Is a U.S. Refining Cartel Emerging?

Major Players Slash Production

- Major US refiners, including Marathon Petroleum, are significantly reducing their refining capacity due to concerns about a global crude oil glut and weakening demand.

- OPEC has downgraded its global oil demand growth forecasts for 2024 and 2025, further adding to the concerns about oversupply.

- Analysts predict that Brent crude oil prices will likely decline in the coming quarters, potentially reaching as low as $64/bbl in the second quarter of 2025.

Following the series of mega-mergers in the oil exploration and production space, a potential US refining cartel—a 'mini OPEC on American soil'—could be taking shape with some of the first coordinated policies to reduce refining capacity this quarter as demand falters and concerns about a global glut of crude mount.

Bloomberg reports that four major refiners, including Marathon Petroleum, owner of the largest US refinery, plan to reduce refining capacity at 13 of its plants to an average of 90%, down 4% from the same quarter in 2023. Similarly, PBF Energy announced plans to refine the least amount of crude in three years. Phillips 66 will operate refineries near two-year lows, and Valero Energy expects to cut oil processing soon.

The four major refiners represent about 40% of the US capacity to refine oil into diesel, jet fuel, gasoline, and other essential crude products critical to the economy. Slowdown fears encompass not just the US economy (recession scare last Monday) but also China, thus reducing crude product demand and shrinking profit margins for refiners.

On Monday morning, commodity firm Argus' Bachar EL-Halabi wrote on X, "Opec blinks first, downgrading for the first time since July 2023 its global oil demand growth forecasts for 2024 and 2025."

Halabi continued:

- Opec now sees demand growth projection for 2024 to be 2.11mn b/d down from 2.25mn b/d.

- Opec has also cut its oil demand growth forecast for next year by 60,000 b/d to 1.78mn b/d.

- Opec's latest oil demand growth projections narrow the gap with other forecasters such as the IEA and EIA, but Opec's figures are still comparatively bullish.

Reminder: The IEA projects oil demand to increase by 970,000 b/d this year, while the EIA sees demand rising by 1.1mn b/d.

#Opec blinks first, downgrading for the first time since July 2023 its global oil demand growth forecasts for 2024 and 2025.

Opec now sees demand growth projection for 2024 to be 2.11mn b/d down from 2.25mn b/d.

Opec has also cut its oil demand growth forecast for next… https://t.co/BPPe0C95id pic.twitter.com/dUxAJDoMvk

— Bachar EL-Halabi | (@Bacharelhalabi) August 12, 2024

Vikas Dwivedi, Macquarie's global oil and gas strategist, told Bloomberg recently in an interview in Houston, "Compressed refining margins are setting up the stage for another round of heavy refinery maintenance in the US during the fall season ... and that's going to weigh on balances and may add to crude builds in the US for the rest of the year."

He said the potential for supplies to exceed demand has reduced the premium geopolitical risks festering in the Middle East, explaining, "The market is no longer willing to pay a huge premium for that because the tensions haven't so far resulted in a loss of barrels."

Dwivedi expects Brent crude oil to average around $75/bbl in the fourth quarter and slide as low as $64/bbl in the second quarter of next year.

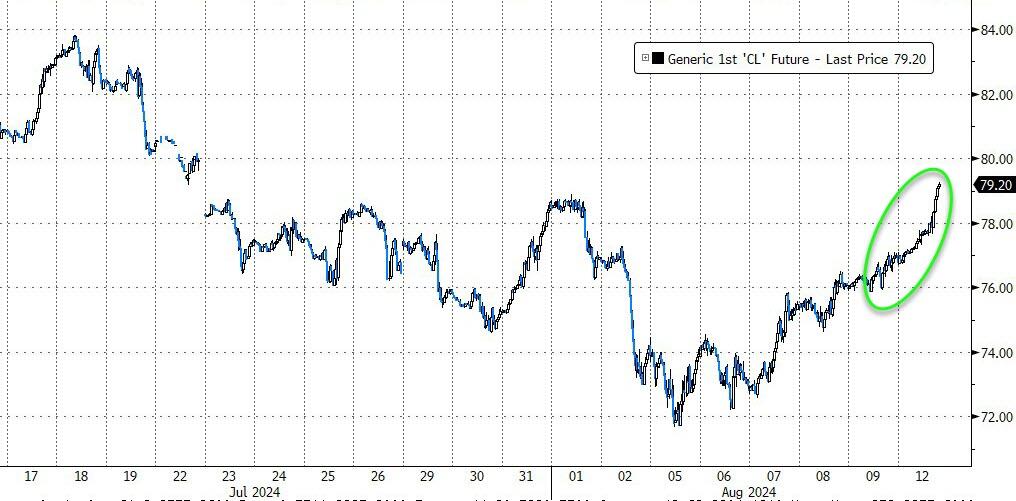

In the meantime, Crude is soaring today amid geopolitical tensions...

Chief Commercial Officer Rick Hessling said Marathon "will run economically at 90%" capacity in the third quarter, a multi-year low. He pointed out that the Chinese economic recovery remains a significant concern, and OPEC could stir volatility with policy in the short term.

The bigger story here is the possible rise of the US refining cartel after a series of mega-mergers in recent quarters.

By Zerohedge.com

Refiners Are Reeling From Low Margins and Weak Demand

- Overcapacity in the petrochemical industry, especially in China, is driving down margins and profitability.

- Weak demand and economic challenges are exacerbating the industry's problems.

- Industry players are responding by cutting production, closing plants, and seeking more efficient operations.

During the latest profit season, U.S. oil refiners signaled they would be curbing output this quarter, pressured by lower margins and the seasonal decline in demand. Petrochemical makers are also having difficulties, mostly due to overcapacity in China. And they are changing in order to overcome them.

A forecast by Wood Mackenzie cited in a recent Reuters article on the petrochemical industry and its long-term outlook said that almost a quarter of global petrochemical capacity was at risk of permanent closure because of depressed—and depressing—margins by 2028. McKinsey added that the downturn in the petrochemicals sector would be longer than usual, which is five to seven years, because of the overcapacity in China. Reuters wrote that the refining industry and the larger oil industry were in trouble because the energy transition would reduce the need for petroleum fuels for transportation.

Of these forecasts, the last is the most uncertain. It hinges on explosive growth in electric vehicles that has so far failed to materialize, and even the recent growth in EV sales is reversing in every country that can no longer afford to subsidize the vehicles. If one looks at the energy transition and the electrification of transport as cause for concern in the oil industry, one may be overestimating the reality of the transition.

Overcapacity, however, is another matter. Back in April, Bloomberg carried a story about the petrochemical industry outside China and how it was going into a "sunset" stage because of the huge capacity gains that Chinese petrochemical makers had made in the past four years. Chinese producers were forcing prior industry majors out of the market because of that capacity, the report said. It was only a matter of time before the effect spread.

"This is yet another example—after steel, solar panels—where China's structural imbalances are clearly spilling over into global markets," Rhodium Group director Charlie Vest told Bloomberg last month in comments on the country's petrochemical industry's growth. That growth was starting to force industry players to cut back on production, Bloomberg reported at the time, with some plants running at just half of capacity amid the squeeze in margins resulting from oversupply. But just like in the solar panel business, it would take a while before the excess capacity is taken care of. In the meantime, petrochemical producers elsewhere would be, as Reuters put it, in survival mode.

The outlook is the grimmest for Asian petrochemicals makers, the report said, likely because they are too close to the behemoth in the petrochemicals room that is China. Margins on propylene in Asia are set to dip below zero this year, coming in at around minus $20 per ton, according to Wood Mac, as quoted by Reuters.

Meanwhile, some refiners are shutting down some petrochemical units. A petrochemicals joint venture between Petronas and Aramco shut its naphtha cracker at the beginning of the year, and a Taiwanese petrochemicals maker shut two of its three crackers later in the year. The situation is perhaps more problematic for petrochemical facilities that are part of refineries—these are still running, even at a loss, Reuters reported.

"Most companies' portfolios are integrated and balanced. If you want to consolidate them, you have to either kill the strengths of one company or get rid of the strengths of the other company," an executive from an unnamed South Korean refiner told Reuters earlier this month.

In Europe, meanwhile, refiners are witnessing the end of the recent rally in their business. It's falling margins and slowing demand again, with TotalEnergies and Neste warning in their latest quarterly presentations about the negative developments.

"Global refining margins, which have sharply decreased since the end of the first quarter 2024, remain impacted by low diesel demand in Europe, as well as by the market normalization following the disruption in Russian supply," TotalEnergies said in its quarterly report, as quoted by Reuters.

Essentially, the refining market in Europe, then, is returning to normal after a brief period of excessively good performance resulting from the war in Ukraine. Now that the impact of those events is weakening, things are going back to the way they were before the war—with pressure from Asia remaining unchanged. There has also been additional pressure from new refineries coming on stream in the Middle East and Africa, although the latter—the Dangote refinery in Nigeria—has been struggling to really take off.

Even so, petrochemical margins in Europe are set to rise this year, according to Wood Mac. While Asian petrochemical makers struggle with their $20 loss per ton of propylene, their European counterparts would enjoy a margin increase to almost $300 per ton, the consultancy has forecast. In the United States, petrochemical makers are set to do even better, despite all the challenges, witnessing a 25% increase in propylene margins to $450 per ton.

The petrochemicals industry may be in trouble, but most of this trouble comes from overcapacity and not transition trends that would ultimately kill the larger energy industry. And the industry is tackling the trouble and adjusting to changing realities. Survival, after all, is an imperative.

By Irina Slav for Oilprice.com

No comments:

Post a Comment