Column: Trump’s copper tariffs won’t lift US output, will boost costs

(The views expressed here are those of the author, Clyde Russell, a columnist for Reuters.)

The planned 50% tariff on copper imports may turn out to be the biggest own goal of US President Donald Trump’s ongoing trade war with the rest of the world.

Trump announced the tariff on Wednesday, saying it would become effective on August 1.

While Trump seemed quite definitive in his statement, there is a lack of detail of what products will be included in the definition of copper, and whether there is scope for exemptions or lower rates for some major suppliers to the United States, such as Chile and Canada.

But even if some concessions are made before the implementation date, the end result is likely to be that copper imports are slugged with a considerably higher tariff than what prevailed prior to Trump’s return to power in January.

As with Trump’s other tariffs the motivation behind the tariffs on copper is to encourage more domestic mining and smelting of the industrial metal, which is key to making electric vehicles, military hardware, semiconductors and a wide range of consumer goods.

The problem for Trump’s somewhat naive economic vision is that the reality of the US copper market is that it will be extremely difficult to get a meaningful boost to copper mining and processing in both the short and long terms.

The United States produces just over half of its annual copper requirements, and its imports of refined metal were 810,000 metric tons in 2024.

It’s possible that copper miners such as Freeport McMoRan and Rio Tinto could run their existing mines harder and lift output, but that would only provide a short-term lift in ore supply and would unlikely be sustainable.

Importing copper ore and refining it is also unlikely, as it would take time and money to re-commission idle smelter capacity, with the only viable candidate being the Grupo Mexico-owned Asarco plant in Hayden, Arizona, which has been mothballed for more than four years.

There are new mines in the planning stage, with the most significant being Rio’s Resolution Copper in Arizona, which has been delayed by legal challenges by the indigenous Apache people.

A Supreme Court ruling in May in favour of Rio and its partner in Resolution BHP Group would appear to clear the way for the mine’s development, but even if this is fast-tracked it will still take several years before first production.

Imports needed

In the meantime, the United States is going to be reliant on copper imports, meaning that buyers of the metal have limited choices.

They can either pay the tariff or lower copper consumption by producing less of whatever they are making.

This means that car makers, home builders and electronics manufacturers will likely face higher costs, as domestic copper prices will rise to match the level of imported metal.

How those costs get absorbed or passed on will depend on the market power of the companies involved, but the overall impact is likely to be higher inflation if costs are passed to consumers, or lower investment and employment if companies do what Trump has suggested and “eat the tariffs.”

The impact of the tariffs will also affect copper pricing and movements around the globe, both in the short and long terms.

The United States has sucked in vast quantities of copper so far in 2025, with analysts at Macquarie estimating imports totalled 881,000 tons in the first half of this year compared to an underlying requirement of roughly 441,000 tons.

This means that once the tariff is implemented US imports are likely to plunge as the stockpiled, and cheaper, metal is used up.

This is likely to drag global copper prices lower, reversing a trend of rising prices since Trump’s return to the White House.

Benchmark London copper contracts ended at $9,630.50 a ton on Wednesday, up almost 10% since the end of last year.

US copper contracts rose to a 26% premium over their London equivalent on Wednesday from a 13% premium before Trump’s announcement.

That 26% premium is still well short of the 50% tariff, likely indicating the uncertainty in the market as to what types of copper products will be subject to tariffs or the risk of a lower rate for some countries.

But once clarity is reached on the final form of the copper tariff, and once the existing stockpile is used up, it’s likely that US prices will rise to a premium that reflects the tariff level.

(Editing by Christian Schmollinger)

Copper Tariffs: A Risky Gamble for U.S. Industry

- Proposed 50 percent tariffs on imported copper would significantly increase prices for American industries and consumers due to the United States' reliance on imports.

- Building domestic copper mining and refining capacity is a challenging, long-term endeavor requiring sustained high prices or substantial government investment.

- The US Department of Defense is actively investing in domestic rare earth element production to secure critical minerals for defense, highlighting broader challenges in mineral self-sufficiency.

The mainstream news media has already figured out that the Trump administration's proposed tariffs on imported copper of 50 percent would dramatically hike copper prices for American industry and raise the price of products containing copper for consumers, which is just about everything electrical. The reason is simple; The United States is a net importer of 45 percent of its copper needs according the U.S. Geological Survey.

All right, you may say, so there will be some short-term pain until the United States develops enough new copper mining and refining capacity to be self-sufficient. First, it's not easy to build such capacity. New mines can take years to build, assuming you already know where the copper is. As for copper refining, few people want such facilities near them so half the challenge is quelling the opposition to any new refining operations. They also take years to build.

Now nobody is going to spend money building new copper mines and refining facilities unless there is a guarantee that the price of copper will stay sufficiently elevated to justify such investments. Even if the proposed tariffs on imported copper were to go into effect, there can be no guarantee that they would be maintained for the couple of decades that investors need for such long-term investments to pay off.

I suppose it's possible that all these new investments would be profitable even if the tariffs are later rescinded. But if the mines and refineries are built on the premise of long-term tariffs, high prices for copper will be part of the profitability analysis.

It's certainly possible to construe the proposed copper tariffs as a bargaining position, that the Trump administration will never actually impose them or that they will be much, much lower. But one thing the administration has proven to be regarding tariffs is dramatic. While the general sentiment has been crystallized into the acronym TACO, meaning "Trump always chickens out," he may not this time.

In any case, even if the United States wants to become more self-sufficient in the production key minerals, as I've explained previously, this would be very difficult, either because the country lacks the in-ground resources or because what resources it does have would be too expensive to develop. Attempting to do so would likely require either 1) substantial long-term tariffs that might break the back of the domestic industries that use these minerals for their products or 2) huge government subsidies that might prove unpopular with the public.

PS. Let the subsidies begin! As I was finishing this piece, the U.S. Department of Defense agreed to become a 15 percent shareholder of MP Materials, a U.S.-based rare earth element miner and processor. The DOD guaranteed that for 10 years it would purchase all the high-strength magnets and all the neodymium-praseodymium oxide minerals produced by new facilities financed by the investment at prices that insure profitable operation. This demonstrates how critical the DOD believes these products are for defense purposes. Of course, the arrangement doesn't do anything for American industries that are also in need of domestic sources of these magnets and minerals because the Chinese government—which controls most of the rare earth market—has severely restricted exports of these minerals and related products such as high-strength magnets.

By Kurt Cobb via Resource Insights

Trump’s 50% copper import tariff said to cover refined metal

US President Donald Trump’s promised 50% copper tariffs are set to include all refined metal, indicating the president’s far-reaching efforts to bolster American production of one of the world’s most ubiquitous materials.

Trump’s announcement of the levy, which he said would begin Aug. 1, was devoid of much detail, but refined copper will be included, according to people familiar with the matter who asked not to be named as discussions are private.

Refined copper represents the biggest category of the metal that is imported by the US, and including it in the tariff list will have widespread impacts. The metal is vital for electric grids, construction, automaking and consumer electronics. Semi-finished products also would be hit with levies, Bloomberg News reported earlier.

The tariff measures haven’t yet been formalized and they shouldn’t be considered final until announced by Trump, according to a White House official.

Just hours after Trump unexpectedly announced the 50% copper tariff Tuesday, the White House’s Council of Economic Advisers met with industry representatives who asked the president not include export controls of copper scrap, according to the people. The US is one of the world’s biggest generators of metal scrap, which annually outpaces domestic consumption. The extra metal gets shipped abroad.

Leading metals companies including miner Rio Tinto Group, fabricator Southwire Co. and trader Trafigura Group have asked the White House to restrict exports of ore and scrap metal rather than imposing tariffs on imports.

(By Joe Deaux and Catherine Lucey)

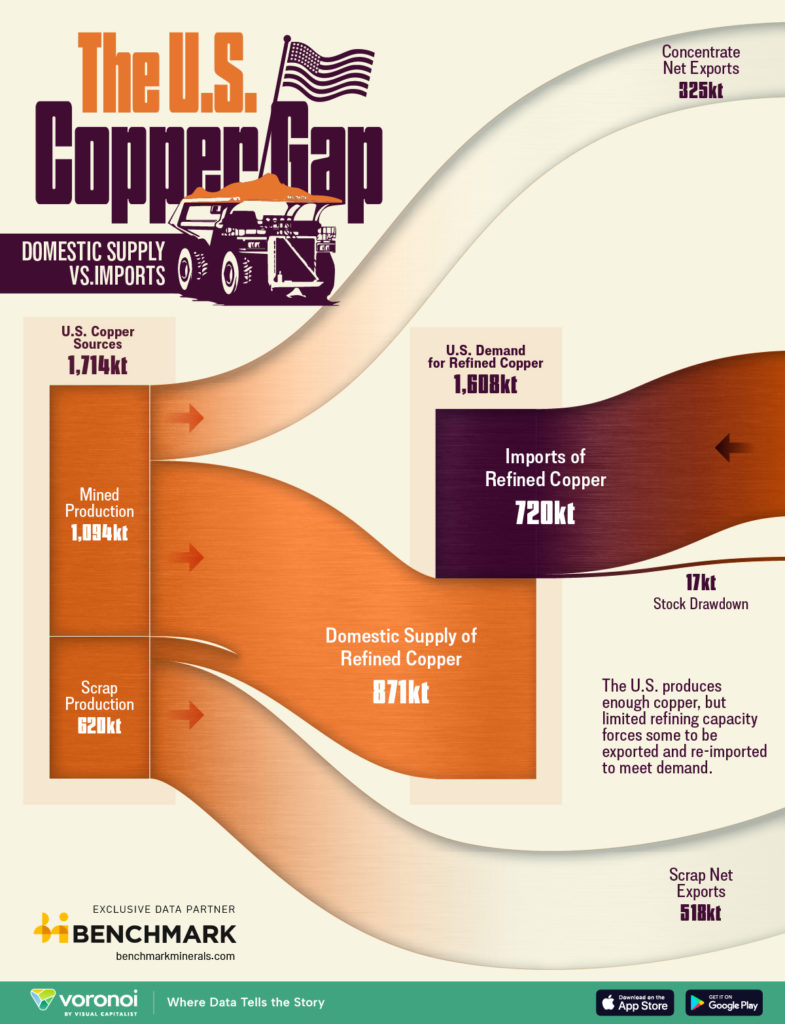

Graphic: visualizing the US copper gap

The US is facing a paradox in its copper supply chain. Despite producing over 1.7 million tonnes of copper annually from mining and scrap, it remains heavily reliant on refined copper imports. This visualization highlights the gap between domestic copper production and the country’s limited processing capacity.

It turns out the issue isn’t a shortage of copper, it’s the lack of infrastructure to turn raw material into usable metal.

The US sends nearly half its copper abroad as concentrate and scrap, only to import refined copper for industrial use. The data reveals a potential for reshoring copper processing and reducing dependency on imports.

This data for this visualization comes from Visual Capitalist and Benchmark Mineral Intelligence. It shows how copper flows through the US economy, from domestic production to international trade and final consumption.

No comments:

Post a Comment