HSBC expects gold’s ‘bull wave’ to hit $5,000 in 2026

01/01/2026

HSBC on Friday forecast that gold’s bull rally would drive prices as high as $5,000 an ounce in 2026, supported by elevated risks and the impact of new entrants into the market.

Spot gold breached the $4,300 level on Thursday and was headed for its strongest week since December 2008.

The advance has been fueled by geopolitical tensions, robust central bank buying, rising exchange-traded-fund inflows, expectations of US rate cuts and tariff-related economic uncertainties.

“The bull market is likely to continue to press prices higher for 1H’26 and we could very well reach a high of $5,000/oz some time in 1H 2026,” HSBC said in a research note.

HSBC also raised its 2025 average gold price forecast to $3,455 per ounce from $3,355 previously. It increased its 2026 average gold price forecast to $4,600, up from its previous estimate of $3,950.

The bank cited geopolitical risks, economic policy uncertainty and rising public debt as factors supporting the price.

HSBC said that, given the sharp rise in prices during the second half of 2025 and heightened risks from new market entrants, it expects gold prices to remain elevated and potentially spike further through early 2026.

But the bank also expects significant volatility and some price moderation in the second half of 2026.

“Unlike previous rallies we believe many of these new buyers are likely stay in the gold space – even after the rally ends – not so much for appreciation necessarily as for gold’s diversification and ‘safe haven’ qualities,” the bank said.

HSBC joins analysts at the Bank of America and Societe Generale, who earlier in the week forecast that gold could reach $5,000 an ounce in 2026.

(By Anushree Mukherjee and Sherin Elizabeth Varghese; Editing by Barbara Lewis and Jane Merriman)

Gold’s historic rally comes with a bonus for emerging markets

A relentless surge in the price of gold is delivering windfalls across emerging markets, boosting investor confidence in countries that mine and buy the metal.

In South Africa, home to the world’s deepest gold mines, stocks are on track for the best year in two decades, with shares of miners like Sibanye Stillwater Ltd., AngloGold Ashanti Plc and Gold Fields Ltd. tripling in value. The credit rating of Ghana, Africa’s top gold producer, has been upgraded by Moody’s Ratings. Emerging-market countries rank among the biggest buyers of bullion, boosting national coffers.

For money managers in emerging markets, gold’s surge is giving them another reason to stay bullish. By fanning a wealth effect for bullion-producers and buyers alike, valuable gold holdings are giving investors more conviction to buy. In a report earlier this month, Goldman Sachs Group Inc. strategists listed South Africa’s mining strength as a top reason it sees gains ahead for the country’s bonds and stocks.

“The rally in gold is beneficial for a small group of countries in emerging markets such as Uzbekistan, Ghana and South Africa,” said Daniel Wood, a portfolio manager at William Blair Investment Management. “The wider story of the rising gold price is that investors are increasingly looking for alternative investments away from the more traditional developed market currencies, particularly the US dollar.”

Wood said he’s bullish on Uzbekistan’s currency because the country is both a major bullion producer and holds substantial reserves. He added that soaring metal prices are part of the reason why South Africa’s markets are having such a historic year.

South Africa’s FTSE/JSE Africa All Shares Index has gained more than 30% in 2025. The rand is near a one-year high, and the 10-year government bond yield recently fell below 9% for the first time in more than seven years. Slowing inflation that’s allowed the country’s central bank to cut interest rates is also boosting market sentiment.

All in all, it’s a dramatic turnaround for a country that has struggled to attract investors for years because of political turmoil and power shortages that sapped economic growth.

Another country that’s benefiting from the gold rally is Ghana. After enduring an economic crisis in 2022 that caused it to default on its debt, the nation has been on a path to recovery under new President John Mahama. The cedi has strengthened about 38% this year, the biggest increase globally.

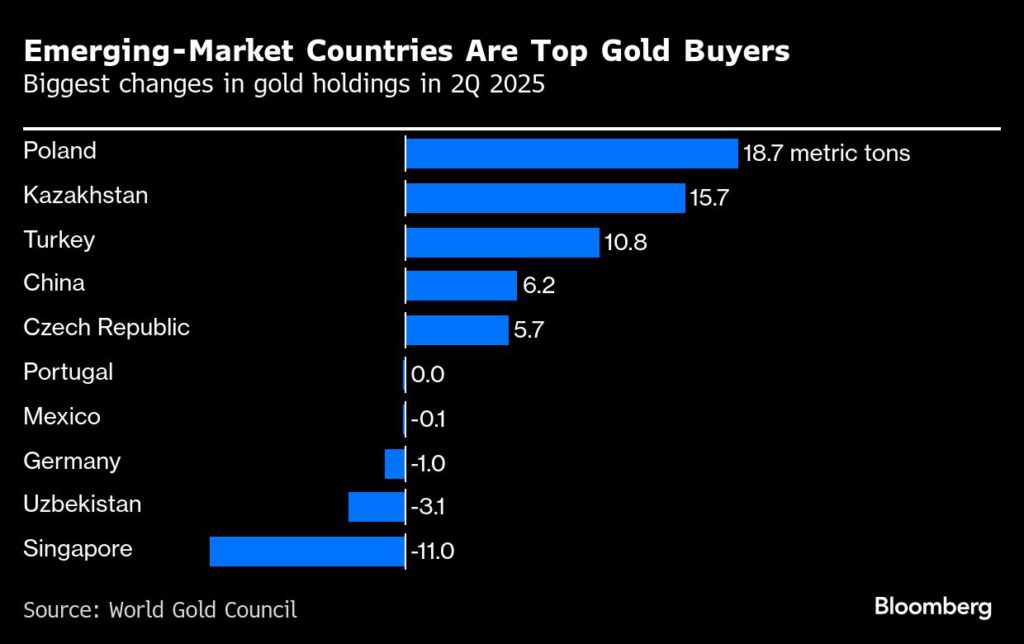

Other investors said they’re watching countries like Poland, Turkey and Kazakhstan, which have all been adding to their gold reserves. Alexis de Mones, a fixed-income portfolio manager at Ashmore Group Plc, said that while the trend is generally positive, investors shouldn’t read too much into it.

“Those countries that have a greater share of gold in their reserves will also look better, but one should not necessarily look at pricing effects as a source of credit strength,” he said.

The bigger driver for emerging markets is the fact that higher gold prices are coming at a time when the dollar is weak and financial conditions are broadly easing, de Mones added. That’s a view echoed by Ning Sun, a senior emerging-markets strategist at State Street Markets in Boston.

She said rising gold prices are usually part of a broad move that drags down anything risky. But in this case, given dollar weakness and nervousness about US economic policy, that relationship has flipped. And now, emerging markets are turning out to be a winner.

“The rally does benefit emerging markets more than developed markets,” she said. “Emerging markets not only produce gold, they also hoard the metal.”

(By Selcuk Gokoluk)

No comments:

Post a Comment