Trump Administration Expands Rare Earth Price Support Policy

- The Trump administration is broadening its rare earth price support policy to include more U.S. mining, refining, and magnet production companies, building on a successful precedent set with MP Materials.

- This expanded policy aims to provide guaranteed price floors for key rare earth elements, reducing investment risk and bolstering domestic critical minerals production to counter China's market dominance.

- The strategy, discussed in a recent White House meeting with rare earth and tech firms, mirrors the Pentagon's previous $400 million equity investment in MP Materials, which significantly boosted its stock and secured long-term domestic supply.

Shares of USA Rare Earth are rocketed higher yesterday afternoon after it was reported that the Trump administration is moving to extend price support mechanisms for U.S. rare earth projects to other companies, broadening a policy that previously focused on MP Materials to include other mining, refining, and magnet production firms.

USA Rare Earth is the obvious #2 name in the U.S. that such an expansion may have an impact on. scale, government stake, and strategic timing. Shares quickly popped 15% on the news:

This expansion will provide guaranteed price floors for key rare earth elements, reducing the investment risk that has historically deterred private capital. The approach mirrors the strategy used to back MP Materials earlier this year, where government involvement transformed market confidence and secured long-term domestic supply.

Top White House officials have told rare earth companies that they are pursuing a pandemic-style strategy to strengthen U.S. critical minerals production and counter China’s market dominance by setting a guaranteed minimum price for their products, according to five sources familiar with the plan, per Reuters.

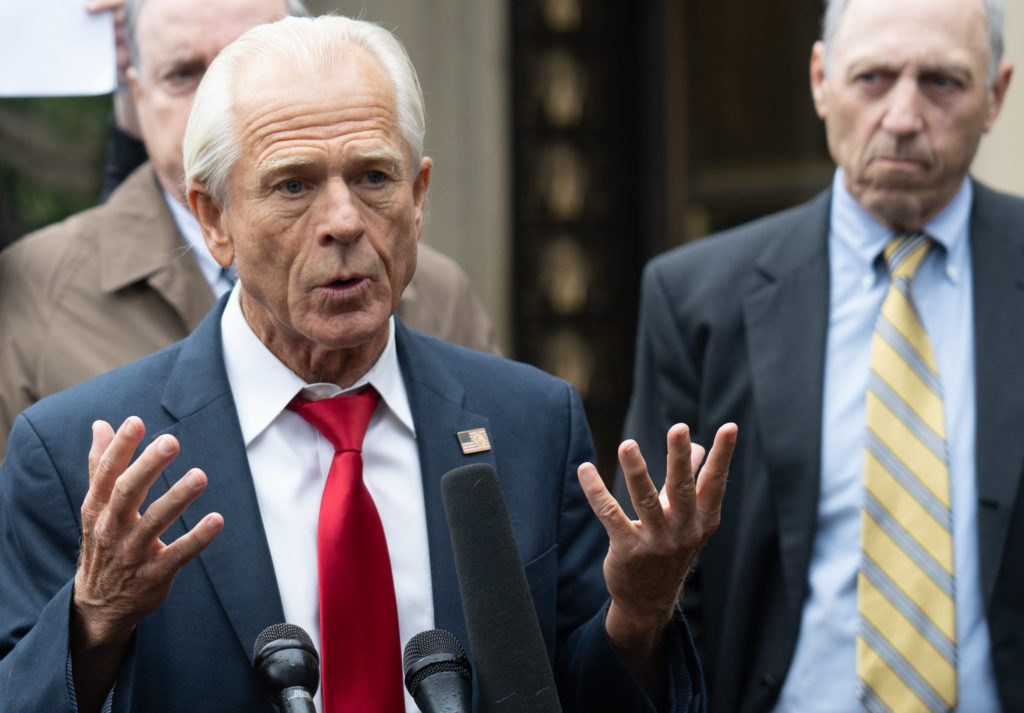

The previously unreported July 24 meeting, led by President Donald Trump’s trade advisor Peter Navarro and National Security Council supply chain official David Copley, included ten rare earth firms alongside major tech companies like Apple, Microsoft, and Corning—all of which depend on reliable supplies of critical minerals for electronics manufacturing.

The precedent for this move was set in July when the Pentagon made an unprecedented $400 million equity investment in MP Materials, the operator of the Mountain Pass rare earth mine in California. As part of that deal, the Department of Defense became MP’s largest shareholder and locked in a 10-year price floor for neodymium-praseodymium oxide at roughly $110 per kilogram—nearly double prevailing Chinese spot prices.

Alongside the equity, the Pentagon committed to purchasing MP’s entire magnet output for a decade, while private lenders like JPMorgan and Goldman Sachs provided over a billion dollars in commercial financing to scale production.

MP Materials’ stock reaction was swift and dramatic. On the day the Pentagon’s investment was announced, MP shares surged more than 50% as investors priced in the guaranteed revenue and government backing. In the days that followed, the stock rallied further after Apple revealed a $500 million supply deal with MP, ultimately pushing the company’s year-to-date gains to well over 200–250% by mid-July.

The market capitalization climbed toward $9.5 billion, marking one of the most significant single-year jumps for a U.S. resource company in recent memory.

Navarro and Copley emphasized that the price floor arrangement granted to MP Materials earlier this month as part of a multibillion-dollar Pentagon investment was “not a one-off” and that similar agreements were being developed for other companies. For years, U.S. critical minerals producers have argued that China’s market dominance deters investment in domestic mining projects, and they have pushed for federally backed price guarantees to reduce risk.

Rare earths—17 metals essential for manufacturing magnets that convert power into motion—are widely used in electronics, including smartphones and military hardware.

HE'S BAAAACK!

Trump team outlines push for rare earths in meeting with executives

The White House met last week with top technology and recycling companies to discuss ways to quickly ramp up production of permanent magnets using rare earth elements, which have emerged as a key point of leverage in the trade war with China.

Trade adviser Peter Navarro convened the meeting and told the executives that the administration is planning a major push to boost US production of the minerals, using incentives including guarantees of minimum prices to producers, according to people familiar with the event who asked not to be identified discussing a matter that isn’t public.

The administration has been racing to come up with alternative sources for rare earth magnets after China — which controls global production — imposed export controls in retaliation for US tariff threats. The magnets are used in products from home appliances and cars to missiles and the shutoff left companies warning they’d have to suspend production. China agreed to resume shipments after the US agreed not to impose the higher import levies.

A White House official confirmed the meeting took place but didn’t provide details on what was discussed. Earlier this month, the Department of Defense announced a $400 million equity stake in MP Materials Corp., the only US rare earth producer, that includes government-guaranteed minimum prices and purchases from the company.

“The MP rare earths deal is an essential part of an overall strategy to onshore critical minerals of which rare earths is just one part,” Navarro said in a statement released Thursday by the White House. “Our goal is to build out our supply chains from mines to end use products across the entire critical mineral spectrum, and the companies assembled at the meeting have the potential to play important roles in this effort.”

Some participants in the meeting with Navarro expressed concern that the MP deal may prevent the emergence of vibrant competitors in the sector.

At the meeting, Navarro told participants the administration is committed to creating a commercially viable environment to incubate the industry, including protective tariffs and price floors.

Participants said they came away from the session with the impression the administration is alarmed about the vulnerability that the lack of alternatives to Chinese supplies presents. The officials discussed the technical details of recycling of the magnets, which could bring production online faster than mine projects currently in the works.

Among the issues discussed was the possibility of banning the export of electronic waste to keep material for recycling in the US, the people said. Currently, most of the reprocessing needed to extract the magnets is done in China.

(By Joe Deaux)

MP Materials seals mega rare-earths deal with US to break China's grip

By Katha Kalia, Eric Onstad and Ernest Scheyder

A view of mining facilities at the MP Materials rare earth mine in Mountain Pass, California, U.S. January 30, 2020. Picture taken January 30, 2020. REUTERS/Steve Marcus/File Photo Purchase Licensing Rights, opens new tab

Summary

US Defense Dept to become MP Materials' biggest shareholder

Deal will boost US output of rare earths, loosen China's dominance

Defense Dept will also guarantee a floor price for key rare earths

Floor price will be twice current Chinese market price

MP Materials' shares surge nearly 50% on news of the deal

July 10 (Reuters) - MP Materials (MP.N), opens new tab unveiled a multibillion-dollar deal with the U.S. government on Thursday to boost output of rare earth magnets and help loosen China's grip on the materials used to build weapons, electric vehicles and many electronics.

Under the deal, which sent MP's shares up nearly 50%, the U.S. Department of Defense (DoD) will become the largest shareholder in Las Vegas-based MP, making it Washington's most high-profile investment to date in the critical minerals sector.

Rare earths are a group of 17 metals used to make magnets that turn power into motion. China halted exports in March as part of a trade spat with U.S. President Donald Trump that showed some signs of easing late last month, even as the broader tensions underscored the need for greater U.S. output.

MP operates the only U.S. rare earths mine and is working to boost domestic processing and magnet production.

The DoD will guarantee a floor price of $110 per kilogram for the two most-popular rare earths, a price nearly twice the current Chinese market level, which has languished at low levels and has long deterred investment. MP received an average of $52 per kilogram for those same rare earths in the second quarter.

MP will also build a new factory for rare earth magnets, lifting the company's output to 10,000 metric tons a year, with the new factory launching in 2028.

"This is a game changer for the ex-China industry and a much-needed surge in magnet production capacity," said Ryan Castilloux, managing director of consultancy Adamas Intelligence.

The price floor especially is one that had long been sought by U.S. critical minerals companies who have complained about China's market manipulations. Past owners of MP's California mine, for example, went bankrupt in part due to Chinese competition.

In a Thursday regulatory filing, MP said that the DoD was funding the investment in part through a Cold War-era piece of legislation known as the Defense Production Act, and that it could not guarantee the U.S. Congress would continue to fund the agreement in perpetuity.

MP is investing $600 million of its own funds into the expansion projects.

CHINESE DOMINANCE

Companies have been scrambling to source rare earths after China imposed restrictions, leading to a 75% drop in rare earth magnet exports from the country last month and causing some auto companies to suspend production.

Trump in March invoked emergency powers to boost domestic production of critical minerals as part of a broad effort to offset China's near-total control of the sector.

China's iron grip on the sector extended to MP, with China's Shenghe Resources (600392.SS), opens new tab one of MP's biggest shareholders, with a stake of about 8%, and with MP having sent most of its ore to China for processing.

But the DoD will vault above Shenghe to take an effective stake of 15% through buying $400 million worth of preferred stock plus receiving warrants, a transaction expected to close on Friday.

MP in April said it would stop sending rare earths to China for processing.

"We're getting an important national security need met, but we're maintaining our free market public company approach," MP CEO James Litinsky said on a Thursday investor call.

The company's shares were trading at $43.95, their highest since April 2022. The stock had already nearly doubled this year through Wednesday's close.

MP Materials said it would construct a second magnet manufacturing facility in the U.S. to compliment one under development in Texas.

The company is calling the second its '10X Facility' at a still-to-be-decided location. The DoD is guaranteeing all of the second facility's offtake will be bought by defense and commercial customers for the next 10 years.

JP Morgan (JPM.N), opens new tab and Goldman Sachs (GS.N), opens new tab are backing a $1 billion loan to build the 10X facility, MP said.

MP Materials expects to add additional heavy rare earth separation capabilities at its California-based Mountain Pass facility for which it will receive a $150 million loan from the Defense Department.

Reporting by Katha Kalia in Bengaluru and Eric Onstad in London; Editing by Sriraj Kalluvila, Susan Fenton and Nick Zieminski

No comments:

Post a Comment