Bloomberg News | March 28, 2024 |

For a global lithium industry still reeling from gluts along the battery supply chain, the greater long-term risk is producing too little of the metal rather than too much, according to the world’s No. 2 producer, Chile.

More threatening than oversupply in the coming years is the risk of a renewed shortage, which would send prices soaring and make alternative battery technologies more viable, the South American nation’s finance minister said.

“Production needs to increase so that it remains profitable and attractive to manufacture lithium batteries for electro-mobility,” Mario Marcel said in an interview Thursday from his office in Santiago.

Chile intends to do its bit to make sure that doesn’t happen. This week, the government unveiled a list of salt flats that will be opened up to mining as part of a plan to double output over the next decade under a new public-private model.

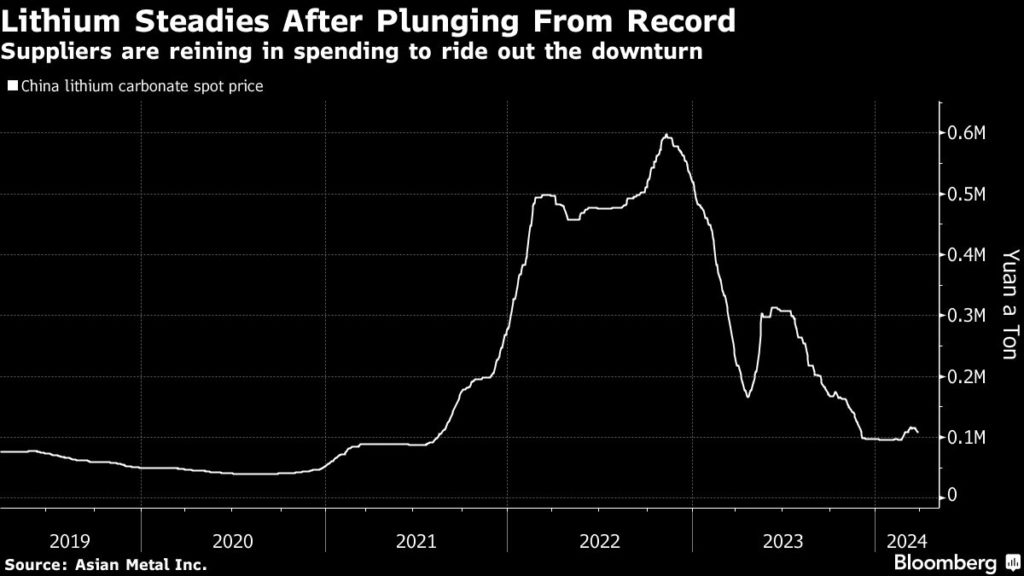

If Chile can pull it off, the flood of new supply would be cheered by the EV supply chain as demand grows in the move away from fossil fuels. Lithium remains a highly volatile and still immature market. Prices surged through late 2022 as battery makers stocked up amid accelerating EV sales before plunging last year as buyers ran down inventories.

Two thirds of additional production out of Chile would come from SQM’s planned partnership with state-owned Codelco, and the other third from new projects, Marcel said. The target doesn’t include proposed expansions at Albemarle Corp.’s operations.

President Gabriel Boric’s plan to tap more of the world’s largest reserves — putting an end to years of market share loss due to strict output quotas — is divided up into three categories.

Two salt flats are considered strategic, meaning future contracts will be controlled by the state. In two others, state-owned companies will have the flexibility to negotiate terms with private partners. In a third process, contracts for as many as 26 other areas will be put out to tender.

The government expects three or four new projects to be under development by 2026, including the Codelco-led Maricunga venture, one other area currently under the domain of a state company and a couple of private operations, Marcel said. Another mine on the giant Salar de Atacama “would be difficult” given water limits, he said.

‘Political bias?’

When Boric first unveiled his lithium strategy a year ago, industry concern centered on his emphasis on a larger role for the state and the need to move to new methods that promise to make extraction more efficient and greener but are barely used commercially anywhere in the world.

This week’s announcement confirms that, at least in some areas, the door is open for companies to control projects and even go it alone. In addition, new production methods – collectively known as direct lithium extraction – will be a “desirable variable” rather than a requirement in new contracts, Marcel said.

“Many of the interpretations assumed that this was a more statist policy than it really is, perhaps because of political bias,” the minister said. “The important thing is that now the situation has been clearly clarified.”

(By James Attwood and Matthew Malinowski)

India to send teams to Chile seeking lithium and copper assets

Reuters | March 28, 2024 |

Northern Chile. Stock image.

India will send two delegations next month to Chile to scout for lithium and copper resources, a government source said, as rapid economic expansion and New Delhi’s efforts to speed up the energy transition stoke demand for critical minerals.

Chile is a key target as it is the world’s biggest supplier of copper and the second-biggest producer of lithium, which are essential for electric vehicle batteries and renewable energy systems in the push away from fossil fuels.

As part of India’s drive to explore overseas for mineral assets, state firms National Aluminium Company, Hindustan Copper and unlisted Mineral Exploration and Consultancy have set up a company called Khanij Bidesh India (KABIL).

“KABIL has to send a delegation to Chile in April,” said the source, who did not wish to be named as details of the plan have not been made public.

“We are interested in buying assets. We are trying to facilitate private and government-owned companies to acquire assets in other countries as well.”

The government is separately sending a delegation to look for copper assets, the source said.

The federal Ministry of Mines and KABIL did not respond to Reuters emails for comments.

India, the world’s third-biggest emitter of greenhouse gases behind China and the United States, has pledged to achieve a net-zero carbon emission target by 2070 and increase the share of renewables in its energy mix to 50% by 2030.

In January, KABIL signed a 2-billion-rupee ($24.01 million) lithium exploration pact for five blocks in Argentina. The deal, signed with an Argentinian state-run enterprise, gives KABIL exploration and development rights for commercial production.

KABIL, which is currently setting up an office in Argentina, is also in talks with another company in the Latin American country for lithium exploration, the source said.

At the same time, KABIL is talking to the Australian government to help appoint a consultant to restart due diligence that would pave the way for a lithium block acquisition in the country, the source said.

India is also looking at Africa for copper, cobalt and other critical minerals, V.L. Kantha Rao, the most senior official at the Ministry of Mines, said last week.

India is in the process of auctioning 38 critical and strategic minerals blocks, including lithium.

($1 = 83.30 rupees)

(By Neha Arora; Editing by Mayank Bhardwaj and Sonali Paul)

Chile needs to finalize more lithium plan details to spur investment, miners say

Reuters | March 27, 2024 |

The Maricunga lithium project sits on its namesake salt flat, Chile’s second-largest in terms of reserves. (Image by SergeJF, Wikimedia Commons).

The Chilean government’s new plan to usher in private investment at a number of the country’s lithium salt flats may stumble over unresolved details that will raise concerns for investors, mining executives and analysts said on Wednesday.

Industry players said they are seeking information on how contracts will be awarded by officials in the country that is the world’s second-biggest lithium producer and are worried about pushback from Indigenous communities and environmental campaigners.

Chile in April will begin seeking proposals from private firms interested in extracting lithium, a key energy transition material used in electric vehicle batteries, from 26 salt flats not earmarked for state control, officials said on Tuesday.

The plan is one of the new planks of President Gabriel Boric’s 2023 lithium policy mandating public-private partnerships.

The government will reserve two of its best salt flats, Atacama and Maricunga, for majority control through state-run copper miner Codelco, while progressing projects via state-run companies at another five salt flats.

The state-developed projects alone are expected to double Chile’s output to about 500,000 metric tons of lithium carbonate equivalent by the end of decade, Mining Minister Aurora Williams said on Wednesday.

For the remaining 26 salt flats, officials will accept statements of interest through July.

Nearly 100 companies from a dozen countries have already approached the government to seek information about launching lithium projects, Williams said, including from the US and China.

Yet, executives and analysts pointed out red flags in Tuesday’s announcement they say could put a damper on new projects.

One concern is how the government will award lithium contracts in salt flats where mining concessions have previously been granted, which risks creating a kind of double ownership.

“It creates many potential conflicts, setting the stage for future judicial problems,” said Sebastian Yang, a board member of Simco Lithium, which has a project in the Maricunga salt flat.

“This will pose a difficulty for attracting potential investors.”

Chile’s Mining Ministry did not immediately respond to a request for comment.

Jose Hofer, a lithium adviser at consultancy SC Insights, said other challenges that could curb investor appetite include required state partnerships, potential pushback from Indigenous communities and limits on extraction throughout a swath of the salt flats due to environmental protections.

“This over layering of policies and excess of state involvement has made Chile ‘un-investable’ in lithium,” he said, noting that Argentina and Brazil will likely become more significant players compared to Chile over the next decade.

Companies must also grapple with a soft patch for lithium prices amid a slowdown in EV sales, which has changed the calculus for ensuring economically viable projects.

For Canada-based Wealth Minerals, moving forward with its lithium project in the Atacama salt flat will mean starting talks with Codelco over the terms in which the state-owned miner will take a majority stake, said Executive Director Marcelo Awad.

“We’re optimistic and very interested in starting a negotiation with Codelco as soon as possible,” he said.

(By Daina Beth Solomon and Alexander Villegas; Editing by Jamie Freed)

Mitsui invests in Atlas Lithium with offtake deal from Brazil mine

Reuters | March 28, 2024 |

Drilling at Atlas Lithium’s 100%-owned hard-rock lithium project. Credit: Atlas Lithium

Mitsui & Co said on Thursday it will spend $30 million to take a 12% stake in US-based Atlas Lithium to venture into Brazil’s lithium mines to tap demand for the battery mineral.

The deal by the Japanese trading house follows a similar one unveiled by rival Mitsubishi Corp this month to buy a stake in the PAK lithium project of Canadian miner Frontier Lithium.

Mitsui said it would subscribe to a $30 million third-party allocation of new shares by Atlas and gain the right to offtake lithium spodumene concentrate.

Atlas is developing the Neves project in Brazil’s Lithium Valley in the state of Minas Gerais. It is one of the largest lithium tenement holders in Brazil.

The Neves project is expected to start production of spodumene concentrate in the fourth quarter of 2024, with annual production to reach 300,000 metric tons after an expansion in late 2025, enough to be used in about 1 million electric vehicles (EVs), Mitsui said.

Mitsui will offtake a total of 315,000 tons of concentrate in about 5 years.

“As Atlas owns more than 50 blocks in the valley, we see the upside potential,” Akinobu Hashimoto, general manager of Mitsui’s new metals & aluminium division, told reporters.

He highlighted the short period from investment to production initiation and the lower development costs compared to those in Australia as key attractive points.

The deal marks Mitsui’s first investment in lithium and comes as part of its strategy to build battery material value chains encompassing development, production, and recycling.

Mitsui aims to expand its lithium portfolio by engaging in additional upstream and conversion projects, while also eyeing investments in other battery minerals such as nickel and manganese, Hashimoto said.

The deal is set for completion in April.

(By Kaori Kaneko; Editing by Tom Hogue and Jason Neely)

Read More: Atlas Lithium raises $20 million from investors led by former Allkem chairman

Drilling at Atlas Lithium’s 100%-owned hard-rock lithium project. Credit: Atlas Lithium

Mitsui & Co said on Thursday it will spend $30 million to take a 12% stake in US-based Atlas Lithium to venture into Brazil’s lithium mines to tap demand for the battery mineral.

The deal by the Japanese trading house follows a similar one unveiled by rival Mitsubishi Corp this month to buy a stake in the PAK lithium project of Canadian miner Frontier Lithium.

Mitsui said it would subscribe to a $30 million third-party allocation of new shares by Atlas and gain the right to offtake lithium spodumene concentrate.

Atlas is developing the Neves project in Brazil’s Lithium Valley in the state of Minas Gerais. It is one of the largest lithium tenement holders in Brazil.

The Neves project is expected to start production of spodumene concentrate in the fourth quarter of 2024, with annual production to reach 300,000 metric tons after an expansion in late 2025, enough to be used in about 1 million electric vehicles (EVs), Mitsui said.

Mitsui will offtake a total of 315,000 tons of concentrate in about 5 years.

“As Atlas owns more than 50 blocks in the valley, we see the upside potential,” Akinobu Hashimoto, general manager of Mitsui’s new metals & aluminium division, told reporters.

He highlighted the short period from investment to production initiation and the lower development costs compared to those in Australia as key attractive points.

The deal marks Mitsui’s first investment in lithium and comes as part of its strategy to build battery material value chains encompassing development, production, and recycling.

Mitsui aims to expand its lithium portfolio by engaging in additional upstream and conversion projects, while also eyeing investments in other battery minerals such as nickel and manganese, Hashimoto said.

The deal is set for completion in April.

(By Kaori Kaneko; Editing by Tom Hogue and Jason Neely)

Read More: Atlas Lithium raises $20 million from investors led by former Allkem chairman

No comments:

Post a Comment