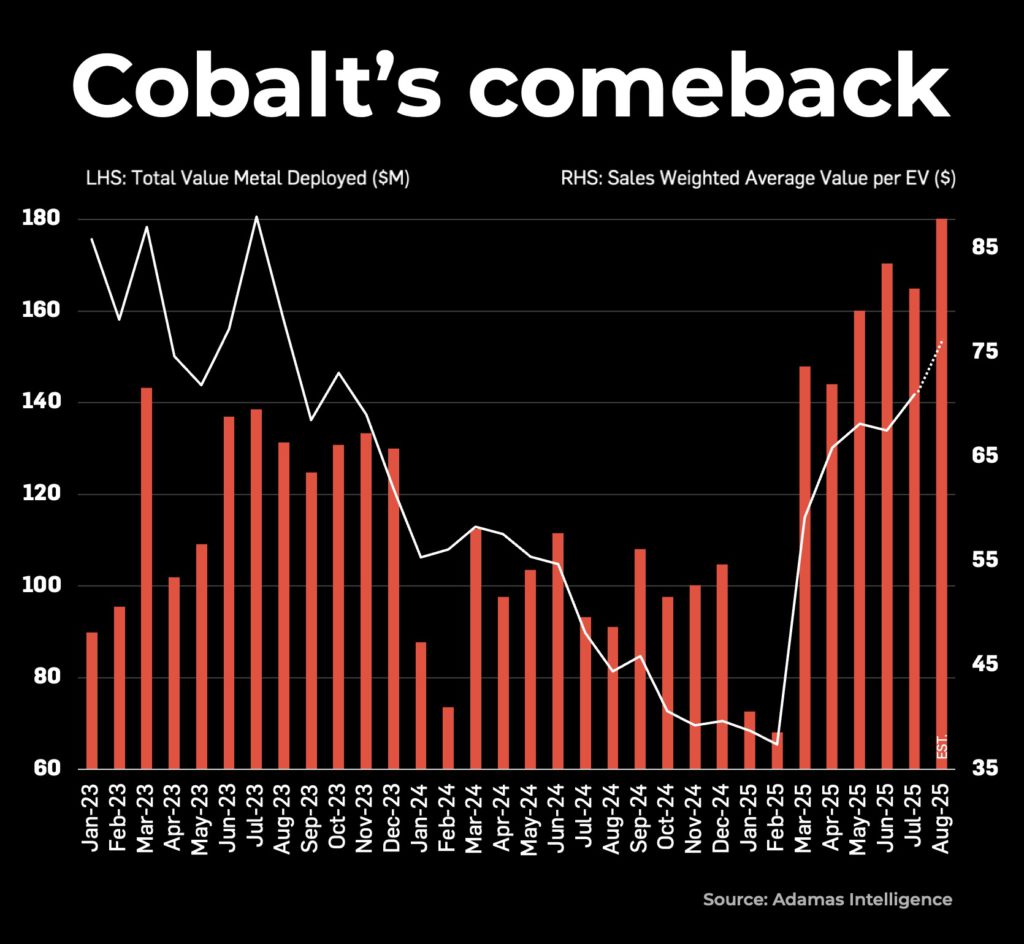

Cobalt’s EV battery comeback as prices nearly double

A surge in supply from the Congo, responsible for 80% of the world’s cobalt output, coupled with tepid demand from the electric vehicle market, saw cobalt prices sink to historic lows at the start of 2025.

Copper production in the DRC, with a big chunk owned by Chinese companies, was rising fast – leading to a near 40% jump in the country’s co-product cobalt output in 2024, but in February the country announced a four month ban on exports, extending it again in June.

The price of cobalt sulphate entering the EV battery supply chain in China duly responded and is now trading over 90% higher than at the start of the year averaging $6,947 a tonne in August (still nowhere near the 2022 peak of $19,000 per tonne).

Cobalt consumption in EV batteries overtook other sources of demand like aerospace several years ago and the impact of the DRC strategy has been swift. The latest data from Toronto-based research consultants Adamas Intelligence tracking EV battery metal deployment in over 120 countries paired with monthly prices shows the cobalt market springing back to life.

The size of the battery cobalt market in August totalled an estimated $180.1 million, the highest since December 2022, lifting the value of sales weighted average cobalt contained in tandem. The average value of the cobalt contained in EV batteries is back up above $70 per vehicle, up from less than $40 at the start of the year.

In total, installed tonnage of nickel, cobalt and manganese now represent more than half the value of the battery metal basket that came to $1.28 billion in August. That’s despite the accelerating adoption of LFP (lithium iron phosphate) battery chemistries over NCM (nickel-cobalt-manganese).

Cobalt use is also being impacted by the move towards high nickel cathodes with chemistries with less than 10% cobalt content now dominant globally.

The value of terminal nickel, cobalt and manganese tonnes deployed in EVs, including plug-in and conventional hybrids, sold around the world from January through August this year totalled $4.93 billion.

Keeping in mind that the installed tonnage does not take into account any losses during processing, chemical conversion or battery production scrap (often well into double digit percentages), so required tonnes and revenues are meaningfully higher at the mine mouth.

Output in the Congo from CMOC, the world’s top producer of cobalt, has been rising while number two producer Glencore warned last month that a significant portion of its cobalt output may remain unsold by the end of 2025.

The impact on the market and pricing – should Kinshasa ease restrictions – and when the stockpiled cobalt begins to re-enter the supply chain, remains to be seen.

The US Defense Department is not waiting for that eventuality, however, and has issued a tender (the first time since 1990) for the supply of 7,500 tonnes over five years.

Helpful, but nowhere near enough to mop up supply should Congo decide to reopen the floodgates.

For a fuller analysis of the EV battery metals market check out the October issue of The Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.

US invests $1.4M in Zambian mine expansion to rival China

The United States is ramping up efforts to secure critical minerals outside China’s control, backing the expansion of a copper and cobalt facility in Zambia.

The US Trade and Development Agency (USTDA) awarded on Thursday a $1.4-million grant to Metalex Africa, a subsidiary of US-based Metalex Commodities, to finance a feasibility study for expanding the company’s Kazozu mine in Zambia’s North-Western province.

The study will assess whether the mine can produce up to 25,000 additional metric tonnes of copper and cobalt concentrates annually.

USTDA officials said the initiative is designed to link Metalex with American buyers while opening opportunities for US companies to supply equipment, materials, and expertise for the expansion.

“USTDA’s partnership with Metalex will help ensure that US industries can reliably access the inputs they need to remain secure, competitive, and prepared to meet the challenges of the future,” acting director Thomas R. Hardy said in a statement.

“By leveraging US technology and expertise, this project will help expand Zambia’s mining sector, advancing responsible resource development to benefit both our nations.”

Metalex chief executive Ayo Sopitan called the grant a milestone, saying it would help expand resources, define project phases, and establish the feasibility of scaling up the Kazozu operation. The project is a joint venture with Zambian company Terra Metals.

Weakening China’s lead

The investment aligns with Washington’s broader strategy to build the Lobito Corridor, a US-backed transport and trade network linking Angola, Zambia, and the Democratic Republic of Congo (DRC).

The corridor centres on a 1,700-kilometre railway from Angola’s Atlantic port of Lobito to the DRC’s mining hub of Kolwezi, with an extension planned into Zambia’s Copperbelt province.

The US has framed the corridor as a strategic alternative to Chinese-backed infrastructure across Africa. China maintains dominance in the region’s mining sector, including near-total control of processing and refining capacity. It continues to expand its presence, most recently through JCHX Mining’s acquisition of an 80% stake in Zambia’s Lubambe copper mine.

Washington’s support goes beyond USTDA. During Joe Biden’s presidency, the US International Development Finance Corporation committed about $550 million to railway and port upgrades, while the Millennium Challenge Corporation is funding rural road and agriculture improvements in Zambia.

US-based KoBold Metals, backed by investors including Bill Gates and Jeff Bezos, has also pledged to make its Mingomba copper and cobalt project an anchor for the Lobito railway.

The combined push highlights the Trump administration’s relentless efforts to loosen China’s hold on the global mineral supply chain while boosting the nation’s own industrial resilience.

No comments:

Post a Comment