Three US-based economists given Nobel Prize for work on banks

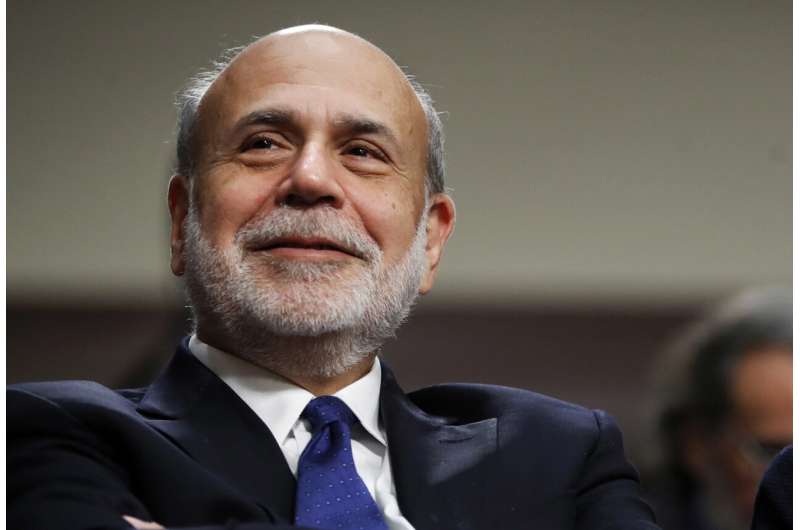

This year's Nobel Prize in economic sciences has been awarded to the former chair of the U.S. Federal Reserve, Ben S. Bernanke, and two U.S.-based economists, Douglas W. Diamond and Philip H. Dybvig, "for research on banks and financial crises."

The prize was announced Monday by the Nobel panel at the Royal Swedish Academy of Sciences in Stockholm.

The committee said their work had shown in their research "why avoiding bank collapses is vital."

Nobel prizes carry a cash award of 10 million Swedish kronor (nearly $900,000) and will be handed out on Dec. 10.

Unlike the other prizes, the economics award wasn't established in Alfred Nobel's will of 1895 but by the Swedish central bank in his memory. The first winner was selected in 1969.

Last year, half of the award went to David Card for his research on how the minimum wage, immigration and education affect the labor market. The other half was shared by Joshua Angrist and Guido Imbens for proposing how to study issues that don't easily fit traditional scientific methods.

A week of Nobel Prize announcements kicked off Oct. 3 with Swedish scientist Svante Paabo receiving the award in medicine for unlocking secrets of Neanderthal DNA that provided key insights into our immune system.

Three scientists jointly won the prize in physics Tuesday. Frenchman Alain Aspect, American John F. Clauser and Austrian Anton Zeilinger had shown that tiny particles can retain a connection with each other even when separated, a phenomenon known as quantum entanglement, that can be used for specialized computing and to encrypt information.

The Nobel Prize in chemistry was awarded Wednesday to Americans Carolyn R. Bertozzi and K. Barry Sharpless, and Danish scientist Morten Meldal for developing a way of "snapping molecules together" that can be used to explore cells, map DNA and design drugs that can target diseases such as cancer more precisely.

French author Annie Ernaux won this year's Nobel Prize in literature Thursday. The panel commended her for blending fiction and autobiography in books that fearlessly mine her experiences as a working-class woman to explore life in France since the 1940s.

The Nobel Peace Prize went to jailed Belarus human rights activist Ales Bialiatski, the Russian group Memorial and the Ukrainian organization Center for Civil Liberties on Friday.

Nobel committee press release: The Prize in Economic Sciences 2022

The Royal Swedish Academy of Sciences has decided to award the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 to

Ben S. Bernanke

The Brookings Institution, Washington DC, U.S.

Douglas W. Diamond

University of Chicago, IL, U.S.

Philip H. Dybvig

Washington University in St. Louis, MO, U.S.

"for research on banks and financial crises"

Their discoveries improved how society deals with financial crises

This year's laureates in the Economic Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig, have significantly improved our understanding of the role of banks in the economy, particularly during financial crises. An important finding in their research is why avoiding bank collapses is vital.

Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.

For the economy to function, savings must be channelled to investments. However, there is a conflict here: savers want instant access to their money in case of unexpected outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely. In their theory, Diamond and Dybvig show how banks offer an optimal solution to this problem. By acting as intermediaries that accept deposits from many savers, banks can allow depositors to access their money when they wish, while also offering long-term loans to borrowers.

However, their analysis also showed how the combination of these two activities makes banks vulnerable to rumours about their imminent collapse. If a large number of savers simultaneously run to the bank to withdraw their money, the rumour may become a self-fulfilling prophecy—a bank run occurs and the bank collapses. These dangerous dynamics can be prevented through the government providing deposit insurance and acting as a lender of last resort to banks.

Diamond demonstrated how banks perform another societally important function. As intermediaries between many savers and borrowers, banks are better suited to assessing borrowers' creditworthiness and ensuring that loans are used for good investments.

Ben Bernanke analysed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society's ability to channel savings to productive investments was thus severely diminished.

"The laureates' insights have improved our ability to avoid both serious crises and expensive bailouts," says Tore Ellingsen, Chair of the Committee for the Prize in Economic Sciences.

The laureates explained the central role of banks in financial crises

The Great Depression of the 1930s paralysed the world's economies for many years and had vast societal consequences. However, we have managed subsequent financial crises better thanks to research insights from this year's laureates in the Economic Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig. They have demonstrated the importance of preventing widespread bank collapses.

We all have some sort of relationship to banks. Our regular income is placed in a bank account and we use the bank's means of payment, such as mobile banking apps or bank cards, when we shop at a supermarket or pay a restaurant bill. At some time in our lives, many of us will need to take a large bank loan, for example to buy a house or apartment. The same applies to businesses—they need to be able to make and receive payments and to finance their investments. In most cases, these services are also provided via a bank.

We take for granted that these services function as they should, perhaps with the exception of brief technical problems. Sometimes, however, all or parts of the banking system fail and a financial crisis arises. Important banks collapse, borrowing becomes more expensive or impossible, prices plunge for property and other assets. If this progression is not stopped, the entire economy can enter a downward spiral of rapidly increasing unemployment and bankruptcies. Some of the biggest economic collapses in history have been financial crises.

Important questions about banks

If banking collapses can cause so much damage, could we manage without banks? Must banks be so unstable and, if so, why? How can society improve the stability of the banking system? Why do the consequences of a banking crisis last so long? And, if banks fail, why can't new ones immediately be established so the economy quickly gets back on its feet? In the early 1980s, this year's laureates, Ben Bernanke, Douglas Diamond and Philip Dybvig laid the scientific foundation for modern research into these issues in three articles.

Diamond and Dybvig developed theoretical models that explain why banks exist, how their role in society makes them vulnerable to rumours about their impending collapse, and how society can lessen this vulnerability. These insights form the foundation of modern bank regulation.

Through statistical analysis and historical source research, Bernanke demonstrated how failing banks played a decisive role in the global depression of the 1930s, the worst economic crisis in modern history. The collapse of the banking system explains why the downturn was not only deep, but also long-lasting.

Bernanke's research shows that bank crises can potentially have catastrophic consequences. This insight illustrates the importance of well-functioning bank regulation, and was also the reasoning behind crucial elements of economic policy during the financial crisis of 2008–2009. At this time, Bernanke was head of the US central bank, the Federal Reserve, and was able to put knowledge from research into policy. Later, when the pandemic hit in 2020, significant measures were taken to avoid a global financial crisis. The laureates' insights have played an important role in ensuring these latter crises did not develop into new depressions with devastating consequences for society.

Bank crises led to depression

The work for which Bernanke is now being recognised is formulated in an article from 1983, which analyses the Great Depression of the 1930s. Between January 1930 and March 1933, US industrial production fell by 46 per cent and unemployment rose to 25 per cent. The crisis spread like wildfire, resulting in a deep economic downturn in much of the world. In Great Britain, unemployment increased to 25 per cent and to 29 per cent in Australia. In Germany, industrial production almost halved and more than one third of the workforce was out of work. In Chile, national income fell by 33 per cent between 1929 and 1932. Everywhere, banks collapsed, people were forced to leave their homes and widespread starvation occurred even in relatively rich countries. The world's economies slowly began to recover only towards the middle of the decade.

Before Bernanke published his article, the conventional wisdom among experts was that the depression could have been prevented if the US central bank had printed more money. Bernanke also shared the opinion that a shortage of money probably contributed to the downturn, but believed this mechanism could not explain why the crisis was so deep and protracted. Instead, Bernanke showed that its main cause was the decline in the banking system's ability to channel savings into productive investments. Using a combination of historical sources and statistical methods, his analysis showed which factors were important in the drop in GDP, gross domestic product. He found that factors that were directly linked to failing banks accounted for the lion's share of the downturn.

The depression began with a fairly normal recession in 1929 but, in 1930, it developed into a banking crisis. The number of banks halved in three years, in many cases due to bank runs. These happen when people who have deposited money in a bank become worried about the bank's survival, and so rush to withdraw their savings. If enough people do this simultaneously, the bank's reserves cannot cover all the withdrawals and it will be forced to conduct a fire sale of assets at potentially huge losses. Ultimately, this may drive the bank into bankruptcy.

The fear of more bank runs led to falling deposits in the remaining banks, and many banks were afraid to grant new loans. Instead, deposits were invested in assets that could be sold quickly in case depositors suddenly wanted to withdraw their money. These problems with obtaining bank loans made it difficult for businesses to finance their investments, as well as huge financial hardship for farmers and ordinary households. The result was the worst global recession in modern history.

Prior to Bernanke's study, the general perception was that the banking crisis was a consequence of a declining economy, rather than a cause of it. Instead, Bernanke established that bank collapses were decisive for the recession developing into deep and prolonged depression. Once a bank goes bankrupt, the relationship between the bank and its borrowers is cut; this relationship contains knowledge capital that is necessary for the bank to manage its lending efficiently. The bank knows its borrowers, it has detailed information about what borrowers have used the money for and what requirements are needed to ensure the loan will be repaid. Building up such knowledge capital takes a long while, and it cannot simply be transferred to other lenders when a bank fails. Repairing a failed banking system can therefore take many years, during which time the economy functions very poorly. Bernanke demonstrated that the economy did not start to recover until the state finally implemented powerful measures to prevent additional bank panics.

Why are banks necessary?

To understand why a banking crisis can have such enormous consequences for society, we need to know what banks actually do: they receive money from people making deposits and channel it to borrowers. This financial intermediation is far from a simple mechanical transfer, because there are fundamental conflicts between the needs of savers and investors. Someone who takes out a loan to finance a home or a long-term investment must know that the lender will not suddenly demand their money back. On the other hand, a saver wants to have at least some of their savings instantly available for unexpected outlays.

Society must somehow resolve these conflicts. If companies or households can be forced to repay their loans at any time, long-term investments become impossible. This would have devastating consequences. The economy cannot function without a financial system that creates enough readily accessible and secure means of payment. Imagine what would happen if you had to pay for your supermarket purchases with a claim on part of your house every time you went shopping.

Diamond and Dybvig's model

Douglas Diamond and Philip Dybvig showed that the problems we have described can best be solved by institutions that are constructed exactly like banks. In an article from 1983, Diamond and Dybvig develop a theoretical model that explains how banks create liquidity for savers, while borrowers can access long-term financing. Despite this model being relatively simple, it captures the central mechanisms of banking—why it works, but also how the system is inherently vulnerable and thus needs regulation.

The model in the article is based upon households saving some of their income, as well as needing to be able to withdraw their money when they wish. No one knows in advance whether and when the need for money will arise, but this does not happen at the same time for every household. Meanwhile, there are investment projects that need financing. These projects are profitable in the longterm, but if they are terminated early, the returns will be very low.

In an economy without banks, the households must make direct investments in these projects. Households that need money at short notice will be forced to terminate the projects early, and will consequently experience very poor returns, with only a small amount of money available for consumption. On the other hand, households that do not need to terminate projects early will enjoy good returns and higher consumption. In such a situation, households will demand a solution that allows them to instantly access their money without this leading to very low returns. Because this solution will be valuable, they will be prepared to accept somewhat lower long-term returns.

In their article, Diamond and Dybvig explain how banks naturally arise as intermediaries and provide this solution. The bank offers accounts where households can deposit their money. It then lends the money to long-term projects. Depositors can withdraw their money when they want, without losing as much as if they had made a direct investment but terminated the project early. These higher returns are financed by households that save for longer thus giving up some long-term returns, compared to if they had made a direct investment in the project.

Banks create money

Diamond and Dybvig show that this process is how banks create liquidity. The money in the depositors' accounts is a liability for the bank, while the bank's assets consist of loans to long-term projects. The bank's assets have a long maturity, because it promises borrowers that they will not need to pay back their loans early. On the other hand, the bank's liabilities have a short maturity; depositors can access their money whenever they want. The bank is an intermediary that transforms assets with long maturity into bank accounts with short maturity. This is usually called maturity transformation.

Savers can use their deposit accounts for direct payments. The bank has thus created money, not from thin air but from the long-term investment projects to which it has lent money. Banks are sometimes criticised for creating money, but here we see that this is precisely why they exist.

Vulnerable to rumours

It is easy to see that maturity transformation is valuable to society, but the laureates also demonstrate that the banks' business model is vulnerable. A rumour may start, saying that more savers than the bank can cope with are about to withdraw their money. Regardless of whether this rumour is true, it can send depositors rushing to the bank to withdraw their money in case the bank goes bankrupt. A bank run ensues. In an attempt to pay all its depositors, the bank is forced to recover its loans early, leading to long-term investment projects being terminated prematurely and assets being sold in fire sales. The resulting losses may cause the bank to collapse. The mechanism that Bernanke showed was the trigger for the depression in the 1930s is thus a direct consequence of banks' inherent vulnerability.

Diamond and Dybvig also present a solution to the problem of bank vulnerability, in the form of deposit insurance from the government. When depositors know that the state has guaranteed their money, they no longer need to rush to the bank as soon as rumours start about a bank run. This stops a bank run before it starts. The existence of a deposit insurance therefore entails, in theory, that it never needs to be used. This explains why most countries have now implemented these schemes.

Banks monitor borrowers…

In an article from 1984, Diamond analyses the conditions necessary for banks to take on another important task, namely monitoring borrowers to ensure they honour their commitments.

In reality, most investments are risky. Returns depend on factors such as general uncertainty and on how well the borrower has done their job. A borrower could try to avoid paying their debts by claiming that an investment failed due to bad luck. To prevent this, going bankrupt needs to be costly for borrowers. However, even borrowers who have done their jobs well and not wasted any money can sometimes go bankrupt, which creates unnecessary costs to society.

In his article, Diamond assumes that the bank can monitor borrowers at a certain cost. The bank makes an initial credit evaluation and then follows how the investment is progressing. Thanks to this, many bankruptcies can be avoided and societal costs are reduced. Without the bank as an intermediary, this type of monitoring would be too difficult or overly costly. All the individuals who have directly or indirectly invested in a project can hardly be expected to monitor that their money has been well managed. Instead, this monitoring is delegated to the bank.

…but who monitors the banks?

However, one difficulty remains. If the bank is monitoring the borrowers—who is monitoring the banks? In practice, we cannot rely on each depositor knowing whether the bank is doing its job properly. One of the conclusions in Diamond's article is that the way in which banks are organised means they do not need to be monitored by the depositors.

If the bank cuts corners on monitoring borrowers, it risks large losses on its loans. The bank would thus be unable to repay what it promised its depositors and collapse. Therefore, it is in the bank's own interest to monitor its borrowers without the depositors needing to monitor the bank.

Even if the bank performs its monitoring duties well, it will incur losses on some of its loans. However, the risk that a major bank will collapse due to this is small, as long as the bank manages its lending activities in a responsible manner. This is because a bank grants loans to a large number of borrowers. Even if a few borrowers default on their loans, the losses across all loans will be small and predictable. Not putting all their eggs in the same basket reduces the average risk in the bank's loans portfolio. Thanks to the bank acting as an intermediary, the costs are reduced for bankruptcy and monitoring borrowers. This benefits society as a whole.

Diamond and Dybvig also present a solution to the problem of bank vulnerability, in the form of deposit insurance from the government. When depositors know that the state has guaranteed their money, they no longer need to rush to the bank as soon as rumours start about a bank run. This stops a bank run before it starts. The existence of a deposit insurance therefore entails, in theory, that it never needs to be used. This explains why most countries have now implemented these schemes.

Banks monitor borrowers…

In an article from 1984, Diamond analyses the conditions necessary for banks to take on another important task, namely monitoring borrowers to ensure they honour their commitments.

In reality, most investments are risky. Returns depend on factors such as general uncertainty and on how well the borrower has done their job. A borrower could try to avoid paying their debts by claiming that an investment failed due to bad luck. To prevent this, going bankrupt needs to be costly for borrowers. However, even borrowers who have done their jobs well and not wasted any money can sometimes go bankrupt, which creates unnecessary costs to society.

In his article, Diamond assumes that the bank can monitor borrowers at a certain cost. The bank makes an initial credit evaluation and then follows how the investment is progressing. Thanks to this, many bankruptcies can be avoided and societal costs are reduced. Without the bank as an intermediary, this type of monitoring would be too difficult or overly costly. All the individuals who have directly or indirectly invested in a project can hardly be expected to monitor that their money has been well managed. Instead, this monitoring is delegated to the bank.

…but who monitors the banks?

However, one difficulty remains. If the bank is monitoring the borrowers—who is monitoring the banks? In practice, we cannot rely on each depositor knowing whether the bank is doing its job properly. One of the conclusions in Diamond's article is that the way in which banks are organised means they do not need to be monitored by the depositors.

If the bank cuts corners on monitoring borrowers, it risks large losses on its loans. The bank would thus be unable to repay what it promised its depositors and collapse. Therefore, it is in the bank's own interest to monitor its borrowers without the depositors needing to monitor the bank.

Even if the bank performs its monitoring duties well, it will incur losses on some of its loans. However, the risk that a major bank will collapse due to this is small, as long as the bank manages its lending activities in a responsible manner. This is because a bank grants loans to a large number of borrowers. Even if a few borrowers default on their loans, the losses across all loans will be small and predictable. Not putting all their eggs in the same basket reduces the average risk in the bank's loans portfolio. Thanks to the bank acting as an intermediary, the costs are reduced for bankruptcy and monitoring borrowers. This benefits society as a whole.

No comments:

Post a Comment