BC

Locals mark 10 years since Mount Polley disaster

By Lauren Stallone

Posted August 5, 2024

It’s been 10 years since the worst mine waste disaster in Canada’s history.

On Aug. 4, 2014, a massive tailings dam at the Mount Polley copper and gold mine in B.C.’s Interior collapsed. The incident about 56 kilometres northeast of Williams Lake sent over 20 million cubic metres of wastewater into nearby Quesnel Lake, Polley Lake, Hazeltine Creek, and surrounding waterways.

Despite a decade having passed, residents in nearby Likely, B.C., say they’re still struggling with unresolved emotions about what happened and should be held accountable.

“The quality of the lake and the water have been and are continuing to deteriorate,” said Doug Watt, an area resident. “Frankly it’s a very strong feeling of frustration.”

Watt was there when disaster struck, and recalls the moments vividly.

“I was asleep and got a call around 6 o’clock in the morning from Likely Fire and Rescue and they told me that the dam had burst,” he told CityNews.

An aerial view shows the damage caused by a tailings pond breach near the town of Likely, B.C. Tuesday, August, 5, 2014, after the Mount Polley mine disaster a day prior. THE CANADIAN PRESS/Jonathan Hayward

“I could hear it just like Niagara Falls from seven or eight kilometres down the lake.”

Watt says some residents have lived by the lake for over 50 years and are devastated to see what has happened since the collapse.

“The water’s cloudy, there’s algae bloom that never occurred before, there’s slime on the rocks,” he described.

He says many locals have opted to no longer drink the water from Quesnel Lake, which was their main water source. Despite these concerns, the government says the water meets drinking standards.

However, residents aren’t buying it.

“They’re polluting the lake, we are not going to drink it anymore,” said Watt.

Related articles:

Mount Polley mine disaster five years later; emotions, accountability unresolved

Mount Polley mine disaster could happen again if laws don’t change: report

In a statement to CityNews, Minister of Energy, Mines, and Low Carbon Innovation Josie Osborne says “the government has taken significant steps to ensure the company responsible continues restoring and monitoring the impacted areas.”

“They have reformed B.C.’s regulations to establish what they say are some of the world’s most stringent safety and environmental standards,” Osborne continued.

The statement goes on to say “it was clear that B.C. had allowed a regulatory framework to exist that did not adequately protect the environment or people.”

“Economic development cannot happen without responsible management of industry, and we must maintain a world-class regulatory system to bring peace of mind to the mining sector and British Columbians,” Osborne’s statement concluded.

But even with the improvements made, the residents affected by the Mount Polley disaster are wary of the potential for things to go wrong.

“There are many mines in B.C. with very, very large tailings ponds. Every one of them is a liability,” said Watts.

Residents worry about waterways 10 years after Mount Polley spill

'We're still picking up levels of metals like copper flowing down Quesnel River,' researcher says

The local fire department was on the line when Doug Watt reached for his phone the morning of Aug. 4, 2014.

"The lady at fire and rescue said that there's been an accident at the mine, the dam is broken, it's pouring into the lake, nobody knows what's happening so get your boat out of the water, don't drink the water and be prepared to evacuate because you don't know whether the lake is going to flood or not," he recalled.

After he got off the phone with the fire department, Watt stepped outside and heard the roar of the dam breach about seven kilometres away from his home in Likely, B.C.

"It was quite disconcerting," he said.

The tailings dam at the Mount Polley mine, about 231 kilometres north of Kamloops, B.C., failed that day, sending toxic mine waste into nearby lakes and streams. It is widely regarded as one of the worst — if not the worst — mine disasters in Canadian history.

Mount Polley mine records filed with Environment Canada reported that hundreds of tonnes of arsenic, lead, copper and nickel flowed out in the sludge.

On the 10-year anniversary of the spill, residents worry not enough has been done to remediate the site and prevent future disasters.

10 years later

Researcher Phil Owens said about 25 million cubic metres of tailings material ended up in Hazeltine Creek and Quesnel Lake — the equivalent of 10,000 Olympic-sized swimming pools, he said.

And most of that is still sitting at the bottom of the lake, researchers have found.

"This was an instantaneous catastrophic failure ... and yet still 10 years later, we're still picking up levels of metals like copper flowing down Quesnel River and getting into the water column of the lake," he said. "That is quite surprising."

Copper, he added, has been detected in zooplankton, a key food source for salmon and trout in the river.

"I would be concerned about eating the fish, particularly those fish that live in the system for a long time because it's now been 10 years," Owens said.

Watt, who used to work in mining, said that while he still supports the industry, he believes the environment needs to be the top priority.

"It's certainly opened my eyes to the immediate effect that a mine can have locally," he said.

In 2014, B.C.'s environment ministry said it had repeatedly warned mining company Imperial Metals about the level of wastewater in the tailings pond at its Mount Polley mine prior to the breach, and then-NDP leader John Horgan said a previous report on Mount Polley's tailings pond noted a tension crack in the earthen dam.

A scathing auditor general report was released in May 2016, calling for an independent compliance and enforcement unit for the mining industry that would protect the environment from future disasters.

Changes

Likely resident and biologist Richard Holmes said that shortly after the spill, he had high hopes for remediation and change in B.C.'s mining industry. But 10 years later, he said there's been little action.

According to Imperial Metals, it has spent $70 million to clean up the Mount Polley spill site, which has gone toward removal of tailings and rebuilding the Hazeltine and lower Edney creeks, and building a new fish spawning and rearing habitat in Hazeltine Creek.

The company also says it repaired the Quesnel Lake shoreline, planted native trees and shrubs in the area and built an on-site rainbow trout hatchery to raise more trout for Polley Lake.

In 2021, two engineers were disciplined for actions that led to the breach. Engineers and Geoscientists B.C., the regulatory body that oversees engineers in the province, found that both had demonstrated unprofessional conduct.

Last week, Minister of Energy, Mines and Low-Carbon Innovation Josie Osborne released a statement explaining what the province has done following the Mount Polley breach.

Osborne said the province has created a chief auditor role, Mines Audit Unit and a Mines Investigation Unit. It has also established financial penalties for companies and, Osborne said, the province has reformed B.C.'s mining regulations.

"For many people, that day 10 years ago is hard to forget," Osborne said in her statement, adding that the NDP government will continue to strengthen mining regulations and oversight.

But residents of the central B.C. community of about 350 people have watched Quesnel Lake continue to deteriorate in the years since the spill, Watt said.

"People that have been here for 25 or 50 years can see that and lots of concern and very much frustration with the fact that the [province] is not listening to what we see out here."

Holmes said he would like the province to give legal standing to rivers and streams in B.C., similar to Magpie River in Quebec, which was granted legal personhood in 2021 for protection.

Holmes also thinks provincial funding should be made available for independent research.

"Very little has changed as a result of this disaster and certainly not enough has changed, that's for sure."

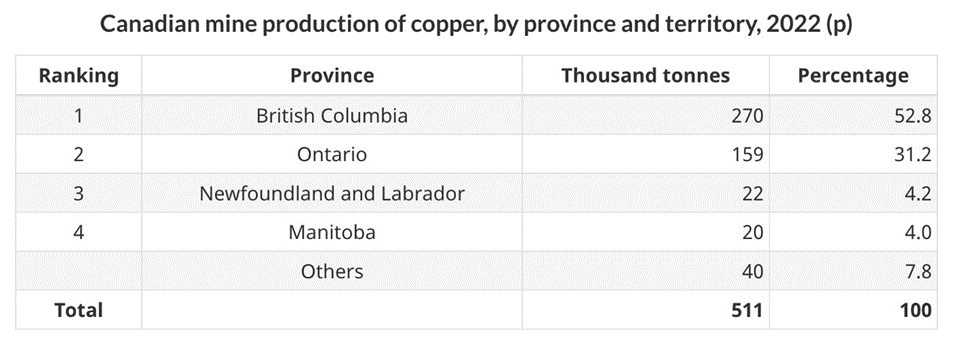

Source: Natural Resources Canada

Source: Natural Resources Canada