CMOC boosts cobalt production despite Congo export ban

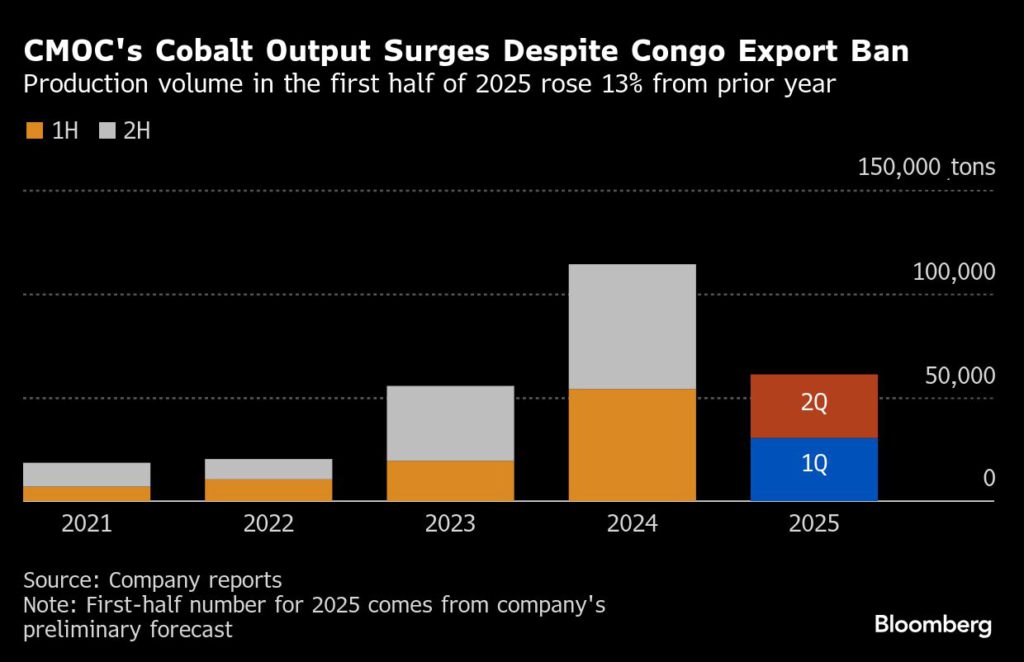

China’s CMOC Group Ltd. produced more cobalt at its two mines in the Democratic Republic of Congo in the first half of this year, despite the African nation’s ban on exports.

The world’s largest cobalt miner reported a 13% year-on-year rise in production of the material, also used in batteries and alloys, to 61,073 tons during the January-June period, according to a preliminary earnings statement released on Monday.

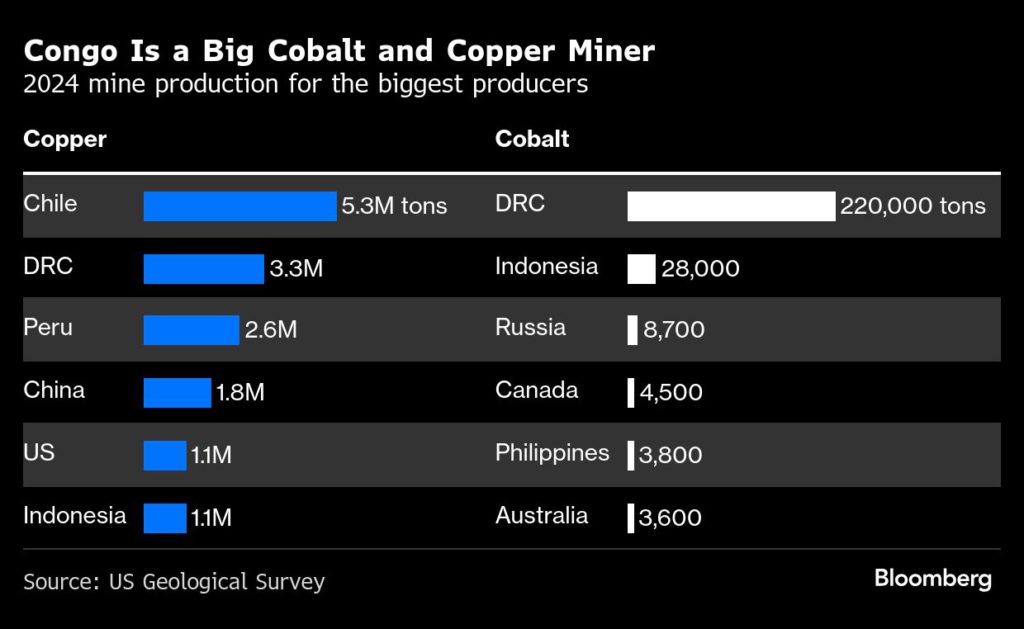

The increase comes even as Congo – which accounts for about 70% of global cobalt output – recently extended an export ban first announced in February for another three months to September. The country cited “a continued high level of stock on the market,” as it attempts to rein in a global cobalt glut deepened by CMOC’s breakneck expansion in recent years.

That signals the Chinese company still produced slightly more cobalt in the second quarter, when the Congo shipment suspension was in force for the entire period. Output in the April-June period totaled 30,659 tons, against 30,414 tons in the prior quarter.

Spot prices of cobalt hydroxide have more than doubled since the export suspension. CMOC’s trading unit IXM has recently declared force majeure on such deliveries.

The Chinese miner said that its net income is likely to be between 8.2 billion yuan ($1.1 billion) and 9.1 billion yuan during the first half of the year, a jump of as much as 68% from a year earlier, due to higher prices and increased sales of cobalt and copper.

The firm’s output of copper – the two metals are extracted together in Congo – also rose 13% in the first half to 353,570 tons.

CMOC’s production of products, including cobalt, molybdenum and tungsten, has exceeded the company’s initial expectations, it said in a post on its website.

Shares of CMOC have surged more than 50% so far this year in Hong Kong.

(By Annie Lee)

Gertler, a ‘king’ in Congo, describes mine payments in arbitration testimony

An arbitration decision seen by Bloomberg describes Israeli billionaire Dan Gertler’s testimony about how he won rights to lucrative Congolese natural resources, made previously undisclosed payments to one of the former president’s associates, and held and sold stakes in ventures on behalf of him and local partners.

The non-public decision revolves around a dispute between Gertler and two former investors. But the document also details for the first time, in his own words, how he paid an associate of the Democratic Republic of Congo’s former president to distribute money in local communities, making Gertler “a king in Congo,” at the same time as he amassed a vast portfolio of mining and oil assets.

Gertler’s testimony cited in the arbitrator’s decision also describes how he made loans to the country and held assets worth hundreds of millions of dollars on behalf of Congolese partners.

The April 2024 arbitration decision — which revolved around claims by brothers Moises and Mendi Gertner that Gertler owed them money for investing in his businesses — was obtained by the Platform to Protect Whistleblowers in Africa, known as PPLAAF, and shared with Bloomberg. The arbitrator in the 14-year civil dispute held in Israel said in the decision that the case wasn’t meant to establish the legality of any dealings, and that no convincing evidence was presented to him of bribes or unfair or improper payments.

Gertler has consistently denied any wrongdoing.

The decision came at a time when Gertler was in talks to lift US sanctions put on him in 2017 for allegedly amassing a “fortune through hundreds of millions of dollars’ worth of opaque and corrupt mining and oil deals” in Congo, a key producer of energy transition metals copper and cobalt. His ongoing interests in mining projects there — where many mines are owned by Chinese companies — have hindered US efforts to get Western firms to invest in the country to tackle Beijing’s dominance in critical metals, according to US officials.

Gertler’s arbitration statements were part of his defense against claims by the Gertners, who began investing in his businesses about two decades ago. His testimony described how he acquired assets, and also leveraged connections to Augustin Katumba Mwanke, who previously was an official adviser to Joseph Kabila — Congo’s president from 2001 to 2019.

Gertler’s lawyers told Bloomberg that Katumba didn’t hold “any official or advisory position” for Kabila during the period covered by the arbitration, and that Gertler chose to work with Katumba once he stepped down from his official role. The arbitrator said in the case that no compelling proof was presented of payments to anyone holding an official position in Congo’s government when payments were received.

Katumba’s partnership with Gertler resulted in investments in community projects such as schools and hospitals, according to a letter to Bloomberg from Gertler’s lawyers. They said “his knowledge and understanding of the needs of the local community were essential.”

Holding assets

In defense statements cited by the arbitrator, Gertler described how in one instance in 2006, he sold shares in gold, iron and copper mining permits that he held on behalf of Katumba and local partners for $120 million, according to the arbitration decision that exceeds 1,200 pages.

“The way in which I held the rights for Katumba was not uniform. In some of the ventures I held the rights for Katumba through separate companies from the companies through which I held my rights,” Gertler testified in the arbitration, according to the decision. For example, “one company for myself and one company for Katumba,” he said, according to the decision.

In some ventures, the same company held the rights intended for both Katumba and Gertler, he testified, according to the decision.

“Either way, the rights intended for Katumba had to be retained by me in order for me to transfer them to Katumba at his request, or make any other use of them as Katumba directs,” the arbitration document quoted Gertler as saying.

Gertler testified that he didn’t know who Katumba’s local partners were.

The arbitrator decided on a monetary award in favor of the Gertner brothers, though far less than they had sought. The decision — most of which is in Hebrew — indicates it was based on more than 10,000 pages of testimony and other documents including payment records.

Bloomberg and PPLAAF haven’t seen the full affidavits, or complete correspondence including emails and text messages, cited in the decision. Gertler, who has applied to cancel the decision, declined to share additional documents while the process is ongoing, and a spokesman for the Gertner brothers told Bloomberg that they can’t disclose details about the confidential arbitration.

According to testimony quoted in the case, Gertler in 2014 said his relationship with Katumba was “based on trust, on large payments,” and that Katumba worked with other parties and “didn’t bring such assets for free.”

“Payments made to Mr. Katumba were based on the necessary community and other local investments connected to each commercial opportunity,” Gertler’s lawyers told Bloomberg in response to questions about the proceeding.

Gertler also said that “a lot of money” was paid to Katumba, according to excerpts of his testimony in the arbitration document. He also described Katumba as “necessary” and someone who dealt with local communities and government and tax officials, in testimony referring to diamond activities in Congo.

“The joint projects of Mr. Gertler and Mr. Katumba that resulted from their partnership are numerous,” Gertler’s lawyers told Bloomberg. “There is absolutely no proper basis on which to paint the payments to Mr. Katumba as improper.”

Loans

Gertler also testified that he gave the country loans. In the arbitration, he said that he “gave in cash to the government. To the central bank of Congo in cash.”

Gertler’s lawyers told Bloomberg he had been referring to a loan to state diamond company Miba. They said such payments were “in no way improper or unusual” at the time and were used to ease cash-flow challenges in the country. Cash payments were also common for business purposes due to a limited banking system at the time, they said.

Summarizing some of Gertler’s defense in the case, arbitrator Eitan Orenstein said that as part of their business partnership, “Katumba had leveraged his connections with local entities in Congo, to ensure that business opportunities for the mining assets in Congo would be referred first and foremost to Gertler.”

Gertler and the Gertners “were literally dependent on the services of Mr. Katumba,” which is why they agreed to pay him “such substantial payments, percentages from transactions of many hundreds of millions of dollars,” Orenstein wrote in the decision.

“The Gertner brothers were not involved in managing any aspects of any business in the DRC, which were run exclusively by Gertler, causing the Gertner brothers significant financial damage,” a spokesman for the Gertner brothers said in an email sent to Bloomberg.

The brothers, who made their fortune in real estate, say they lost hundreds of millions of dollars as a result of their dealings with Gertler, but are “prevented from disclosing any details about the arbitration,” which is “subject to strict confidentiality,” the Gertners’ spokesman said in the email.

Arbitrator’s decision

Orenstein decided in April 2024 that Gertler owed the Gertners about $85 million plus interest and some assets, for payments and shares that Gertler allegedly promised them, rejecting most of the brothers’ claim for more than $1.6 billion. Gertler’s lawyers told Bloomberg that a hearing was held on Feb. 2 after he applied to cancel the award, though it’s unclear when exactly a judgment may come.

Israeli judges and arbitrators are prohibited from referring to their own rulings, Orenstein told Bloomberg through his lawyer, adding that the decision took two years to write and that both parties were allowed to present arguments in full.

Still, the case provides a glimpse into the extent of Gertler’s relationship with Katumba.

“All I had, half of it was his,” Gertler was quoted as saying during the arbitration in reference to Katumba, who died in a plane crash in 2012. Gertler’s lawyers told Bloomberg that he was speaking colloquially in that statement, and that while in some deals the share may have reached 50%,the majority were at about 15%.

A spokesman for Congo’s current government didn’t provide comment when contacted by Bloomberg.

Former President Kabila cannot be associated with the various deals that Gertler made with his partners, including Katumba, Kabila’s longtime adviser Barnabe Kikaya Bin Karubi told Bloomberg. It’s “unfortunate” that Katumba’s death more than a decade ago means that he couldn’t give his version of the facts in the arbitration, he said.

Since first coming to Congo in 1997, Gertler secured permits to huge copper and cobalt resources now owned by Glencore Plc and Eurasian Resources Group. He also won oil, iron ore and gold permits, as well as lucrative deals with diamond company Miba.

While he agreed in 2022 to relinquish some of his holdings in Congo, he still holds rights to royalties in three major copper and cobalt projects. In the arbitration, he highlighted how his investments helped local communities and bolstered his standing and reputation for keeping his word there.

“I am a king in Miba to this day. I am a king in Congo to this day,” he said in testimony from 2014 that was quoted in the case.

(By Michael J. Kavanagh)

No comments:

Post a Comment