’s minorities can hold out for more

(Reporting by Isla Binnie in Madrid and Christoph Steitz in FrankfurtEditing by Edmund Blair, Emelia Sithole-Matarise and Matthew Lewis)