Spirit Aero to be broken up as Boeing agrees $4.7 billion stock deal

By Tim Hepher, Shivani Tanna and Mike Stone

Summary

Companies

Airbus to take on some Spirit operations related to its planes

Spirit made 737 MAX door plug involved in mid-air blowout

Boeing had spun off the fuselage supplier in 2005

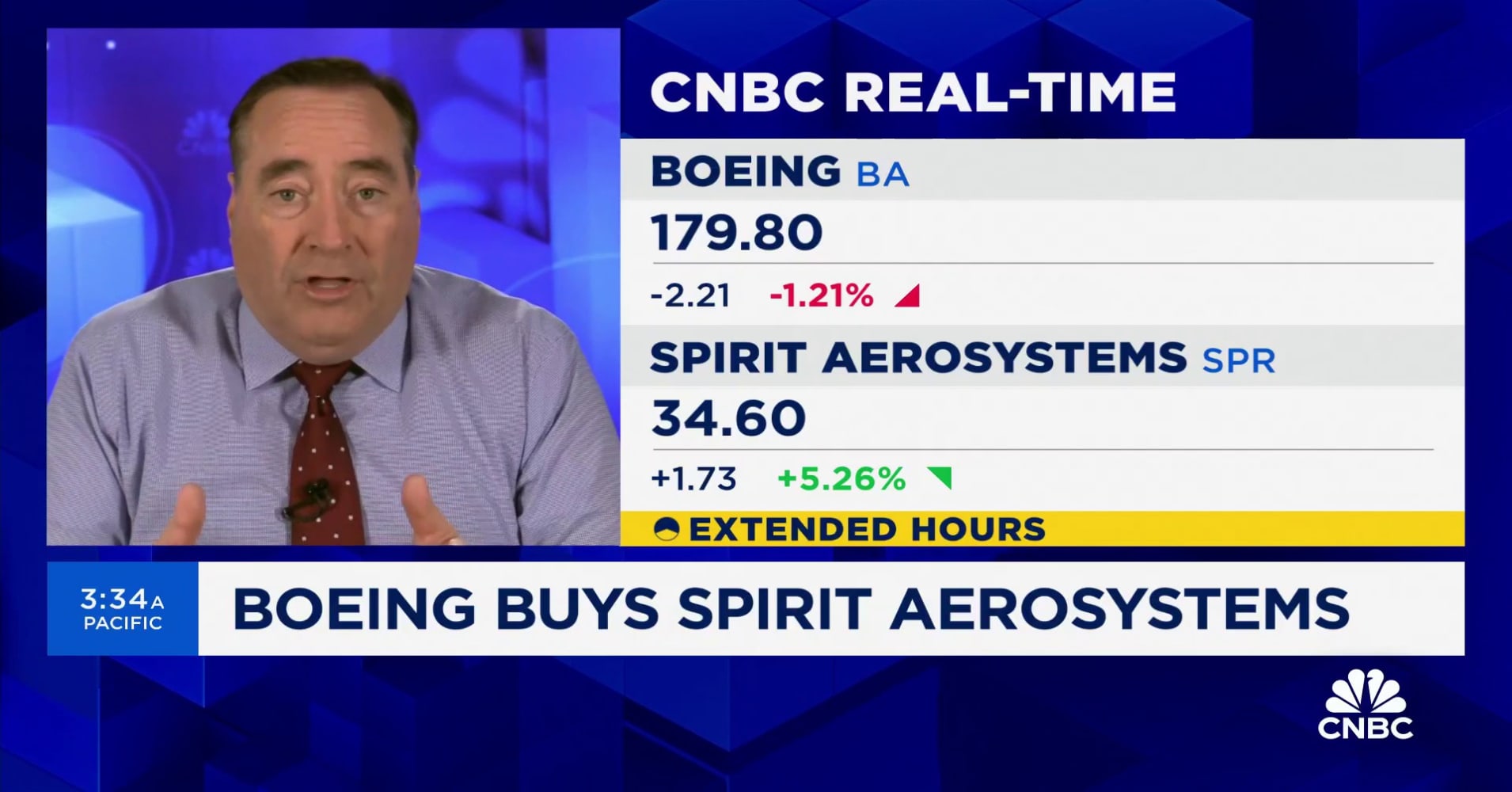

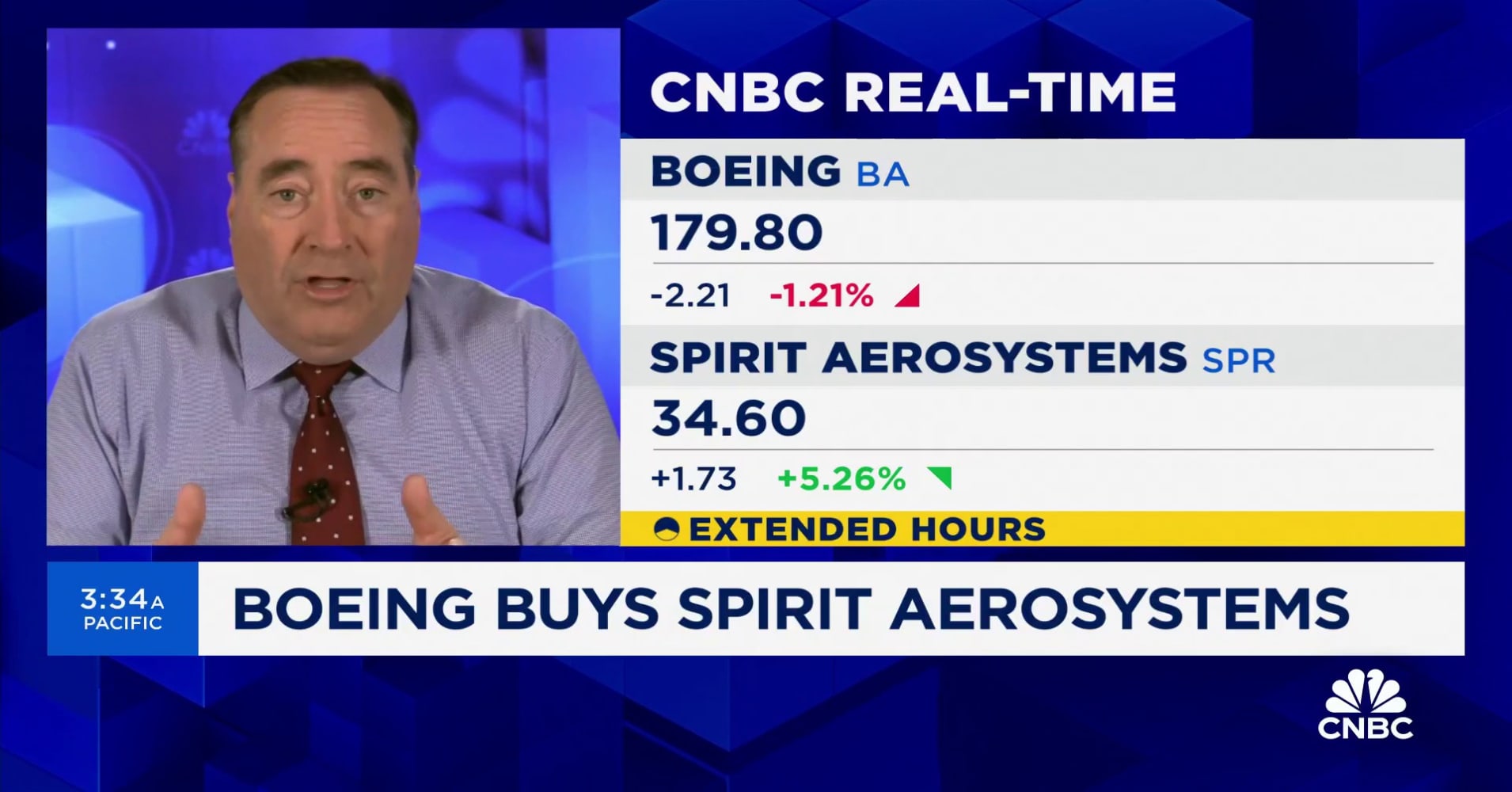

July 1 (Reuters) - Boeing (BA.N), opens new tab agreed to buy back Spirit AeroSystems (SPR.N), opens new tab for $4.7 billion in stock and Airbus moved to take on the supplier's loss-making Europe-focused activities, sending shares in all three companies higher in a rare transatlantic break-up.

The near-two-decade independence of the world's largest standalone aerostructures company ended in a carve-up between its largest customers after the latest Boeing 737 MAX crisis, sparked by a mid-air door plug blowout in January, brought to a head doubts over the resilience of fuselage manufacturing.

Boeing, which spun off Spirit's core Wichita and Oklahaoma plants in 2005, said it would repurchase its former subsidiary for about $37.25 per share, as reported by Reuters on Sunday, giving it an enterprise value of $8.3 billion including debt.

"Bringing Spirit and Boeing together will enable greater integration of both companies' manufacturing and engineering capabilities, including safety and quality systems," Spirit CEO Pat Shanahan said in a statement.

Spirit shares rose 3.6% in early U.S. trading, while Boeing gained 2%

The Wichita, Kansas-based company said the deal offered a 30% premium versus the day before Boeing and Spirit announced talks to bring the struggling supplier back in house on March 1.

Boeing has long pondered buying back its former subsidiary, which analysts say has struggled to thrive independently despite diversifying into work for Europe's Airbus (AIR.PA), opens new tab and others.

The decision to go ahead comes as Boeing tries to resolve a sprawling corporate and industrial crisis that has engulfed one of the industry's key suppliers.

Boeing is trying to move past months of difficulties sparked by the Jan. 5 blowout of a door plug on a virtually new Alaska Airlines (ALK.N), opens new tab 737 MAX 9 jet that exposed quality problems.

Those issues have led to a substantial slowdown in output at Boeing, rippling across the global commercial aviation industry.

Rating agency Fitch said the deal should be "operationally beneficial" to Boeing, allowing it to better plan and control future 737 MAX production.

The U.S. planemaker has announced the planned departure of CEO Dave Calhoun in the wake of the crisis, with industry executives and analysts pointing to Spirit's Shanahan, a former senior Boeing executive, as one of the possible replacements.

It was not immediately clear how long he might be tied to Spirit, with the Boeing deal not due to close until mid-2025.

A Boeing 737 MAX-10 lands over the Spirit AeroSystems logo during a flying display at the 54th International Paris Air Show at Le Bourget Airport near Paris, France, June 22, 2023. REUTERS/Benoit Tessier/ File Photo Purchase Licensing Rights, opens new tab

AIRBUS DEAL

Spirit had been spun off from Boeing in one of a series of moves that critics say were emblematic of a focus on cost-cutting over quality.

Boeing made the decision to buy it back in the aftermath of the door plug blowout, in what it described as an effort to address its safety problems and shore up its production line.

That raised questions over the future of work that Spirit carries out for Boeing's arch-rival Airbus, prompting the CEO of the European giant to warn in April that it stood ready if necessary to veto changes in control of Airbus-related plants.

On Monday, Airbus said it would take over core activities at four of the supplier's plants in the United States, Northern Ireland, France and Morocco as reported by Reuters last week.

It will also take over minor work currently carried out in Wichita. The separate Airbus deal was triggered by talks between Boeing and Spirit and was loosely coordinated between the three companies, sources said. It is subject to due diligence.

Airbus shares rose about 3.3% on Monday.

Since Spirit's Airbus-related operations are in the red, industry sources had said the planemaker was pressing for up to $1 billion in compensation in return for taking over the plants, which make strategic parts for its A350 and A220 airliners.

Airbus said it would receive $559 million in compensation from Spirit, depending on the final outlines of the deal, while it would pay the supplier a symbolic $1 for the assets.

That echoes its decision to buy the Canadian-designed CSeries small jetliner program for just $1 from Bombardier (BBDb.TO), opens new tab in 2018. It later renamed the jet the A220.

Until the latest shake-up, Airbus had not envisaged taking control of the loss-making A220 wings manufacturing carried out in Belfast, which Spirit bought from Bombardier in 2019.

Monday's deal lifts doubts over the future of part of Northern Ireland's top industrial employer, though sources have said Airbus may need to invest significant sums to increase output and make the wings more affordable to produce.

Spirit said it planned to sell operations in Prestwick, Scotland and in Subang, Malaysia that support Airbus programs and those in Belfast that do not support Airbus programs.

Reporting by Mike Stone and David Shepardson in Washington, Allison Lampert in Montreal, Tim Hepher in Paris and Shivansh Tiwary, Abhijith Ganapavaram and Shivani Tanna in Bengaluru; editing by David Gaffen, Shubham Kalia, Jamie Freed and Jason Neely

By Tim Hepher, Shivani Tanna and Mike Stone

July 1, 2024

Summary

Companies

Airbus to take on some Spirit operations related to its planes

Spirit made 737 MAX door plug involved in mid-air blowout

Boeing had spun off the fuselage supplier in 2005

July 1 (Reuters) - Boeing (BA.N), opens new tab agreed to buy back Spirit AeroSystems (SPR.N), opens new tab for $4.7 billion in stock and Airbus moved to take on the supplier's loss-making Europe-focused activities, sending shares in all three companies higher in a rare transatlantic break-up.

The near-two-decade independence of the world's largest standalone aerostructures company ended in a carve-up between its largest customers after the latest Boeing 737 MAX crisis, sparked by a mid-air door plug blowout in January, brought to a head doubts over the resilience of fuselage manufacturing.

Boeing, which spun off Spirit's core Wichita and Oklahaoma plants in 2005, said it would repurchase its former subsidiary for about $37.25 per share, as reported by Reuters on Sunday, giving it an enterprise value of $8.3 billion including debt.

"Bringing Spirit and Boeing together will enable greater integration of both companies' manufacturing and engineering capabilities, including safety and quality systems," Spirit CEO Pat Shanahan said in a statement.

Spirit shares rose 3.6% in early U.S. trading, while Boeing gained 2%

The Wichita, Kansas-based company said the deal offered a 30% premium versus the day before Boeing and Spirit announced talks to bring the struggling supplier back in house on March 1.

Boeing has long pondered buying back its former subsidiary, which analysts say has struggled to thrive independently despite diversifying into work for Europe's Airbus (AIR.PA), opens new tab and others.

The decision to go ahead comes as Boeing tries to resolve a sprawling corporate and industrial crisis that has engulfed one of the industry's key suppliers.

Boeing is trying to move past months of difficulties sparked by the Jan. 5 blowout of a door plug on a virtually new Alaska Airlines (ALK.N), opens new tab 737 MAX 9 jet that exposed quality problems.

Those issues have led to a substantial slowdown in output at Boeing, rippling across the global commercial aviation industry.

Rating agency Fitch said the deal should be "operationally beneficial" to Boeing, allowing it to better plan and control future 737 MAX production.

The U.S. planemaker has announced the planned departure of CEO Dave Calhoun in the wake of the crisis, with industry executives and analysts pointing to Spirit's Shanahan, a former senior Boeing executive, as one of the possible replacements.

It was not immediately clear how long he might be tied to Spirit, with the Boeing deal not due to close until mid-2025.

A Boeing 737 MAX-10 lands over the Spirit AeroSystems logo during a flying display at the 54th International Paris Air Show at Le Bourget Airport near Paris, France, June 22, 2023. REUTERS/Benoit Tessier/ File Photo Purchase Licensing Rights, opens new tab

In a note to investors, Bernstein analyst Douglas Harned said the deal "should add clarity ... potentially for the Boeing board’s attention to move to the decision on the next CEO".

AIRBUS DEAL

Spirit had been spun off from Boeing in one of a series of moves that critics say were emblematic of a focus on cost-cutting over quality.

Boeing made the decision to buy it back in the aftermath of the door plug blowout, in what it described as an effort to address its safety problems and shore up its production line.

That raised questions over the future of work that Spirit carries out for Boeing's arch-rival Airbus, prompting the CEO of the European giant to warn in April that it stood ready if necessary to veto changes in control of Airbus-related plants.

On Monday, Airbus said it would take over core activities at four of the supplier's plants in the United States, Northern Ireland, France and Morocco as reported by Reuters last week.

It will also take over minor work currently carried out in Wichita. The separate Airbus deal was triggered by talks between Boeing and Spirit and was loosely coordinated between the three companies, sources said. It is subject to due diligence.

Airbus shares rose about 3.3% on Monday.

Since Spirit's Airbus-related operations are in the red, industry sources had said the planemaker was pressing for up to $1 billion in compensation in return for taking over the plants, which make strategic parts for its A350 and A220 airliners.

Airbus said it would receive $559 million in compensation from Spirit, depending on the final outlines of the deal, while it would pay the supplier a symbolic $1 for the assets.

That echoes its decision to buy the Canadian-designed CSeries small jetliner program for just $1 from Bombardier (BBDb.TO), opens new tab in 2018. It later renamed the jet the A220.

Until the latest shake-up, Airbus had not envisaged taking control of the loss-making A220 wings manufacturing carried out in Belfast, which Spirit bought from Bombardier in 2019.

Monday's deal lifts doubts over the future of part of Northern Ireland's top industrial employer, though sources have said Airbus may need to invest significant sums to increase output and make the wings more affordable to produce.

Spirit said it planned to sell operations in Prestwick, Scotland and in Subang, Malaysia that support Airbus programs and those in Belfast that do not support Airbus programs.

Reporting by Mike Stone and David Shepardson in Washington, Allison Lampert in Montreal, Tim Hepher in Paris and Shivansh Tiwary, Abhijith Ganapavaram and Shivani Tanna in Bengaluru; editing by David Gaffen, Shubham Kalia, Jamie Freed and Jason Neely

Story by Christopher Jasper • 19h •

Spirit AeroSystems - Handout© Provided by The Telegraph

The future of a major British aerospace plant is in doubt with up to 2,400 jobs at risk following a carve-up of owner Spirit AeroSystems between Boeing and Airbus.

A chunk of Spirit’s operations at the facility in Belfast have been left without an owner, putting the long-term future of the entire factory in danger.

Boeing is to buy Kansas-based Spirit for $4.7bn (£3.7bn) in order to gain control of a key supplier to its troubled 737 Max jet, while offloading operations that provide components for Airbus to its European rival.

This means Airbus will be taking control of a part of the Belfast factory that oversees wing and fuselage production for the Airbus A220 regional jet.

Boeing said an alternative buyer is being sought for the other parts of Spirit’s Belfast business that neither manufacturer is prepared to take on.

But if this deal falls through, it is feared the entire facility – the biggest manufacturer in Northern Ireland – will no longer be commercially viable.

Spirit is the biggest manufacturer in Northern Ireland - Spirit AeroSystems

© Provided by The Telegraph

George Brash, regional officer for the trade union Unite, said: “This deal provides no clarity whatsoever about the future of the majority of employees at Spirit Belfast.

“Our fear is that there will be a dismantling of the site and that jobs will be put at risk. We’re talking about a huge number of jobs in the context of Northern Ireland.”

George Brash, regional officer for the trade union Unite, said: “This deal provides no clarity whatsoever about the future of the majority of employees at Spirit Belfast.

“Our fear is that there will be a dismantling of the site and that jobs will be put at risk. We’re talking about a huge number of jobs in the context of Northern Ireland.”

Related video: Boeing Buys Back 737 Max Supplier Spirit Aerosystems (Cheddar News)

Duration 1:18 View on Watch

More videos

Bloomberg Boeing Agrees to Buy Spirit Aero for $4.7 Billion in Stock Deal

1:39

CNBC Boeing to buy Spirit AeroSystems in $4.7 billion deal

3:56

FOX 13 Seattle Boeing faces deadline to decide on plea deal

2:05

The unwanted operations, which produce fuselage and tail sections for Bombardier business jets and housings for Rolls-Royce engines, account for 40pc of Spirit’s business but a majority of its 3,600-strong Belfast workforce, according to Unite.

DUP leader Gavin Robinson hit out at the plan as representing only a “partial solution”.

He said: “My preference would be to see a single buyer for the entire site. That is the best way to secure all jobs and make the site sustainable.”

The threat to the Belfast plant, once the headquarters of Short Brothers, the world’s first manufacturer of commercial aircraft, was followed by news that another Northern Irish business, Titanic shipbuilder Harland & Wolff, had halted trading in its shares.

The company, which has 500 staff in Belfast, was forced into the action after auditors declined to sign off on its accounts, six weeks after the Treasury threatened to withdraw vital funding.

Northern Irish shipbuilder Harland & Wolff halted trading after auditors declined to sign off on its accounts - Liam McBurney/PA Wire© Provided by The Telegraph

Boeing said that under the terms of its takeover of Spirit, the supplier is proposing to sell non-Airbus activities in Belfast to a third party. Sources said that represents a declaration of intent and that there’s no prospect of a quick sale.

Airbus confirmed that it will take on operations including wing production in Belfast and other A220-related work in the US and Morocco, as well as manufacturing of fuselage sections for the A350 wide-body plane in the US and France.

Airbus will pay Spirit a nominal $1 while receiving $559m in compensation for assuming responsibility for the unprofitable activities.

Should a buyer not be found for a subsidiary business in Prestwick, Scotland, which makes wing slats for the A320 jet, Airbus said it would also be prepared to take that on as it works through a record order backlog for the popular single-aisle plane.

However, there is no such safety net in place for remaining operations in Northern Ireland.

Sir Michael Ryan, chairman of Spirit UK, warned in April that a break-up of the Belfast business would be “extremely detrimental” to its future and to the province’s wider standing in the aerospace industry.

In a letter, he said that maintaining the site as a single entity was the best option, and that vital economies of scale and technological synergies could otherwise be lost.

Spirit’s Belfast footprint spans six sites, including some located in the Catholic west of the city regarded as integral to the Northern Ireland peace process.

The main factory, sandwiched between Belfast City Airport and the docks, was built by Short Brothers in 1936 and produced Second World War aircraft including the Stirling bomber and Sunderland flying boat.

Shorts began trading in 1897, making hot-air balloons before switching to aircraft after the Wright Brothers’ first flight.

The company built six planes on the Isle of Sheppey in 1909, making it the first in the world to undertake volume aircraft production.

It was sold to Canada’s Bombardier in 1989 and to Spirit in 2020.

1:39

CNBC Boeing to buy Spirit AeroSystems in $4.7 billion deal

3:56

FOX 13 Seattle Boeing faces deadline to decide on plea deal

2:05

The unwanted operations, which produce fuselage and tail sections for Bombardier business jets and housings for Rolls-Royce engines, account for 40pc of Spirit’s business but a majority of its 3,600-strong Belfast workforce, according to Unite.

DUP leader Gavin Robinson hit out at the plan as representing only a “partial solution”.

He said: “My preference would be to see a single buyer for the entire site. That is the best way to secure all jobs and make the site sustainable.”

The threat to the Belfast plant, once the headquarters of Short Brothers, the world’s first manufacturer of commercial aircraft, was followed by news that another Northern Irish business, Titanic shipbuilder Harland & Wolff, had halted trading in its shares.

The company, which has 500 staff in Belfast, was forced into the action after auditors declined to sign off on its accounts, six weeks after the Treasury threatened to withdraw vital funding.

Northern Irish shipbuilder Harland & Wolff halted trading after auditors declined to sign off on its accounts - Liam McBurney/PA Wire© Provided by The Telegraph

Boeing said that under the terms of its takeover of Spirit, the supplier is proposing to sell non-Airbus activities in Belfast to a third party. Sources said that represents a declaration of intent and that there’s no prospect of a quick sale.

Airbus confirmed that it will take on operations including wing production in Belfast and other A220-related work in the US and Morocco, as well as manufacturing of fuselage sections for the A350 wide-body plane in the US and France.

Airbus will pay Spirit a nominal $1 while receiving $559m in compensation for assuming responsibility for the unprofitable activities.

Should a buyer not be found for a subsidiary business in Prestwick, Scotland, which makes wing slats for the A320 jet, Airbus said it would also be prepared to take that on as it works through a record order backlog for the popular single-aisle plane.

However, there is no such safety net in place for remaining operations in Northern Ireland.

Sir Michael Ryan, chairman of Spirit UK, warned in April that a break-up of the Belfast business would be “extremely detrimental” to its future and to the province’s wider standing in the aerospace industry.

In a letter, he said that maintaining the site as a single entity was the best option, and that vital economies of scale and technological synergies could otherwise be lost.

Spirit’s Belfast footprint spans six sites, including some located in the Catholic west of the city regarded as integral to the Northern Ireland peace process.

The main factory, sandwiched between Belfast City Airport and the docks, was built by Short Brothers in 1936 and produced Second World War aircraft including the Stirling bomber and Sunderland flying boat.

Shorts began trading in 1897, making hot-air balloons before switching to aircraft after the Wright Brothers’ first flight.

The company built six planes on the Isle of Sheppey in 1909, making it the first in the world to undertake volume aircraft production.

It was sold to Canada’s Bombardier in 1989 and to Spirit in 2020.

No comments:

Post a Comment