Bloomberg News | March 17, 2022 |

Patience Lake potash mine. Credit: Nutrien Ltd.

Nutrien Ltd. is increasing output of key crop nutrients in the face of a global shortage. But there’s only so much even the world’s largest fertilizer company can do.

The Canadian company said Wednesday it would boost potash production by about 1 million metric tons in 2022 to a total of 15 million tons, with most of the additional volume coming in the second half of the year.

Nutrien won’t be able to go beyond that in 2022 — even if the market is desperate for it, Interim Chief Executive Officer Ken Seitz said in an interview. To increase output, the company is having to place additional mining machines at three sites, while also pushing off some maintenance operations. But the company needs to balance that ramp up with safety considerations, which limits how much they can add to supplies this year, Seitz said.

The company can continue to boost production over the next two or three years, if it’s still needed, he said.

“We are going to be watching the supply side of the equation, and therefore the pace at which we think about our own potash production ramp up as well,” Seitz said.

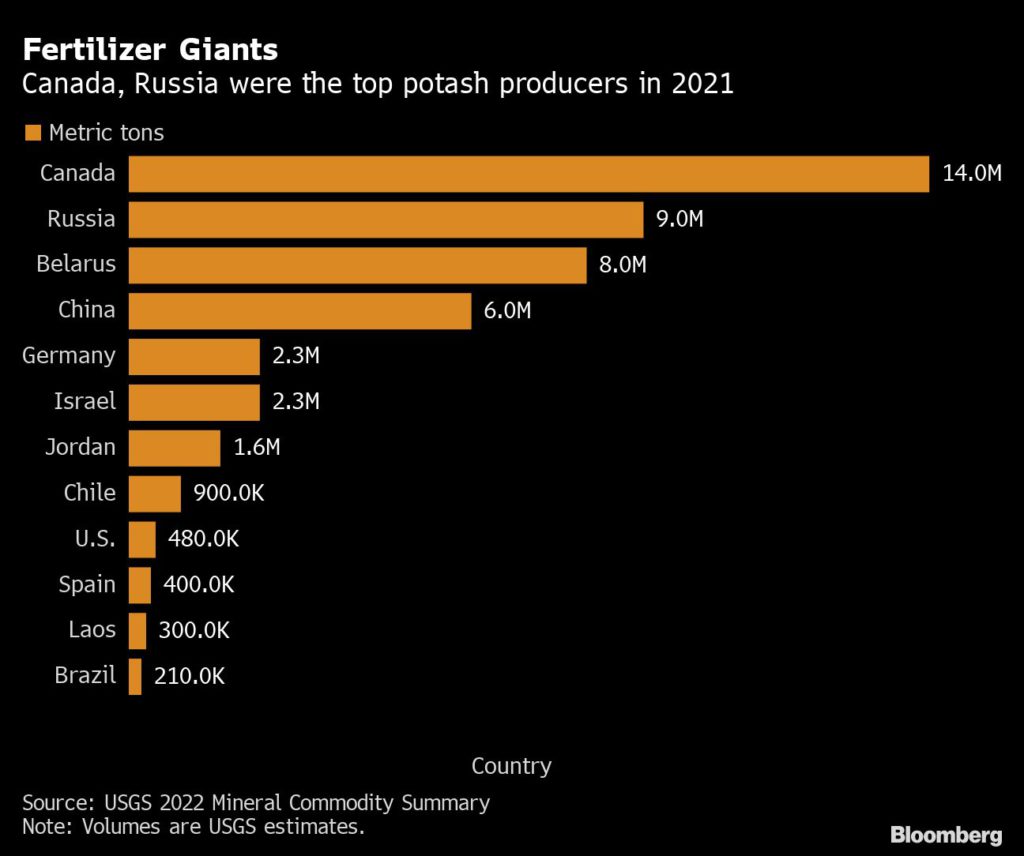

Nutrien’s bump of 1 million tons this year may not be nearly enough to meet demand. Sanctions on major producers means there could be a shortage. Second-ranked producer Russia may face sanctions due to its invasion of Ukraine, while third-ranked Belarus has already been cut off from global markets. That leaves Canada scrambling to supply agriculture powerhouses like Brazil, the biggest importer. The northern nation already supplies nearly all of the potash used in the U.S.

Nutrien’s move “while sorely needed by the market, does not come close to fixing the supply gap if both Russia and Belarus are sanctioned out of the global potash trade,” said Alexis Maxwell, an analyst for Bloomberg’s Green Markets.

Russia and Belarus together supply about 42% of the $35 billion global potash trade, or some 24 million metric tons annually, Maxwell said.

Nitrogen fertilizer is also being squeezed on concerns over supply from Russia, which was the world’s largest exporter of nitrogen products last year. The price of natural gas, the number one feedstock for most nitrogen fertilizer, is also climbing in Europe, and some producers are cutting back output.

Nutrien is also stretching its nitrogen production, hoping to add a half a million tons of production over the next couple of years from its North American plants, Seitz said. The company has very competitive production costs because of lower natural gas prices in North America, he said.

“We are expanding production as we speak,” Seitz said.

(By Elizabeth Elkin)

No comments:

Post a Comment